|

Feb 06, 2026 |

The Walt Disney Company (NYSE: DIS)$108.70 USD ( As of 02/06/26 ) |

|

|||||||||||||

Data Overview

| 52 Week High-Low | $124.01 - $81.72 |

|---|---|

| 20 Day Average Volume | 12,506,714 |

| Beta | 1.43 |

| Market Cap | 185.96 B |

| Dividend / Div Yld | $1.50 / 1.43% |

| Industry | Media Conglomerates |

| Industry Rank | 155 / 243 (Bottom 36%) |

| Current Ratio | 0.67 |

| Debt/Capital | 23.91% |

| Net Margin | 12.80% |

| Price/Book (P/B) | 1.63 |

| Price/Cash Flow (P/CF) | 11.58 |

| Earnings Yield | 6.27% |

| Debt/Equity | 0.31 |

| Value Score |  |

|---|---|

| P/E (F1) | 15.94 |

| P/E (F1) Rel to Industry | 7.71 |

| PEG Ratio | 1.43 |

| P/S (F1) | 1.94 |

| P/S (TTM) | 1.94 |

| P/CFO | 11.58 |

| P/CFO Rel to Industry | 0.29 |

| EV/EBITDA Annual | 11.08 |

| Growth Score |  |

|---|---|

| Proj. EPS Growth (F1/F0) | 11.04% |

| Hist. EPS Growth (Q0/Q-1) | 38.69% |

| Qtr CFO Growth | 20.50 |

| 2 Yr CFO Growth | 52.75 |

| Return on Equity (ROE) | 8.90% |

| (NI - CFO) / Total Assets | -16.01 |

| Asset Turnover | 0.48 |

| Momentum Score |  |

|---|---|

| 1 week Volume change | 35.13% |

| 1 week Price Cng Rel to Industry | -5.92% |

| (F1) EPS Est 1 week change | 0.02% |

| (F1) EPS Est 4 week change | -0.13% |

| (F1) EPS Est 12 week change | 1.71% |

| (Q1) EPS Est 1 week change | -5.54% |

Summary

Shares of Disney have outperformed the industry in the past three months. The company is acquiring majority of Twenty-First Century Fox’s assets, which includes its Film and Television studios accompanied by cable and international TV businesses. The deal provides a bout of fresh air to Disney, which for quite some time now has been jostling in the fast changing media landscape, where rise in streaming and cord cutting have become two faces of the coin. No wonder, the buyout of these assets would considerably enhance the media mogul’s bargaining power with Cable TV providers, increase affiliate fees, provide a fresh lease of life to ESPN and create cost synergies. Further, the addition of Fox's rich library of movies and TV series would greatly enhance Disney’s prospects in the streaming service. Bob Iger will continue to spearhead the company through 2021 for a smooth integration of Fox’s assets into Disney.

Elements of the Zacks Rank

Agreement Estimate Revisions (60 days)

|

100% Q1 (Current Qtr)Revisions: 4 Up: 0 Down: 4 |

75% Q2 (Next Qtr)Revisions: 4 Up: 3 Down: 1 |

50% F1 (Current Year)Revisions: 8 Up: 4 Down: 4 |

83% F2 (Next Year)Revisions: 6 Up: 1 Down: 5 |

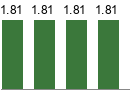

Magnitude Consensus Estimate Trend (60 days)

|

||||||||||

|

||||||||||

|

||||||||||

|

||||||||||

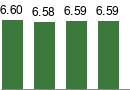

Upside Zacks Consensus Estimate vs. Most Accurate Estimate

|

|

|

|

|

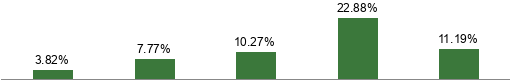

Surprise Reported Earnings History

|

|

|

|

Average 4 Qtr Surprise |

||||||||||||||||||||||||

The data on the front page and all the charts in the report represent market data as of 02/06/26, while the report's text is as of 01/02/2018

Overview

The Walt Disney Company is one of the world’s largest diversified entertainment companies. The Burbank, CA.-based company’s assets span across movies, television, publishing and theme parks. The company reports its operating results under the following segments:

Media Networks (43% of Fiscal 2017 Revenues) segment includes domestic broadcast television network, television production and distribution operations, domestic television stations, cable networks, domestic broadcast radio networks and stations, and publishing and digital operations. The company operates the ABC Television Network and 8 owned television stations; ESPN and Disney Channel cable networks; ESPN Radio and Radio Disney networks.

