This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

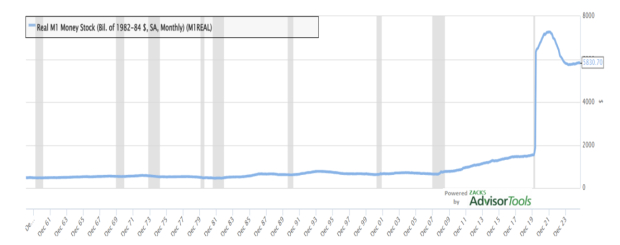

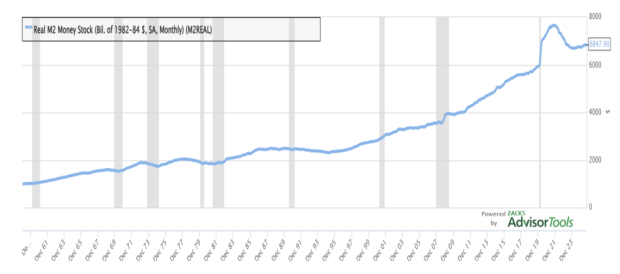

An Unprecedented Rise in the Real U.S. M1 and M2 Money Stock Followed the COVID Pandemic (Peaking around 2020 and 2021)

This was caused by a unique and massive U.S. coordination of monetary policy and fiscal policy; and a technical regulatory change.

The combo led to a huge surge in deposits held by households, banks, and businesses.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Three primary forces built up this dramatic M1 and M2 growth:

A. The Federal Reserve's Quantitative Easing (aka “QE” Monetary Policy)

The Federal Reserve (the Fed) undertook a massive expansionary monetary policy known as Quantitative Easing (QE) in March 2020 to stabilize financial markets and pump liquidity into the U.S. economy.

The Fed purchased trillions of dollars-worth of U.S. government bonds (Treasuries) and mortgage-backed securities (MBS).

When the Fed buys a bond from a commercial bank or financial institution, it pays for it by crediting that bank's reserve account at the Fed.

- The bank's asset (the bond) is replaced with an asset (reserves)

- When the seller of the bond is a non-bank public entity (like a pension fund), the transaction results in a new deposit at a commercial bank

These deposits are the components that make up the M1 and M2 money supply

Result: The Fed's actions directly injected funds into the U.S. banking system, which immediately showed up as a huge increase in bank deposits (M1 and M2).

B. Unprecedented Fiscal Stimulus (Federal and State Government Spending)

Unlike the 2008 financial crisis, the Fed's monetary expansion was accompanied by massive fiscal stimulus packages from the U.S. government (aka Congress):

- Programs like the CARES Act provided direct stimulus checks to households and expanded unemployment benefits

- Programs like the Paycheck Protection Program (PPP) issued hundreds of billions of dollars in loans and grants to small businesses too

Finally, the Treasury Department issued debt (often purchased by the Fed in its QE operations) to fund these transfers.

When the U.S. Treasury deposited money into individuals' and businesses' checking accounts, this money immediately became new demand deposits, causing M1 and M2 to surge.

C. Regulation D Change (A Technical M1 Spike)

A key regulatory change technically exaggerated the increase in the M1 measure:

- In March 2020, the Fed eliminated reserve requirements for banks (Regulation D)

- In April 2020, the Fed formally allowed savings accounts to be classified as transaction accounts (checkable), effectively making them indistinguishable from checking accounts -- for the purpose of the M1 calculation

A vast amount of money that was previously in savings accounts (part of M2, but not M1) was now counted in M1, causing the M1 number to skyrocket.

This was a definitional change that caused a larger one-time jump in M1 vis-à-vis M2.

In summary, the combined effect — of the Fed creating new reserves and the U.S. Treasury putting that money directly into public deposits — resulted in the historic spike in the U.S. money supply measures.

"Real" Consequences from the COVID Money Flood

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

An Unprecedented Rise in the Real U.S. M1 and M2 Money Stock Followed the COVID Pandemic (Peaking around 2020 and 2021)

This was caused by a unique and massive U.S. coordination of monetary policy and fiscal policy; and a technical regulatory change.

The combo led to a huge surge in deposits held by households, banks, and businesses.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Three primary forces built up this dramatic M1 and M2 growth:

A. The Federal Reserve's Quantitative Easing (aka “QE” Monetary Policy)

The Federal Reserve (the Fed) undertook a massive expansionary monetary policy known as Quantitative Easing (QE) in March 2020 to stabilize financial markets and pump liquidity into the U.S. economy.

The Fed purchased trillions of dollars-worth of U.S. government bonds (Treasuries) and mortgage-backed securities (MBS).

When the Fed buys a bond from a commercial bank or financial institution, it pays for it by crediting that bank's reserve account at the Fed.

These deposits are the components that make up the M1 and M2 money supply

Result: The Fed's actions directly injected funds into the U.S. banking system, which immediately showed up as a huge increase in bank deposits (M1 and M2).

B. Unprecedented Fiscal Stimulus (Federal and State Government Spending)

Unlike the 2008 financial crisis, the Fed's monetary expansion was accompanied by massive fiscal stimulus packages from the U.S. government (aka Congress):

Finally, the Treasury Department issued debt (often purchased by the Fed in its QE operations) to fund these transfers.

When the U.S. Treasury deposited money into individuals' and businesses' checking accounts, this money immediately became new demand deposits, causing M1 and M2 to surge.

C. Regulation D Change (A Technical M1 Spike)

A key regulatory change technically exaggerated the increase in the M1 measure:

A vast amount of money that was previously in savings accounts (part of M2, but not M1) was now counted in M1, causing the M1 number to skyrocket.

This was a definitional change that caused a larger one-time jump in M1 vis-à-vis M2.

In summary, the combined effect — of the Fed creating new reserves and the U.S. Treasury putting that money directly into public deposits — resulted in the historic spike in the U.S. money supply measures.