We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Gold Shines as Geopolitical Crisis Intensifies: 5 Top Picks

Read MoreHide Full Article

The outbreak of the Russia-Ukraine war, which resulted in market participants’ concern about the global economic growth and consequently its impact on stock markets, boosted demand for safe-haven assets. Demand for the precious metal gold, considered as a major investment option under market turmoil, was also bolstered.

At this juncture, it will be prudent to invest in gold stocks to gain in the near term. We have selected five gold stocks with a favorable Zacks Rank. These are — Gold Resource Corp. (GORO - Free Report) , Gold Standard Ventures Corp. , Northern Dynasty Minerals Ltd. (NAK - Free Report) , Sibanye Stillwater Ltd. (SBSW - Free Report) and Golden Minerals Co. (AUMN - Free Report) .

Turmoil in Wall Street

The geopolitical conflict between Russia and Ukraine heightened as Russia started entering more territories of Ukraine with massive shelling and missile firing that devastated a major part of Ukraine. More than 1.7 million people have fled from Ukraine to the neighboring countries. The UNHRC has said that this has turned out to be the biggest refuge problem in Europe after World War II.

Three negotiation meetings between Russia and Ukraine ended without any fruitful result. Market participants are highly concerned that this war will further elevate the level of inflation globally. Moreover, higher commodity prices may result in a reduction in aggregate demand, indicating stagflation, especially in Europe.

Year to date, the three major stock indexes of Wall Street — the Dow, the S&P 500 and the Nasdaq Composite — tumbled 9.7%, 11.9% and 18%, respectively. On Mar 7, at their intraday trading low, the Dow entered the correction territory while the Nasdaq Composite fell into bear territory. The S&P 500 is already in correction territory.

Gold Glitters

Buying pressure on gold is likely to remain firm with investors focusing on precious metals as a store of wealth and hedge against market turmoil. On Mar 7, the price of gold surpassed $2,000 per ounce before settling at $1,995.90 per ounce, up 1.5%. This was the highest close of gold forward contract since August 2020.

The present scenario of soaring gold price despite a surge in the U.S. dollar index has left several economists and financial experts perplexed. On Mar 7, the U.S. Dollar Index (DXY), a gauge of the greenback against a basket of a half-dozen major currencies, gained 0.5% to settle at nearly 99, its highest closing in two years.

Usually, a strong U.S. dollar weakens demand for other dollar-denominated bullions like gold. However, the northbound movement of both safe-haven assets indicates about how the outbreak of the Russia-Ukraine war has dented investor confidence.

Our Top Picks

At this stage, it will be prudent to invest in gold stocks with strong growth potential. We have narrowed our search to five such stocks. Each of these stocks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

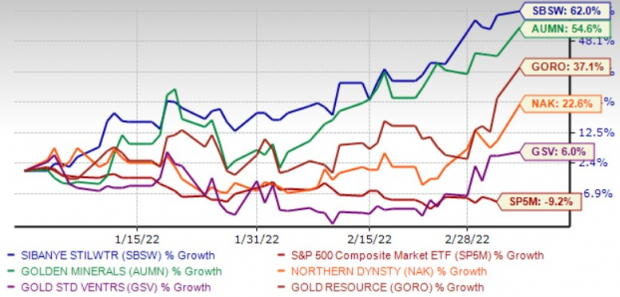

The chart below shows the price performance of our five picks year to date.

u Image Source: Zacks Investment Research

Sibanye Stillwater operates as a precious metals mining company in South Africa, the United States, Zimbabwe, Canada, and Argentina. SBSW produces gold, platinum group metals, including palladium, platinum, and rhodium, and by-products, such as iridium, ruthenium, nickel, copper and chrome.

The Zacks Rank #1 Sibanye Stillwater has expected earnings growth of 15.3% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 16.7% over the last 30 days.

Golden Minerals is a precious metals exploration company that mines, constructs, and explores for mineral properties containing precious metals. AUMN explores for gold, silver, zinc, lead, and other minerals. Golden Minerals has many exploration projects, primarily located in Argentina, Peru, Chile and Mexico.

The Zacks Rank #2 Golden Minerals has expected earnings growth of more than 100% for the current year. The Zacks Consensus Estimate for the current-year earnings improved more than 100% over the last 60 days.

Gold Resource is a mining company focused on production and pursuing the development of select, high-grade gold and silver projects that feature low operation costs and produce high returns on capital in Mexico and the United States. GORO has 100% interest in four potential high-grade gold and silver properties in Mexico's southern state of Oaxaca.

The Zacks Rank #2 Gold Resources has expected earnings growth of more than 100% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 10% over the last 60 days.

Northern Dynasty Minerals is engaged in the exploration of mineral properties in the United States. Its principal mineral property is the Pebble copper-gold-molybdenum project. NAK owns the rights to purchase 100% of the Pebble gold-copper-molybdenum porphyry deposit, where successful drilling programs have delineated an Inferred Mineral Resource.

The Zacks Rank #2 Northern Dynasty Minerals has expected earnings growth of 33.3% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 20% over the last 60 days.

