| © 2024 Zacks Investment Research, All Rights Reserved | 10 S. Riverside Plaza Suite 1600 · Chicago, IL 60606 |

| Zacks Equity Research | www.zacks.com | Page $[page] of $[total] |

|

Zacks Report Date: June 17, 2024 |

Starbucks Corporation (SBUX)$79.65 (Stock Price as of 06/14/2024) Price Target (6-12 Months): $116.00 |

|

||||||||||||||||

Summary

Data Overview

| 52 Week High-Low | $107.66 - $71.80 |

|---|---|

| 20 Day Average Volume (sh) | 10,637,254 |

| Market Cap | $90.2 B |

| YTD Price Change | -17.0% |

| Beta | 0.97 |

| Dividend / Div Yld | $2.28 / 2.9% |

| Industry | Retail - Restaurants |

| Zacks Industry Rank | Bottom 34% (164 out of 250) |

| Last EPS Surprise | -13.9% |

|---|---|

| Last Sales Surprise | -6.3% |

| EPS F1 Est- 4 week change | -0.1% |

| Expected Report Date | 08/06/2024 |

| Earnings ESP | 2.7% |

| P/E TTM | 21.9 |

|---|---|

| P/E F1 | 22.2 |

| PEG F1 | 1.9 |

| P/S TTM | 2.5 |

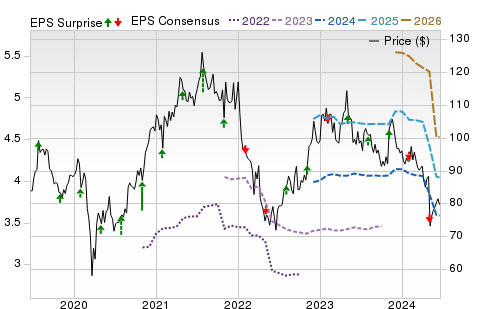

Price, Consensus & Surprise(1)

Sales and EPS Growth Rates (Y/Y %)(1)

Sales  |

EPS  |

Sales Estimates (millions of $)(1)

| Q1 | Q2 | Q3 | Q4 | Annual* | |

|---|---|---|---|---|---|

2025 |

10,022 E |

9,293 E |

10,056 E |

10,412 E |

39,569 E |

2024 |

9,425 A |

8,563 A |

9,244 E |

9,593 E |

36,856 E |

2023 |

8,714 A |

8,720 A |

9,168 A |

9,374 A |

35,976 A |

EPS Estimates(1)

| Q1 | Q2 | Q3 | Q4 | Annual* | |

|---|---|---|---|---|---|

2025 |

0.98 E |

0.78 E |

1.07 E |

1.19 E |

4.04 E |

2024 |

0.90 A |

0.68 A |

0.94 E |

1.06 E |

3.59 E |

2023 |

0.75 A |

0.74 A |

1.00 A |

1.06 A |

3.54 A |

*Quarterly figures may not add up to annual.

1) The data in the charts and tables, including the Zacks Consensus EPS and sales estimates, is as of 06/14/2024.

2) The report's text and the price target are as of 12/02/2021.

Overview

As of 06/14/2024

Founded in 1985 and based in Seattle, WA, Starbucks Corporation is the leading roaster and retailer of specialty coffee globally. In addition to fresh, rich-brewed coffees, Starbucks’ offerings include many complimentary food items and a selection of premium teas and other beverages, sold mainly through the company’s retail stores. The company’s popular brands include Starbucks coffee, Teavana tea, Seattle's Best Coffee, La Boulange bakery products and Evolution Fresh juices.

Other than the company’s own retail stores, it generates revenues through licensed stores, consumer packaged goods and foodservice operations. The company receives royalties and license fees from the U.S. and international licensed stores. Under its consumer packaged goods operations, Starbucks sells packed coffee and tea products as well as a variety of ready-to-drink beverages and single-serve coffee and tea products to grocery, warehouse clubs and specialty retail stores. It also includes revenues from licensing deals with many partners to produce and sell its Starbucks and Seattle's Best Coffee branded products.

During fourth-quarter fiscal 2021, the company initiated certain changes related to its operating segment structure. The company renamed the Americas segment to North America operating segment, featuring company-operated and licensed stores in the United States and Canada. Starbucks realigned the licensed Latin America and Caribbean markets from the earlier Americas segment to the International segment. The company’s latest reportable operating segments comprise North America (70.4% of total revenues in fiscal 2021); International (23.8%); and Channel Development (CD — 5.8%).

