Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put AmerisourceBergen Corporation stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

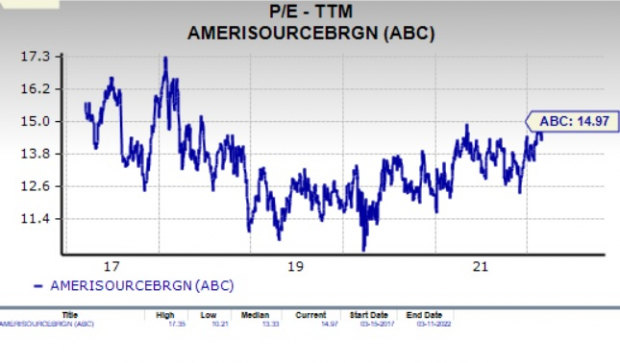

On this front, AmerisourceBergen has a trailing twelve months PE ratio of 14.97, as you can see in the chart below:

Image Source: Zacks Investment Research

This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 stands at about 20.40. If we focus on the long-term PE trend, AmerisourceBergen’s current PE level puts it above its midpoint over the past five years.

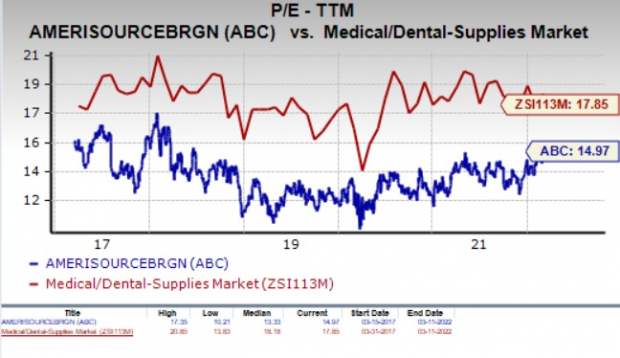

Image Source: Zacks Investment Research

Further, the stock’s PE also compares favorably with the industry’s trailing twelve months PE ratio, which stands at 17.85. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

Image Source: Zacks Investment Research

We should also point out that AmerisourceBergen has a forward PE ratio (price relative to this year’s earnings) of just 13.39, so it is fair to say that a slightly more value-oriented path may be ahead for AmerisourceBergen stock in the near term too.

P/S Ratio

Another key metric to note is the Price/Sales ratio. This approach compares a given stock’s price to its total sales, where a lower reading is generally considered better. Some people like this metric more than other value-focused ones because it looks at sales, something that is far harder to manipulate with accounting tricks than earnings.

Right now, AmerisourceBergen has a P/S ratio of about 0.14. This is significantly lower than the S&P 500 average, which comes in at 4.38 right now. As we can see in the chart below, this is above the median for this stock in particular over the past few years.

Image Source: Zacks Investment Research

ABC is actually in the higher zone of its trading range in the time period per the P/S metric, which suggests that the company’s stock price has already appreciated to some degree, relative to its sales.

Broad Value Outlook

In aggregate, AmerisourceBergen currently has a Zacks Value Style Score of A, putting it into the top 20% of all stocks we cover from this look. This makes AmerisourceBergen a solid choice for value investors, and some of its other key metrics make this pretty clear too.

For example, the PEG ratio for AmerisourceBergen is 1.64, a level that is lower than the industry average of 2.27. The PEG ratio is a modified PE ratio that takes into account the stock’s earnings growth rate. Additionally, its P/CF ratio (another great indicator of value) comes in at 12.30, which is better than the industry average of 13.02. Clearly, ABC is a solid choice on the value front from multiple angles.

What About the Stock Overall?

Though AmerisourceBergen might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth grade of A and a Momentum score of F. This gives ABC a Zacks VGM score—or its overarching fundamental grade—of A. (You can read more about the Zacks Style Scores here >>)

Meanwhile, the company’s recent earnings estimates have been mostly trending higher. The current fiscal quarter has seen two estimates go higher in the past sixty days compared to one lower, while the fiscal full year estimate has seen six upward and zero downward revisions in the same time period.

As a result, the current fiscal quarter consensus estimate has risen by 5.6% in the past two months, while the fiscal full year estimate has increased 1%.

