| © 2026 Zacks Investment Research, All Rights Reserved | 101 N Wacker Drive, Floor 15, Chicago, IL 60606 |

| Zacks Equity Research | www.zacks.com | Page $[page] of $[total] |

|

Zacks Report Date: February 11, 2026 |

Atlassian Corporation (TEAM)$92.92 (Stock Price as of 02/10/2026) Price Target (6-12 Months): $257.00 |

|

||||||||||||||||

Summary

Atlassian is benefiting from the rising demand for remote working tools amid the hybrid work trend and accelerated digital transformation. An improvement in product quality and performance, multiple product launches, transparent pricing and a unique sales strategy are upsides. The expansion of its product portfolio through acquisitions is expected to fuel its growth momentum. Its focus on adding generative AI features to some of its collaboration software is likely to drive the top line. However, the decelerating customer growth rate makes us slightly cautious about the company’s near-term prospects. Our estimate suggests that its customer base is likely to witness a CAGR of 4% through fiscal 2024-2026 compared with 18.1% through fiscal 2021-2023. Softening IT spending amid macroeconomic headwinds may hurt growth in the near term.

Data Overview

| 52 Week High-Low | $324.16 - $88.51 |

|---|---|

| 20 Day Average Volume (sh) | 6,196,105 |

| Market Cap | $24.0 B |

| YTD Price Change | -43.7% |

| Beta | 0.88 |

| Dividend / Div Yld | $0.00 / 0.0% |

| Industry | Internet - Software |

| Zacks Industry Rank | Top 36% (87 out of 243) |

| Last EPS Surprise | 8.9% |

|---|---|

| Last Sales Surprise | 3.0% |

| EPS F1 Est- 4 week change | -9.8% |

| Expected Report Date | 05/07/2026 |

| Earnings ESP | -0.3% |

| P/E TTM | 21.7 |

|---|---|

| P/E F1 | 40.8 |

| PEG F1 | 1.9 |

| P/S TTM | 4.2 |

Price, Consensus & Surprise(1)

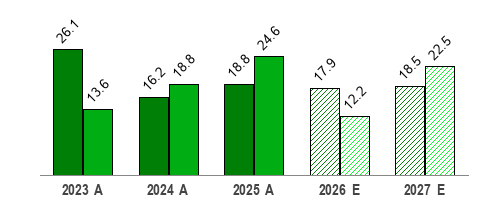

Sales and EPS Growth Rates (Y/Y %)(2)

Sales  |

EPS  |

Sales Estimates (millions of $)(2)

| Q1 | Q2 | Q3 | Q4 | Annual* | |

|---|---|---|---|---|---|

2027 |

|||||

2026 |

|||||

2025 |

1,188 A |

1,286 A |

1,357 A |

1,384 A |

5,215 A |

EPS Estimates(2)

| Q1 | Q2 | Q3 | Q4 | Annual* | |

|---|---|---|---|---|---|

2027 |

|||||

2026 |

|||||

2025 |

0.77 A |

0.96 A |

0.97 A |

0.98 A |

3.68 A |

*Quarterly figures may not add up to annual.

1) The data in the charts and tables, except the estimates, is as of 02/10/2026.

2) The report's text, the analyst-provided estimates, and the price target are as of 12/22/2023.

Overview

As of 12/22/2023

Atlassian is a global leader and innovator in the enterprise collaboration and workflow software space. The company offers a suite of cloud-based software solutions, which help organizations, collaborate and manage their workforce, such that the teams work better together.

Initially, Atlassian’s products were designed to help software developer teams communicate, collaborate, and manage the design and delivery cycle of software. However, over the years, uses of Atlassian’s solutions have expanded virally to teams across diverse industries. With its sustained focus on developing new collaboration tools, the company now caters to the need of several corporate functions, including finance, legal, human resource and IT support.

The company has more than 262,000 customers in 190 countries and virtually across every industry sector. Over two-thirds of the Fortune 500 companies, including General Motors, Bank of America Merrill Lynch, and Verizon, are currently using at least one Atlassian solution.

