We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Purple Innovation (PRPL) Lowers Q2 & Withdraws 2021 Outlook

Read MoreHide Full Article

Shares of Purple Innovation, Inc. (PRPL - Free Report) have declined nearly 4% during the trading hours on Jun 29, following the company’s revised second-quarter 2021 view. Also, the company withdrew its full-year guidance. Management informed that in the current quarter due to an accident, it faced production challenges following sudden mechanical and maintenance issues cropping up while fixing the machines.

Consequently, it now expects meaningfully lower production levels overall for around 10 weeks, which in turn, may induce shipment backlogs. These backlogs are expected to hurt both the second and third-quarter revenues. However, it forecasts full production to be back online by mid-July. Moreover, management is certain that these headwinds are isolated events and won’t affect the company’s ability to scale up its performance beyond 2021.

Considering the aforesaid difficulties, management now projects net revenues in the bracket of $175-$185 million and a gross margin of 43-45% for the quarter ended Jun 30, 2021. It also suspended the adjusted EBITDA guidance issued on May 17, 2021 for the same quarter. Earlier, the company expected net revenues between $200 million and $210 million and an adjusted EBITDA between $21 million and $25 million.

Following the updated second-quarter outlook and taking into account the anticipated impacts of production woes on the third quarter, management stalled its guidance for 2021. On May 17, Purple Innovation anticipated net revenues of $860-$900 million and adjusted EBITDA of $95-$105 million for the ongoing year.

Meanwhile, the company completed a detailed review of the effects of production challenges, and macro-economic trends considering supply-chain, labor and marketing costs. Therefore, it expects to provide 2021 outlook when it will release second-quarter results. Furthermore, it shared growth targets for the long run. It hopes to recognize revenues worth $2-$2.5 billion and predicts adjusted EBITDA margins in the mid-teens over the coming three-five years.

Image Source: Zacks Investment Research

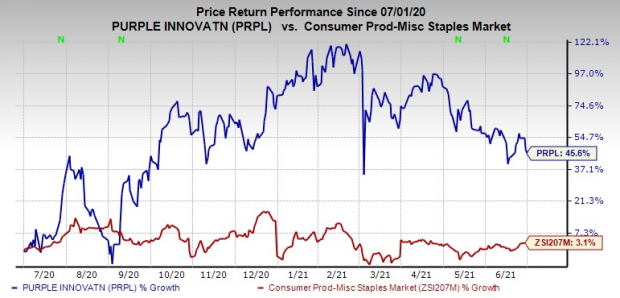

Shares of this currently Zacks Rank #3 (Hold) company have soared 45.6% in the past year, outperforming the industry’s mere 3.1% rise.

Hain Celestial (HAIN - Free Report) has a trailing four-quarter earnings surprise of 26.4%, on average, and a Zacks Rank #2 (Buy) at present.

Nomad Foods (NOMD - Free Report) came up with an earnings surprise of 10.3% in the trailing four quarters, on average. It currently carries a Zacks Rank of 2.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

Image: Shutterstock

Purple Innovation (PRPL) Lowers Q2 & Withdraws 2021 Outlook

Shares of Purple Innovation, Inc. (PRPL - Free Report) have declined nearly 4% during the trading hours on Jun 29, following the company’s revised second-quarter 2021 view. Also, the company withdrew its full-year guidance. Management informed that in the current quarter due to an accident, it faced production challenges following sudden mechanical and maintenance issues cropping up while fixing the machines.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Consequently, it now expects meaningfully lower production levels overall for around 10 weeks, which in turn, may induce shipment backlogs. These backlogs are expected to hurt both the second and third-quarter revenues. However, it forecasts full production to be back online by mid-July. Moreover, management is certain that these headwinds are isolated events and won’t affect the company’s ability to scale up its performance beyond 2021.

Considering the aforesaid difficulties, management now projects net revenues in the bracket of $175-$185 million and a gross margin of 43-45% for the quarter ended Jun 30, 2021. It also suspended the adjusted EBITDA guidance issued on May 17, 2021 for the same quarter. Earlier, the company expected net revenues between $200 million and $210 million and an adjusted EBITDA between $21 million and $25 million.

Following the updated second-quarter outlook and taking into account the anticipated impacts of production woes on the third quarter, management stalled its guidance for 2021. On May 17, Purple Innovation anticipated net revenues of $860-$900 million and adjusted EBITDA of $95-$105 million for the ongoing year.

Meanwhile, the company completed a detailed review of the effects of production challenges, and macro-economic trends considering supply-chain, labor and marketing costs. Therefore, it expects to provide 2021 outlook when it will release second-quarter results. Furthermore, it shared growth targets for the long run. It hopes to recognize revenues worth $2-$2.5 billion and predicts adjusted EBITDA margins in the mid-teens over the coming three-five years.

Shares of this currently Zacks Rank #3 (Hold) company have soared 45.6% in the past year, outperforming the industry’s mere 3.1% rise.

Better-Ranked Consumer Staples Stocks

Darling Ingredients (DAR - Free Report) delivered an earnings surprise of 29.8% in the last four quarters, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hain Celestial (HAIN - Free Report) has a trailing four-quarter earnings surprise of 26.4%, on average, and a Zacks Rank #2 (Buy) at present.

Nomad Foods (NOMD - Free Report) came up with an earnings surprise of 10.3% in the trailing four quarters, on average. It currently carries a Zacks Rank of 2.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>