We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Boston Beer's (SAM) Innovation and Expansion Plans on Track

Read MoreHide Full Article

The Boston Beer Company, Inc. (SAM - Free Report) remains committed to innovation and product portfolio expansion to boost long-term growth. Its advancement in the non-beer categories including ciders and hard seltzer should continue to drive progress. The company is also focused on accelerated cost savings and efficiency projects to aid margins. We expect its intensified concentration on pricing, product innovation, growth of non-beer categories alongside brand-building efforts to reinforce its position in the market.

We note that Boston Beer has made successful innovations in craft beer, hard cider and hard iced tea categories over the years. The company has been witnessing robust trends for the Truly and Twisted Tea brands, which are driving depletions. In the first quarter of 2021, the company witnessed accelerated depletion growth for the Truly Hard Seltzer and Twisted Tea brands. In a latest development, the well-known craft brewer inked a long-term partnership deal with Beam Suntory, through which it looks to expand select iconic brands into some fastest-growing beverage alcohol segments.

More on Latest Partnership

Boston Beer’s collaboration with Beam Suntory will help grow its industry-leading Truly Hard Seltzer into bottled spirits, thus gaining from the latter’s distilling expertise and distribution network. Both companies also expect product launches including the Sauza tequila brand into ready-to-drink beverages (RTDs) by capitalizing on Boston Beer's production capabilities and distribution footprint.

Management remains quite impressed with this recent alliance, which will help the company transition into the spirits category. This alliance will enable Boston Beer to offer customers more options while accomplishing its mission of serving high-quality products including the tequila brand.

Being a recognized premium spirits player and an RTD leader in Japan, Australia and Germany, Beam Suntory has brands like Jim Beam, Canadian Club and -196° in its kitty, and looks to strengthen its flourishing US RTD business. Boston Beer boasts a robust portfolio of brands like Dogfish Head beer, Samuel Adams, Twisted Tea Hard Iced Tea, Truly Hard Seltzer and Angry Orchard Hard Cider. These premium brands coupled with an extension in the spirits category through the latest tie-up are likely to deliver sustainable growth for Boston Beer.

What Else?

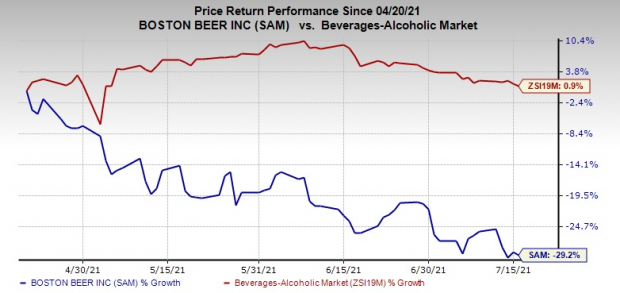

Shares of this presently Zacks Rank #5 (Strong Sell) player have decreased 29.2% against the industry’s 0.9% rise in the past three months. The downside can be attributed to the adverse impacts of the prevalent pandemic. The company has also been witnessing higher labor and safety-related costs at its breweries for a while now due to the ongoing economic uncertainties. It also continues to be affected by higher advertising, promotional and selling expenses as well as freight costs.

Image Source: Zacks Investment Research

Nonetheless, Boston Beer’s sturdy shipments and depletion growth are steadily aiding its top and bottom-line performances. The company reported better-than-expected earnings and sales results for first-quarter 2021. Both metrics improved on a year-over-year basis. Its shipments surged 60.1% year over year in the quarter, led by actions to maintain adequate distributor inventory levels to buoy demand.

Depletions grew 48%, marking the 12th successive quarter of double-digit growth. Depletions for the fifteen-week period, having ended Apr 10, 2021, soared nearly 49% from the year-ago period’s level.

Molson Coors (TAP - Free Report) delivered an earnings surprise of 63.8% in the trailing four quarters, on average. It currently has a Zacks Rank #2 (Buy).

Medifast (MED - Free Report) delivered an earnings surprise of 12.7% in the trailing four quarters, on average. It has a Zacks Rank of 2, presently.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Boston Beer's (SAM) Innovation and Expansion Plans on Track

The Boston Beer Company, Inc. (SAM - Free Report) remains committed to innovation and product portfolio expansion to boost long-term growth. Its advancement in the non-beer categories including ciders and hard seltzer should continue to drive progress. The company is also focused on accelerated cost savings and efficiency projects to aid margins. We expect its intensified concentration on pricing, product innovation, growth of non-beer categories alongside brand-building efforts to reinforce its position in the market.

We note that Boston Beer has made successful innovations in craft beer, hard cider and hard iced tea categories over the years. The company has been witnessing robust trends for the Truly and Twisted Tea brands, which are driving depletions. In the first quarter of 2021, the company witnessed accelerated depletion growth for the Truly Hard Seltzer and Twisted Tea brands. In a latest development, the well-known craft brewer inked a long-term partnership deal with Beam Suntory, through which it looks to expand select iconic brands into some fastest-growing beverage alcohol segments.

More on Latest Partnership

Boston Beer’s collaboration with Beam Suntory will help grow its industry-leading Truly Hard Seltzer into bottled spirits, thus gaining from the latter’s distilling expertise and distribution network. Both companies also expect product launches including the Sauza tequila brand into ready-to-drink beverages (RTDs) by capitalizing on Boston Beer's production capabilities and distribution footprint.

Management remains quite impressed with this recent alliance, which will help the company transition into the spirits category. This alliance will enable Boston Beer to offer customers more options while accomplishing its mission of serving high-quality products including the tequila brand.

Being a recognized premium spirits player and an RTD leader in Japan, Australia and Germany, Beam Suntory has brands like Jim Beam, Canadian Club and -196° in its kitty, and looks to strengthen its flourishing US RTD business. Boston Beer boasts a robust portfolio of brands like Dogfish Head beer, Samuel Adams, Twisted Tea Hard Iced Tea, Truly Hard Seltzer and Angry Orchard Hard Cider. These premium brands coupled with an extension in the spirits category through the latest tie-up are likely to deliver sustainable growth for Boston Beer.

What Else?

Shares of this presently Zacks Rank #5 (Strong Sell) player have decreased 29.2% against the industry’s 0.9% rise in the past three months. The downside can be attributed to the adverse impacts of the prevalent pandemic. The company has also been witnessing higher labor and safety-related costs at its breweries for a while now due to the ongoing economic uncertainties. It also continues to be affected by higher advertising, promotional and selling expenses as well as freight costs.

Image Source: Zacks Investment Research

Nonetheless, Boston Beer’s sturdy shipments and depletion growth are steadily aiding its top and bottom-line performances. The company reported better-than-expected earnings and sales results for first-quarter 2021. Both metrics improved on a year-over-year basis. Its shipments surged 60.1% year over year in the quarter, led by actions to maintain adequate distributor inventory levels to buoy demand.

Depletions grew 48%, marking the 12th successive quarter of double-digit growth. Depletions for the fifteen-week period, having ended Apr 10, 2021, soared nearly 49% from the year-ago period’s level.

Key Picks in the Consumer Staples Space

Darling Ingredients (DAR - Free Report) delivered an earnings surprise of 29.8% in the last four quarters, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Molson Coors (TAP - Free Report) delivered an earnings surprise of 63.8% in the trailing four quarters, on average. It currently has a Zacks Rank #2 (Buy).

Medifast (MED - Free Report) delivered an earnings surprise of 12.7% in the trailing four quarters, on average. It has a Zacks Rank of 2, presently.