Regardless of your personal approach to investing, I believe everyone can benefit from insight into the world of dividend investing. The most important fact to realize is that stock investing builds greater wealth than any other traditional investing method. One of the most paramount skills to learn is how to select the most profitable stocks for your investment portfolio.

Once you purchase a stock, you become a partial owner of the company and own a percentage of that company. In terms of fundamental analysis, there are many ways to select profitable companies such as earnings growth, revenue growth, cash flow data, and return on equity. One of the main things I personally like to focus on is a company’s approach to dividend payouts.

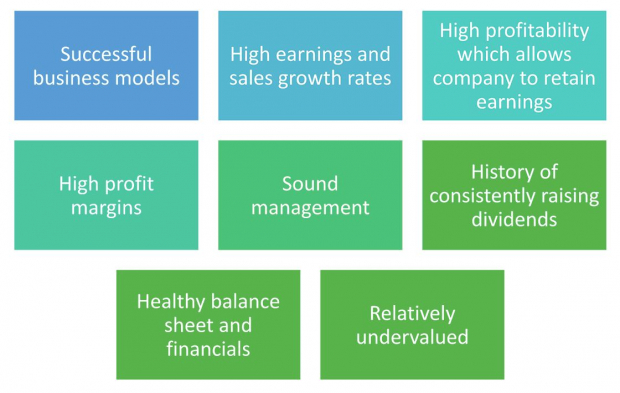

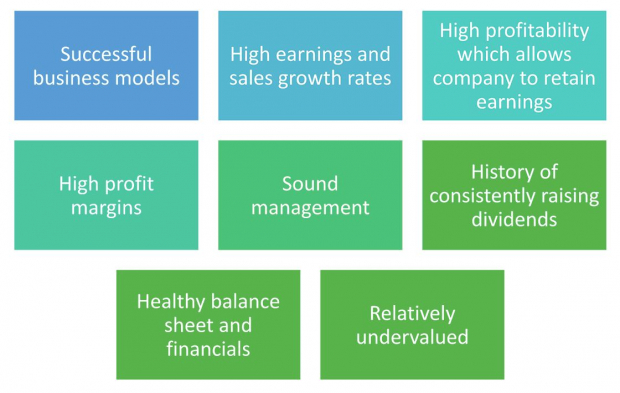

In addition, I look for companies that have the following characteristics:

Image Source: Zacks Investment Research

I prefer to target companies that have a history of raising dividends, even during uncertain times such as the current market environment. I have found the dividend growth rate to be a reliable forecaster of future earnings growth. Dividends are paid in cash – they’re not just figures on a balance sheet that can be manipulated.

The Power of Dividends

Corporate directors know their companies better than anyone else. They know the financial condition of their business, along with the outlook for its future earnings growth. They will only raise dividends if they truly believe that future earnings will be able to sustain higher dividend payouts.

A consistently rising dividend trend subtly reveals a company’s progress and is one of the best indicators of a healthy, growing enterprise. Using this simple yet effective strategy of investing in companies that consistently raise their dividends, investors can harness the power of compounding income. There are no complex formulas or calculations required.

Continued . . .

------------------------------------------------------------------------------------------------------

Zacks’ Answer to Market Volatility and Inflation

Spoiler Alert: It’s not fixed-income investments like T-Notes, CDs, and Money Market Accounts that are losing money relative to inflation.

Instead we find stocks that not only pay nearly 2X higher dividends than the S&P 500 but are projected to do so quarter after quarter. This can give you a smoother ride through volatile periods. PLUS we apply Zacks Rank analysis to catch rising earnings estimates for market-beating growth.

See Our "Growthy" Dividend Stocks Now >>

------------------------------------------------------------------------------------------------------

The Zacks Income Investor service reverses the conventional wisdom that high returns must come with high risk. One of the goals of this service is to achieve above-average returns with relatively low risk. Our aim is to make profits during both bull and bear markets. Over the years, I’ve learned that simple is better – both in life and investing. The more complicated a strategy is, the less likely it is to work in the future.

"Wealth comes from knowing what others do not know." – Aristotle Onassis

Dividend investing is a strategy that can help to diversify your profit flow and reduce overall risk. Most brokerages today offer what is referred to as a Dividend Reinvestment Program (DRIP), whereby the brokerage automatically reinvests cash dividends into additional shares of stock. One of the best ways to increase returns is to compound dividends received. Over time, reinvesting dividends and distributions can have a significant impact on overall portfolio returns.

