Redfin Corporation is expected to see negative earnings in 2021 even though home buying demand is strong. This Zacks Rank #5 (Strong Sell) is still growing revenue at a fast clip, however.

Redfin is a real estate broker, instant home-buyer (iBuyer), lender, title insurer and renovations company. It operates the country's top real-estate brokerage site.

It charges half the industry fee to sell a home.

Customers selling a home can take an instant cash offer from Redfin or have their renovations crew fix up their home so they can get top dollar.

It operates in 95 markets across the United States and Canada.

A Miss on the First Quarter

On May 5, 2021, Redfin reported its first quarter results and missed on the Zacks Consensus Estimate by $0.04. It reported a loss of $0.37 versus the Zacks Consensus of a loss of $0.33.

Revenue, however, rose 40% year-over-year to $268 million. Gross profit was $42 million, up 229% from $13 million in the first quarter of last year.

The net loss was $36 million compared to the net loss of $60 million in the year ago quarter.

Redfin's mobile app and website reached 46 million average monthly users in the first quarter, an increase of 30% compared to the year ago period as the hot pandemic home buying market extended into 2021.

On Apr 2, it also completed the acquisition of RentPath. RentPath is a rental listings company which owns sites such as ApartmentGuide.com, Rent.com and Rentals.com.

Second Quarter Guidance

Redfin guided to second quarter revenue of between $446 million and $457 million, an increase of between 109% and 114% year-over-year. But don't forget that the second quarter was highly impacted by the pandemic last year.

Included in that total revenue number are properties segment revenue between $151 million and $156 million and RentPath revenue between $41 million and $42 million.

Analysts expect full year revenue to jump 91.7% to $1.76 billion from $886 million in 2020.

Earnings are a different picture though. 1 analyst lowered their estimate for 2021 in the last 60 days.

The Zacks Consensus Estimate has fallen to $0.69 over the last 60 days. That's a decline of 200% compared to 2020 when the company lost $0.23.

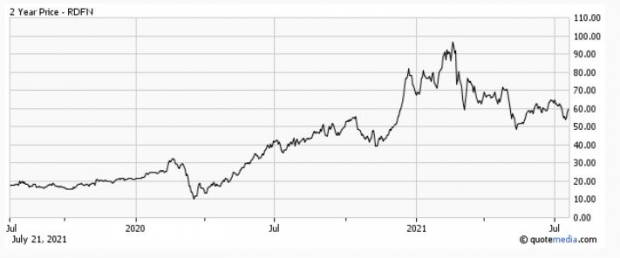

Shares Pull Back From 2021 Highs

Redfin was a big winner in 2020 during the pandemic but shares have cooled off in 2021.

Shares are down 22% over the last 6 months and are down 11.9% year-to-date.

Image Source: Zacks Investment Research

Is this a buying opportunity?

Redfin reports second quarter on Aug 5. Investors interested in the housing stocks should tune in.

Image: Bigstock

Bear of the Day: Redfin (RDFN)

Redfin Corporation is expected to see negative earnings in 2021 even though home buying demand is strong. This Zacks Rank #5 (Strong Sell) is still growing revenue at a fast clip, however.

Redfin is a real estate broker, instant home-buyer (iBuyer), lender, title insurer and renovations company. It operates the country's top real-estate brokerage site.

It charges half the industry fee to sell a home.

Customers selling a home can take an instant cash offer from Redfin or have their renovations crew fix up their home so they can get top dollar.

It operates in 95 markets across the United States and Canada.

A Miss on the First Quarter

On May 5, 2021, Redfin reported its first quarter results and missed on the Zacks Consensus Estimate by $0.04. It reported a loss of $0.37 versus the Zacks Consensus of a loss of $0.33.

Revenue, however, rose 40% year-over-year to $268 million. Gross profit was $42 million, up 229% from $13 million in the first quarter of last year.

The net loss was $36 million compared to the net loss of $60 million in the year ago quarter.

Redfin's mobile app and website reached 46 million average monthly users in the first quarter, an increase of 30% compared to the year ago period as the hot pandemic home buying market extended into 2021.

On Apr 2, it also completed the acquisition of RentPath. RentPath is a rental listings company which owns sites such as ApartmentGuide.com, Rent.com and Rentals.com.

Second Quarter Guidance

Redfin guided to second quarter revenue of between $446 million and $457 million, an increase of between 109% and 114% year-over-year. But don't forget that the second quarter was highly impacted by the pandemic last year.

Included in that total revenue number are properties segment revenue between $151 million and $156 million and RentPath revenue between $41 million and $42 million.

Analysts expect full year revenue to jump 91.7% to $1.76 billion from $886 million in 2020.

Earnings are a different picture though. 1 analyst lowered their estimate for 2021 in the last 60 days.

The Zacks Consensus Estimate has fallen to $0.69 over the last 60 days. That's a decline of 200% compared to 2020 when the company lost $0.23.

Shares Pull Back From 2021 Highs

Redfin was a big winner in 2020 during the pandemic but shares have cooled off in 2021.

Shares are down 22% over the last 6 months and are down 11.9% year-to-date.

Image Source: Zacks Investment Research

Is this a buying opportunity?

Redfin reports second quarter on Aug 5. Investors interested in the housing stocks should tune in.