The CD segment is not a geographic region but an entirely different channel (it is a combination of the consumer packaged goods or CPG and foodservice businesses). It includes roasted whole bean and ground coffees, premium Tazo teas, a variety of ready-to-drink beverages (like Frappuccino and Starbucks Refreshers) and Starbucks and Tazo branded K-Cup packs sold through channels such as grocery, specialty retailers, and foodservice to name a few.

As of 06/14/2024

Reasons To Buy:

Strong Brand Position: Starbucks is one of the most recognized coffee brands in the world. From espresso to specialty roast and ground coffee to premium single-serve market, Starbucks commands authority and a leading position in all coffee segments. Further, management focuses on increasing global market share by judiciously opening stores in new and existing markets, remodeling existing stores, deploying technology, controlling costs and aggressive product innovation and brand building. In fiscal 2019, Starbucks added 1,900 net new stores. In 2018 and 2017, the company had added 2,300 and 2,250 net new locations. Despite the pandemic, the company opened 130 and 260 net new stores in third and fourth-quarter fiscal 2020, respectively. Moreover, the company inaugurated 1,400 new stores in fiscal 2020. In fiscal 2021, Starbucks opened 1,173 net new stores worldwide, bringing the total store count to 33,833. The company expects to open nearly 2,000 net new stores worldwide in fiscal 2022.

Global Coffee Alliance With Nestle Expands Starbucks’ Channel Development Footprint: Starbucks and the Swiss-based food giant Nestle SA have teamed up to revitalize their coffee domains. Starbucks and Nestle announced a global marketing deal that gives the latter "perpetual rights" to market Starbucks’ products globally outside its coffee shops. This alliance will expand the global reach of Starbucks brands in the consumer packaged goods (“CPG’) and foodservice categories to nearly 190 countries around the world. Earlier, the company launched three new coffee platforms in more than 30 new markets — Starbucks by Nespresso, Starbucks by Dolce Gusto as well as Starbucks roast and ground coffee. The Global Coffee Alliance with Nestle has been a powerful partnership and the company finished the year 2020 as the number one coffee brand across the entire coffee category. During fourth-quarter fiscal 2021, the company registered growth in the Global Coffee Alliance and the International ready-to-drink businesses with double-digit sales growth in key markets like Japan, the U.K., Korea and Mexico.

Emphasis on China: China Asia Pacific has now become the fastest growing segment. Improving customer experience via innovative new store designs, upgrading product offerings and margin expansion through process and supply chain efficiencies are driving CAP performance. China has witnessed comps growth of 1%, 3%, 6% and 5% in the first, second, third and fourth of fiscal 2019. In first-quarter 2020, China delivered comps growth of 3%. After posting comps decline in second, third and fourth-quarter fiscal 2020 due to the coronavirus pandemic, it returned to growth in first-quarter fiscal 2021 and delivered an improvement of 5% (including 3% VAT benefit). In second- and third-quarter fiscal 2021, the company witnessed 91% and 19% year over year comps growth, respectively. In second-quarter fiscal 2021, the company launched its flagship store on JD.com, which is China’s major e-commerce platform.

During fourth-quarter fiscal 2021, operations in Starbucks China were affected by pandemic-induced restrictions across 18 provincial level regions. With a majority of the stores closed (or operating at different levels of elevated public health protocols), the company reported constrained customer mobility with operations pertaining to mobile ordering and limited seating. Although the crisis affected the recovery momentum, the company witnessed a recovery in September, propelled by a solid pace of store developments and significant growth in digital customer relationships. In the fiscal fourth quarter, the company registered a 5% sequential increase in its digital footprint with Starbucks Rewards, reaching 17.9 million active members. Emphasis on member engagement and exclusive offerings benefitted the company. Also, frequency of purchases by Gold members remained at pre-pandemic levels.

In terms of expansion in China, the company opened 225 net new stores (in the fiscal fourth quarter) and 654 net new stores (in fiscal 2021), thereby bringing the total count to 5,360 stores in the region. The company plans to build 600 net new stores annually over the next five years in Mainland China, which will double the market's store count from the end of fiscal 2017 to 6,000 across 230 cities.