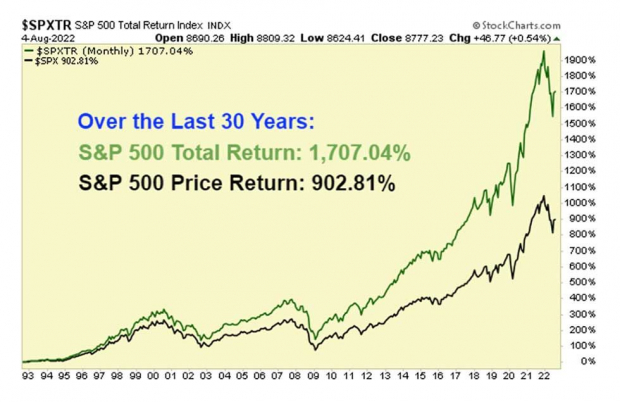

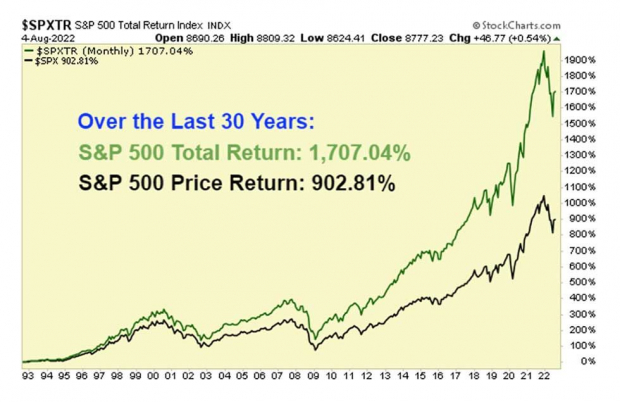

It helps to gain a perspective of the role dividends have played throughout history. Dividends and their reinvestment represent a major portion of a stock investor’s total return over the long run. An examination of equity returns dating back 30 years dramatically illustrates this property.

Image Source: StockCharts

An investor in domestic stocks would have realized a +1,707.04% total return over this timeframe. Excluding dividends that return would have been reduced to +902.81%. This demonstrates that dividends represented nearly 47% of the total return over the 30-year period. Price appreciation is the glamour that investors tend to focus on, but dividends are the slow and steady engine that drive portfolio returns over the long run.

Where to Find the Best Dividend-Paying Stocks

There is a tremendous amount of financial spin out there in the media, so I recommend using proven strategies with an actual history of profitable results. The best way to evaluate any investment methodology is to look at verified results.

That’s why I invite you to check out our Zacks Income Investor portfolio right now.

In the past year, we’ve closed out major gains such as a +189% winner in a domestic real estate investment trust (REIT), as well as a +150% return in an aerospace and defense company. Our top holding in the present is a leading company in the steel industry which is showing another tremendous gain of +183%.¹

This year, Income Investor currently has open trade results displaying an average return north of +32% across more than 20 holdings, with an average dividend yield of +3% and an astonishing 88% in the green. Keep in mind, these results were achieved during one of the worst starts to a year in market history. At the time of this writing, the Nasdaq is still off greater than -20% from its peak last November, while the S&P 500 has fallen more than -13% this year.

Image Source: Zacks Investment Research

This demonstrates the Income Investor’s ability to produce substantial gains even during bear markets.

Investors in our service have received significant price appreciation, in addition to a dividend that makes what savings rate banks are offering look like the slap in the face that they are. If the Income Investor service can produce these types of results during economic uncertainty, imagine what it could do once the market turns the corner.

I think dividend-paying stocks are more important than ever, particularly in this highly inflationary environment. With earnings growth continuing to slow, the best investments are steady, income-producing equities with strong balance sheets and a history of raising dividends.

That’s why I wholeheartedly believe that dividend investing is an ideal strategy for today’s volatile markets and uncertain economy.

Your cost for sharing our recommendations and commentary for a full month? Only $1 and not a cent of further obligation.

Bonus Report: You’ll also gain access to 5 Stocks Set to Double. Each of these ultra-growth plays was selected by a Zacks expert to have the best chance to gain +100% or more during the coming year. They give you the opportunity to balance Income Investor’s steadier approach to profits.

I should mention that this special arrangement ends midnight Sunday, August 14.

So claim your access to both our best dividend stocks and bonus report now >>

Wishing You the Best on Your Investing Journey,

Bryan

Bryan Hayes, CFA is a Strategist with Zacks Investment Research and invites you to take advantage of the highly successful portfolio he’s directing – Zacks Income Investor.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.

Image: Bigstock

An Ideal Strategy for Today's Volatile Markets

Regardless of your personal approach to investing, I believe everyone can benefit from insight into the world of dividend investing. The most important fact to realize is that stock investing builds greater wealth than any other traditional investing method. One of the most paramount skills to learn is how to select the most profitable stocks for your investment portfolio.

Once you purchase a stock, you become a partial owner of the company and own a percentage of that company. In terms of fundamental analysis, there are many ways to select profitable companies such as earnings growth, revenue growth, cash flow data, and return on equity. One of the main things I personally like to focus on is a company’s approach to dividend payouts.

In addition, I look for companies that have the following characteristics:

Image Source: Zacks Investment Research

I prefer to target companies that have a history of raising dividends, even during uncertain times such as the current market environment. I have found the dividend growth rate to be a reliable forecaster of future earnings growth. Dividends are paid in cash – they’re not just figures on a balance sheet that can be manipulated.

