About Zacks Rank In Industry

The key to investment success is to buy the best stocks in the best industries. When you understand the power of earnings estimate revisions, you will want to start the selection process with the Zacks Industry Rank List to identify the best industries. The next step in your research will lead you here, to the Zacks Rank in Industry, where you will find the best stocks in those best industries.

What is the Zacks Rank?

The Zacks Industry Rank is based on the highly successful Zacks Rank indicator. As many of you already know, the Zacks Rank is our proprietary quantitative model that uses trends in earnings estimate revisions and EPS surprises to classify stocks into five groups:

| Zacks Rank |

Rating |

| 1 |

Strong Buy |

| 2 |

Buy |

| 3 |

Hold |

| 4 |

Sell |

| 5 |

Strong Sell |

Since 1988, Zacks Rank #1 stocks have generated an annualized return of +23.86% , more than doubled the S&P 500s return of +11.43% . The Zacks Rank has also been very successful in telling investors which stocks to avoid. Since 1988, Zacks Rank #5 stocks have only generated an annualized return of just +2.90% . Learn more about the Zacks Rank

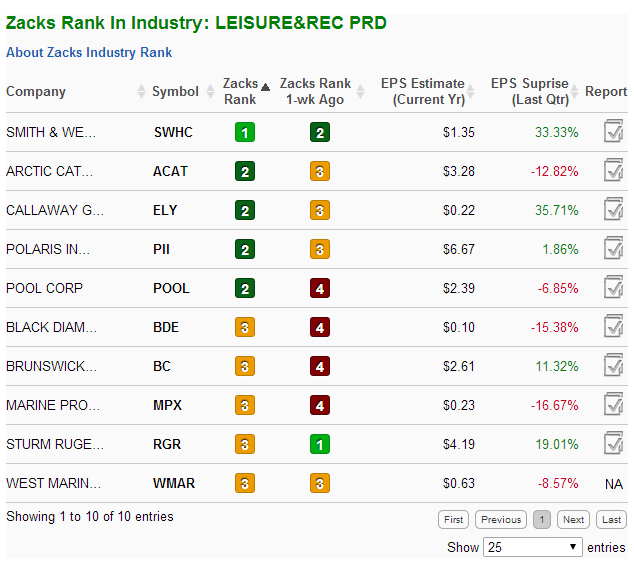

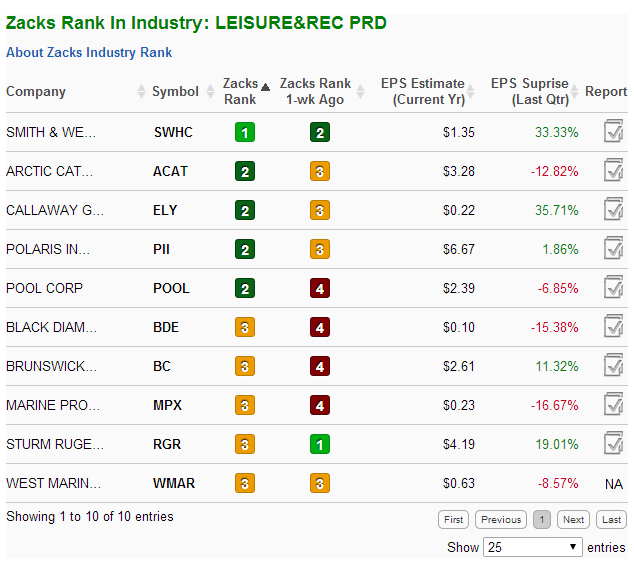

How to Read the Zacks Industry Rank Table

Here is a snapshot of the Zacks Rank in Industry table. Descriptions of each column are provided below. The table can be resorted by clicking on any of the column headings.

Company - Clicking on the companys name calls up the Zacks Equity Research report for the stock.

Ticker - Clicking on the ticker symbol calls up a small quote window with links to interactive java charts, financial statements and company research

Zacks Rank - The current Zacks Rank for the stock. You will want to buy stocks with ranks of 1 or 2 and sell stocks with ranks of 4 or 5.

Zacks Rank 1-wk Ago - The stocks Zacks Rank from one week ago. Look for stocks with an improvement in the Zacks Rank to 1 or 2.

EPS Estimate (Current Yr) - The forecast earnings per share for the current year based on the consensus forecast of covering analysts.

EPS Surprise (Last Qtr) - The percentage by which a company beat (or missed) earnings expectations for the last reported quarter. Positive surprises are good and negative surprises are bad. Earnings surprises are one of the four factors that comprise the Zacks Rank.

Report - The current Zacks Equity Research report. Learn about the difference between analyst and snapshot reports

Frequently Asked Question

Q: What is the difference between the Zacks Rank and the Average Brokerage Recommendation (ABR)?

A: Both of these concepts share the same purpose, which is to highlight the stocks most likely to outperform the market. They differ in how they rank the stocks, with the Zacks Rank solely relying on earnings surprises and earnings estimate revisions. The reliance on estimate revisions has led the Zacks Rank to generating an annualized return of +23.86% since 1998.