Terminix provides residential and commercial termite and pest management services. The company offers termite remediation and prevention treatments including periodic pest management services, insulation services, crawlspace encapsulation, and disinfection. These offerings protect clients against termite damage, rodents, insects and other pests, as well as bed bugs.

Terminix markets its services to homeowners and businesses through digital marketing, TV and radio advertising, print advertising, marketing partnerships, door-to-door sales programs, telemarketing, and social media channels. TMX was founded in 1929 and is headquartered in Memphis, TN.

The Zacks Rundown

Formerly known as ServiceMaster Global Holdings, TMX is a Zacks Rank #5 (Strong Sell) stock. The company is a component of the Zacks Industrial Services industry, which currently ranks in the bottom 32% out of approximately 250 industries. This group has underperformed the S&P 500 with a nearly 20% decline year-to-date. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to continue to underperform the market over the next 3 to 6 months.

Candidates in the bottom tiers of industries can often be solid potential short candidates. While individual stocks have the ability to outperform even when included in a poor-performing industry group, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much tougher.

The stock topped out all the way back in January of 2021, well before the major indices. When a stock fails to gain ground along with the general market, it’s telling us “I’m very weak.” TMX represents a compelling short opportunity as the market continues its volatile pattern this year.

Recent Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for TMX during the past year. The pest control provider has fallen short of estimates in two of the past four quarters. TMX most recently reported Q2 EPS earlier this month of $0.02/share, missing the $0.44 consensus estimate by -95.45%.

TMX has posted an average earnings miss of -22.65% over the past four quarters. This is the type of negative trend that the bears like to see. When you’re consistently missing earnings estimates by a wide margin, you’re going to be fighting an uphill battle when it comes to the stock price.

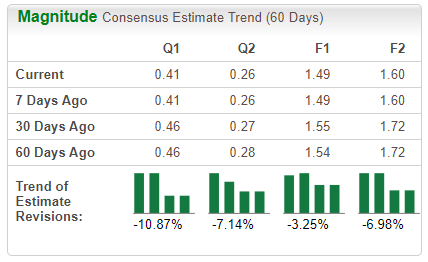

Analysts covering the company are in agreement and have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -10.87% over the past 60 days. The Q3 Zacks Consensus EPS Estimate now stands at $0.41/share, translating to zero growth relative to the same quarter last year – not exactly what the bulls are looking for.

Image Source: Zacks Investment Research

Technical Outlook

TMX stock has been steadily falling since last year and has now established a well-defined downtrend. Shares broke back below the 200-day (blue line) moving average recently, which could trigger a new leg down.

Image Source: StockCharts

TMX has also formed an ominous head-and-shoulders pattern, highlighted by the purple parabolas. This pattern tends to precede large moves to the downside.

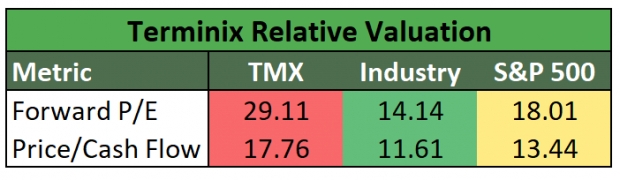

Even with the recent price declines, Terminix is still relatively overvalued, irrespective of the valuation metric used:

Image Source: Zacks Investment Research

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to print new highs anytime soon. The recent earnings misses in addition to deteriorating estimates are both huge red flags and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

TMX’s characteristics have resulted in a worst-possible Zacks Momentum Style Score of ‘F’, indicating further downside is likely. The fact that TMX is included in a bottom-performing industry group simply adds to the growing list of concerns. Investors will want to steer clear of an overvalued TMX until the situation shows major signs of improvement, or possibly include it as part of a hedge or short strategy.

Bear of the Day: Terminix Global Holdings, Inc. (TMX)

Terminix provides residential and commercial termite and pest management services. The company offers termite remediation and prevention treatments including periodic pest management services, insulation services, crawlspace encapsulation, and disinfection. These offerings protect clients against termite damage, rodents, insects and other pests, as well as bed bugs.

Terminix markets its services to homeowners and businesses through digital marketing, TV and radio advertising, print advertising, marketing partnerships, door-to-door sales programs, telemarketing, and social media channels. TMX was founded in 1929 and is headquartered in Memphis, TN.

The Zacks Rundown

Formerly known as ServiceMaster Global Holdings, TMX is a Zacks Rank #5 (Strong Sell) stock. The company is a component of the Zacks Industrial Services industry, which currently ranks in the bottom 32% out of approximately 250 industries. This group has underperformed the S&P 500 with a nearly 20% decline year-to-date. Because this industry is ranked in the bottom half of all Zacks Ranked Industries, we expect it to continue to underperform the market over the next 3 to 6 months.

Candidates in the bottom tiers of industries can often be solid potential short candidates. While individual stocks have the ability to outperform even when included in a poor-performing industry group, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much tougher.

The stock topped out all the way back in January of 2021, well before the major indices. When a stock fails to gain ground along with the general market, it’s telling us “I’m very weak.” TMX represents a compelling short opportunity as the market continues its volatile pattern this year.

Recent Earnings and Deteriorating Forecasts

Earnings misses have been a sore spot for TMX during the past year. The pest control provider has fallen short of estimates in two of the past four quarters. TMX most recently reported Q2 EPS earlier this month of $0.02/share, missing the $0.44 consensus estimate by -95.45%.

TMX has posted an average earnings miss of -22.65% over the past four quarters. This is the type of negative trend that the bears like to see. When you’re consistently missing earnings estimates by a wide margin, you’re going to be fighting an uphill battle when it comes to the stock price.

Analysts covering the company are in agreement and have been revising earnings estimates downward as of late. For the current quarter, estimates have been slashed -10.87% over the past 60 days. The Q3 Zacks Consensus EPS Estimate now stands at $0.41/share, translating to zero growth relative to the same quarter last year – not exactly what the bulls are looking for.

Image Source: Zacks Investment Research

Technical Outlook

TMX stock has been steadily falling since last year and has now established a well-defined downtrend. Shares broke back below the 200-day (blue line) moving average recently, which could trigger a new leg down.

Image Source: StockCharts

TMX has also formed an ominous head-and-shoulders pattern, highlighted by the purple parabolas. This pattern tends to precede large moves to the downside.

Even with the recent price declines, Terminix is still relatively overvalued, irrespective of the valuation metric used:

Image Source: Zacks Investment Research

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to print new highs anytime soon. The recent earnings misses in addition to deteriorating estimates are both huge red flags and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

TMX’s characteristics have resulted in a worst-possible Zacks Momentum Style Score of ‘F’, indicating further downside is likely. The fact that TMX is included in a bottom-performing industry group simply adds to the growing list of concerns. Investors will want to steer clear of an overvalued TMX until the situation shows major signs of improvement, or possibly include it as part of a hedge or short strategy.