Robust Digitalization: The company announced a historic partnership with Alibaba for providing seamless Starbucks Experience to drive growth in China. Starbucks began delivery services in Beijing and Shanghai via Alibaba's Ele.me platform. Recently, the company has also strengthened its relationship with Alibaba. Starbucks lovers in China can now place orders via multiple Alibaba Group apps. Starbucks has introduced its mobile order and pay feature — Starbucks Now — to multiple platforms in the Alibaba Digital Economy, which includes Taobao, Amap, Koubei and Alipay. Starbucks customers can also use Starbucks Now feature to pre-order and pay for their favorite Starbucks beverage and food online before in-person pick-up at local stores. This will help Starbucks in expanding presence in China as Alibaba Digital Economy has user base of nearly 1 billion. Starbucks' business in China is rapidly growing due to innovative store designs, local product innovations and the success of MSR program. In fiscal 2021, the company reported 90-day active Starbucks Rewards members of 24.8 million members, reflecting a growth of 30% year over year. To reduce complexity in its stores, Starbucks rolled out Deep Brew (artificial intelligence platform) covering daily inventory management, store staffing and training improvements.

The company made progress with respect to personalized digital relationship to expand reach with members. This includes program enhancements like Stars for Everyone. Starbucks initiated payment partnerships with PayPal and Bakkt, thereby allowing customers to reload their Starbucks card through a range of cryptocurrencies (including Bitcoin and Ethereum) coupled with the option of converting digital currencies to physical currency. Notably, the company is exploring the blockchain platform for ways to connect Starbucks Rewards program with other merchant rewards program coupled with the motive of tokenization of stars. The initiative paves a path for the exchange of value across brands, enhanced digital services as well as swapping of other loyalty points for stars. To support this initiative, the company recently launched Canadian loyalty program with Air Canada. Going forward, the company is likely to highlight this format as it is likely to serve the foundation for a new modern payment that aligns expenses with the value received by customers and merchants.

Focus on Innovation: Starbucks is strengthening its product portfolio with significant innovation around beverages, refreshment, health and wellness, tea and core food offerings. Starbucks is leaning toward fast-growing categories like Cold Brew, Draft Nitro beverages, and plant-based modifiers, including almond, coconut, and soy milk alternatives. Apart from the numerous beverage innovations, Starbucks has also been making an effort to offer more nutritional and healthy products to its customers. Meanwhile, the company’s Reserve Roastery and Tasting Room elevates the coffee experience to the next level, with small-batch super-premium coffee produced using innovative coffee-brewing techniques. Starbucks’ collaboration with Beyond Meat to roll out a plant-based lunch menu in the China is a testament to the same. Now Starbucks customers can enjoy pastas and lasagna made utilizing Beyond Meat's plant-based beef products. It will also include meatless pork alternative known as Omnipork and popular non-dairy milk called Oatley. The new menu is available at more than 3,300 Starbucks locations in China. Both the companies have already partnered to roll out a plant-based sandwich to Canadian locations.

Positive U.S. Comps Growth: The company’s U.S. comps have impressed investors for the third straight quarter. In fourth-quarter fiscal 2021, the company’s North America segment reported comps growth of 22% year over year, owing to an 18% increase in transaction comps and a 3% rise in average ticket. U.S. comps rose 20% in the fiscal fourth quarter, owing to a material increase in transaction comps of 19%. The company now anticipates global comparable sales to reach high-single digits in fiscal 2022.

Enough Liquidity to Tide Over Coronavirus Pandemic: Maintaining liquidity has become a herculean task during the coronavirus pandemic. At the end of fourth-quarter fiscal 2021, the company reported cash and cash equivalent of $6,455.7 million up from $4.9 billion in the previous quarter. The company’s long-term debt totaled $13,616.9 million (as of Oct 3, 2021) compared with $13,619 million (as of Jun 27, 2021). Although the company’s cash balance is lower than its debt levels, it has available cash and cash flows from operations that will provide sufficient liquidity to meet operating cash requirements for some time. Times-interest-earned ratio at the end of the fiscal fourth quarter came in at 12.4x compared with 8.5x in the previous quarter. This indicates that the company is in a better position to meet debt obligations.

Reasons To Sell:

Coronavirus Might Hurt results: The Delta variant, which was first found in India, has been rapidly spreading to other parts of the world, increasing the risk of infections. The variant has been found in 135 countries including the United States. The World Health Organization warned that Delta will become the globally dominant variant of the coronavirus in the coming months. Consequently, this might hurt the restaurant industry.