Gold Standard Ventures is a precious metals exploration & gold mining company focused on district scale gold discoveries within North Central Nevada. GSV’s flagship property is the Railroad-Pinion project covering an area of approximately 21,679 hectares located in the Elko County, NV. The Zacks Rank #2 Gold Standard Ventures has expected earnings growth of more than 100% for the current year.

Unique Zacks Analysis of Your Chosen Ticker

Pick one free report - opportunity may be withdrawn at any time

Image: Bigstock

Gold Shines as Geopolitical Crisis Intensifies: 5 Top Picks

The outbreak of the Russia-Ukraine war, which resulted in market participants’ concern about the global economic growth and consequently its impact on stock markets, boosted demand for safe-haven assets. Demand for the precious metal gold, considered as a major investment option under market turmoil, was also bolstered.

At this juncture, it will be prudent to invest in gold stocks to gain in the near term. We have selected five gold stocks with a favorable Zacks Rank. These are — Gold Resource Corp. (GORO - Free Report) , Gold Standard Ventures Corp. , Northern Dynasty Minerals Ltd. (NAK - Free Report) , Sibanye Stillwater Ltd. (SBSW - Free Report) and Golden Minerals Co. (AUMN - Free Report) .

Turmoil in Wall Street

The geopolitical conflict between Russia and Ukraine heightened as Russia started entering more territories of Ukraine with massive shelling and missile firing that devastated a major part of Ukraine. More than 1.7 million people have fled from Ukraine to the neighboring countries. The UNHRC has said that this has turned out to be the biggest refuge problem in Europe after World War II.

Three negotiation meetings between Russia and Ukraine ended without any fruitful result. Market participants are highly concerned that this war will further elevate the level of inflation globally. Moreover, higher commodity prices may result in a reduction in aggregate demand, indicating stagflation, especially in Europe.

Year to date, the three major stock indexes of Wall Street — the Dow, the S&P 500 and the Nasdaq Composite — tumbled 9.7%, 11.9% and 18%, respectively. On Mar 7, at their intraday trading low, the Dow entered the correction territory while the Nasdaq Composite fell into bear territory. The S&P 500 is already in correction territory.

Gold Glitters

Buying pressure on gold is likely to remain firm with investors focusing on precious metals as a store of wealth and hedge against market turmoil. On Mar 7, the price of gold surpassed $2,000 per ounce before settling at $1,995.90 per ounce, up 1.5%. This was the highest close of gold forward contract since August 2020.

The present scenario of soaring gold price despite a surge in the U.S. dollar index has left several economists and financial experts perplexed. On Mar 7, the U.S. Dollar Index (DXY), a gauge of the greenback against a basket of a half-dozen major currencies, gained 0.5% to settle at nearly 99, its highest closing in two years.

Usually, a strong U.S. dollar weakens demand for other dollar-denominated bullions like gold. However, the northbound movement of both safe-haven assets indicates about how the outbreak of the Russia-Ukraine war has dented investor confidence.

Our Top Picks

At this stage, it will be prudent to invest in gold stocks with strong growth potential. We have narrowed our search to five such stocks. Each of these stocks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

u

Image Source: Zacks Investment Research

Sibanye Stillwater operates as a precious metals mining company in South Africa, the United States, Zimbabwe, Canada, and Argentina. SBSW produces gold, platinum group metals, including palladium, platinum, and rhodium, and by-products, such as iridium, ruthenium, nickel, copper and chrome.

The Zacks Rank #1 Sibanye Stillwater has expected earnings growth of 15.3% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 16.7% over the last 30 days.

Golden Minerals is a precious metals exploration company that mines, constructs, and explores for mineral properties containing precious metals. AUMN explores for gold, silver, zinc, lead, and other minerals. Golden Minerals has many exploration projects, primarily located in Argentina, Peru, Chile and Mexico.

The Zacks Rank #2 Golden Minerals has expected earnings growth of more than 100% for the current year. The Zacks Consensus Estimate for the current-year earnings improved more than 100% over the last 60 days.

Gold Resource is a mining company focused on production and pursuing the development of select, high-grade gold and silver projects that feature low operation costs and produce high returns on capital in Mexico and the United States. GORO has 100% interest in four potential high-grade gold and silver properties in Mexico's southern state of Oaxaca.

The Zacks Rank #2 Gold Resources has expected earnings growth of more than 100% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 10% over the last 60 days.

Northern Dynasty Minerals is engaged in the exploration of mineral properties in the United States. Its principal mineral property is the Pebble copper-gold-molybdenum project. NAK owns the rights to purchase 100% of the Pebble gold-copper-molybdenum porphyry deposit, where successful drilling programs have delineated an Inferred Mineral Resource.

The Zacks Rank #2 Northern Dynasty Minerals has expected earnings growth of 33.3% for the current year. The Zacks Consensus Estimate for the current-year earnings improved 20% over the last 60 days.

Gold Standard Ventures is a precious metals exploration & gold mining company focused on district scale gold discoveries within North Central Nevada. GSV’s flagship property is the Railroad-Pinion project covering an area of approximately 21,679 hectares located in the Elko County, NV. The Zacks Rank #2 Gold Standard Ventures has expected earnings growth of more than 100% for the current year.