The company has 13 sets of solutions divided under four product categories — Plan, Track, & Support; Collaborate; Code, Build, & Ship; and Security & Identity. Among these 13 products, Atlassian’s JIRA, Confluence, Bitbucket, and Trello are the most notable ones.

The company’s JIRA team collaboration software leads among the software developer community. Atlassian’s sustained focus on adding new features to JIRA software as per customer requirements has helped it stay ahead of its competitor’s offerings including Broadcom’s Rally Software, Microsoft’s Azure DevOps Server and IBM’s Rational.

With the Confluence solution, teams can create, share, and collaborate on content. Atlassian’s Bitbucket is used by professionals for code sharing. The Trello software adds a visual component that helps organizations keep track of who is working on what project and how far they have reached.

Atlassian generates revenues primarily in the form of subscriptions, maintenance, perpetual license and other sources. Subscription and maintenance, together, contributed approximately 94% to fiscal 2023 revenues of $3.53 billion.

As of 02/10/2026

Reasons To Buy:

Atlassian is poised to benefit from the rising demand for remote working tools amid hybrid working trend. Improvement in product quality, product launches, transparent pricing and online sales strategy are positives.

As the demand for offsite working increases amid the ongoing hybrid work trend, companies offering remote-working software and services like Atlassian are expected to grow exponentially. The company’s Confluence and Trello applications can help organizations collaborate and manage staffs who are currently working from different locations. Our estimates suggest Atlassian’s revenues will grow at a CAGR of 19.6% through fiscal 2024-2026.

Atlassian is a global leader and innovator in the enterprise collaboration and workflow software space. The company is poised to grow given the rising demand for automated and improved communication system within organizations. Furthermore, the company will benefit from the ongoing digitalization of work from organizations and the rapid adoption of cloud services. According to a Mordor Intelligence report, the global enterprise collaboration market is likely to reach approximately $90.6 billion by 2028 from $54.5 billion in 2023, indicating a CAGR of 10.7%.

Atlassian is currently focused on selling more subscription-based solutions. This unique business model is helping the company in generating stable revenues while expanding margins. Subscription-based service is a high margin business as the incremental cost to add a user declines as the company’s user base increases. Subscriptions have been the company’s fastest-growing segment which has witnessed CAGR of over 46% between fiscal 2020 and fiscal 2023. We believe that the strategy will continue to improve the company’s top and bottom-line performances. We expect that the company’s subscription revenues will grow at a CAGR of 25.5% through fiscal 2024-2026.

Atlassian’s latest focus on adding generative AI features to some of its collaboration software is likely to drive the top line over the long run. In April 2023, the company collaborated with OpenAI to enhance the capabilities of its Confluence, Jira Service Management and other programs with generative AI features. The company is offering generative AI-enabled features under the Atlassian Intelligence brand which is designed to help employees be more efficient while users remain in control of data.

Atlassian’s differentiated and easy-to-use products, along with a low and transparent pricing model, help it expand the client base, which has almost doubled in the last four years. The company has designed and built its team collaboration, application development, and workflow tools in such a way that organizations can easily set up and adopt those without any support. Furthermore, the company has a complete transparent pricing model as prices of all its products are available on the website. Atlassian does not offer any discount to any enterprise, big or small which attracts organizations. Moreover, the company’s product prices are significantly lower in comparison to solutions offered by its competitors, including Broadcom, Microsoft, and IBM, which is driving the adoption of its products. Atlassian’s approach of pursuing customer volume and targeting every organization regardless of the size, industry, and geography is anticipated to continue driving its top- and bottom-line performances over the long run.

Atlassian has a unique go-to-market approach and sells its products mostly online, which contribute approximately 75% to revenues. The company also sells products through third-party vendors which contribute the remaining 25% to revenues. The strategy has helped the company keep sales expenses rock bottom, thereby boosting its margins. Furthermore, what it saves from lower sales and marketing, the company spends in research and development to roll out new products as well as raise the profile of its existing solutions.