Lower-than-Expected Q4 Global Comps: Despite reporting better-than-expected fourth-quarter fiscal 2021 results, investors’ sentiments were hurt by lower-than-expected global comps. Global comparable store sales increased 17% year over year. The upside was primarily driven by a 15% rise in comparable transactions and a 2% increase in average ticket. However, the figure remained below the company’s expectation of 18-21% growth.

Fiscal 2022 Earnings Guidance Below Expectation: Despite an impressive sales outlook, the company’s earnings in fiscal 2022 are likely to be impacted by strategic investments and cost inflation. The expiration of government subsidies in Asia and the transition of Starbucks Korea to the licensee are likely to hurt the company’s margin in fiscal 2022. For fiscal 2022, the company anticipates non-GAAP EPS growth to be a minimum 10% from the base of $3.10 in fiscal 2021 (the figure is adjusted for non-GAAP treatment of certain integration costs and excludes the involvement of extra week). However, the figure is well below the analyst’s expectation.

Dismal Channel Development Performance: Dismal Channel Development revenues continues to hurt the company. In fourth-quarter fiscal 2021, the segment’s net revenues declined 6% following a fall of 7%, 29% and 25% year over year in the third, the second and the first quarter of fiscal 2021, respectively. The downside was primarily due to nearly 20% unfavorable impact of Global Coffee Alliance transition-related activities.

Tricky Retail and Consumer Spending Environment in the United States: Being a retail restaurant, Starbucks is dependent on consumer discretionary spending environment. Consumers’ propensity to spend largely depends upon the overall macro-economic scenario. Although higher disposable income and increased wages are favoring the industry right now, it can change with the slightest disruption in the economy. The company, therefore, is highly vulnerable to the inconsistent nature of consumer discretionary spending. If it does not make pragmatic use of advanced technologies to innovate across value chains, it has high chances of fading out like many other restaurant retailers.

Last Earnings Report

FY Quarter Ending |

9/30/2023 |

|---|

| Earnings Reporting Date | Apr 30, 2024 |

|---|---|

| Sales Surprise | -6.31% |

| EPS Surprise | -13.92% |

| Quarterly EPS | 0.68 |

| Annual EPS (TTM) | 3.64 |

Starbucks Q4 Earnings Meet Estimates, Increase Y/Y

Starbucks reported mixed fourth-quarter fiscal 2021 results, with earnings meeting the Zacks Consensus Estimate and revenues missing the same. However, the top and bottom line improved on a year over year basis.

Discussion on Earnings, Revenues & Comps

In the quarter under review, the company reported adjusted earnings per share (EPS) of $1 that is in line with the Zacks Consensus Estimate. In the prior-year quarter, the company had reported adjusted earnings per share of 51 cents.

Quarterly revenues of $8,146.7 million missed the Zacks Consensus Estimate of $8,263 million by 1.4%. However, the top line increased 31.3% on a year-over-year basis. The upside was primarily driven by growth in comparable store sales backed by the lapping of business disruption in the prior year due to the COVID-19 pandemic. Global comparable store sales increased 17% year over year. The upside was primarily driven by a 15% rise in comparable transactions and a 2% increase in average ticket. However, the figure remained below the company’s expectation of 18-21% growth. Starbucks opened 538 net new stores worldwide in the fiscal fourth quarter, bringing the total store count to 33,833. Global store growth came in at 4% on a year-over-year basis.

Overall Margin Expands in Q4

On a non-GAAP basis, operating margin during the fiscal fourth quarter came in at 19.6%, up from 13.2% reported in the prior-year quarter. The uptrend can be attributed to sales leverage from business recovery and the lapping of COVID-19 related costs in the prior year. However, this was partially offset by a rise in supply chain costs.

Segmental Details

During the fiscal fourth quarter, the company initiated certain changes related to its operating segment structure. The company renamed the Americas segment to North America operating segment, featuring company-operated and licensed stores in the United States and Canada. Starbucks realigned the licensed Latin America and Caribbean markets from the earlier Americas segment to the International segment. The company’s latest reportable operating segments comprise North America, International and Channel Development.

North America: The segment’s fiscal fourth-quarter net revenues came in at $5,763 million, up 37% year over year. The segment benefited from 22% growth in comparable store sales. Operating margin in the North America segment came in at 21.8% compared with 12% reported in the prior-year quarter. The uptrend was driven by the lapping of COVID-19 related costs in the prior year as well as sales leverage from business recovery and pricing along with the benefits of North America Trade Area Transformation. However, this was partly negated by a rise in supply chain costs.

