We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

NewtekOne (NEWT) Rewards Investors With 5.5% Dividend Hike

Read MoreHide Full Article

NewtekOne, Inc. (NEWT - Free Report) has increased its quarterly dividend. The company announced a quarterly cash dividend of 19 cents per share, marking an increase of 5.5% from the prior payout. This dividend will be paid out on Apr 15, 2024, to shareholders of record as of Apr 1.

The company has increased its dividend payout 12 times in the past five years. Currently, NEWT’s payout ratio is 44% of earnings. This indicates that NewtekOne retains ample earnings for reinvestment and future growth initiatives while still delivering attractive returns to shareholders.

Based on yesterday’s closing price of $10.19, NEWT’s dividend yield is pegged at 7.45%.

On Jan 6, 2023, the company completed the acquisition of the National Bank of New York City with a deal value of $20 million. Under the term, NewtekOne acquired 0.0336 million shares of the National Bank of New York City. Also, NEWT withdrew its Business Development Company status and became a financial holding company. Simultaneously, the company reduced its dividend payout to 18 cents in February 2023 from 70 cents in November 2022.

NewtekOne has a strong balance sheet. As of Dec 31, 2023, the company’s total cash and cash equivalent was $184 million, which increased 46.5% from the previous year. This reflects an improving liquidity position.

Considering its common equity Tier-1 capital ratio of 16.5%, total capital ratio of 19.6% and leverage ratio of 15.6%, the company has a decent capital position to continue paying an attractive dividend.

Given its decent capital position and rising liquidity position, NEWT is expected to sustain current capital distributions in the future and keep enhancing shareholder value.

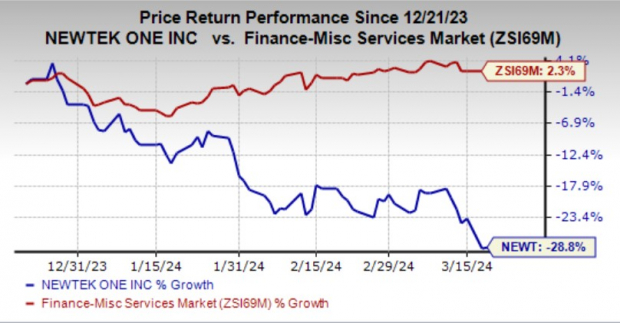

In the past three months, shares of NEWT have plunged 28.8% against the industry’s growth of 2.3%. Image Source: Zacks Investment Research

Guaranty Bancshares, Inc. (GNTY - Free Report) recently announced a quarterly cash dividend of 24 cents per share, representing a hike of 4.3% from the prior payout. The dividend will be paid out on Apr 10 to shareholders of record as of Mar 25.

Prior to this, GNTY increased its quarterly dividend by 4.5% to 23 cents per share. Over the past five years, the company raised its dividend seven times, with annualized dividend growth of 9.8%. At present, Guaranty Bancshares's payout ratio is 36% of earnings.

In March 2024, Capital City Bank Group, Inc. (CCBG - Free Report) also increased its quarterly dividend. The bank announced a quarterly cash dividend of 21 cents per share, marking an increase of 5% from the prior payout. The dividend will be paid out on Mar 25, 2024, to shareholders of record as of Mar 11.

Prior to this, CCBG hiked its dividend by 11.1% to 20 cents per share on Aug 24, 2023. It has increased its dividend payout eight times in the past five years. Also, the company has five-year annualized dividend growth of 11.45%. Currently, Capital City Bank’s payout ratio is 25% of earnings.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

NewtekOne (NEWT) Rewards Investors With 5.5% Dividend Hike

NewtekOne, Inc. (NEWT - Free Report) has increased its quarterly dividend. The company announced a quarterly cash dividend of 19 cents per share, marking an increase of 5.5% from the prior payout. This dividend will be paid out on Apr 15, 2024, to shareholders of record as of Apr 1.

The company has increased its dividend payout 12 times in the past five years. Currently, NEWT’s payout ratio is 44% of earnings. This indicates that NewtekOne retains ample earnings for reinvestment and future growth initiatives while still delivering attractive returns to shareholders.

Based on yesterday’s closing price of $10.19, NEWT’s dividend yield is pegged at 7.45%.

On Jan 6, 2023, the company completed the acquisition of the National Bank of New York City with a deal value of $20 million. Under the term, NewtekOne acquired 0.0336 million shares of the National Bank of New York City. Also, NEWT withdrew its Business Development Company status and became a financial holding company. Simultaneously, the company reduced its dividend payout to 18 cents in February 2023 from 70 cents in November 2022.

NewtekOne has a strong balance sheet. As of Dec 31, 2023, the company’s total cash and cash equivalent was $184 million, which increased 46.5% from the previous year. This reflects an improving liquidity position.

Considering its common equity Tier-1 capital ratio of 16.5%, total capital ratio of 19.6% and leverage ratio of 15.6%, the company has a decent capital position to continue paying an attractive dividend.

Given its decent capital position and rising liquidity position, NEWT is expected to sustain current capital distributions in the future and keep enhancing shareholder value.

In the past three months, shares of NEWT have plunged 28.8% against the industry’s growth of 2.3%.

Image Source: Zacks Investment Research

Currently, NEWT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks That Announced Dividend Hike

Guaranty Bancshares, Inc. (GNTY - Free Report) recently announced a quarterly cash dividend of 24 cents per share, representing a hike of 4.3% from the prior payout. The dividend will be paid out on Apr 10 to shareholders of record as of Mar 25.

Prior to this, GNTY increased its quarterly dividend by 4.5% to 23 cents per share. Over the past five years, the company raised its dividend seven times, with annualized dividend growth of 9.8%. At present, Guaranty Bancshares's payout ratio is 36% of earnings.

In March 2024, Capital City Bank Group, Inc. (CCBG - Free Report) also increased its quarterly dividend. The bank announced a quarterly cash dividend of 21 cents per share, marking an increase of 5% from the prior payout. The dividend will be paid out on Mar 25, 2024, to shareholders of record as of Mar 11.

Prior to this, CCBG hiked its dividend by 11.1% to 20 cents per share on Aug 24, 2023. It has increased its dividend payout eight times in the past five years. Also, the company has five-year annualized dividend growth of 11.45%. Currently, Capital City Bank’s payout ratio is 25% of earnings.