Cigna Group (CI)

(Delayed Data from NYSE)

$354.47 USD

-0.04 (-0.01%)

Updated Apr 26, 2024 04:00 PM ET

After-Market: $354.44 -0.03 (-0.01%) 7:58 PM ET

3-Hold of 5 3

A Value C Growth B Momentum A VGM

Company Summary

Headquartered in Bloomfield, CT and formed in 1982, Cigna Corporation has rebranded itself as The Cigna Group. The company was formed as a result of a merger between Connecticut General Life Insurance Company and Insurance Company of North America. Cigna completed its combination with Express Scripts Holding Company by 2018-end. Shares of the new combined company trade on the NYSE under the stock ticker symbol “CI.”

The global health company has also announced the rebranding of its segments, which are Cigna Healthcare and Evernorth Health Services.

Cigna Healthcare will take care ...

Company Summary

Headquartered in Bloomfield, CT and formed in 1982, Cigna Corporation has rebranded itself as The Cigna Group. The company was formed as a result of a merger between Connecticut General Life Insurance Company and Insurance Company of North America. Cigna completed its combination with Express Scripts Holding Company by 2018-end. Shares of the new combined company trade on the NYSE under the stock ticker symbol “CI.”

The global health company has also announced the rebranding of its segments, which are Cigna Healthcare and Evernorth Health Services.

Cigna Healthcare will take care of the health benefits function, catering to customers and clients through its U.S. Commercial, U.S. Government and International Health businesses. Meanwhile, the newly named Evernorth Health Services will operate as the pharmacy, care and benefits solutions provider.

In 2023 end, the company’s reportable segments were as follows:

Evernorth Health Services (constitutes 75% of adjusted total segment revenues in 2023) includes a broad range of coordinated and point solution health services, including pharmacy services, benefits management, care solutions and data and analytics, which are provided to health plans, employers, government organizations, and health care providers.

Cigna Healthcare (25%): The segment comprises Cigna's U.S. Commercial, U.S. Government, and International Health businesses that provide comprehensive medical and coordinated solutions to clients and customers.

General Information

Cigna Group

900 COTTAGE GROVE ROAD

BLOOMFIELD, CT 06002

Phone: 860-226-6000

Fax: 860-226-6741

Web: http://www.cigna.com

Email: ralph.giacobbe@cigna.com

| Industry | Medical - HMOs |

| Sector | Medical |

| Fiscal Year End | December |

| Last Reported Quarter | 3/31/2024 |

| Earnings Date | 5/2/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 6.17 |

| Current Year EPS Consensus Estimate | 28.35 |

| Estimated Long-Term EPS Growth Rate | 11.50 |

| Earnings Date | 5/2/2024 |

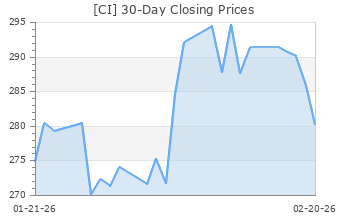

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 354.51 |

| 52 Week High | 365.71 |

| 52 Week Low | 240.50 |

| Beta | 0.56 |

| 20 Day Moving Average | 1,260,787.38 |

| Target Price Consensus | 384.25 |

| 4 Week | -2.39 |

| 12 Week | 15.35 |

| YTD | 18.39 |

| 4 Week | 1.59 |

| 12 Week | 12.10 |

| YTD | 11.85 |

| Shares Outstanding (millions) | 292.36 |

| Market Capitalization (millions) | 103,642.78 |

| Short Ratio | NA |

| Last Split Date | 6/5/2007 |

| Dividend Yield | 1.58% |

| Annual Dividend | $5.60 |

| Payout Ratio | 0.20 |

| Change in Payout Ratio | 0.07 |

| Last Dividend Payout / Amount | 3/5/2024 / $1.40 |

Fundamental Ratios

| P/E (F1) | 12.50 |

| Trailing 12 Months | 14.12 |

| PEG Ratio | 1.09 |

| vs. Previous Year | 36.90% |

| vs. Previous Quarter | 0.30% |

| vs. Previous Year | 11.72% |

| vs. Previous Quarter | 4.21% |

| Price/Book | 2.24 |

| Price/Cash Flow | 9.90 |

| Price / Sales | 0.53 |

| 3/31/24 | NA |

| 12/31/23 | 13.59 |

| 9/30/23 | 12.63 |

| 3/31/24 | NA |

| 12/31/23 | 4.12 |

| 9/30/23 | 3.85 |

| 3/31/24 | NA |

| 12/31/23 | 0.67 |

| 9/30/23 | 0.71 |

| 3/31/24 | NA |

| 12/31/23 | 0.67 |

| 9/30/23 | 0.71 |

| 3/31/24 | NA |

| 12/31/23 | 3.17 |

| 9/30/23 | 3.00 |

| 3/31/24 | NA |

| 12/31/23 | 2.64 |

| 9/30/23 | 2.79 |

| 3/31/24 | NA |

| 12/31/23 | 2.82 |

| 9/30/23 | 3.52 |

| 3/31/24 | NA |

| 12/31/23 | 158.03 |

| 9/30/23 | 156.18 |

| 3/31/24 | NA |

| 12/31/23 | NA |

| 9/30/23 | NA |

| 3/31/24 | NA |

| 12/31/23 | 0.61 |

| 9/30/23 | 0.61 |

| 3/31/24 | NA |

| 12/31/23 | 37.93 |

| 9/30/23 | 38.12 |