PENN Entertainment, Inc. (PENN)

(Delayed Data from NSDQ)

$16.26 USD

-0.28 (-1.69%)

Updated Apr 17, 2024 04:00 PM ET

After-Market: $16.26 0.00 (0.00%) 7:58 PM ET

5-Strong Sell of 5 5

C Value F Growth C Momentum F VGM

Company Summary

PENN Entertainment was incorporated in Pennsylvania in 1982 as PNRC Corp. The company’s current name was formulated in 1994 when it became a publicly-traded company. PENN Entertainment is a leading, multi-jurisdictional owner and manager of gaming and racing facilities with video gaming terminal operations, and a focus on slot machine entertainment. The company is geographically widespread with a vast portfolio.

With the acquisition of Charles Town property in 1997 and introduction of video lottery terminals in West Virginia, PENN Entertainment began its transition from a pari-mutuel to a diversified gaming company. Ever since then, the ...

Company Summary

PENN Entertainment was incorporated in Pennsylvania in 1982 as PNRC Corp. The company’s current name was formulated in 1994 when it became a publicly-traded company. PENN Entertainment is a leading, multi-jurisdictional owner and manager of gaming and racing facilities with video gaming terminal operations, and a focus on slot machine entertainment. The company is geographically widespread with a vast portfolio.

With the acquisition of Charles Town property in 1997 and introduction of video lottery terminals in West Virginia, PENN Entertainment began its transition from a pari-mutuel to a diversified gaming company. Ever since then, the company expanded its gaming portfolio through strategic acquisitions, greenfield projects and property expansions.

As of Dec 31, 2023, the company operated 43 properties in 20 states.

In 2017, the company entered an agreement to acquire Pinnacle Entertainment, Inc., a leading regional gaming operator. This transaction closed on Oct 15.

During the fourth quarter of 2018, the company made revisions to its reportable segments upon the consummation of the Pinnacle acquisition. Apart from the addition of the properties, the most significant change was dividing the South/West segment into two separate reportable segments.

In February 2020, PENN Entertainment entered into a strategic partnership with Barstool Sports, whereby Barstool will exclusively promote the company's land-based and online casinos and sports betting products, including the Barstool Sportsbook mobile app. The company's omni-channel approach is bolstered by the mychoice loyalty program, which rewards and recognizes more than 20 million members for their loyalty to both retail and online gaming and sports betting products.

General Information

PENN Entertainment, Inc

825 BERKSHIRE BLVD STE 200

WYOMISSING, PA 19610

Phone: 610-373-2400

Fax: 610-373-4966

Web: http://www.pennentertainment.com

Email: penn@jcir.com

| Industry | Gaming |

| Sector | Consumer Discretionary |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 5/2/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | -0.56 |

| Current Year EPS Consensus Estimate | -0.86 |

| Estimated Long-Term EPS Growth Rate | 10.60 |

| Earnings Date | 5/2/2024 |

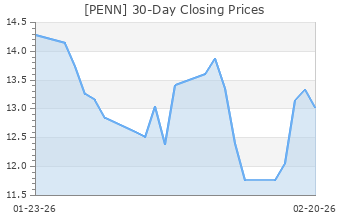

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 16.54 |

| 52 Week High | 31.63 |

| 52 Week Low | 15.88 |

| Beta | 2.06 |

| 20 Day Moving Average | 4,999,833.50 |

| Target Price Consensus | 27.56 |

| 4 Week | -5.49 |

| 12 Week | -30.94 |

| YTD | -36.43 |

| 4 Week | -3.11 |

| 12 Week | -33.49 |

| YTD | -39.98 |

| Shares Outstanding (millions) | 152.42 |

| Market Capitalization (millions) | 2,521.07 |

| Short Ratio | NA |

| Last Split Date | 3/8/2005 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | NA |

| Trailing 12 Months | 66.16 |

| PEG Ratio | NA |

| vs. Previous Year | -1,446.15% |

| vs. Previous Quarter | -244.63% |

| vs. Previous Year | -12.00% |

| vs. Previous Quarter | -13.83% |

| Price/Book | 0.78 |

| Price/Cash Flow | 4.61 |

| Price / Sales | 0.40 |

| 3/31/24 | NA |

| 12/31/23 | 1.31 |

| 9/30/23 | 8.67 |

| 3/31/24 | NA |

| 12/31/23 | 0.30 |

| 9/30/23 | 1.97 |

| 3/31/24 | NA |

| 12/31/23 | 1.11 |

| 9/30/23 | 1.42 |

| 3/31/24 | NA |

| 12/31/23 | 1.11 |

| 9/30/23 | 1.41 |

| 3/31/24 | NA |

| 12/31/23 | 0.77 |

| 9/30/23 | 5.10 |

| 3/31/24 | NA |

| 12/31/23 | -7.70 |

| 9/30/23 | -1.70 |

| 3/31/24 | NA |

| 12/31/23 | -7.85 |

| 9/30/23 | -0.60 |

| 3/31/24 | NA |

| 12/31/23 | 21.08 |

| 9/30/23 | 22.94 |

| 3/31/24 | NA |

| 12/31/23 | 202.32 |

| 9/30/23 | 194.09 |

| 3/31/24 | NA |

| 12/31/23 | 1.60 |

| 9/30/23 | 1.47 |

| 3/31/24 | NA |

| 12/31/23 | 61.47 |

| 9/30/23 | 59.49 |