Atlassian has made strategic acquisitions to expedite growth. Acquired in 2010, Bitbucket has helped the company expand its foothold in the software developer community. The product allows software developers to build, test and deploy code efficiently. The acquisition of Trello in 2017 helped Atlassian expand its reach across multiple industries. Notably, Trello software adds a visual component that helps organizations keep track of who is working on what project and how far they have reached. In 2019, the company acquired three businesses – Code Barrel, Good Software, and AgileCraft. In 2020, it bought two companies – Halp and Mindville. In 2021, it has acquired two firms – Charito and ThinkTilt. In 2022, Atlassian acquired Percept.AI. Recently in October 2023, the firm agreed to buy the video-messaging startup and one-time unicorn, Loom, for $975 million, its largest-ever deal. Loom acquisition is anticipated to boost Atlassian’s team collaboration capabilities and help tap opportunities from the growing hybrid working trend-led demand. These acquisitions have not only expanded Atlassian’s product portfolio but have also added to the customer base and incremental revenues. This apart, integration with leading applications like Slack, Dropbox, and Adobe, along with partnerships with the likes of Amazon’s AWS and Microsoft, will likely expand the Atlassian paying-user base.

Atlassian has a strong balance sheet with ample liquidity position and no debt obligations. Cash and short-term investments were $2.11 billion as of Jun 30, 2023. In fiscal 2023, the company generated operating and free cash flows of $868 million and $843 million, respectively. It is to be noted that Atlassian has been able to regularly increase its cash balance as well as its cash from operations since fiscal 2017. The increasing liquidity and cash flow trend reflect that the company is making investments in the right direction. The company ended the first quarter of fiscal 2024 with cash and cash equivalents and short-term investments of $2.24 billion. Moreover, it generated operating and free cash flows of $167 million and $163.3 million, respectively, during the first quarter. Since it carries no long-term debt, the cash is available for pursuing strategic acquisitions, investment in growth initiatives and distribution to shareholders.

Reasons To Sell:

Intensifying competition from the likes of Salesforce Chatter, Microsoft’s Azure DevOps Server is likely to make Atlassian resort to competitive pricing in an effort to maintain and gain further market share.

Atlassian’s decelerating customer growth rate makes us increasingly cautious about its near-term prospects. Despite the customers accelerated migration to Atlassian’s Cloud and Data Center offerings during fourth-quarter fiscal 2023 before the end of its loyalty discount program, the company managed to add just 2,562 net new customers in the quarter. The fourth-quarter fiscal 2024 net new customer addition was the lowest in the past 12 quarters. In the first quarter of fiscal 2024, the company added 2,663 net new customers, slightly higher than the previous quarter. Furthermore, the year-over-year growth rate of total customers have decelerated in the last eight quarters. Moreover, our estimate suggests its customer base will grow at a CAGR of 4% through fiscal 2024-2026 compared with the CAGR of 18.1% through fiscal 2021-2023.

Atlassian’s near-term prospects might be hurt by softening IT spendings. Enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. This does not bode well for Atlassian’s prospects in the near term.

The team collaboration and workflow-software market is flooded with a wide range of competitors with distinctive strength. Atlassian’s JIRA software matches up with solutions like Broadcom’s Rally Software, Microsoft’s Azure DevOps Server and IBM’s Rational. Its Confluence product competes with Salesforce Chatter, and Google’s Apps for Work. Therefore, Atlassian will have to continue delivering prompt and advanced technologies to suit customer requirements and expedite product introduction in order to survive. Moreover, we believe Atlassian’s dominance could be further challenged by new entrants, thus forcing it to resort to competitive pricing to maintain and gain further market share.

To survive in the highly competitive team collaboration and workflow-software market, each player must continually invest in broadening its capabilities. Over the past few years, Atlassian has invested heavily to enhance its sales and marketing (S&M) capabilities, particularly by increasing the sales force. Furthermore, the company is continuously increasing its investments in research and development (R&D) to add new and innovative products to its portfolio. Higher spending on S&M and R&D is likely to negatively impact its margins in the near-term.

