We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Whether it’s a business deal, a job, a relationship or your favorite brand of toothpaste at the supermarket; nobody likes to just settle for something. It means we’re accepting less than the best… usually because it’s easy.

And when it comes to investing, it means we’re making less money than we could. If you want to invest in Growth AND Value… you should be able to do it! And Zacks can help.

We’ve got a screen that not only helps you find big growth rates and low valuations, but also adds the power of the Zacks Rank. This screen is ingeniously titled: Growth & Value Plus Zacks Rank #1. Below are three stocks that recently passed the test.

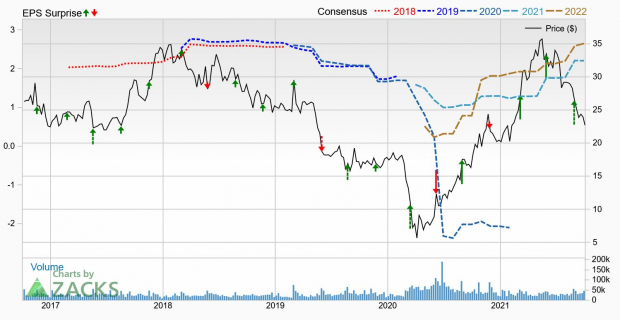

The Gap Inc.

The name of the company may be The Gap Inc. , but the real powerhouse these days is Old Navy. And active women’s apparel brand Athleta is also starting to gain some traction. These two brands led to a strong fiscal second quarter performance in late August, which included a raised full-year outlook.

GPS is a premier international specialty retailer with more than 3,800 stores worldwide. It’s four segments are Gap Global, Old Navy Global, Banana Republic Global and Other (which includes the aforementioned Athleta brand). As part of the retail – apparel & shoes space, the company is in the Top 16% of the Zacks Industry Rank. Shares have climbed approximately 14% so far in 2021.

Earnings per share in its fiscal second quarter came to 70 cents, which trounced the Zacks Consensus Estimate by nearly 50%. Net sales of $4.2 billion inched past our expectation of $4.17 billion and jumped 29% year over year. Most impressively though, the result improved 5% over the same time in 2019, which was pre-covid.

Same-store sales were up 3% year over year and a solid 12% from two years ago.

Those annoying Old Navy commercials must really work, because net sales at that segment jumped 21% in the quarter with comps up 18% against 2019. Moving forward, Old Navy has big hopes for its inclusive shopping experience BODEQUALITY, which is part of its Power Plan 2023 for long-term sustainable growth.

Net sales at Athleta soared 35% with comps up 27% from 2019. GPS is also working to transform Banana Republic through various factors including product assortment. Sales were still down in the quarter, but improved from the first quarter 2021.

GPS has worked hard to better its marketing efforts, improve its brand management and enhance its technology. These factors paid off so much that the company raised its full-year outlook. It now expects adjusted EPS of between $2.10 and $2.25 with net sales growing about 30% versus 2020.

The Zacks Consensus Estimate for this fiscal year (ending January 2022) is now $2.21, which marks a 24.2% improvement over the past 60 days. Next fiscal year (ending January 2023) is now seen at $2.65, an advance of 20.5% over the same amount of time and suggests a year-over-year improvement of 20%.

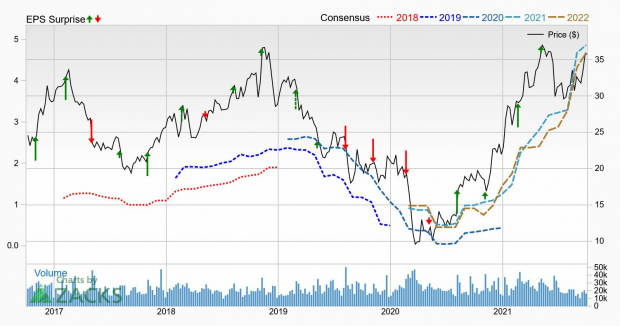

At a time of artificial intelligence, 5G, the Internet of Things, blockchain and dozens of other technologies; it seems weird that something like fertilizers could be considered “hot”. And yet, this space is in the top 6% of the Zacks Industry Rank, as agriculture trends are expected to be strong moving forward.

One of the biggest names in the space is The Mosaic Company (MOS - Free Report) , a leading producer and marketer of concentrated phosphate and potash crop nutrients. Shares are up over 60% so far this year, and the company expects the second half of 2021 to be one of its best periods in over a decade.

In the second quarter, MOS reported earnings per share of $1.17, which beat the Zacks Consensus Estimate by more than 15%. It was the fifth straight quarter with a positive surprise. The average beat over the past four quarters is just under 43%, but that’s skewed a bit by a triple digit surprise in the fourth quarter.

Net sales of $2.8 billion actually fell a little short of our expectations, but still jumped 37% year over year as stronger pricing offset the lower volumes. Net sales in Phosphates rose 54%, while sales in Potash advanced 19%. Volumes in both segments declined.

Looking forward, MOS sees a $90-$100 per ton improvement in average realized price in the Phosphates segment sequentially in the third quarter, while the Potash segment should have a $25-$35 per ton improvement.

The Zacks Consensus Estimate for this year is up to $4.86, which has surged 47.7% over the past two months. Expectations for next year are at $4.68, which suggests a year-over-year decline. However, analysts have raised their expectations by approximately 43% in 60 days, so there’s a lot of room for improvement before December 2022 rolls around.