Parks and Resorts (33% of Fiscal 2017 Revenues) division owns and operates the Disney World Resort in Florida, the Disneyland Resort in California, the Disney Vacation Club, the Disney Cruise Line, and Adventures by Disney. The company also has ownership interests in Disneyland Paris, in Hong Kong Disneyland Resort and in Shanghai Disney Resort, and licenses the operations of the Tokyo Disney Resort in Japan.

Studio Entertainment (15% of Fiscal 2017 Revenues) segment produces animated and live-action motion pictures, direct-to-video programming, musical recordings, and live stage plays. The library of films is distributed under 5 banners namely Walt Disney Pictures, Touchstone Pictures, Pixar, Marvel, and Lucasfilms.

Consumer Products & Interactive Media (9% of Fiscal 2017 Revenues) division engages with licensees, manufacturers, publishers and retailers to design, develop, publish, promote and sell a wide variety of products based on existing and new Disney characters and other intellectual property via its Merchandise Licensing, Publishing and Retail businesses throughout the world. The segment also creates and delivers Disney-branded entertainment and lifestyle content across interactive media platforms.

Reasons To Buy:

Disney’s Buyout of Fox’s Assets to Fuel Growth: Disney is acquiring majority of Twenty-First Century Fox’s assets, which includes its Film and Television studios accompanied by cable and international TV businesses in a transaction worth $52.4 billion. The accord would give the the company a hold on Twenty-First Century Fox's film production business like Twentieth Century Fox, Fox Searchlight Pictures as well as Fox 2000 and its storied television units Twentieth Century Fox Television, FX Productions and Fox21. It would also give control over FX Networks, National Geographic Partners, Fox Sports Regional Networks (excluding flagship broadcast network, Fox News and the cable sports networks FS1 and FS2), Fox Networks Group International, Star India along with Fox’s stake in Hulu, Sky plc, Tata Sky as well as Endemol Shine Group. The stock has gained 8% in the past three months compared with the industry’s growth of 1%.

Following the approval of deal, Disney would have telecasting rights of Major League Baseball and NBA in United States, Premier League, Serie A, Bundesliga and UEFA Champions League in Europe and also Indian Premier League. Disney’s international footprint will increase substantially by the addition of the aforementioned sports channels. Inclusion of Sky will give Disney 23 million customers in UK, Ireland, Germany, Austria and Italy. Moreover, Fox Networks International operates above 350 channels in 170 countries, while Star India has 69 channels serving 720 viewers per month.

Hopes Hinge on New Star Wars: Disney’s Studio segment, which impressed investors with blockbuster hits in 2016, has somewhat disappointed in 2017 as the year has been dull for the movie industry. However, the company’s latest movie Star Wars: The Last Jedi has provided a superb ending to 2017, which is a huge boost as we move into 2018. So far, the movie has crossed $1 billion mark at the box office. Moreover, analysts believe that the deal with Rian Johnson, the director of The Last Jedi, to produce a brand new Star Wars trilogy may rekindle investors’ hopes. Further, we believe that the coming two years will be most fruitful for Disney. The studio is all set to continue with its success story beyond Star Wars, Zootopia and Beauty and the Beast as it boasts an impressive line-up of big budget movies up to 2018. This year, the company is expected to release Black Panther, A Wrinkle in Time, Avengers: Infinity War, The Incredibles 2 and Ant-Man and the Wasp. The success of the company’s movies will ensure great business for its Consumer Products division as demand for merchandise associated with superhit movies usually skyrockets as seen in case of Frozen. Also, addition of these popular themes to Parks & Resorts are likely to increase footfall.