As Atlassian has a software-as-a-service (SaaS) based business model, the company is vulnerable to security breaches and cyber attacks. Any security breach can tarnish its image and influence negative customer confidence, thereby impacting client retention and renewal rates.

Atlassian has been focusing on acquisitions to add features to its platform and fuel growth. Since its inception, the company has acquired 20 companies which have helped it enhance its product capabilities, increase the paying-user base and generate incremental revenues. Nonetheless, frequent acquisitions add to integration risks. Furthermore, increased focus on acquisitions could negatively impact Atlassian’s balance sheet in the form of a high level of goodwill, which totaled $726.5 million, or approximately 18% of its total assets as of Sep 30, 2023.

Atlassian currently has a trailing 12-month Price/Sales (P/S) ratio of 17.06. This level compares unfavorably with what the industry saw over the past year. Hence, the valuation looks slightly stretched from a P/S TTM perspective.

Last Earnings Report

FY Quarter Ending |

6/30/2025 |

|---|

| Earnings Reporting Date | Feb 05, 2026 |

|---|---|

| Sales Surprise | 3.00% |

| EPS Surprise | 8.93% |

| Quarterly EPS | 1.22 |

| Annual EPS (TTM) | 4.21 |

Atlassian’s Q1 Earnings and Revenues Beat Estimates

Atlassian reported stronger-than-expected first-quarter fiscal 2024 results. Its first-quarter fiscal 2024 non-GAAP earnings per share of 65 cents beat the Zacks Consensus Estimate of 53 cents. The figure increased 80.5% from the year-ago quarter’s non-GAAP earnings of 36 cents per share, mainly driven by double-digit year-over-year growth across segments like Cloud, Data Center and Server.

Atlassian’s first-quarter revenues jumped 24% to $977.8 million and surpassed the consensus mark of $959 million. The top line was primarily driven by growth in Subscription revenues, stronger renewals, migrations and paid seat expansion.

Quarterly Details

Segment-wise, Subscription revenues jumped 31% year over year to $852 million. Due to the ongoing shift toward cloud, the increasing number of customers coupled with higher prices on some products boosted the company's quarterly revenues. Our estimate for Subscription revenues was pegged at $840.3 million.

Sales from the Maintenance business decreased 30.7% year over year to $78.6 million. The decline was primarily due to the company’s planned end of providing maintenance and support for its Server offerings, beginning in February 2024. Our estimate for Maintenance revenues was pegged at $61.2 million.

Atlassian’s Other revenues (including perpetual license revenues) increased 10.2% year over year to $47.2 million. Our estimate for Other revenues was pegged at $52.4 million.

During the first quarter, Cloud revenues were $604.6 million, representing 27.3% year-over-year growth. Meanwhile, revenues from the Data Center rose 42% to $243 million. Marketplace and services revenues were $51.4 million, reflecting an 8.7% year-over-year surge. However, revenues from Server declined 30.8% to $78.8 million.

Our revenue estimates for the Cloud, Data Center, Marketplace and Services and Server businesses were pegged at $600.7 million, $222 million, $75.2 million and $56 million, respectively.

Atlassian added more than 2,663 net new customers, bringing the total count to over 265,000 customers on an active subscription or maintenance agreement basis in the reported quarter. A large number of customers are opting for cloud offerings amid the ongoing cloud migration. Such new additions and increased pricing on certain products contributed to the company’s quarterly revenues.

The company’s non-GAAP gross profit climbed 20.2% year over year to $822.3 million. The non-GAAP gross margin contracted 70 basis points to 84.1% during the quarter. The decrease primarily resulted from investments aimed at meeting the increasing demand for Atlassian’s Cloud services and the ongoing shift in revenue composition toward cloud-based offerings.

