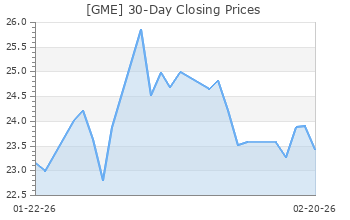

GameStop (GME)

(Delayed Data from NYSE)

$21.85 USD

+2.34 (11.99%)

Updated Sep 20, 2024 04:00 PM ET

After-Market: $21.68 -0.17 (-0.78%) 7:58 PM ET

3-Hold of 5 3

D Value A Growth F Momentum C VGM

Company Summary

Headquartered in Grapevine, TX, GameStop Corp. is the world's largest video game retailer. The company offers the best selection of new and pre-owned video gaming consoles, accessories and video game titles, in both physical and digital formats. Through all its channels, the company sells various types of digital products, including downloadable content, network points cards, prepaid digital, prepaid subscription cards and digitally downloadable software as well as collectible products. The company also publishes Game Informer, the world’s largest print and digital video game publication featuring reviews of new title releases, game tips and ...

Company Summary

Headquartered in Grapevine, TX, GameStop Corp. is the world's largest video game retailer. The company offers the best selection of new and pre-owned video gaming consoles, accessories and video game titles, in both physical and digital formats. Through all its channels, the company sells various types of digital products, including downloadable content, network points cards, prepaid digital, prepaid subscription cards and digitally downloadable software as well as collectible products. The company also publishes Game Informer, the world’s largest print and digital video game publication featuring reviews of new title releases, game tips and news regarding current developments in the video game industry. It also operates PowerUp Rewards program. The company operates business in four geographic segments: United States, Canada, Australia and Europe.

The company’s products are categorized as follows:

Hardware and Accessories (56.5% of second-quarter fiscal 2024 sales): GameStop offers new and pre-owned video game platforms from the major console and PC manufacturers. The current generation of consoles include the Sony PlayStation 4 (2013), Microsoft Xbox One (2013) and the Nintendo Switch (2017). Accessories consist primarily of controllers, gaming headsets, virtual reality products and memory cards.

Software (26% of Sales): The company provides new and pre-owned video game software for current and certain prior generation consoles. It also sells a wide variety of in-game digital currency and digital downloadable content.

Collectibles (17.5% of Sales): The category consists of licensed merchandise, primarily related to the video game, television and movie industries and pop-culture themes, which are sold through the company’s video game store and e-commerce properties, and ThinkGeek and Zing Pop Culture stores.

General Information

GameStop Corp

625 WESTPORT PARKWAY

GRAPEVINE, TX 76051

Phone: 817-424-2000

Fax: 817-424-2002

Email: ir@gamestop.com

| Industry | Gaming |

| Sector | Consumer Discretionary |

| Fiscal Year End | January |

| Last Reported Quarter | 7/31/2024 |

| Exp Earnings Date | 12/4/2024 |

EPS Information

| Current Quarter EPS Consensus Estimate | 0.00 |

| Current Year EPS Consensus Estimate | 0.01 |

| Estimated Long-Term EPS Growth Rate | NA |

| Exp Earnings Date | 12/4/2024 |

Price and Volume Information

| Zacks Rank | |

| Yesterday's Close | 19.51 |

| 52 Week High | 48.75 |

| 52 Week Low | 9.95 |

| Beta | NA |

| 20 Day Moving Average | 13,044,311.00 |

| Target Price Consensus | 10.00 |

| 4 Week | -1.62 |

| 12 Week | -11.50 |

| YTD | 24.64 |

| 4 Week | -2.79 |

| 12 Week | -15.26 |

| YTD | 4.26 |

| Shares Outstanding (millions) | 426.51 |

| Market Capitalization (millions) | 9,319.24 |

| Short Ratio | NA |

| Last Split Date | 3/19/2007 |

| Dividend Yield | 0.00% |

| Annual Dividend | $0.00 |

| Payout Ratio | 0.00 |

| Change in Payout Ratio | NA |

| Last Dividend Payout / Amount | NA / $0.00 |

Fundamental Ratios

| P/E (F1) | 2,185.00 |

| Trailing 12 Months | 198.64 |

| PEG Ratio | NA |

| vs. Previous Year | 133.33% |

| vs. Previous Quarter | 108.33% |

| vs. Previous Year | -31.41% |

| vs. Previous Quarter | -9.47% |

| Price/Book | 1.75 |

| Price/Cash Flow | 90.70 |

| Price / Sales | 2.05 |

| 7/31/24 | 1.79 |

| 4/30/24 | 1.78 |

| 1/31/24 | 1.35 |

| 7/31/24 | 1.06 |

| 4/30/24 | 0.82 |

| 1/31/24 | 0.59 |

| 7/31/24 | 6.23 |

| 4/30/24 | 2.22 |

| 1/31/24 | 2.11 |

| 7/31/24 | 5.52 |

| 4/30/24 | 1.42 |

| 1/31/24 | 1.44 |

| 7/31/24 | 0.82 |

| 4/30/24 | 0.47 |

| 1/31/24 | 0.33 |

| 7/31/24 | 0.93 |

| 4/30/24 | 0.51 |

| 1/31/24 | 0.13 |

| 7/31/24 | 1.07 |

| 4/30/24 | 0.57 |

| 1/31/24 | 0.25 |

| 7/31/24 | 10.28 |

| 4/30/24 | 4.27 |

| 1/31/24 | 4.38 |

| 7/31/24 | 4.65 |

| 4/30/24 | 4.88 |

| 1/31/24 | 5.15 |

| 7/31/24 | 0.00 |

| 4/30/24 | 0.01 |

| 1/31/24 | 0.01 |

| 7/31/24 | 0.28 |

| 4/30/24 | 1.13 |

| 1/31/24 | 1.30 |