Direct-to-Consumer Streaming Service: Disney had stated that it will terminate distribution agreement with Netflix for subscription streaming of the new movies starting in 2019. Instead, the company will have its own streaming services – one for Disney and Pixar brands and another for ESPN followers. Disney will start online streaming services for ESPN sports in early 2018 and its branded direct-to-consumer streaming service in 2019 will air Disney movies as well as TV shows. The ESPN-branded multi-sport streaming service will give an option to enjoy 10,000 live international, national and regional games every year. Tournaments like Major League Baseball, National Hockey League, Major League Soccer, Grand Slam tennis, and college sports will be live streamed. Meanwhile, through the fresh Disney-branded service subscribers can view both Disney’s and Pixar’s latest live action and animated movies, starting with the 2019 theatrical slate. Movies like Toy Story 4, the sequel to Frozen and The Lion King will also be streamed. This step gives an indication that Disney is confident about distributing content itself without relying on Netflix or any other companies.

Consistent Performance by Parks & Resorts Driving Growth: Disney’s Parks & Resorts division continues to impress investors. In fourth-quarter fiscal 2017, the segment reported a revenue increase of 6% following a gain of 12%, 9% and 6% in the third, second and first quarter, respectively. In the quarter under review, the segment’s operating income climbed 7% to $746 million backed by growth at the company’s international operations on the back of a robust performance of Disneyland Paris and Shanghai Disney Resort. Rise in guest spending and attendance was the main reason behind growth in operating income at Disneyland Paris. Meanwhile, growth at Shanghai Disney Resort was driven by lower marketing cost and increase in attendance, which negated lower average ticket pricing. The company is focused on deploying capital toward expansion of the Parks & Resorts business, thereby increasing market share and creating long-term growth opportunities in the process. The company is on the verge of completing Toy Story Lands in Shanghai and Orlando, which are likely to be open by next summer. Further, constructions of Star Wars Lands in Disneyland as well as Walt Disney World are in progress.

Acquires Majority Stake in BAMTech: Most media companies are failing to cope with cord cutting as consumers are unwilling to pay for large bundles of channels. Disney is making full efforts to bring back ESPN’s golden days. In an effort to attract online viewers, the company has completed the acquisition of video streaming, data analytics as well as commerce management company BAMTech in September. The company stated that it will use BAMTech to create an ESPN-branded, over-the-top video streaming service that will cover a variety of sports. Disney is striving to make its content accessible to more customers. It said that AT&T’s DirecTV will feature channels like ESPN, ESPN2, ABC, Freeform, Disney Channel, Disney XD as well as Disney Junior in their subscription packages in the upcoming DirecTV Now OTT service. The company stated that mobile apps are going to play an important role in the future of media and ESPN is rightly on the way of taking the advantage of the trend with wide range of apps.

Enhancing Shareholders’ Return: In fourth-quarter fiscal 2017, Disney bought back 33.6 million shares for $3.4 billion. In fiscal 2017, the company repurchased 89.5 million shares for $9.4 billion. Disney has been actively managing cash flow, returning much of its free cash to shareholders through share repurchases and dividends. In fiscal 2016, Disney bought back 73.8 million shares for approximately $7.5 billion.

Reasons To Sell:

Lower-than-expected Q4 Results: Disney reported a negative earnings surprise in fourth-quarter fiscal 2017 after beating estimates in the trailing three quarters. The company’s top line also missed the Zacks Consensus Estimate for the fifth straight quarter. Its adjusted earnings in the reported quarter came in at $1.07 per share, missing the Zacks Consensus Estimate of $1.12 and decreased 3% year over year. Also, revenues came in at $12,779 million, down 3% year over year and also missed the Zacks Consensus Estimate of $13,149 million. The company’s disappointing results in the quarter was primarily due to dismal performance of Media Networks, Studio Entertainment and Consumer Products & Interactive Media, which overshadowed growth at Parks & Resorts.