Atlassian’s non-GAAP operating income increased 52.1% year over year to $224.9 million, while its non-GAAP operating margin increased to 23% from 18.3% in the year-ago quarter. The operating income is benefiting from the company’s focus on cost management.

Balance Sheet

The company ended the first quarter of fiscal 2024 with cash and cash equivalents and short-term investments of $2.24 billion, up from $2.11 billion at the end of the previous quarter.

In the fiscal first quarter, Atlassian generated operating and free cash flows of $167 million and $163.3 million, respectively.

Guidance

Atlassian reiterated its guidance for non-GAAP gross margin while raising it for non-GAAP operating margin for fiscal 2024. The company still projects non-GAAP gross margin to be approximately 83.5%. It now forecasts non-GAAP operating margin to be approximately 20% compared with the previous guidance of 18.5%.

The company provided guidance for the second quarter. For the second quarter of fiscal 2024, the company anticipates revenues between $1.01 billion and $1.03 billion. The Zacks Consensus Estimate is pegged at 1.01 billion.

The non-GAAP gross margin for the second quarter is estimated to be approximately 83.5%. The non-GAAP operating margin is anticipated to be approximately 21% in the third quarter.

Recent News

On Nov 30, Atlassian announced that it has completed the acquisition of the video messaging platform named Loom.

On Nov 6, Atlassian announced that it has been named a Leader in The Forrester WaveTM: Enterprise Service Management, Q4 2023. Atlassian received the highest possible score in the strategy category.

On Oct 12, Atlassian announced that it has signed a finalized contract to acquire the video messaging platform, Loom.

On Sep 14, Atlassian announced that Zeynep Ozdemir has been appointed as the new Chief Marketing Officer and Kevin Egan has been promoted to Chief Sales Officer.

On Jun 8, Atlassian announced that it has been named a leader in the 2023 Gartner Magic Quadrant for DevOps Platforms.

On May 26, Atlassian announced that Scott Farquhar and Mike Cannon-Brookes, co-CEOs, co-founders and directors of Atlassian, each adopted a new stock trading plan in February 2023 in accordance with guidelines specified under Rule 10b5-1 of the Securities and Exchange Act of 1934, as amended, and the policies of Atlassian regarding stock transactions.

On Feb 15, Atlassian announced the promotion of Anutthara Bharadwaj to President. In her new role, Ms. Bharadwaj will lead and support the newly unified "Markets and Transformations" organization.

Valuation

Shares of Atlassian have gained 50.9% in the past six months and risen 90.4% year to date. While stocks in the Zacks sub-industry increased 14.7%, the Zacks Computer & Technology sector gained 10.4% in the past six-month period. Year-to-date, the Zacks sub-industry jumped 68.9% and the sector increased 49.8%.

The S&P 500 Index has increased 7.5% in the past six months, while climbing 23.1% year to date.

The stock is currently trading at 13.91X forward 12-month sales, which compares with 2.41X for the Zacks sub-industry, 4.10X for the Zacks sector and 3.77X for the S&P 500 index.

Over the past five years, the stock has traded as high as 23.13X and as low as 6.27X with a five-year median of 11.40X. Our Neutral recommendation indicates that the stock will perform in line with the market. Our $257 price target reflects 14.60X forward 12-month sales.

The table below shows a summary valuation data for Atlassian.

Industry Analysis(1)Zacks Industry Rank: Top 36% (87 out of 243)

Top Peers(1)

