Chesapeake Energy ) currently lands a Zacks Rank #5 (Strong Sell) with its Oil and Gas - Exploration and Production - United States Industry currently in the bottom 3% of over 250 Zacks Industries.

Although many stocks in the broader Zacks Oils & Energy sector have largely outperformed the S&P 500 benchmark in recent years, some of these equities may be due for a pullback. Investors will want to be cautious of companies that may not be able to continue benefiting even as oil prices have remained high.

Business & Industry Overview

Chesapeake Energy and others could continue to be affected by lower demand for drilling and discovery operations in regard to oil and natural gas. As a result of oil prices remaining high along with reserve supplies, the need for additional drilling is declining at the moment.

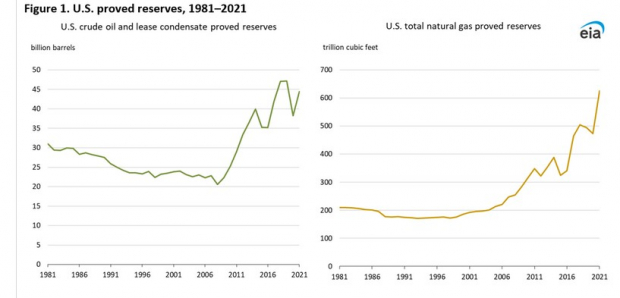

Overall, proved reserves of U.S. crude oil and lease condensate increased by 6.2 billion barrels at the end of 2022, up 16% from 38.2 billion barrels at year-end 2021 to 44.4 billion barrels. This comes after historical highs among oil reserves were seen in 2020 due to extremely low demand for oil and energy during the pandemic.

Additionally, the natural gas market has been very volatile as prices have unreliably fluctuated in recent weeks with reserves higher as well and demand lower from a mild winter.

Image Source: U.S. Energy Information Administration

Declining Earnings Estimates

In correlation with higher reserves leading to a dimmer outlook for Chesapeake and its business industry, CHK’s earnings estimates have alarmingly gone down.

As Chesapeake wraps up fiscal 2022 with Q4 earnings on February 21, FY23 earnings estimates have plummeted 57% over the last quarter to $9.15 per share compared to $21.13 a share 90 days ago. This could continue to negatively impact CHK’s stock performance and valuation.

Image Source: Zacks Investment Research

Recent Performance & Valuation

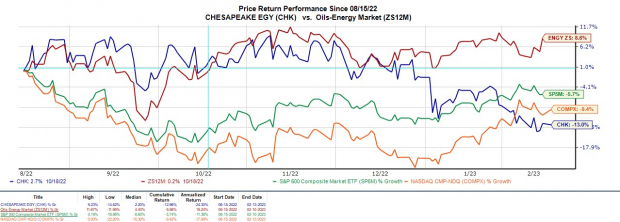

Year to date, CHK stock is down -11% to lag the S&P 500’s +6% and the broader Oils and Energy Market’s +3% with the Nasdaq up +13%. More concerning, over the last three months, CHK stock is now down -16% to largely underperform the broader indexes and the Oils and Energy Market as the company continues to give back gains in recent years.

Image Source: Zacks Investment Research

Trading around $83 per share, Chesapeake stock trades at 9.1X forward earnings but estimates are continuing to decline and CHK is at its P/E high following a 1 for 200 reverse stock split in April of 2020. Plus, Chesapeake stock currently trades 30% above its median of 6.9X during this period and 49% above the industry average of 6.1X forward earnings.

Bottom Line

There is certainly short-term risk ahead for Chesapeake Energy stock with oil and natural gas reserves spiking. It is also important to note that investors will want to monitor management’s adjustment to a potentially dimmer outlook as the investment value, market capitalization, and per-share price of CHK stock have been volatile in recent history as indicated in its 2020 reverse stock split.

Bear of the Day: Chesapeake Energy (CHK)

Chesapeake Energy ) currently lands a Zacks Rank #5 (Strong Sell) with its Oil and Gas - Exploration and Production - United States Industry currently in the bottom 3% of over 250 Zacks Industries.

Although many stocks in the broader Zacks Oils & Energy sector have largely outperformed the S&P 500 benchmark in recent years, some of these equities may be due for a pullback. Investors will want to be cautious of companies that may not be able to continue benefiting even as oil prices have remained high.

Business & Industry Overview

Chesapeake Energy and others could continue to be affected by lower demand for drilling and discovery operations in regard to oil and natural gas. As a result of oil prices remaining high along with reserve supplies, the need for additional drilling is declining at the moment.

Overall, proved reserves of U.S. crude oil and lease condensate increased by 6.2 billion barrels at the end of 2022, up 16% from 38.2 billion barrels at year-end 2021 to 44.4 billion barrels. This comes after historical highs among oil reserves were seen in 2020 due to extremely low demand for oil and energy during the pandemic.

Image Source: U.S. Energy Information Administration

Declining Earnings Estimates

In correlation with higher reserves leading to a dimmer outlook for Chesapeake and its business industry, CHK’s earnings estimates have alarmingly gone down.

As Chesapeake wraps up fiscal 2022 with Q4 earnings on February 21, FY23 earnings estimates have plummeted 57% over the last quarter to $9.15 per share compared to $21.13 a share 90 days ago. This could continue to negatively impact CHK’s stock performance and valuation.

Image Source: Zacks Investment Research

Recent Performance & Valuation

Year to date, CHK stock is down -11% to lag the S&P 500’s +6% and the broader Oils and Energy Market’s +3% with the Nasdaq up +13%. More concerning, over the last three months, CHK stock is now down -16% to largely underperform the broader indexes and the Oils and Energy Market as the company continues to give back gains in recent years.

Image Source: Zacks Investment Research

Trading around $83 per share, Chesapeake stock trades at 9.1X forward earnings but estimates are continuing to decline and CHK is at its P/E high following a 1 for 200 reverse stock split in April of 2020. Plus, Chesapeake stock currently trades 30% above its median of 6.9X during this period and 49% above the industry average of 6.1X forward earnings.

Bottom Line

There is certainly short-term risk ahead for Chesapeake Energy stock with oil and natural gas reserves spiking. It is also important to note that investors will want to monitor management’s adjustment to a potentially dimmer outlook as the investment value, market capitalization, and per-share price of CHK stock have been volatile in recent history as indicated in its 2020 reverse stock split.