Declining Subscriber Count at ESPN a Concern: Over the last few quarters, Disney’s ESPN has been closely monitored by investors because of its performance. Falling subscriber base and higher programming costs at ESPN were the major concerns this quarter too. Fresh NBA agreement and increase in contractual rate for NFL programming are driving the overall programming cost higher for ESPN. Most media companies are failing to cope with "cord cutting" as consumers are unwilling to pay for large bundles of channels. At ESPN, increase in affiliate revenues were offset by higher programming cost and dismal advertising revenues in the final quarter of fiscal 2017. Decrease in advertising revenues were chiefly due to decline in average viewership.

Stock Looks Overvalued: Considering price-to-earnings (P/E) ratio, Disney looks pretty overvalued when compared with the industry. The stock has a trailing 12-month P/E ratio of 18.86, above the median level of 18.68 scaled in a year’s time. Meanwhile, the trailing 12-month P/E ratio for the industry is 13.91.

Advertising Slump Can Hurt Revenues: Advertising remains a significant source of revenue for Disney, which remains vulnerable to the macroeconomic headwinds. The deterioration in the economy and lower primetime ratings will adversely affect the advertising revenues and, in turn, the company’s revenue generating capabilities.

Last Earnings Report

Quarter Ending 12/2025

| Report Date | Feb 02, 2026 |

|---|---|

| Sales Surprise | -0.03% |

| EPS Surprise | 3.82% |

| Quarterly EPS | 1.63 |

| Annual EPS (TTM) | 5.80 |

Disney Misses on Q4 Earnings & Sales Estimates

Disney reported negative earnings surprise in the fourth-quarter fiscal 2017 after beating the estimate in the trailing three quarters. Moreover, the company’s top-line also missed the Zacks Consensus Estimate for the fifth straight quarter.

The company’s adjusted earnings in the reported quarter came in at $1.07 per share, missing the Zacks Consensus Estimate of $1.12 and decreased 3% year over year. Moreover, revenues came in at $12,779 million, down 3% year over year and also missed the Zacks Consensus Estimate of $13,149 million. The company’s disappointing results in the quarter was primarily due to dismal performance of Media Networks, Studio Entertainment and Consumer Products & Interactive Media, which overshadowed growth at Parks and Resorts.

The company’s total operating income came in at $2,812 million during the quarter, down 11% year over year. The downside was due to decline in operating income from Media Network, Studio Entertainment, and Consumer Products & Interactive Media.

Disney Now Controls BAMTech

In an effort to attract online viewers, the company has completed the acquisition of video streaming, data analytics as well as commerce management company BAMTech in September.

In the past few quarters Disney’s ESPN has been a hot topic in the media industry and investors are closely monitoring the performance of ESPN. In the reported quarter, advertising revenues declined in the low-single digit. Falling subscriber base and higher programming costs at ESPN continues to hamper the company’s results. Most of the media companies are failing to cope with "cord cutting" as consumers are unwilling to pay for large bundles of channels.

ESPN has sealed a number of deals with new platform owners, mostly over-the-top. These deals have started to yield positive results and are also increasing the number of subscribers. Moreover, the company has inked a deal with Hulu and another entity, and is also in discussion with others. The company had earlier stated that mobile apps are going to play an important role in the future of media, and ESPN is rightly on the way of taking the advantage of the trend with wide range of apps.

Segment Details

The Media Networks segment’s revenues were down 3% to $5,465 million, primarily due to 11% decrease in Broadcasting revenues to $1,514 million. However, Cable Networks came in at $3,951 million, almost flat year over year.

