Caterpillar (CAT)

(Real Time Quote from BATS)

$361.23 USD

+2.91 (0.81%)

Updated Apr 18, 2024 09:34 AM ET

3-Hold of 5 3

C Value B Growth A Momentum A VGM

Company Summary

Caterpillar, known for its iconic yellow machines, is the largest global construction and mining equipment manufacturer. Given that it serves a gamut of sectors - infrastructure, construction, mining, oil & gas and transportation, the company is considered a bellwether of the global economy.

Since 1925, Caterpillar’s product portfolio has evolved and boasts 20 brands and generated revenues of $67 billion in 2023. It has more than 4 million products with an extensive dealer network of 165 dealers spanning 191 countries.

Caterpillar started using telematics in the 1990s and reached its target ...

Company Summary

Caterpillar, known for its iconic yellow machines, is the largest global construction and mining equipment manufacturer. Given that it serves a gamut of sectors - infrastructure, construction, mining, oil & gas and transportation, the company is considered a bellwether of the global economy.

Since 1925, Caterpillar’s product portfolio has evolved and boasts 20 brands and generated revenues of $67 billion in 2023. It has more than 4 million products with an extensive dealer network of 165 dealers spanning 191 countries.

Caterpillar started using telematics in the 1990s and reached its target of 1 million connected assets in 2019. It currently has more than 1.2 million connected assets. The combination of innovation, and cutting-edge technology, coupled with the formidable reputation, set Caterpillar apart from its peers.

Caterpillar is the 42nd largest company on the S&P 500 Index, with a market capitalization of around $180 billion. It holds the fourth position in the Dow Jones Industrial Average, with a 6.33% weight. It is also a member of the S&P 500 Dividend Aristocrat Index.

The Irving, TX-based company has six operating segments.

Machinery, Energy & Transportation (ME&T) (95.2% of total revenues in 2023) includes the Construction Industries segment, which manufactures machinery utilized in infrastructure, forestry and building construction.

The Resource Industries segment caters to customers using machinery in mining, quarry and aggregates, heavy construction, waste and material handling applications.

The Energy & Transportation segment supports customers in oil and gas, power generation, marine, rail and industrial applications.

All Other Segments primarily comprise activities such as re-manufacturing CAT engines and components and re-manufacturing services for other companies and product management, development, manufacturing, marketing and product support.

Financial Products Segment (5.9% of total revenues in 2023) provides retail and wholesale financing alternatives for Caterpillar products.

General Information

Caterpillar Inc

5205 N. O`Connor Boulevard Suite 100

Irving, TX 75039

Phone: 972-891-7700

Fax: 309-675-6620

Web: http://www.caterpillar.com

Email: catir@cat.com

| Industry | Manufacturing - Construction and Mining |

| Sector | Industrial Products |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 4/25/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 5.12 |

| Current Year EPS Consensus Estimate | 21.40 |

| Estimated Long-Term EPS Growth Rate | 10.50 |

| Earnings Date | 4/25/2024 |

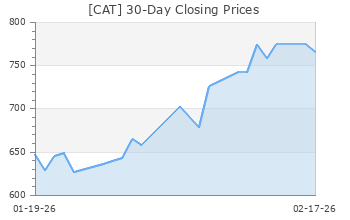

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 358.32 |

| 52 Week High | 382.01 |

| 52 Week Low | 204.04 |

| Beta | 1.17 |

| 20 Day Moving Average | 2,098,391.75 |

| Target Price Consensus | 327.50 |

| 4 Week | 0.52 |

| 12 Week | 23.27 |

| YTD | 21.19 |

| 4 Week | 4.58 |

| 12 Week | 19.50 |

| YTD | 15.10 |

| Shares Outstanding (millions) | 499.40 |

| Market Capitalization (millions) | 178,945.02 |

| Short Ratio | NA |

| Last Split Date | 7/14/2005 |

| Dividend Yield | 1.45% |

| Annual Dividend | $5.20 |

| Payout Ratio | 0.25 |

| Change in Payout Ratio | -0.16 |

| Last Dividend Payout / Amount | 1/19/2024 / $1.30 |

Fundamental Ratios

| P/E (F1) | 16.75 |

| Trailing 12 Months | 16.89 |

| PEG Ratio | 1.59 |

| vs. Previous Year | 35.49% |

| vs. Previous Quarter | -5.25% |

| vs. Previous Year | 2.85% |

| vs. Previous Quarter | 1.55% |

| Price/Book | 9.35 |

| Price/Cash Flow | 13.99 |

| Price / Sales | 2.67 |

| 3/31/24 | NA |

| 12/31/23 | 56.99 |

| 9/30/23 | 56.29 |

| 3/31/24 | NA |

| 12/31/23 | 12.69 |

| 9/30/23 | 12.14 |

| 3/31/24 | NA |

| 12/31/23 | 1.35 |

| 9/30/23 | 1.45 |

| 3/31/24 | NA |

| 12/31/23 | 0.87 |

| 9/30/23 | 0.92 |

| 3/31/24 | NA |

| 12/31/23 | 16.24 |

| 9/30/23 | 15.39 |

| 3/31/24 | NA |

| 12/31/23 | 15.41 |

| 9/30/23 | 13.69 |

| 3/31/24 | NA |

| 12/31/23 | 19.46 |

| 9/30/23 | 17.87 |

| 3/31/24 | NA |

| 12/31/23 | 38.31 |

| 9/30/23 | 40.28 |

| 3/31/24 | NA |

| 12/31/23 | 2.46 |

| 9/30/23 | 2.51 |

| 3/31/24 | NA |

| 12/31/23 | 1.25 |

| 9/30/23 | 1.18 |

| 3/31/24 | NA |

| 12/31/23 | 55.65 |

| 9/30/23 | 54.19 |