Macquarie Infrastructure Corporation announced the results of the shareholders’ vote at a special meeting held virtually yesterday. Unanimously, shareholders cast their votes in favor of the divestment of the company’s MIC Hawaii businesses and the Atlantic Aviation business.

Notably, Macquarie’s shares gained 0.47% yesterday, ending the trading session at $40.23.

Inside the Headlines

As noted, holders of nearly 67% of Macquarie’s outstanding shares participated in the voting process and 99.6% of them gave a green signal for the above-mentioned divestments. With this, Macquarie will be in a position to reorganize itself into a listed limited liability company (“Macquarie Infrastructure Holdings LLC”). MIC Hawaii businesses will be distributed to Macquarie Infrastructure Holdings LLC. This, in turn, will divest the businesses to an affiliate of Argo Infrastructure Partners, LP.

Macquarie anticipates the MIC Hawaii businesses’ distribution to be complete in a day and predicts the divestment of the Atlantic Aviation business to consummate in a couple of days. The divestments are in sync with the company’s strategic alternatives (announced in October 2019), which include disposing of businesses to unlock values for its shareholders.

A brief discussion of important events/announcements related to Macquarie’s strategic alternatives is provided below:

June Announcements: On Jun 14, 2021, Macquarie entered an agreement to divest its MIC Hawaii businesses to Argo Infrastructure’s affiliate. Subject to the receipt of necessary approvals and the fulfillment of customary conditions, the company anticipates the transaction to be complete in the first half of 2022.

Macquarie’s unitholders will likely receive $3.83 per unit if the transaction gets completed on or before Jul 1, 2022. On closing after this date, unitholders will be entitled to get the consideration of $4.11 per unit. On the completion of the transaction, the MIC Hawaii businesses will operate as a wholly-owned subsidiary of Argo.

Macquarie’s MIC Hawaii segment comprises an energy company — Hawaii Gas — which processes and distributes gas, and provides related services as well as several smaller businesses. These are collectively engaged in reducing costs as well as improving reliability and the sustainability of energy in Hawaii.

On Jun 7, 2021, Macquarie announced that it agreed to divest its Atlantic Aviation business in a transaction worth $4.475 billion to New York-based KKR & Co. Inc.

The Atlantic Aviation business offers aircraft hangaring, fuel, terminal and other services primarily to owners and operators of general aviation jet aircraft at 69 airports throughout the United States. It also caters to freight, commercial, government and military aviation customers.

May Announcement: On May 6, 2021, Macquarie received its shareholder approval to reorganize the company into a listed limited liability company. The reorganization plans, announced in February, will be accomplished before the completion of the Atlantic Aviation divestment.

Earlier Events: In December 2020, Macquarie completed the divestment of its liquid storage and handling business, International-Matex Tank Terminals, for $2.67 billion to an affiliate of Riverstone Holdings, Inc.

Zacks Rank, Price Performance and Estimate Trend

With a market capitalization of $3.5 billion, the company currently carries a Zacks Rank #3 (Hold). Cost-control measures, investments in growth opportunities and divestment activities are likely to be beneficial. Higher costs and expenses are concerning.

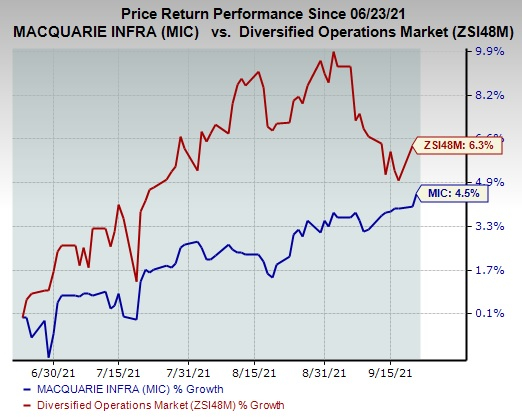

In the past three months, the company’s stock has gained 4.5% compared with the industry’s growth of 6.3%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Macquarie’s earnings is pegged at $2.12 for 2021 and $2.58 for 2022, reflecting no change from the 60-day-ago figures. Also, the consensus estimate for third-quarter 2021 earnings has been stable at 49 cents in the past couple of months.