The segment’s operating income came in at $1,475 million, down 12% year over year. Cable Networks saw 1% drop in operating income to $1,236 million, while the Broadcasting segment reported a 15% slump in operating income to $229 million. Drop in operating income at Cable Networks were primarily due to decline at Freeform, which overshadowed the gain at the Disney Channels. At ESPN increase in affiliate revenues were offset by higher programming cost and dismal advertising revenues. Decrease in advertising revenues were chiefly due to decline in average viewership. Meanwhile, growth in affiliate revenues was driven by rise in contractual rate, which mitigated the fall in subscribers.

Parks and Resorts revenues came in at $4,667 million, up 6% from the year-ago period. The segment’s operating income climbed 7% to $746 million backed by growth at the company’s international operations, which was due to robust performance of Disneyland Paris and Shanghai Disney Resort. Rise in guest spending and attendance were the main reasons behind growth in operating income at Disneyland Paris. Meanwhile, growth at Shanghai Disney Resort was driven by lower marketing cost, increase in attendance, which negated lower average ticket pricing. Meanwhile, operating income declined at the company’s domestic operations due to the impact of Hurricane Irma.

The Studio segment generated revenues of $1,432 million, down 21% year over year. Moreover, operating income dropped 43% to $218 million. Sharp decline in operating income was due to decrease in TV/SVOD distribution results and increase in film cost impairments. Home entertainment as well as theatrical distribution results was flat year-over-year. However, decrease in theatrical distribution results were due to better performance of the company’s releases in the prior-year quarter compared with this quarter.

However, analysts believe that the coming two years will be the most fruitful for Disney. The studio is all set to continue with its success story beyond Star Wars, Zootopia and Beauty and the Beast as it boasts of an impressive lineup of big budget movies up to 2018. In 2018, the company is expected to release Black Panther, A Wrinkle in Time, Avengers: Infinity War, The Incredibles 2 and Ant-Man and the Wasp. Further, movie lovers must be really pumped up as Star Wars saga, The Last Jedi will hit the in December.

Consumer Products & Interactive Media division saw a 6% decrease in revenues to $1,215 million. Moreover, the unit’s operating income dropped 12% to $373 million owing to decline at merchandise licensing business.

Other Financial Details

Disney generated free cash flow of $2,691 million during the reported quarter, down 3% year over year. The company ended the quarter with cash and cash equivalents of $4,017 million, borrowings of $19,119 million and shareholder’s equity of $41,315 million, excluding non-controlling interest of $3,689 million.

During the quarter, the company bought back nearly 33.6 million shares for $3.4 billion.

Recent News

Disney to Acquire Majority of Fox's TV and Movie Entities – Dec 14, 2017

Disney is acquiring majority of Twenty-First Century Fox’s assets, which includes its Film and Television studios accompanied by cable and international TV businesses in a transaction worth $52.4 billion. Under the terms of the deal, Fox stockholders will receive 0.2745 Disney shares for each share held. Disney is expected to issue 515 million new shares, which will be distributed to shareholders of 21st Century Fox. This represents nearly 25% stake in Disney on a pro-forma basis. Disney will assume roughly $13.7 billion of 21st Century Fox’s debt, bringing the total value of the planned transaction to $66.1 billion.

