MSCI (MSCI)

(Delayed Data from NYSE)

$510.07 USD

+4.31 (0.85%)

Updated Apr 19, 2024 04:00 PM ET

After-Market: $509.72 -0.35 (-0.07%) 6:46 PM ET

3-Hold of 5 3

D Value C Growth A Momentum C VGM

Company Summary

MSCI Inc. provides investment decision support tools, including indexes; portfolio construction and risk management products and services; Environmental, Social and Governance (ESG) research and ratings; and real estate research, reporting and benchmarking offerings.

MSCI reported operating revenues of $2.53 billion in 2023. The company operates under four segments — Index (57.4% of operating revenues), Analytics (24.4%), ESG and Climate (11.4%) and All other- Private Assets (6.9%). During the year ended Dec 31, 2023, MSCI renamed The Burgiss Group, LLC operating segment to Private Capital Solutions.

Index segment includes MSCI Global Equity Indexes, MSCI Custom Indexes, MSCI Factor Indexes, MSCI ESG ...

Company Summary

MSCI Inc. provides investment decision support tools, including indexes; portfolio construction and risk management products and services; Environmental, Social and Governance (ESG) research and ratings; and real estate research, reporting and benchmarking offerings.

MSCI reported operating revenues of $2.53 billion in 2023. The company operates under four segments — Index (57.4% of operating revenues), Analytics (24.4%), ESG and Climate (11.4%) and All other- Private Assets (6.9%). During the year ended Dec 31, 2023, MSCI renamed The Burgiss Group, LLC operating segment to Private Capital Solutions.

Index segment includes MSCI Global Equity Indexes, MSCI Custom Indexes, MSCI Factor Indexes, MSCI ESG Indexes, MSCI Real Assets Indexes and Thematic Indexes. Global Industry Classification Standard (GICS) and GICS Direct were developed and are maintained jointly by MSCI and Standard & Poor’s Financial Services.

Analytics segment includes Equity Factor Models, Fixed Income Factor Models, Multi-Asset Class Factor Models, Multi-Asset Class Risk Analytics and Performance Analytics.

MSCI’s major application offerings include RiskMetrics RiskManager, BarraOne, Barra Portfolio Manager, WealthBench & CreditManager, and MSCI Analytics Platform. Through the Analytics segment, MSCI also provides Managed Services, HedgePlatform and InvestorForce solutions.

MSCI’s ESG Research analyzes more than 10,000 entities worldwide. Offerings include MSCI ESG Ratings and MSCI ESG Business Involvement Screening Research.

MSCI generates revenues primarily through subscription fees, which, in most of the cases, is paid in advance. Clients using the company’s indexes as the basis for index-linked investment products (ETFs) or as the basis for passively managed funds also pay license fee, typically in arrears, based on the assets under management (“AUM”) in their investment products.

The company’s clientele includes pension funds, endowments, foundations, central banks, sovereign wealth funds, family offices, insurance companies, mutual funds, hedge funds, ETFs, private wealth, private banks, REITs, broker-dealers, exchanges, custodians, trust companies and wealth managers.

As of Dec 31, 2023, MSCI served more than 7,000 clients across 95 countries worldwide.

General Information

MSCI Inc

7 WORLD TRADE CENTER 250 GREENWICH STREET 49TH FLOOR

NEW YORK, NY 10007

Phone: 212-804-3900

Fax: 212-981-7401

Web: http://www.msci.com

Email: investor.relations@msci.com

| Industry | Business - Software Services |

| Sector | Computer and Technology |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 4/23/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 3.44 |

| Current Year EPS Consensus Estimate | 14.84 |

| Estimated Long-Term EPS Growth Rate | 13.40 |

| Earnings Date | 4/23/2024 |

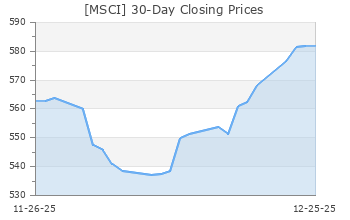

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 505.76 |

| 52 Week High | 617.39 |

| 52 Week Low | 451.55 |

| Beta | 1.06 |

| 20 Day Moving Average | 402,974.56 |

| Target Price Consensus | 602.45 |

| 4 Week | -10.29 |

| 12 Week | -8.83 |

| YTD | -10.59 |

| 4 Week | -6.17 |

| 12 Week | -10.96 |

| YTD | -14.89 |

| Shares Outstanding (millions) | 79.22 |

| Market Capitalization (millions) | 40,068.11 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 1.27% |

| Annual Dividend | $6.40 |

| Payout Ratio | 0.41 |

| Change in Payout Ratio | -0.01 |

| Last Dividend Payout / Amount | 2/15/2024 / $1.60 |

Fundamental Ratios

| P/E (F1) | 34.08 |

| Trailing 12 Months | 37.38 |

| PEG Ratio | 2.54 |

| vs. Previous Year | 29.58% |

| vs. Previous Quarter | 6.67% |

| vs. Previous Year | 19.77% |

| vs. Previous Quarter | 10.34% |

| Price/Book | NA |

| Price/Cash Flow | 32.16 |

| Price / Sales | 15.84 |

| 3/31/24 | NA |

| 12/31/23 | -111.17 |

| 9/30/23 | -97.86 |

| 3/31/24 | NA |

| 12/31/23 | 21.37 |

| 9/30/23 | 20.64 |

| 3/31/24 | NA |

| 12/31/23 | 0.93 |

| 9/30/23 | 1.36 |

| 3/31/24 | NA |

| 12/31/23 | 0.93 |

| 9/30/23 | 1.36 |

| 3/31/24 | NA |

| 12/31/23 | 42.68 |

| 9/30/23 | 42.06 |

| 3/31/24 | NA |

| 12/31/23 | 45.42 |

| 9/30/23 | 39.76 |

| 3/31/24 | NA |

| 12/31/23 | 54.14 |

| 9/30/23 | 48.32 |

| 3/31/24 | NA |

| 12/31/23 | -9.35 |

| 9/30/23 | -13.26 |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |