We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

3 Stocks to Watch as the Football Mania Grips Americans

Read MoreHide Full Article

The football frenzy is going to grip Americans with the National Football League (NFL) set to kick-start the season on Sep 9, 2021 and last through Jan 9, 2022.

While watching their favorite game, Americans will also indulge in betting on the match outcomes, capitalizing on the opportunity of minting money legally.

The NFL season is a phase when sports betting sees a huge surge, given that the same has historically been the favourite pastime for Americans. Now after betting became legalized in 2018 via a Supreme Court ruling, the overall participation, especially among the younger fans has risen over time.

The legalization of online sports betting led to a new revenue source for the sports industry. More than two dozen US states already legalized the same and more are soon to follow suit.

Despite online betting still being in a nascent stage , the market is growing fast. Per H2 Gambling Capital, the U.S. sports betting market is projected to generate an estimated $8 billion in gross gaming revenue in 2025, increased from just an estimated $2 billion in 2020.

For the upcoming football fever, prediction remains bullish. Per a study by the US online gaming outlet PlayUSA, punters could place more than $20 billion at stake on the NFL and college soccer during the 2021 season.

Wider accessibility and social acceptance of sports betting place the dealers in this domain in a sweet spot. By the end of 2023, 37 states are expected to legalize sports betting and generate total collective betting revenues worth $6 billion.

Against this backdrop, we choose three companies, which should be retained for the long haul, given their exposure to sports betting business. Each of these stocks carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Stocks to Retain

MGM Resorts International (MGM - Free Report) is a global entertainment company with properties in the United States and Macau comprising hotels and casinos, conference spaces, restaurants, shops and live entertainment. Given the vast opportunity offered by online gambling, the company is expanding its market share in the said space via BetMGM. It is the exclusive sports betting platform of MGM. Ever since its launch in 2018, BetMGM has done extremely well and is now operating in 12 states.

BetMGM is the number two operator nationwide and its market share in live markets increased to 24%. It continues to be a leader in the iGaming space with its market share reaching 30% in second-quarter 2021. BetMGM is on track to rake in $1 billion net revenues by 2022, up significantly from $178 million recognized in 2020. Year to date the stock is up 35.1%.

Image Source: Zacks Investment Research

Caesars Entertainment, Inc. (CZR - Free Report) expanded its share in the sports betting and online gaming in the United States with the acquisition of sports betting company William Hill in April this year. The combined entity currently runs sports betting in 18 jurisdictions within the country, leading 13 of which offer mobile sports betting. The company expects to be operational in 20 U.S. jurisdictions by the end of 2021.

It plans to rebrand the sportsbooks at its properties as Caesars Sportsbook and integrate the Caesars Sports app with the Caesars Rewards database. Recently, the company launched the Caesars Sportsbook app in Arizona for downloading and depositing purposes to cash in on the NFL event. Also, a single wallet product is in the pipeline. Nonetheless, we believe that the closure and non-US divestiture of William Hill represent a fully-integrated digital gaming opportunity for the company in the longer term. Year to date the stock is up 39.3%.

Image Source: Zacks Investment Research

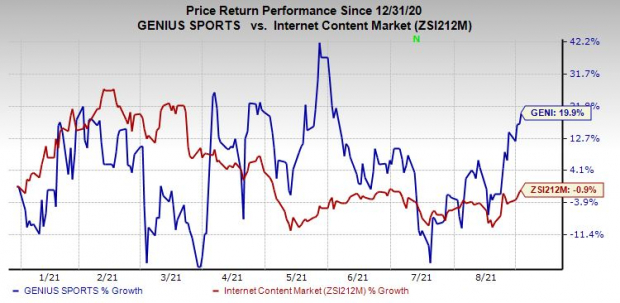

Another stock worth holding is Genius Sports Limited (GENI - Free Report) , which provides high quality, live sports data, indispensable for sports betting. The company supplies live data to more than 300 sportsbook brands worldwide with the likes of Fanduel, Betfair, PaddyPower and Sky Bet (all Flutter), BetMGM, Ladbrokes and Coral (all GVC/Entain), DraftKings Inc. (DKNG - Free Report) , bet365, William Hill, 888 and others. None of these sportsbooks currently takes Genius’ entire product offerings and so these integrations provide a clear opportunity of growth.

Genius established long-term relationships with popular leagues, such as the NFL, EPL, NBA, NCAA, PGA, FIBA, FIFA and Serie A, which provide it with the rights to collect and monetize their data.

Its long-term contracts guarantee minimum payments throughout the life of the term (typically 3-5 years), which allow good earnings visibility. Genius’ contracts are also structured with upside levers that help it benefit as it partner's business expand. The company is clearly aligned with growth of sport betting. Year to date the stock is up 19.9%.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Stocks to Watch as the Football Mania Grips Americans

The football frenzy is going to grip Americans with the National Football League (NFL) set to kick-start the season on Sep 9, 2021 and last through Jan 9, 2022.

While watching their favorite game, Americans will also indulge in betting on the match outcomes, capitalizing on the opportunity of minting money legally.

The NFL season is a phase when sports betting sees a huge surge, given that the same has historically been the favourite pastime for Americans. Now after betting became legalized in 2018 via a Supreme Court ruling, the overall participation, especially among the younger fans has risen over time.

The legalization of online sports betting led to a new revenue source for the sports industry. More than two dozen US states already legalized the same and more are soon to follow suit.

Despite online betting still being in a nascent stage , the market is growing fast. Per H2 Gambling Capital, the U.S. sports betting market is projected to generate an estimated $8 billion in gross gaming revenue in 2025, increased from just an estimated $2 billion in 2020.

For the upcoming football fever, prediction remains bullish. Per a study by the US online gaming outlet PlayUSA, punters could place more than $20 billion at stake on the NFL and college soccer during the 2021 season.

Wider accessibility and social acceptance of sports betting place the dealers in this domain in a sweet spot. By the end of 2023, 37 states are expected to legalize sports betting and generate total collective betting revenues worth $6 billion.

Against this backdrop, we choose three companies, which should be retained for the long haul, given their exposure to sports betting business. Each of these stocks carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Stocks to Retain

MGM Resorts International (MGM - Free Report) is a global entertainment company with properties in the United States and Macau comprising hotels and casinos, conference spaces, restaurants, shops and live entertainment.

Given the vast opportunity offered by online gambling, the company is expanding its market share in the said space via BetMGM. It is the exclusive sports betting platform of MGM. Ever since its launch in 2018, BetMGM has done extremely well and is now operating in 12 states.

BetMGM is the number two operator nationwide and its market share in live markets increased to 24%. It continues to be a leader in the iGaming space with its market share reaching 30% in second-quarter 2021. BetMGM is on track to rake in $1 billion net revenues by 2022, up significantly from $178 million recognized in 2020. Year to date the stock is up 35.1%.

Image Source: Zacks Investment Research

Caesars Entertainment, Inc. (CZR - Free Report) expanded its share in the sports betting and online gaming in the United States with the acquisition of sports betting company William Hill in April this year. The combined entity currently runs sports betting in 18 jurisdictions within the country, leading 13 of which offer mobile sports betting. The company expects to be operational in 20 U.S. jurisdictions by the end of 2021.

It plans to rebrand the sportsbooks at its properties as Caesars Sportsbook and integrate the Caesars Sports app with the Caesars Rewards database. Recently, the company launched the Caesars Sportsbook app in Arizona for downloading and depositing purposes to cash in on the NFL event. Also, a single wallet product is in the pipeline. Nonetheless, we believe that the closure and non-US divestiture of William Hill represent a fully-integrated digital gaming opportunity for the company in the longer term. Year to date the stock is up 39.3%.

Image Source: Zacks Investment Research

Another stock worth holding is Genius Sports Limited (GENI - Free Report) , which provides high quality, live sports data, indispensable for sports betting. The company supplies live data to more than 300 sportsbook brands worldwide with the likes of Fanduel, Betfair, PaddyPower and Sky Bet (all Flutter), BetMGM, Ladbrokes and Coral (all GVC/Entain), DraftKings Inc. (DKNG - Free Report) , bet365, William Hill, 888 and others. None of these sportsbooks currently takes Genius’ entire product offerings and so these integrations provide a clear opportunity of growth.

Genius established long-term relationships with popular leagues, such as the NFL, EPL, NBA, NCAA, PGA, FIBA, FIFA and Serie A, which provide it with the rights to collect and monetize their data.

Its long-term contracts guarantee minimum payments throughout the life of the term (typically 3-5 years), which allow good earnings visibility.

Genius’ contracts are also structured with upside levers that help it benefit as it partner's business expand. The company is clearly aligned with growth of sport betting. Year to date the stock is up 19.9%.

Image Source: Zacks Investment Research