Industry Analysis(1)Zacks Industry Rank: NA

Top Peers

| Paramount Skydance Corporation (PSKY) |

|

| Nexstar Media Group, Inc. (NXST) |

|

| Pearson, PLC (PSO) |

|

| Tencent Music Entertainment Group Sponsored ADR (TME) |

|

| Sinclair, Inc. (SBGI) |

|

| Grupo Televisa S.A. (TV) |

|

| Liberty Media Corporation - Liberty Formula One Series A (FWONA) |

|

| Liberty Media Corporation - Liberty Formula One Series C (FWONK) |

|

| Lionsgate Studios Corp. (LION) |

|

Industry Comparison Media Conglomerates | Position in Industry: 3 of 21 |

Industry Peers |

DIS  |

|

|---|---|

| Market Cap | 185.96 B |

| # of Analysts | 10 |

| Dividend Yield | 1.43% |

| Value Score |  |

| Cash/Price | 0.03 |

| EV/EBITDA | 11.08 |

| PEG Ratio | 1.43 |

| Price/Book (P/B) | 1.63 |

| Price/Cash Flow (P/CF) | 11.58 |

| P/E (F1) | 15.94 |

| Price/Sales (P/S) | 1.94 |

| Earnings Yield | 6.27% |

| Debt/Equity | 0.31 |

| Cash Flow ($/share) | 9.07 |

| Growth Score |  |

| Hist. EPS Growth (3-5 yrs) | 38.69% |

| Proj. EPS Growth (F1/F0) | 11.04% |

| Curr. Cash Flow Growth | -6.71% |

| Hist. Cash Flow Growth (3-5 yrs) | 3.33% |

| Current Ratio | 0.67 |

| Debt/Capital | 23.91% |

| Net Margin | 12.80% |

| Return on Equity | 8.90% |

| Sales/Assets | 0.48 |

| Proj. Sales Growth (F1/F0) | 6.57% |

| Momentum Score |  |

| Daily Price Chg | -1.94% |

| 1 Week Price Chg | -5.92% |

| 4 Week Price Chg | -8.06% |

| 12 Week Price Chg | -2.45% |

| 52 Week Price Chg | -6.35% |

| 20 Day Average Volume | 12,506,714 |

| (F1) EPS Est Wkly Chg | 0.02% |

| (F1) EPS Est Mthly Chg | -0.13% |

| (F1) EPS Est Qtrly Chg | 1.71% |

| (Q1) EPS Est Mthly Chg | -6.12% |

| X Industry | S&P 500 |

|---|---|

| 872.35 M | 39.74 B |

| 2 | 22 |

| 0.00% | 1.36% |

| - | - |

| 0.06 | 0.04 |

| 2.38 | 14.95 |

| 1.43 | 1.97 |

| 1.38 | 3.66 |

| 9.63 | 15.48 |

| 15.94 | 18.81 |

| 1.33 | 3.13 |

| 2.48% | 5.28% |

| 0.31 | 0.57 |

| 0.54 | 8.99 |

| - | - |

| -14.51% | 8.04% |

| 20.69% | 9.25% |

| 0.40% | 6.74% |

| 3.33% | 7.76% |

| 0.96 | 1.19 |

| 25.40% | 38.14% |

| -0.14% | 12.75% |

| -1.87% | 17.16% |

| 0.54 | 0.53 |

| 6.57% | 5.31% |

| - | - |

| -1.26% | -1.23% |

| -0.50% | -2.45% |

| -4.14% | -1.78% |

| -9.32% | 0.90% |

| -9.09% | 11.75% |

| 342,595 | 3,086,422 |

| 0.00% | 0.00% |

| 0.00% | 0.00% |

| -0.25% | 0.27% |

| 0.00% | 0.00% |

PSKY  | NXST  | PSO  |

|---|---|---|

| 11.27 B | 6.61 B | 7.67 B |

| 6 | 2 | |

| 1.90% | 3.41% | 1.76% |

|  |  |

| 0.27 | 0.04 | 0.06 |

| 2.38 | 5.62 | NA |

| NA | 0.83 | 1.70 |

| 0.87 | 2.92 | 1.64 |

| 0.46 | 4.32 | 9.63 |

| 11.28 | 8.28 | 13.05 |

| 0.39 | 1.28 | NA |

| 8.84% | 12.08% | 7.63% |

| 1.00 | 2.76 | 0.40 |

| 22.83 | 50.48 | 1.25 |

|  |  |

| NA | -5.22% | NA |

| 54.19% | 109.00% | 9.22% |

| -1.35% | 17.48% | -0.61% |

| -0.96% | 16.64% | -4.85% |

| 1.34 | 1.87 | 2.31 |

| 50.03% | 73.43% | 28.34% |

| -0.95% | 10.02% | NA |

| 3.95% | 22.99% | NA |

| 0.64 | 0.45 | NA |

| 3.35% | 10.72% | 4.93% |

|  |  |

| -2.14% | 2.06% | -1.79% |

| -6.57% | 5.38% | -8.01% |

| -14.26% | 5.74% | -15.19% |

| -31.56% | 18.76% | -9.32% |

| -2.95% | 43.82% | -26.78% |

| 6,711,167 | 327,815 | 1,237,124 |

| 0.00% | 0.00% | 0.00% |

| 0.00% | -0.21% | -2.48% |

| -28.15% | -2.94% | -2.22% |

| 0.00% | 0.00% | NA |

Zacks Stock Rating System

We offer two rating systems that take into account investors' holding horizons; Zacks Rank and Zacks Recommendation. Each provides valuable insights into the future profitability of the stock and can be used separately or in combination with each other depending on your investment style.

Zacks Recommendation

This rating system that has an excellent track record of predicting performance over the next 6 to 12 months. The foundation for the quantitatively determined Zacks Recommendation is trends in the company's estimate revisions and earnings outlook.