This favorable trend is why the stock has a Zacks Rank #2 (Buy) and why we are looking for outperformance from the company in the near term.

Bottom Line

AmerisourceBergen is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. Furthermore, a robust industry rank (among the Top 45%) and a solid Zacks Rank instills investor confidence.

However, it is hard to get too excited about this company overall as over the past two years, the industry has underperformed the broader market, as you can see below:

Image Source: Zacks Investment Research

Despite the poor past performance of the industry, a good industry rank signals that the stock is likely to benefit from favorable broader factors in the immediate future. Add to this the positive estimate revisions and robust value metrics, and we believe that we have a strong value contender in AmerisourceBergen.

Image: Bigstock

Should Value Investors Pick AmerisourceBergen (ABC) Stock?

Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put AmerisourceBergen Corporation stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

On this front, AmerisourceBergen has a trailing twelve months PE ratio of 14.97, as you can see in the chart below:

Image Source: Zacks Investment Research

This level actually compares pretty favorably with the market at large, as the PE for the S&P 500 stands at about 20.40. If we focus on the long-term PE trend, AmerisourceBergen’s current PE level puts it above its midpoint over the past five years.

Image Source: Zacks Investment Research

Further, the stock’s PE also compares favorably with the industry’s trailing twelve months PE ratio, which stands at 17.85. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

Image Source: Zacks Investment Research

We should also point out that AmerisourceBergen has a forward PE ratio (price relative to this year’s earnings) of just 13.39, so it is fair to say that a slightly more value-oriented path may be ahead for AmerisourceBergen stock in the near term too.

P/S Ratio

Another key metric to note is the Price/Sales ratio. This approach compares a given stock’s price to its total sales, where a lower reading is generally considered better. Some people like this metric more than other value-focused ones because it looks at sales, something that is far harder to manipulate with accounting tricks than earnings.

Right now, AmerisourceBergen has a P/S ratio of about 0.14. This is significantly lower than the S&P 500 average, which comes in at 4.38 right now. As we can see in the chart below, this is above the median for this stock in particular over the past few years.

Image Source: Zacks Investment Research

ABC is actually in the higher zone of its trading range in the time period per the P/S metric, which suggests that the company’s stock price has already appreciated to some degree, relative to its sales.

Broad Value Outlook

In aggregate, AmerisourceBergen currently has a Zacks Value Style Score of A, putting it into the top 20% of all stocks we cover from this look. This makes AmerisourceBergen a solid choice for value investors, and some of its other key metrics make this pretty clear too.

For example, the PEG ratio for AmerisourceBergen is 1.64, a level that is lower than the industry average of 2.27. The PEG ratio is a modified PE ratio that takes into account the stock’s earnings growth rate. Additionally, its P/CF ratio (another great indicator of value) comes in at 12.30, which is better than the industry average of 13.02. Clearly, ABC is a solid choice on the value front from multiple angles.

What About the Stock Overall?

Though AmerisourceBergen might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth grade of A and a Momentum score of F. This gives ABC a Zacks VGM score—or its overarching fundamental grade—of A. (You can read more about the Zacks Style Scores here >>)

Meanwhile, the company’s recent earnings estimates have been mostly trending higher. The current fiscal quarter has seen two estimates go higher in the past sixty days compared to one lower, while the fiscal full year estimate has seen six upward and zero downward revisions in the same time period.

As a result, the current fiscal quarter consensus estimate has risen by 5.6% in the past two months, while the fiscal full year estimate has increased 1%.

This favorable trend is why the stock has a Zacks Rank #2 (Buy) and why we are looking for outperformance from the company in the near term.

Bottom Line

AmerisourceBergen is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. Furthermore, a robust industry rank (among the Top 45%) and a solid Zacks Rank instills investor confidence.

However, it is hard to get too excited about this company overall as over the past two years, the industry has underperformed the broader market, as you can see below:

Image Source: Zacks Investment Research

Despite the poor past performance of the industry, a good industry rank signals that the stock is likely to benefit from favorable broader factors in the immediate future. Add to this the positive estimate revisions and robust value metrics, and we believe that we have a strong value contender in AmerisourceBergen.