In the current environment with stocks at or near recent highs, most investors are sitting on accumulated profits and may be wondering if there’s an effective way to protect those gains if the seas ahead start to look rough.

As you might expect, options tend to get fairly expensive in implied volatility terms when big down moves appear possible, so simply buying puts on individual holdings or on the broad market ETFs will cost more if you wait until a broad market decline has already started.

Right now, the CBOE Volatility Index is a little higher than its multi-year average of 12-13%, but still as low as it has been in well over a year. At the close of trading on Wednesday, the VIX was just a bit over 16%. The “skew” – a measure of the relative implied volatilities of puts and calls – is fairly flat.

To protect all or part of a diversified portfolio from future declines, you can currently buy an inexpensive spread on index ETF options that protects that basket of stocks from a steep drop, yet still maintains upside profit potential.

It’s the “Collar.”

The trade involves buying a put below the current value of the market and also selling a call above the market price to offset the cost of that put.

This trade is also sometimes referred to in professional trading as a “risk reversal.”

You give up some of the profit opportunity to the upside, while protecting the portfolio from severe declines.

You could buy protection on individual stocks, but with the increasing popularity of indexed investing, big-cap stocks are increasingly correlated, so it probably makes more sense to make a single trade using options on broad market ETFs which tend to closely replicate an average individual portfolio.

Here is the payoff diagram if you own 100 shares of SPY:

Image Source: etrade

As you’d expect, it makes and loses money in a linear fashion as the S&P 500 moves up and down.

Here’s what it looks like if you protect the position by buying one August 400 put for $1.50 and selling one August 450 call for $1.20:

Image Source: etrade

If SPY rises between now and expiration, your profits are capped at prices above $450/share, but if the index declines, your losses are limited to $35/share. You are indifferent at every price below $400/share.

With volatilities near the typical lows we tend to see during summer rallies and the skew relatively flat, the trade only costs you 30 cents/share – or a total of $30 for each spread that covers 100 shares of SPY.

In an environment in which stocks are rallying, but inflation fears are creating uncertainty for the major indexes, you might find that a reasonable price for protection – and a good night’s sleep.

-Dave

Want to apply this winning option strategy and others to your trading? Then be sure to check out our Zacks Options Trader service.

Interested in strategies with profit potential even in declining markets? Maybe our Short List Trader service is for you.

Image: Bigstock

"Buy When You Can, Not When You Have To"

In the current environment with stocks at or near recent highs, most investors are sitting on accumulated profits and may be wondering if there’s an effective way to protect those gains if the seas ahead start to look rough.

As you might expect, options tend to get fairly expensive in implied volatility terms when big down moves appear possible, so simply buying puts on individual holdings or on the broad market ETFs will cost more if you wait until a broad market decline has already started.

Right now, the CBOE Volatility Index is a little higher than its multi-year average of 12-13%, but still as low as it has been in well over a year. At the close of trading on Wednesday, the VIX was just a bit over 16%. The “skew” – a measure of the relative implied volatilities of puts and calls – is fairly flat.

To protect all or part of a diversified portfolio from future declines, you can currently buy an inexpensive spread on index ETF options that protects that basket of stocks from a steep drop, yet still maintains upside profit potential.

It’s the “Collar.”

The trade involves buying a put below the current value of the market and also selling a call above the market price to offset the cost of that put.

This trade is also sometimes referred to in professional trading as a “risk reversal.”

You give up some of the profit opportunity to the upside, while protecting the portfolio from severe declines.

You could buy protection on individual stocks, but with the increasing popularity of indexed investing, big-cap stocks are increasingly correlated, so it probably makes more sense to make a single trade using options on broad market ETFs which tend to closely replicate an average individual portfolio.

Here is the payoff diagram if you own 100 shares of SPY:

Image Source: etrade

As you’d expect, it makes and loses money in a linear fashion as the S&P 500 moves up and down.

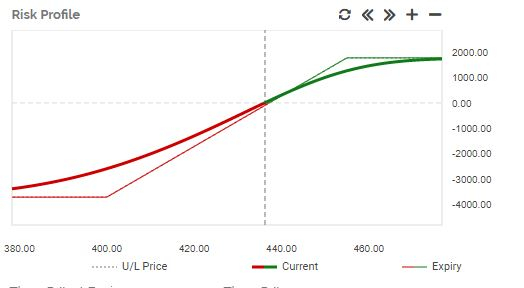

Here’s what it looks like if you protect the position by buying one August 400 put for $1.50 and selling one August 450 call for $1.20:

Image Source: etrade

If SPY rises between now and expiration, your profits are capped at prices above $450/share, but if the index declines, your losses are limited to $35/share. You are indifferent at every price below $400/share.

With volatilities near the typical lows we tend to see during summer rallies and the skew relatively flat, the trade only costs you 30 cents/share – or a total of $30 for each spread that covers 100 shares of SPY.

In an environment in which stocks are rallying, but inflation fears are creating uncertainty for the major indexes, you might find that a reasonable price for protection – and a good night’s sleep.

-Dave

Want to apply this winning option strategy and others to your trading? Then be sure to check out our Zacks Options Trader service.

Interested in strategies with profit potential even in declining markets? Maybe our Short List Trader service is for you.