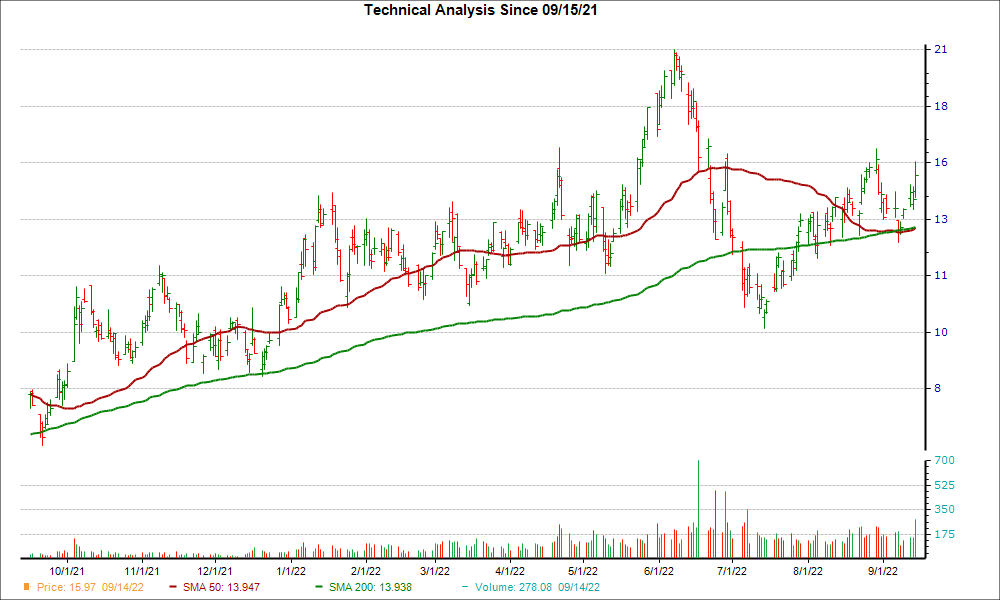

From a technical perspective, Earthstone Energy, Inc. is looking like an interesting pick, as it just reached a key level of support. ESTE's 50-day simple moving average crossed above its 200-day simple moving average, which is known as a "golden cross" in the trading world.

There's a reason traders love a golden cross -- it's a technical chart pattern that can indicate a bullish breakout is on the horizon. This kind of crossover is formed when a stock's short-term moving average breaks above a longer-term moving average. Typically, a golden cross involves the 50-day and the 200-day moving averages, since bigger time periods tend to form stronger breakouts.

Golden crosses have three key stages that investors look out for. It starts with a downtrend in a stock's price that eventually bottoms out, followed by the stock's shorter moving average crossing over its longer moving average and triggering a trend reversal. The final stage is when a stock continues the upward climb to higher prices.

A golden cross is the opposite of a death cross, another technical event that indicates bearish price movement may be on the horizon.

ESTE has rallied 7.4% over the past four weeks, and the company is a #1 (Strong Buy) on the Zacks Rank at the moment. This combination indicates ESTE could be poised for a breakout.

Looking at ESTE's earnings expectations, investors will be even more convinced of the bullish uptrend. For the current quarter, there have been 2 changes higher compared to none lower over the past 60 days, and the Zacks Consensus Estimate has moved up as well.

With a winning combination of earnings estimate revisions and hitting a key technical level, investors should keep their eye on ESTE for more gains in the near future.

Image: Bigstock

Should You Buy Earthstone Energy (ESTE) After Golden Cross?

From a technical perspective, Earthstone Energy, Inc. is looking like an interesting pick, as it just reached a key level of support. ESTE's 50-day simple moving average crossed above its 200-day simple moving average, which is known as a "golden cross" in the trading world.

There's a reason traders love a golden cross -- it's a technical chart pattern that can indicate a bullish breakout is on the horizon. This kind of crossover is formed when a stock's short-term moving average breaks above a longer-term moving average. Typically, a golden cross involves the 50-day and the 200-day moving averages, since bigger time periods tend to form stronger breakouts.

Golden crosses have three key stages that investors look out for. It starts with a downtrend in a stock's price that eventually bottoms out, followed by the stock's shorter moving average crossing over its longer moving average and triggering a trend reversal. The final stage is when a stock continues the upward climb to higher prices.

A golden cross is the opposite of a death cross, another technical event that indicates bearish price movement may be on the horizon.

ESTE has rallied 7.4% over the past four weeks, and the company is a #1 (Strong Buy) on the Zacks Rank at the moment. This combination indicates ESTE could be poised for a breakout.

Looking at ESTE's earnings expectations, investors will be even more convinced of the bullish uptrend. For the current quarter, there have been 2 changes higher compared to none lower over the past 60 days, and the Zacks Consensus Estimate has moved up as well.

With a winning combination of earnings estimate revisions and hitting a key technical level, investors should keep their eye on ESTE for more gains in the near future.