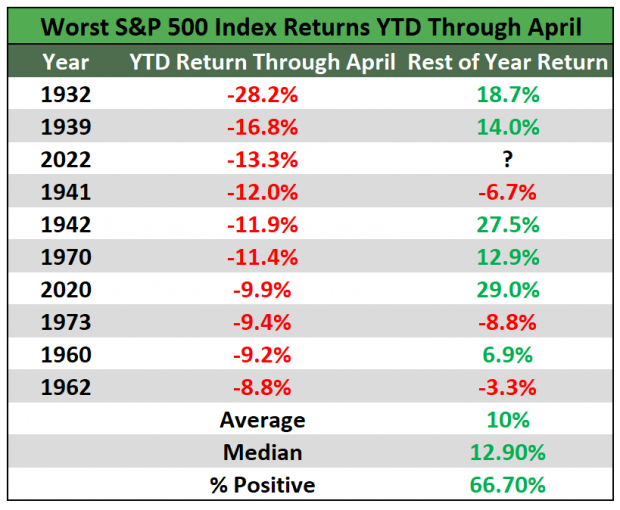

It’s been a year to forget for the markets as the S&P 500 is off to the worst start (-13% through April) dating back to 1939. The blue-chip index fell 8.8% in April, extending the decline and marking the worst April since 1970. There’s no shortage of concerns for investors, ranging from an ongoing foreign war to high inflation and rising interest rates. After a brutal start, investors are now entering a seasonally weak period for stocks. The question now is – should you sell in May and go away?

Most investors have heard this phrase before as the underperformance during the May-October period has been weak over time. Since 1950, this 6-month period has averaged just a 1.8% return, making it the weakest period of the year. The S&P 500 has been higher 65.3% of the time during this 6-month period over the past 72 years.

Yet this ‘worst’ 6-month period has been higher 9 of the past 10 years, with an average return of 5.7%. May returns have been strong lately, averaging 0.94% over the past nine years. With many stocks in oversold territory and consumer sentiment hovering near historic lows, investors are wondering if the recent history will repeat itself.

I’m not one for predictions; rather, I like to focus on facts. We are privileged to have many decades of market data to learn from, and it is this historical research and analysis that can help guide us in the current market environment. This begs the question – what has happened in the past when the market has started off the year extremely weak?

As we can see below, the previous worst ten starts to a year haven’t corresponded to continued weakness throughout the remainder of the year. According to LPL Research, the S&P 500 experienced a 10% average gain through the rest of the year and was higher 66.7% of the time.

Image Source: Zacks Investment Research

It’s important to state that history rarely repeats itself exactly in the market – but it often rhymes. We don’t want to get too zoned in on any one particular statistic or data point. While other years may serve as a guidepost for what we can expect, markets are dynamic and can shift directions quickly. There are variables at play that may not have been present in those prior years, and these will impact the market’s direction moving forward.

Should we sell in May? There isn’t an easy answer to this question, but history has shown that above-average returns after painful starts to the year may be waiting for us on the other side. Fear has settled into the minds of investors, many of whom may be anticipating more pain ahead. But as we know, the market has a way of proving the majority wrong.

The truth is no one knows for sure what the market will do, and anyone who tells you otherwise is not to be trusted. Having a plan in place for a variety of outcomes is the key to managing portfolio risk. We’ll see how it all unfolds from here.

Image: Bigstock

Should You Sell in May and Go Away?

It’s been a year to forget for the markets as the S&P 500 is off to the worst start (-13% through April) dating back to 1939. The blue-chip index fell 8.8% in April, extending the decline and marking the worst April since 1970. There’s no shortage of concerns for investors, ranging from an ongoing foreign war to high inflation and rising interest rates. After a brutal start, investors are now entering a seasonally weak period for stocks. The question now is – should you sell in May and go away?

Most investors have heard this phrase before as the underperformance during the May-October period has been weak over time. Since 1950, this 6-month period has averaged just a 1.8% return, making it the weakest period of the year. The S&P 500 has been higher 65.3% of the time during this 6-month period over the past 72 years.

Yet this ‘worst’ 6-month period has been higher 9 of the past 10 years, with an average return of 5.7%. May returns have been strong lately, averaging 0.94% over the past nine years. With many stocks in oversold territory and consumer sentiment hovering near historic lows, investors are wondering if the recent history will repeat itself.

I’m not one for predictions; rather, I like to focus on facts. We are privileged to have many decades of market data to learn from, and it is this historical research and analysis that can help guide us in the current market environment. This begs the question – what has happened in the past when the market has started off the year extremely weak?

As we can see below, the previous worst ten starts to a year haven’t corresponded to continued weakness throughout the remainder of the year. According to LPL Research, the S&P 500 experienced a 10% average gain through the rest of the year and was higher 66.7% of the time.

Image Source: Zacks Investment Research

It’s important to state that history rarely repeats itself exactly in the market – but it often rhymes. We don’t want to get too zoned in on any one particular statistic or data point. While other years may serve as a guidepost for what we can expect, markets are dynamic and can shift directions quickly. There are variables at play that may not have been present in those prior years, and these will impact the market’s direction moving forward.

Should we sell in May? There isn’t an easy answer to this question, but history has shown that above-average returns after painful starts to the year may be waiting for us on the other side. Fear has settled into the minds of investors, many of whom may be anticipating more pain ahead. But as we know, the market has a way of proving the majority wrong.

The truth is no one knows for sure what the market will do, and anyone who tells you otherwise is not to be trusted. Having a plan in place for a variety of outcomes is the key to managing portfolio risk. We’ll see how it all unfolds from here.