The Power of Dividends

Corporate directors know their companies better than anyone else. They know the financial condition of their business, along with the outlook for its future earnings growth. They will only raise dividends if they truly believe that future earnings will be able to sustain higher dividend payouts.

A consistently rising dividend trend subtly reveals a company’s progress and is one of the best indicators of a healthy, growing enterprise. Using this simple yet effective strategy of investing in companies that consistently raise their dividends, investors can harness the power of compounding income. There are no complex formulas or calculations required.

Continued . . .

------------------------------------------------------------------------------------------------------

Zacks’ Answer to Market Volatility and Inflation

Spoiler Alert: It’s not fixed-income investments like T-Notes, CDs, and Money Market Accounts that are losing money relative to inflation.

Instead we find stocks that not only pay nearly 2X higher dividends than the S&P 500 but are projected to do so quarter after quarter. This can give you a smoother ride through volatile periods. PLUS we apply Zacks Rank analysis to catch rising earnings estimates for market-beating growth.

See Our "Growthy" Dividend Stocks Now >>

------------------------------------------------------------------------------------------------------

The Zacks Income Investor service reverses the conventional wisdom that high returns must come with high risk. One of the goals of this service is to achieve above-average returns with relatively low risk. Our aim is to make profits during both bull and bear markets. Over the years, I’ve learned that simple is better – both in life and investing. The more complicated a strategy is, the less likely it is to work in the future.

"Wealth comes from knowing what others do not know." – Aristotle Onassis

Dividend investing is a strategy that can help to diversify your profit flow and reduce overall risk. Most brokerages today offer what is referred to as a Dividend Reinvestment Program (DRIP), whereby the brokerage automatically reinvests cash dividends into additional shares of stock. One of the best ways to increase returns is to compound dividends received. Over time, reinvesting dividends and distributions can have a significant impact on overall portfolio returns.

It helps to gain a perspective of the role dividends have played throughout history. Dividends and their reinvestment represent a major portion of a stock investor’s total return over the long run. An examination of equity returns dating back 30 years dramatically illustrates this property.

Image Source: StockCharts

An investor in domestic stocks would have realized a +1,707.04% total return over this timeframe. Excluding dividends that return would have been reduced to +902.81%. This demonstrates that dividends represented nearly 47% of the total return over the 30-year period. Price appreciation is the glamour that investors tend to focus on, but dividends are the slow and steady engine that drive portfolio returns over the long run.

Where to Find the Best Dividend-Paying Stocks

There is a tremendous amount of financial spin out there in the media, so I recommend using proven strategies with an actual history of profitable results. The best way to evaluate any investment methodology is to look at verified results.

That’s why I invite you to check out our Zacks Income Investor portfolio right now.

In the past year, we’ve closed out major gains such as a +189% winner in a domestic real estate investment trust (REIT), as well as a +150% return in an aerospace and defense company. Our top holding in the present is a leading company in the steel industry which is showing another tremendous gain of +183%.¹

This year, Income Investor currently has open trade results displaying an average return north of +32% across more than 20 holdings, with an average dividend yield of +3% and an astonishing 88% in the green. Keep in mind, these results were achieved during one of the worst starts to a year in market history. At the time of this writing, the Nasdaq is still off greater than -20% from its peak last November, while the S&P 500 has fallen more than -13% this year.

Image Source: Zacks Investment Research

This demonstrates the Income Investor’s ability to produce substantial gains even during bear markets.

Investors in our service have received significant price appreciation, in addition to a dividend that makes what savings rate banks are offering look like the slap in the face that they are. If the Income Investor service can produce these types of results during economic uncertainty, imagine what it could do once the market turns the corner.

I think dividend-paying stocks are more important than ever, particularly in this highly inflationary environment. With earnings growth continuing to slow, the best investments are steady, income-producing equities with strong balance sheets and a history of raising dividends.

That’s why I wholeheartedly believe that dividend investing is an ideal strategy for today’s volatile markets and uncertain economy.

Your cost for sharing our recommendations and commentary for a full month? Only $1 and not a cent of further obligation.

Bonus Report: You’ll also gain access to 5 Stocks Set to Double. Each of these ultra-growth plays was selected by a Zacks expert to have the best chance to gain +100% or more during the coming year. They give you the opportunity to balance Income Investor’s steadier approach to profits.

I should mention that this special arrangement ends midnight Sunday, August 14.

So claim your access to both our best dividend stocks and bonus report now >>

Wishing You the Best on Your Investing Journey,

Bryan

Bryan Hayes, CFA is a Strategist with Zacks Investment Research and invites you to take advantage of the highly successful portfolio he’s directing – Zacks Income Investor.

¹ The results listed above are not (or may not be) representative of the performance of all selections made by Zacks Investment Research's newsletter editors and may represent the partial close of a position.