Commercial Metals (CMC)

(Real Time Quote from BATS)

$53.27 USD

+1.38 (2.66%)

Updated Sep 19, 2024 10:14 AM ET

3-Hold of 5 3

A Value B Growth F Momentum B VGM

Company Summary

Irving, TX- based Commercial Metals Company manufactures, recycles and markets steel and metal products, related materials and services. It provides these through a network of facilities that includes seven electric arc furnace ("EAF") mini mills, two EAF micro mills, a rerolling mill, steel fabrication and processing plants, construction-related product warehouses, and metal recycling facilities in the United States and Poland.

Commercial Metals realigned its reporting structure into three operating segments — North America Steel Group, Europe Steel Group and Emerging Businesses Group — from the beginning of first-quarter fiscal 2024.

North America Steel Group ...

Company Summary

Commercial Metals realigned its reporting structure into three operating segments — North America Steel Group, Europe Steel Group and Emerging Businesses Group — from the beginning of first-quarter fiscal 2024.

North America Steel Group segment consists largely of CMC's former North America segment's recycling, steel mill, rebar fabrication, fence post manufacturing and post-tension cable operations.

The steel mill operations include six EAF mini mills, two EAF micro mills, and one rerolling mill. The fabrication operations include 56 facilities engaged in various aspects of steel fabrication. Most of these facilities engage in the general fabrication of reinforcing steel.

The steel mills manufacture finished long steel products including rebar, merchant bar, light structural and other special sections and wire rod, as well as semi-finished billets for rerolling and forging applications (collectively referred to as steel products).

Europe Steel Group segment includes essentially all recycling, steel mill and steel fabrication operations that were previously part of the company's Europe segment. It comprises mini mill s, recycling and fabrication operations located in Poland.

Emerging Businesses Group segment includes the Tensar geogrid and Geopier, CMC Construction Services, Performance Reinforcing Steel, CMC Anchoring Systems, and Impact Metals operations. Except for the geogrid operations located outside North America, which were included in the former Europe segment, these were reported under CMC's former North America segment.

General Information

Commercial Metals Company

6565 N. MACARTHUR BLVD. SUITE 800 P O BOX 1046

IRVING, TX 75039

Phone: 214-689-4300

Fax: 214-689-5886

Web: http://www.cmc.com

Email: ir@cmc.com

| Industry | Steel - Producers |

| Sector | Basic Materials |

| Fiscal Year End | August |

| Last Reported Quarter | 8/31/2024 |

| Earnings Date | 10/17/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 1.07 |

| Current Year EPS Consensus Estimate | 4.26 |

| Estimated Long-Term EPS Growth Rate | NA |

| Earnings Date | 10/17/2024 |

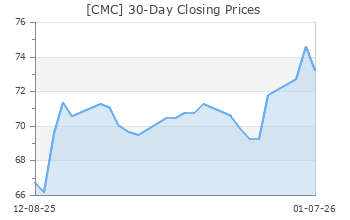

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 51.89 |

| 52 Week High | 61.26 |

| 52 Week Low | 39.85 |

| Beta | 1.15 |

| 20 Day Moving Average | 697,325.38 |

| Target Price Consensus | 63.40 |

| 4 Week | -3.73 |

| 12 Week | -3.53 |

| YTD | 3.70 |

| 4 Week | -3.68 |

| 12 Week | -5.94 |

| YTD | -11.96 |

| Shares Outstanding (millions) | 114.99 |

| Market Capitalization (millions) | 5,966.96 |

| Short Ratio | NA |

| Last Split Date | 5/23/2006 |

| Dividend Yield | 1.39% |

| Annual Dividend | $0.72 |

| Payout Ratio | 0.14 |

| Change in Payout Ratio | 0.00 |

| Last Dividend Payout / Amount | 7/1/2024 / $0.18 |

Fundamental Ratios

| P/E (F1) | 9.54 |

| Trailing 12 Months | 9.94 |

| PEG Ratio | NA |

| vs. Previous Year | -49.50% |

| vs. Previous Quarter | 15.91% |

| vs. Previous Year | -11.36% |

| vs. Previous Quarter | 12.45% |

| Price/Book | 1.40 |

| Price/Cash Flow | 5.53 |

| Price / Sales | 0.73 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 14.62 |

| 2/29/24 | 17.72 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 9.21 |

| 2/29/24 | 11.09 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 4.24 |

| 2/29/24 | 4.19 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 2.83 |

| 2/29/24 | 2.69 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 7.56 |

| 2/29/24 | 8.75 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 6.95 |

| 2/29/24 | 8.09 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 9.09 |

| 2/29/24 | 10.58 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 37.04 |

| 2/29/24 | 36.49 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 6.23 |

| 2/29/24 | 6.24 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 0.27 |

| 2/29/24 | 0.27 |

| 8/31/24 | Pending Next EPS Report |

| 5/31/24 | 21.08 |

| 2/29/24 | 21.06 |