Boeing (BA)

(Delayed Data from NYSE)

$154.59 USD

-0.52 (-0.34%)

Updated Sep 19, 2024 04:00 PM ET

After-Market: $154.70 +0.11 (0.07%) 7:58 PM ET

3-Hold of 5 3

D Value F Growth C Momentum F VGM

Company Summary

Based in Arlington, VA, Boeing has been the premier manufacturer of commercial jetliners for decades. The company’s premier jet aircraft along with varied defense products positions it as one of the largest defense contractors in the United States. Its customers include domestic and foreign airlines, the U.S. Department of Defense (DoD), the Department of Homeland Security, the National Aeronautics and Space Administration (NASA), other aerospace prime contractors, and certain U.S. government and commercial communications customers. Currently, the company operates through three segments:

The Boeing Commercial Airplanes (BCA) segment develops, produces ...

Company Summary

Based in Arlington, VA, Boeing has been the premier manufacturer of commercial jetliners for decades. The company’s premier jet aircraft along with varied defense products positions it as one of the largest defense contractors in the United States. Its customers include domestic and foreign airlines, the U.S. Department of Defense (DoD), the Department of Homeland Security, the National Aeronautics and Space Administration (NASA), other aerospace prime contractors, and certain U.S. government and commercial communications customers. Currently, the company operates through three segments:

The Boeing Commercial Airplanes (BCA) segment develops, produces and markets commercial jets, along with providing related support services. The company is a leading producer of commercial aircraft and has a series (737 Next-Generation narrow-body model and the 767, 777 and 787 wide-body models) of commercial jetliners. Segmental revenues in 2023 totaled $33.90 billion, representing 43.6% of the company’s top line.

The Boeing Defense, Space & Security (BDS) segment engages in the research, development, production and modification of manned and unmanned military aircraft and weapons systems for strike, surveillance and mobility, including fighter and trainer aircraft; vertical lift, including rotorcraft and tilt-rotor aircraft; and commercial derivative aircraft, including anti-submarine and tanker aircraft. The segment recorded revenues of $24.93 billion in 2023, contributing 32.1% to the company’s top line.

The Boeing Global Services (BGS) segment brings together certain Commercial Aviation Services businesses and BDS services businesses. It provides parts, maintenance, modifications, logistics support, training, data analytics and information-based services to commercial and government customers worldwide. Revenues for this segment in 2023 amounted to $19.13 billion, comprising 24.6% of the company’s top line.

Total revenues included unallocated items, eliminations and other charges of $0.17 billion.

General Information

The Boeing Company

929 LONG BRIDGE DRIVE

ARLINGTON, VA 22202

Phone: 703-465-3500

Fax: 312-544-2082

Email: boeinginvestorrelations@boeing.com

| Industry | Aerospace - Defense |

| Sector | Aerospace |

| Fiscal Year End | December |

| Last Reported Quarter | 6/30/2024 |

| Exp Earnings Date | 10/23/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | -0.50 |

| Current Year EPS Consensus Estimate | -4.26 |

| Estimated Long-Term EPS Growth Rate | 21.30 |

| Exp Earnings Date | 10/23/2024 |

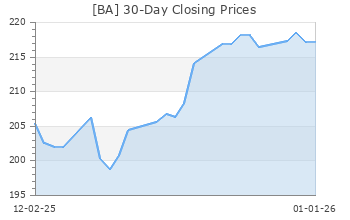

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 155.11 |

| 52 Week High | 267.54 |

| 52 Week Low | 154.02 |

| Beta | 1.57 |

| 20 Day Moving Average | 6,815,191.00 |

| Target Price Consensus | 215.63 |

| 4 Week | -10.56 |

| 12 Week | -13.10 |

| YTD | -40.49 |

| 4 Week | -10.52 |

| 12 Week | -15.28 |

| YTD | -49.48 |

| Shares Outstanding (millions) | 616.17 |

| Market Capitalization (millions) | 95,573.69 |

| Short Ratio | NA |

| Last Split Date | 6/9/1997 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | NA |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | NA |

| Trailing 12 Months | NA |

| PEG Ratio | NA |

| vs. Previous Year | -253.66% |

| vs. Previous Quarter | -156.64% |

| vs. Previous Year | -14.61% |

| vs. Previous Quarter | 1.79% |

| Price/Book | NA |

| Price/Cash Flow | NA |

| Price / Sales | 1.30 |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 6/30/24 | -3.46 |

| 3/31/24 | -2.55 |

| 12/31/23 | -2.60 |

| 6/30/24 | 1.18 |

| 3/31/24 | 1.14 |

| 12/31/23 | 1.14 |

| 6/30/24 | 0.30 |

| 3/31/24 | 0.25 |

| 12/31/23 | 0.31 |

| 6/30/24 | -6.45 |

| 3/31/24 | -4.51 |

| 12/31/23 | -4.52 |

| 6/30/24 | -4.68 |

| 3/31/24 | -2.81 |

| 12/31/23 | -2.86 |

| 6/30/24 | -4.08 |

| 3/31/24 | -2.47 |

| 12/31/23 | -2.58 |

| 6/30/24 | -29.18 |

| 3/31/24 | -27.72 |

| 12/31/23 | -28.24 |

| 6/30/24 | 0.81 |

| 3/31/24 | 0.86 |

| 12/31/23 | 0.89 |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 6/30/24 | NA |

| 3/31/24 | NA |

| 12/31/23 | NA |