| Company (Ticker) | Rec | Rank |

| Alight, Inc. (ALIT) | Neutral |  |

| Diebold Nixdorf, Incorporated (DBD) | Neutral |  |

| F5, Inc. (FFIV) | Neutral |  |

| Pinterest, Inc. (PINS) | Neutral |  |

| Toast, Inc. (TOST) | Neutral |  |

| Twilio Inc. (TWLO) | Neutral |  |

| CrowdStrike (CRWD) | Underperform |  |

| Snowflake Inc. (SNOW) | Underperform |  |

Industry Comparison(1)Industry: Internet - Software |

Industry Peers |

| TEAM | |

|---|---|

| Zacks Recommendation (Long Term) | Neutral |

| Zacks Rank (Short Term) |  |

| VGM Score |  |

| Market Cap | 24.00 B |

| # of Analysts | 12 |

| Dividend Yield | 0.00% |

| Value Score |  |

| Cash/Price | 0.11 |

| EV/EBITDA | 924.42 |

| PEG Ratio | 1.89 |

| Price/Book (P/B) | 15.09 |

| Price/Cash Flow (P/CF) | NA |

| P/E (F1) | 40.75 |

| Price/Sales (P/S) | 4.17 |

| Earnings Yield | 5.23% |

| Debt/Equity | 0.62 |

| Cash Flow ($/share) | -0.44 |

| Growth Score |  |

| Hist. EPS Growth (3-5 yrs) | NA% |

| Proj. EPS Growth (F1/F0) | 18.75% |

| Curr. Cash Flow Growth | -34.17% |

| Hist. Cash Flow Growth (3-5 yrs) | NA% |

| Current Ratio | 0.89 |

| Debt/Capital | 38.33% |

| Net Margin | -3.29% |

| Return on Equity | -6.33% |

| Sales/Assets | 0.97 |

| Proj. Sales Growth (F1/F0) | 16.20% |

| Momentum Score |  |

| Daily Price Chg | -3.68% |

| 1 Week Price Chg | -19.85% |

| 4 Week Price Chg | -37.70% |

| 12 Week Price Chg | -37.52% |

| 52 Week Price Chg | -71.75% |

| 20 Day Average Volume | 6,196,105 |

| (F1) EPS Est 1 week change | -9.80% |

| (F1) EPS Est 4 week change | -9.80% |