The Zacks Recommendation is broken down into 3 Levels; Outperform, Neutral and Underperform. Unlike most Wall Street firms, we have an excellent balance between the number of Outperform and Neutral recommendations.

Our team of 70 analysts are fully versed in the benefits of earnings estimate revisions and how that is harnessed through the Zacks quantitative rating system. But we have given our analysts the ability to override the Zacks Recommendation for the 1200 stocks that they follow. The reason for the analyst over-rides is that there are often factors such as valuation, industry conditions and management effectiveness that a trained investment professional can spot better than a quantitative model.

Zacks Rank

The Zacks Rank is our short-term rating system that is most effective over the one- to three-month holding horizon. The underlying driver for the quantitatively-determined Zacks Rank is the same as the Zacks Recommendation, and reflects trends in earnings estimate revisions.

| Value Score |

|

| Growth Score |

|

| Momentum Score |

|

| VGM Score |

|

Zacks Style Score Education

The Zacks Style Score is as a complementary indicator to the Zacks Rank, giving investors a way to focus on the best Zacks Rank stocks that best fit their own stock picking preferences.

Academic research has proven that stocks with the best Growth, Value, and Momentum characteristics outperform the market. The Zacks Style Scores rate stocks on each of these individual styles and assigns a rating of A, B, C, D and F. An A, is better than a B; a B is better than a C; and so on.

As an investor, you want to buy stocks with the highest probability of success. That means buying stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Style Score of an A or a B.

Disclosures

This report contains independent commentary to be used for informational purposes only. The analysts contributing to this report do not hold any shares of this stock. The analysts contributing to this report do not serve on the board of the company that issued this stock. The EPS and revenue forecasts are the Zacks Consensus estimates, unless otherwise indicated in the report’s first-page footnote. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts' personal views as to the subject securities and issuers. ZIR certifies that no part of the analysts' compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report.

Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Any opinions expressed herein are subject to change.

ZIR is not an investment advisor and the report should not be construed as advice designed to meet the particular investment needs of any investor. Prior to making any investment decision, you are advised to consult with your broker, investment advisor, or other appropriate tax or financial professional to determine the suitability of any investment. This report and others like it are published regularly and not in response to episodic market activity or events affecting the securities industry.

This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. ZIR or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. ZIR is not a broker-dealer. ZIR may enter into arms-length agreements with broker-dealers to provide this research to their clients. Zacks and its staff are not involved in investment banking activities for the stock issuer covered in this report.

ZIR uses the following rating system for the securities it covers. Outperform- ZIR expects that the subject company will outperform the broader U.S. equities markets over the next six to twelve months. Neutral- ZIR expects that the company will perform in line with the broader U.S. equities markets over the next six to twelve months. Underperform- ZIR expects the company will underperform the broader U.S. equities markets over the next six to twelve months.

No part of this report can be reprinted, republished or transmitted electronically without the prior written authorization of ZIR.