Image: Bigstock

Macquarie (MIC) Receives Shareholder Approval for Divestments

Macquarie Infrastructure Corporation announced the results of the shareholders’ vote at a special meeting held virtually yesterday. Unanimously, shareholders cast their votes in favor of the divestment of the company’s MIC Hawaii businesses and the Atlantic Aviation business.

Notably, Macquarie’s shares gained 0.47% yesterday, ending the trading session at $40.23.

Inside the Headlines

As noted, holders of nearly 67% of Macquarie’s outstanding shares participated in the voting process and 99.6% of them gave a green signal for the above-mentioned divestments. With this, Macquarie will be in a position to reorganize itself into a listed limited liability company (“Macquarie Infrastructure Holdings LLC”). MIC Hawaii businesses will be distributed to Macquarie Infrastructure Holdings LLC. This, in turn, will divest the businesses to an affiliate of Argo Infrastructure Partners, LP.

Macquarie anticipates the MIC Hawaii businesses’ distribution to be complete in a day and predicts the divestment of the Atlantic Aviation business to consummate in a couple of days. The divestments are in sync with the company’s strategic alternatives (announced in October 2019), which include disposing of businesses to unlock values for its shareholders.

A brief discussion of important events/announcements related to Macquarie’s strategic alternatives is provided below:

June Announcements: On Jun 14, 2021, Macquarie entered an agreement to divest its MIC Hawaii businesses to Argo Infrastructure’s affiliate. Subject to the receipt of necessary approvals and the fulfillment of customary conditions, the company anticipates the transaction to be complete in the first half of 2022.

Macquarie’s unitholders will likely receive $3.83 per unit if the transaction gets completed on or before Jul 1, 2022. On closing after this date, unitholders will be entitled to get the consideration of $4.11 per unit. On the completion of the transaction, the MIC Hawaii businesses will operate as a wholly-owned subsidiary of Argo.

Macquarie’s MIC Hawaii segment comprises an energy company — Hawaii Gas — which processes and distributes gas, and provides related services as well as several smaller businesses. These are collectively engaged in reducing costs as well as improving reliability and the sustainability of energy in Hawaii.

On Jun 7, 2021, Macquarie announced that it agreed to divest its Atlantic Aviation business in a transaction worth $4.475 billion to New York-based KKR & Co. Inc.

The Atlantic Aviation business offers aircraft hangaring, fuel, terminal and other services primarily to owners and operators of general aviation jet aircraft at 69 airports throughout the United States. It also caters to freight, commercial, government and military aviation customers.

May Announcement: On May 6, 2021, Macquarie received its shareholder approval to reorganize the company into a listed limited liability company. The reorganization plans, announced in February, will be accomplished before the completion of the Atlantic Aviation divestment.

Earlier Events: In December 2020, Macquarie completed the divestment of its liquid storage and handling business, International-Matex Tank Terminals, for $2.67 billion to an affiliate of Riverstone Holdings, Inc.

Zacks Rank, Price Performance and Estimate Trend

With a market capitalization of $3.5 billion, the company currently carries a Zacks Rank #3 (Hold). Cost-control measures, investments in growth opportunities and divestment activities are likely to be beneficial. Higher costs and expenses are concerning.

In the past three months, the company’s stock has gained 4.5% compared with the industry’s growth of 6.3%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Macquarie’s earnings is pegged at $2.12 for 2021 and $2.58 for 2022, reflecting no change from the 60-day-ago figures. Also, the consensus estimate for third-quarter 2021 earnings has been stable at 49 cents in the past couple of months.

Macquarie Infrastructure Company Price and Consensus

Macquarie Infrastructure Company price-consensus-chart | Macquarie Infrastructure Company Quote

Stocks to Consider

Three better-ranked stocks in the industry are Carlisle Companies Incorporated (CSL - Free Report) , Raven Industries, Inc. and Crane Co. (CR - Free Report) . While both Carlisle and Raven presently sport a Zacks Rank #1 (Strong Buy), Crane carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for the companies have improved for the current year. Also, earnings surprise for the last reported quarter was 3.35% for Carlisle, 100.00% for Raven and 31.65% for Crane.