| (F1) EPS Est 12 week change | 6.83% |

| (Q1) EPS Est Mthly Chg | 0.00% |

| X Industry | S&P 500 |

|---|---|

| - | - |

| - | - |

| - | - |

| 700.09 M | 40.52 B |

| 4 | 22 |

| 0.00% | 1.35% |

| - | - |

| 0.17 | 0.04 |

| 4.73 | 15.24 |

| 1.10 | 2.01 |

| 2.78 | 3.66 |

| 20.78 | 15.56 |

| 20.13 | 19.33 |

| 3.04 | 3.12 |

| 4.32% | 5.14% |

| 0.00 | 0.57 |

| 0.11 | 9.07 |

| - | - |

| 14.25% | 7.79% |

| 32.13% | 9.25% |

| -13.02% | 6.96% |

| 15.21% | 7.81% |

| 1.61 | 1.19 |

| 4.44% | 37.83% |

| -1.06% | 12.75% |

| 2.31% | 17.16% |

| 0.60 | 0.53 |

| 12.03% | 5.26% |

| - | - |

| 0.25% | 0.47% |

| -4.93% | -0.17% |

| -14.60% | -0.18% |

| -16.10% | 4.38% |

| -33.17% | 14.81% |

| 857,525 | 3,069,428 |

| 0.00% | 0.00% |

| 0.00% | 0.00% |

| 0.00% | 0.34% |

| 0.00% | 0.00% |

| ALIT | TWLO |

|---|---|

| Neutral | Neutral |

|  |

|  |

| 821.13 M | 17.95 B |

| 1 | 8 |

| 10.39% | 0.00% |

|  |

| 0.51 | 0.14 |

| 6.80 | 96.51 |

| NA | 1.08 |

| 0.41 | 2.27 |

| 1.41 | 47.67 |

| 2.44 | 21.56 |

| 0.36 | 3.67 |

| 40.91% | 4.64% |

| 0.99 | 0.13 |

| 1.09 | 2.45 |

|  |

| 10.66% | NA |

| 18.75% | 31.06% |

| -4.58% | 151.84% |

| 15.15% | 41.37% |

| 1.21 | 4.68 |

| 49.83% | 11.16% |

| -94.23% | 1.37% |

| 7.89% | 3.36% |

| 0.32 | 0.50 |

| -3.00% | 12.60% |

|  |

| -3.75% | 1.70% |

| 4.58% | -4.52% |

| -7.23% | -11.39% |

| -28.04% | -2.70% |

| -77.12% | -19.02% |

| 10,164,125 | 2,554,734 |

| 0.00% | 0.00% |

| 0.00% | 0.00% |

| 1.92% | -0.55% |

| 0.00% | 0.00% |

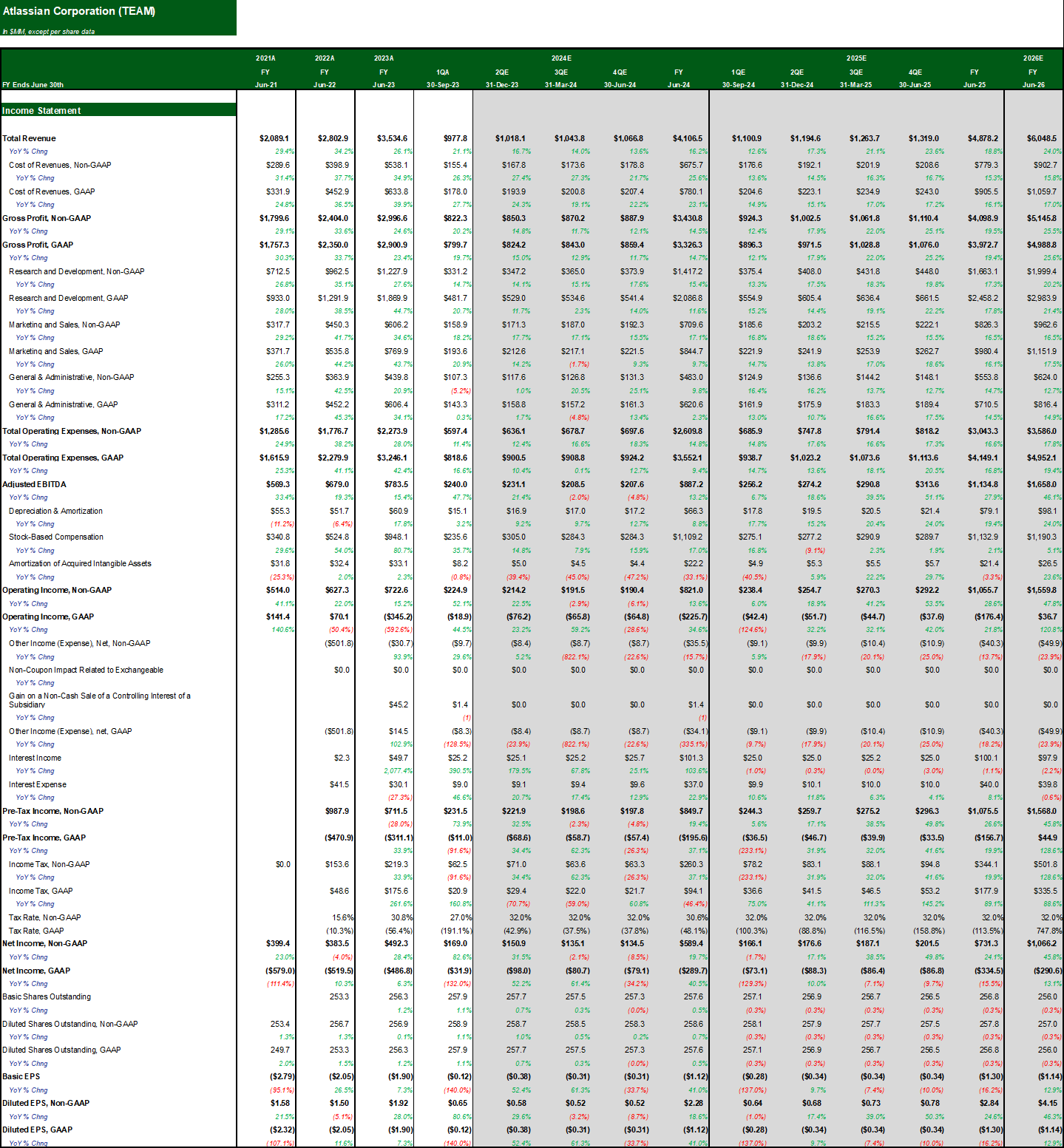

Analyst Earnings Model(2)

