Cimpress (CMPR)

(Delayed Data from NSDQ)

$88.33 USD

-1.90 (-2.11%)

Updated Apr 18, 2024 04:00 PM ET

After-Market: $88.51 +0.18 (0.20%) 7:58 PM ET

1-Strong Buy of 5 1

B Value A Growth D Momentum A VGM

Company Summary

Cimpress plc is an online supplier of high-quality graphic design services and customized printed products to small businesses and consumers. Its product offerings include business cards, brochures and websites, and e-commerce platforms, calendars, address labels, note pads and signage, among others. With the use of proprietary web-based design software and advanced computer integrated printing facilities, the company has a competitive advantage over traditional graphic design and printing methods. It has production facilities in the United States, Austria, China, Brazil, Australia, Canada, India, France, Japan, Italy, the U.K., Ireland, Mexico and the Netherlands. Cimpress plc was ...

Company Summary

Cimpress plc is an online supplier of high-quality graphic design services and customized printed products to small businesses and consumers. Its product offerings include business cards, brochures and websites, and e-commerce platforms, calendars, address labels, note pads and signage, among others. With the use of proprietary web-based design software and advanced computer integrated printing facilities, the company has a competitive advantage over traditional graphic design and printing methods. It has production facilities in the United States, Austria, China, Brazil, Australia, Canada, India, France, Japan, Italy, the U.K., Ireland, Mexico and the Netherlands. Cimpress plc was originally known as Compress N.V. On Dec 3, 2019, Cimpress N.V. shifted its incorporation site from the Netherlands to Ireland by completing a cross-border merger. In the merger, Cimpress N.V. (originally a Dutch public limited company) merged with and into Cimpress plc (an Irish public limited company), in which the latter survived the merger. The company reports its revenues under four segments:

Vista: The segment represents Vista-branded websites focused on the North America, Europe, Australia and New Zealand markets. It also includes the company's Vista Corporate Solutions, Vista India and Vista Japan businesses, which were previously incorporated in its All Other segment.

Upload and Print: The segment consists of two subgroups — PrintBrothers and The Print Group. PrintBrothers includes the druck.at, Printdeal and WIRmachenDRUCK branded businesses whereas PrintBrothers includes EasyFlyer, Exaprint, Pixartprinting and Tradeprint branded businesses.

National Pen: The segment includes the global operations of its National Pen business. It is engaged in manufacturing and marketing custom writing instruments and promotional products, apparel and gifts.

All Other: It includes a collection of businesses that comprises BuildASign (e-commerce provider), Printi (provider of online printing solutions), VIDA (e-commerce provider) and YSD (provider of end-to-end mass customization software solutions).

General Information

Cimpress plc

FIRST FLOOR BUILDING 3 FINNABAIR BUSINESS AND TECHNOLOGY PARK

DUNDALK COUNTY LOUTH, L2 02451

Phone: 353-42-938-8500

Fax: 441-292-8666

Email: ir@cimpress.com

| Industry | Consumer Services - Miscellaneous |

| Sector | Consumer Discretionary |

| Fiscal Year End | June |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 5/1/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.14 |

| Current Year EPS Consensus Estimate | 3.16 |

| Estimated Long-Term EPS Growth Rate | 24.00 |

| Earnings Date | 5/1/2024 |

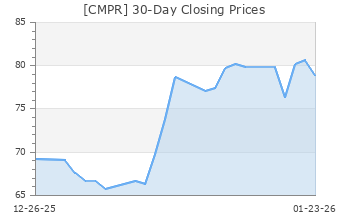

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 90.23 |

| 52 Week High | 100.01 |

| 52 Week Low | 42.78 |

| Beta | 1.97 |

| 20 Day Moving Average | 127,275.40 |

| Target Price Consensus | 111.50 |

| 4 Week | -4.47 |

| 12 Week | 16.73 |

| YTD | 10.34 |

| 4 Week | -0.07 |

| 12 Week | 14.01 |

| YTD | 7.05 |

| Shares Outstanding (millions) | 26.64 |

| Market Capitalization (millions) | 2,352.81 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 27.92 |

| Trailing 12 Months | 36.50 |

| PEG Ratio | 1.16 |

| vs. Previous Year | 565.22% |

| vs. Previous Quarter | 1,158.82% |

| vs. Previous Year | 9.01% |

| vs. Previous Quarter | 21.67% |

| Price/Book | NA |

| Price/Cash Flow | NA |

| Price / Sales | 0.73 |

| 3/31/24 | NA |

| 12/31/23 | -10.76 |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 3.51 |

| 9/30/23 | -0.23 |

| 3/31/24 | NA |

| 12/31/23 | 0.82 |

| 9/30/23 | 0.69 |

| 3/31/24 | NA |

| 12/31/23 | 0.67 |

| 9/30/23 | 0.52 |

| 3/31/24 | NA |

| 12/31/23 | 2.05 |

| 9/30/23 | -0.14 |

| 3/31/24 | NA |

| 12/31/23 | 1.31 |

| 9/30/23 | -4.98 |

| 3/31/24 | NA |

| 12/31/23 | 2.72 |

| 9/30/23 | -0.07 |

| 3/31/24 | NA |

| 12/31/23 | -20.76 |

| 9/30/23 | -23.08 |

| 3/31/24 | NA |

| 12/31/23 | 15.08 |

| 9/30/23 | 13.88 |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |