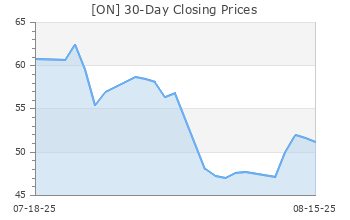

ON Semiconductor (ON)

(Delayed Data from NSDQ)

$65.53 USD

+3.85 (6.24%)

Updated Apr 24, 2024 04:00 PM ET

After-Market: $64.51 -1.02 (-1.56%) 7:58 PM ET

4-Sell of 5 4

C Value D Growth D Momentum D VGM

Company Summary

On Semiconductor or onsemi, is an original equipment manufacturer of a broad range of discrete and embedded semiconductor components. The company was spun off from Motorola in Aug 1999 and went public through an IPO in May 2000.

onsemi’s product lines include discretes, such as bipolar transistors, diodes, filters, FETs, rectifiers and thyristors.

onsemi’s acquisition of GT Advanced Technologies will help the company to grow and innovate disruptive intelligent power technologies. Moreover secure supply of SiC to meet growing demand of customers for SiC based solutions. Moreover, the company’...

Company Summary

On Semiconductor or onsemi, is an original equipment manufacturer of a broad range of discrete and embedded semiconductor components. The company was spun off from Motorola in Aug 1999 and went public through an IPO in May 2000.

onsemi’s product lines include discretes, such as bipolar transistors, diodes, filters, FETs, rectifiers and thyristors.

onsemi’s acquisition of GT Advanced Technologies will help the company to grow and innovate disruptive intelligent power technologies. Moreover secure supply of SiC to meet growing demand of customers for SiC based solutions. Moreover, the company’s acquisitions of Cypress Semiconductor’s CMOS Image Sensor Business Unit, SANYO Semiconductor, AMI Semiconductor, Analog Devices’ power PC controller business, CMD, Catalyst, and SoundDesign gave it new technical capabilities, some custom ASIC products, higher-margin products, exposure to new end markets and greater product breadth.

The power management product line includes AC-DC controllers and regulators, DC-DC converters and regulators, drivers, thermal managers, and voltage controllers, references and supervisors.

The logic product line includes clocking, memory, differential logic and standard logic products.

Signal processing products include amplifiers and comparators, analog switches, digital potentiometers, DSP systems and interfaces.

The company also offers custom application specific integrated circuits (ASICs), foundry services and memory products.

Customers include OEMs, electronic manufacturing service (EMS) providers and distributors. Top OEM customers include Motorola, Delta, Hewlett-Packard, Samsung, Siemens, Apple, Dell, Nokia, Intel, Sony, Continental Automotive Systems, DaimlerChrysler, Delphi, TRW and Visteon.

Top distributor customers include Arrow, Avnet, EBV Elektronik, Future, Solomon Enterprise and World Peace. Top EMS customers are Flextronics, Jabil and Celestica.

Phoenix, AZ-based onsemi reported revenues of $8.25 billion in 2023.

General Information

ON Semiconductor Corporation

5701 N. Pima Road

Scottsdale, AZ 85250

Phone: 602-244-6600

Fax: 602-244-6609

Email: investor@onsemi.com

| Industry | Semiconductor - Analog and Mixed |

| Sector | Computer and Technology |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 4/29/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 1.05 |

| Current Year EPS Consensus Estimate | 4.30 |

| Estimated Long-Term EPS Growth Rate | 2.40 |

| Earnings Date | 4/29/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 61.68 |

| 52 Week High | 111.35 |

| 52 Week Low | 59.34 |

| Beta | 1.80 |

| 20 Day Moving Average | 6,276,124.50 |

| Target Price Consensus | 87.95 |

| 4 Week | -15.38 |

| 12 Week | -15.01 |

| YTD | -26.16 |

| 4 Week | -13.69 |

| 12 Week | -17.91 |

| YTD | -30.88 |

| Shares Outstanding (millions) | 429.85 |

| Market Capitalization (millions) | 26,512.88 |

| Short Ratio | NA |

| Last Split Date | NA |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 14.34 |

| Trailing 12 Months | 11.95 |

| PEG Ratio | 6.02 |

| vs. Previous Year | -5.30% |

| vs. Previous Quarter | -10.07% |

| vs. Previous Year | -4.06% |

| vs. Previous Quarter | -7.46% |

| Price/Book | 3.41 |

| Price/Cash Flow | 9.23 |

| Price / Sales | 3.21 |

| 3/31/24 | NA |

| 12/31/23 | 31.36 |

| 9/30/23 | 33.78 |

| 3/31/24 | NA |

| 12/31/23 | 17.51 |

| 9/30/23 | 18.26 |

| 3/31/24 | NA |

| 12/31/23 | 2.71 |

| 9/30/23 | 2.44 |

| 3/31/24 | NA |

| 12/31/23 | 1.74 |

| 9/30/23 | 1.60 |

| 3/31/24 | NA |

| 12/31/23 | 27.34 |

| 9/30/23 | 27.53 |

| 3/31/24 | NA |

| 12/31/23 | 26.46 |

| 9/30/23 | 26.69 |

| 3/31/24 | NA |

| 12/31/23 | 30.73 |

| 9/30/23 | 32.24 |

| 3/31/24 | NA |

| 12/31/23 | 18.11 |

| 9/30/23 | 17.42 |

| 3/31/24 | NA |

| 12/31/23 | 2.19 |

| 9/30/23 | 2.34 |

| 3/31/24 | NA |

| 12/31/23 | 0.33 |

| 9/30/23 | 0.34 |

| 3/31/24 | NA |

| 12/31/23 | 24.75 |

| 9/30/23 | 25.46 |