Zacks Stock Rating System

We offer two rating systems that take into account investors' holding horizons: Zacks Rank and Zacks Recommendation. Each provides valuable insights into the future profitability of the stock and can be used separately or in combination with each other depending on your investment style.

Zacks Recommendation

The Zacks Recommendation aims to predict performance over the next 6 to 12 months. The foundation for the quantitatively determined Zacks Recommendation is trends in the company's estimate revisions and earnings outlook. The Zacks Recommendation is broken down into 3 Levels; Outperform, Neutral and Underperform. Unlike many Wall Street firms, we have an excellent balance between the number of Outperform and Neutral recommendations. Our team of 70 analysts are fully versed in the benefits of earnings estimate revisions and how that is harnessed through the Zacks quantitative rating system. But we have given our analysts the ability to override the Zacks Recommendation for the 1200 stocks that they follow. The reason for the analyst over-rides is that there are often factors such as valuation, industry conditions and management effectiveness that a trained investment professional can spot better than a quantitative model.

Zacks Rank

The Zacks Rank is our short-term rating system that is most effective over the one- to three-month holding horizon. The underlying driver for the quantitatively-determined Zacks Rank is the same as the Zacks Recommendation, and reflects trends in earnings estimate revisions.

Zacks Style Scores

| Value Score |

|

| Growth Score |

|

| Momentum Score |

|

| VGM Score |

|

The Zacks Style Score is as a complementary indicator to the Zacks rating system, giving investors a way to focus on the highest rated stocks that best fit their own stock picking preferences.

Academic research has proven that stocks with the best Value, Growth and Momentum characteristics outperform the market. The Zacks Style Scores rate stocks on each of these individual styles and assigns a rating of A, B, C, D and F. We also produce the VGM Score (V for Value, G for Growth and M for Momentum), which combines the weighted average of the individual Style Scores into one score. This is perfectly suited for those who want their stocks to have the best scores across the board.

As an investor, you want to buy stocks with the highest probability of success. That means buying stocks with a Zacks Recommendation of Outperform, which also has a Style Score of an A or a B.

Disclosures

This report contains independent commentary to be used for informational purposes only. The analysts contributing to this report do not hold any shares of this stock. The analysts contributing to this report do not serve on the board of the company that issued this stock. The EPS and revenue forecasts are the Zacks Consensus estimates, unless otherwise indicated in the report’s first-page footnote. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts' personal views as to the subject securities and issuers. ZIR certifies that no part of the analysts' compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report.

Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Any opinions expressed herein are subject to change.

ZIR is not an investment advisor and the report should not be construed as advice designed to meet the particular investment needs of any investor. Prior to making any investment decision, you are advised to consult with your broker, investment advisor, or other appropriate tax or financial professional to determine the suitability of any investment. This report and others like it are published regularly and not in response to episodic market activity or events affecting the securities industry.

This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. ZIR or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. ZIR is not a broker-dealer. ZIR may enter into arms-length agreements with broker-dealers to provide this research to their clients. Zacks and its staff are not involved in investment banking activities for the stock issuer covered in this report.

ZIR uses the following rating system for the securities it covers. Outperform- ZIR expects that the subject company will outperform the broader U.S. equities markets over the next six to twelve months. Neutral- ZIR expects that the company will perform in line with the broader U.S. equities markets over the next six to twelve months. Underperform- ZIR expects the company will underperform the broader U.S. equities markets over the next six to twelve months.

No part of this report can be reprinted, republished or transmitted electronically without the prior written authorization of ZIR.