International: Net revenues in the segment rose 27% year over year to $1,914.6 million. The upside was primarily driven by 1,287 net new store openings (in the past 12 months), incremental revenues from an extra week (in the fiscal fourth quarter), higher product sales and royalty revenues (with reference to its licensees) and 3% favorable impact from foreign currency translation. International comparable store sales rose 3% year over year. Operating margin in the segment expanded 770 basis points (bps) year over year to 19.7%. The upside can be attributed to sales leverage from the lapping of the severe impact of the COVID-19 pandemic, favorability from temporary government subsidies and labor efficiencies. During the fiscal fourth quarter, comps in China declined 7% year over year compared with a 3% fall reported in the prior-year quarter. The downtick was caused by a 5% decline in average ticket and a 2% decline in transactions.

Channel Development: Net revenues in the segment declined 6% from the prior-year quarter’s figure to $438.3 million. The downside was primarily due to nearly 20% unfavorable impact of Global Coffee Alliance transition-related activities. This was somewhat mitigated by incremental revenues arising from an extra week (in the fiscal fourth quarter) coupled with growth in its ready-to-drink business and Global Coffee Alliance. Meanwhile, operating margin expanded 740 bps year over year to 50.1%.

Other Financial Updates

The company ended the quarter with cash and cash equivalents of $ 6,455.7 million compared with $4,350.9 million at the end of Sep 27, 2020. As of Oct 3, 2021, long-term debt is at $13,616.9 million compared with $14,659.6 million as of Sep 27, 2020. The company declared a quarterly cash dividend of 49 cents per share. The dividend will be payable on Nov 26, 2021, to shareholders of record as of Nov 12, 2021. Management stated its intention to return $20 billion (over the next three years) in dividends and share repurchases.

Fiscal 2022 Guidance

For fiscal 2022, the company anticipates global comparable sales to reach high-single digits. The company expects to open approximately 2,000 net new stores globally in fiscal 2022, up from 1,173 store openings reported in fiscal 2021. Starbucks intends to diversify its portfolio across highly-profitable markets as it expects 75% of its net new stores openings outside the United States. Consolidated revenues for fiscal 2022 is anticipated between $32.5 billion and $33 billion. For fiscal 2022, the company anticipates non-GAAP EPS growth to be a minimum 10% from the base of $3.10 in fiscal 2021 (the figure is adjusted for non-GAAP treatment of certain integration costs and excludes the involvement of extra week).

Valuation

Starbucks’s shares are up 3.3% in year-to-date and 10.3% in the trailing 12-month period. Stocks in the Zacks sub-industry are up by 6% while the Zacks Retail-Wholesale sector is down 9% in the year-to-date period. Over the past year, the Zacks sub-industry is up by 9%, but the sector is down by 10.6%.

The S&P 500 index is up 22.7% in the year-to-date period and 25.3% in the past year.

The stock is currently trading at 30.51X forward 12-month earnings, which compares to 25.81X for the Zacks sub-industry, 26.34X for the Zacks sector and 21.35X for the S&P 500 index.

Over the past five years, the stock has traded as high as 88.46x and as low as 18.15x, with a 5-year median of 26.46x. Our Neutral recommendation indicates that the stock will perform in-line with the market. Our $116 price target reflects 32.04x forward 12-months earnings.

The table below shows summary valuation data for SBUX.

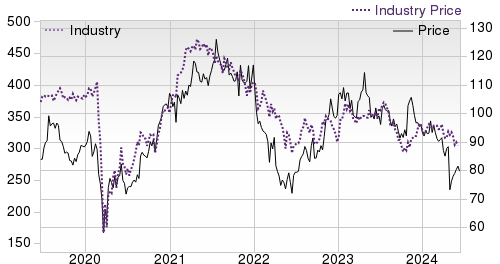

Industry Analysis(1)Zacks Industry Rank: Bottom 34% (164 out of 250)

Top Peers(1)

| Company (Ticker) | Rec | Rank |

| Chipotle Mexican Grill, Inc. (CMG) | Neutral |  |

| Compass Group PLC (CMPGY) | Neutral |  |

| Darden Restaurants, Inc. (DRI) | Neutral |  |

| McDonald's Corporation (MCD) | Neutral |  |

| Restaurant Brands International Inc. (QSR) | Neutral |  |

| Yum! Brands, Inc. (YUM) | Neutral |  |

| Yum China (YUMC) | Neutral |  |

| Bloomin' Brands, Inc. (BLMN) | Underperform |  |

Industry Comparison(1)Industry: Retail - Restaurants |

Industry Peers |

| SBUX | |

|---|---|

| Zacks Recommendation (Long Term) | Underperform |

| Zacks Rank (Short Term) |  |

| VGM Score |  |

| Market Cap | 90.22 B |

| # of Analysts | 13 |

| Dividend Yield | 2.86% |

| Value Score |  |

| Cash/Price | 0.03 |

| EV/EBITDA | 13.87 |

| PEG Ratio | 1.85 |

| Price/Book (P/B) | NA |

| Price/Cash Flow (P/CF) | 16.50 |

| P/E (F1) | 22.19 |

| Price/Sales (P/S) | 2.47 |

| Earnings Yield | 4.51% |

| Debt/Equity | -1.84 |

| Cash Flow ($/share) | 4.83 |

| Growth Score |  |

| Hist. EPS Growth (3-5 yrs) | 15.14% |

| Proj. EPS Growth (F1/F0) | 1.41% |

| Curr. Cash Flow Growth | 11.43% |

| Hist. Cash Flow Growth (3-5 yrs) | 3.39% |

| Current Ratio | 0.86 |

| Debt/Capital | NA% |

| Net Margin | 11.38% |

| Return on Equity | -49.91% |

| Sales/Assets | 1.25 |

| Proj. Sales Growth (F1/F0) | 2.40% |

| Momentum Score |  |

| Daily Price Chg | -0.74% |

| 1 Week Price Chg | 1.51% |

| 4 Week Price Chg | 2.31% |

| 12 Week Price Chg | -12.19% |

| 52 Week Price Chg | -21.81% |

| 20 Day Average Volume | 10,637,254 |

| (F1) EPS Est 1 week change | -0.19% |

| (F1) EPS Est 4 week change | -0.11% |

| (F1) EPS Est 12 week change | -11.79% |

| (Q1) EPS Est Mthly Chg | -1.56% |

| X Industry | S&P 500 |

|---|---|

| - | - |

| - | - |

| - | - |

| 1.02 B | 33.73 B |

| 6.5 | 18 |

| 0.00% | 1.59% |

| - | - |

| 0.07 | 0.04 |

| 9.63 | 14.55 |

| 1.74 | 2.16 |

| 2.50 | 3.34 |

| 9.82 | 13.45 |

| 19.07 | 18.26 |

| 0.74 | 2.69 |

| 4.85% | 5.45% |

| 0.11 | 0.62 |

| 2.76 | 8.64 |

| - | - |

| 12.98% | 9.87% |

| 7.62% | 7.41% |

| 10.71% | 3.70% |

| 5.43% | 6.94% |

| 0.64 | 1.22 |

| 25.49% | 39.29% |

| 3.44% | 11.99% |

| 3.24% | 16.63% |

| 0.97 | 0.54 |

| 2.06% | 3.99% |

| - | - |

| -1.23% | -0.04% |

| -1.43% | 1.58% |

| -5.29% | 2.42% |

| -9.15% | 3.77% |

| -13.20% | 23.18% |

| 242,881 | 2,019,074 |

| 0.00% | 0.00% |

| 0.00% | 0.00% |

| -0.97% | 0.39% |

| 0.00% | 0.00% |

| CMPGY | MCD | YUMC |

|---|---|---|

| Neutral | Neutral | Neutral |

|  |  |

|  |  |

| 48.52 B | 182.75 B | 13.21 B |

| 3 | 14 | 7 |

| 1.35% | 2.63% | 1.89% |

|  |  |

| 0.02 | 0.00 | 0.18 |

| 16.03 | 15.78 | 7.54 |

| 1.94 | 2.86 | 1.60 |

| 7.71 | NA | 2.02 |

| 18.31 | 17.16 | 10.83 |

| 23.88 | 20.84 | 15.52 |

| NA | 7.09 | 1.20 |

| 4.18% | 4.80% | 6.43% |

| 0.59 | -7.61 | 0.28 |

| 1.56 | 14.78 | 3.13 |

|  |  |

| NA | 13.41% | -0.65% |

| 12.26% | 1.93% | 9.00% |

| 22.52% | 14.59% | 23.57% |

| 4.28% | 6.87% | 4.26% |

| 0.75 | 0.83 | 1.39 |

| 37.02% | NA | 22.05% |

| NA | 33.36% | 7.49% |

| NA | -180.74% | 11.90% |

| NA | 0.49 | 0.94 |

| 9.70% | 4.40% | 7.10% |

|  |  |

| -1.72% | -0.05% | -2.36% |

| 2.70% | -1.04% | -1.62% |

| -1.66% | -6.90% | -13.50% |

| -0.21% | -10.28% | -10.48% |

| 0.74% | -13.66% | -42.91% |

| 174,813 | 3,373,019 | 2,609,893 |

| 0.00% | 0.00% | 0.00% |

| 0.00% | -0.04% | -0.13% |

| 0.56% | -1.68% | -0.39% |

| NA | 0.15% | -0.52% |

Zacks Stock Rating System

We offer two rating systems that take into account investors' holding horizons: Zacks Rank and Zacks Recommendation. Each provides valuable insights into the future profitability of the stock and can be used separately or in combination with each other depending on your investment style.

Zacks Recommendation

The Zacks Recommendation aims to predict performance over the next 6 to 12 months. The foundation for the quantitatively determined Zacks Recommendation is trends in the company's estimate revisions and earnings outlook. The Zacks Recommendation is broken down into 3 Levels; Outperform, Neutral and Underperform. Unlike many Wall Street firms, we have an excellent balance between the number of Outperform and Neutral recommendations. Our team of 70 analysts are fully versed in the benefits of earnings estimate revisions and how that is harnessed through the Zacks quantitative rating system. But we have given our analysts the ability to override the Zacks Recommendation for the 1200 stocks that they follow. The reason for the analyst over-rides is that there are often factors such as valuation, industry conditions and management effectiveness that a trained investment professional can spot better than a quantitative model.

Zacks Rank

The Zacks Rank is our short-term rating system that is most effective over the one- to three-month holding horizon. The underlying driver for the quantitatively-determined Zacks Rank is the same as the Zacks Recommendation, and reflects trends in earnings estimate revisions.

Zacks Style Scores

| Value Score |

|

| Growth Score |

|

| Momentum Score |

|

| VGM Score |

|

The Zacks Style Score is as a complementary indicator to the Zacks rating system, giving investors a way to focus on the highest rated stocks that best fit their own stock picking preferences.

Academic research has proven that stocks with the best Value, Growth and Momentum characteristics outperform the market. The Zacks Style Scores rate stocks on each of these individual styles and assigns a rating of A, B, C, D and F. We also produce the VGM Score (V for Value, G for Growth and M for Momentum), which combines the weighted average of the individual Style Scores into one score. This is perfectly suited for those who want their stocks to have the best scores across the board.

As an investor, you want to buy stocks with the highest probability of success. That means buying stocks with a Zacks Recommendation of Outperform, which also has a Style Score of an A or a B.

Disclosures

This report contains independent commentary to be used for informational purposes only. The analysts contributing to this report do not hold any shares of this stock. The analysts contributing to this report do not serve on the board of the company that issued this stock. The EPS and revenue forecasts are the Zacks Consensus estimates, unless otherwise indicated in the report’s first-page footnote. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts' personal views as to the subject securities and issuers. ZIR certifies that no part of the analysts' compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report.

Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Any opinions expressed herein are subject to change.

ZIR is not an investment advisor and the report should not be construed as advice designed to meet the particular investment needs of any investor. Prior to making any investment decision, you are advised to consult with your broker, investment advisor, or other appropriate tax or financial professional to determine the suitability of any investment. This report and others like it are published regularly and not in response to episodic market activity or events affecting the securities industry.

This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. ZIR or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. ZIR is not a broker-dealer. ZIR may enter into arms-length agreements with broker-dealers to provide this research to their clients. Zacks and its staff are not involved in investment banking activities for the stock issuer covered in this report.

ZIR uses the following rating system for the securities it covers. Outperform- ZIR expects that the subject company will outperform the broader U.S. equities markets over the next six to twelve months. Neutral- ZIR expects that the company will perform in line with the broader U.S. equities markets over the next six to twelve months. Underperform- ZIR expects the company will underperform the broader U.S. equities markets over the next six to twelve months.

No part of this report can be reprinted, republished or transmitted electronically without the prior written authorization of ZIR.