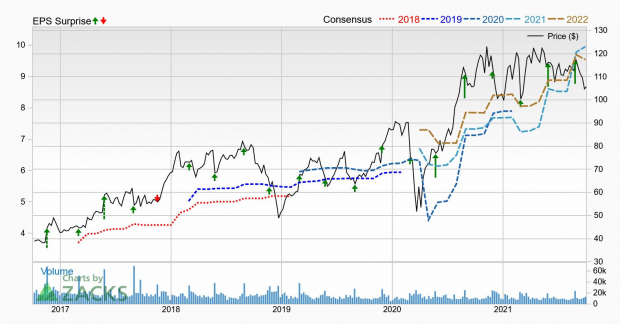

It’s scary to think where this country would’ve been in this pandemic without technology. It allowed millions of people to work from home and students to learn from home during an unprecedented shutdown. We were able to stay in close contact with loved ones in quarantine. And technology provided gaming and streaming options to keep the family occupied so you can have just a few sweet moments of solitude before resuming your government-mandated house arrest with those lovely people.

Throughout all these circumstances, Best Buy (BBY - Free Report) was there with the consumer electronics necessary to keep things going when Covid locked things up. The dependence on technology led to 14 straight quarters of positive surprises for the company, including a more than 56% beat in its recently reported fiscal second quarter.

BBY is part of the Retail – Consumer Electronics space, which means it’s in the top 13% of the Zacks Industry Rank. The company has been focused on developing its omni-channel capabilities, improving the supply chain and cost-containment efforts. It’s really been paying off!

Earnings per share reached $2.98 in its fiscal second quarter, which trounced the Zacks Consensus Estimate by more than $1.

Enterprise revenues jumped nearly 20% to $11.85 billion, compared to our expectation of $11.6 billion. Enterprise comp sales increased by the same percentage. Key drivers in the quarter were computing, mobile phones, home theater, appliances and services.

Best of all though, BBY expects continued customer demand and solid momentum. In fact, it now sees enterprise comparable sales increasing between 9% and 11% for fiscal 2022, compared to the previous outlook of 3% to 6%.

The Zacks Consensus Estimate for this fiscal year (ending January 2022) is up to $9.95, which has advanced 16.9% in just two months. The expectation for next year (ending January 2023) is only at $9.54, which is up 9.3% in two months but down year over year. However, there’s plenty of time for that to improve as consumers are unlikely to throw their computers, TVs and gaming systems away in the future.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Zacks Rank #1s with Growth AND Value

Whether it’s a business deal, a job, a relationship or your favorite brand of toothpaste at the supermarket; nobody likes to just settle for something. It means we’re accepting less than the best… usually because it’s easy.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

And when it comes to investing, it means we’re making less money than we could. If you want to invest in Growth AND Value… you should be able to do it! And Zacks can help.

We’ve got a screen that not only helps you find big growth rates and low valuations, but also adds the power of the Zacks Rank. This screen is ingeniously titled: Growth & Value Plus Zacks Rank #1. Below are three stocks that recently passed the test.

The Gap Inc.

The name of the company may be The Gap Inc. , but the real powerhouse these days is Old Navy. And active women’s apparel brand Athleta is also starting to gain some traction. These two brands led to a strong fiscal second quarter performance in late August, which included a raised full-year outlook.

GPS is a premier international specialty retailer with more than 3,800 stores worldwide. It’s four segments are Gap Global, Old Navy Global, Banana Republic Global and Other (which includes the aforementioned Athleta brand). As part of the retail – apparel & shoes space, the company is in the Top 16% of the Zacks Industry Rank. Shares have climbed approximately 14% so far in 2021.

Earnings per share in its fiscal second quarter came to 70 cents, which trounced the Zacks Consensus Estimate by nearly 50%. Net sales of $4.2 billion inched past our expectation of $4.17 billion and jumped 29% year over year. Most impressively though, the result improved 5% over the same time in 2019, which was pre-covid.

Same-store sales were up 3% year over year and a solid 12% from two years ago.

Those annoying Old Navy commercials must really work, because net sales at that segment jumped 21% in the quarter with comps up 18% against 2019. Moving forward, Old Navy has big hopes for its inclusive shopping experience BODEQUALITY, which is part of its Power Plan 2023 for long-term sustainable growth.

Net sales at Athleta soared 35% with comps up 27% from 2019. GPS is also working to transform Banana Republic through various factors including product assortment. Sales were still down in the quarter, but improved from the first quarter 2021.

GPS has worked hard to better its marketing efforts, improve its brand management and enhance its technology. These factors paid off so much that the company raised its full-year outlook. It now expects adjusted EPS of between $2.10 and $2.25 with net sales growing about 30% versus 2020.

The Zacks Consensus Estimate for this fiscal year (ending January 2022) is now $2.21, which marks a 24.2% improvement over the past 60 days. Next fiscal year (ending January 2023) is now seen at $2.65, an advance of 20.5% over the same amount of time and suggests a year-over-year improvement of 20%.

The Mosaic Company (MOS - Free Report)

At a time of artificial intelligence, 5G, the Internet of Things, blockchain and dozens of other technologies; it seems weird that something like fertilizers could be considered “hot”. And yet, this space is in the top 6% of the Zacks Industry Rank, as agriculture trends are expected to be strong moving forward.

One of the biggest names in the space is The Mosaic Company (MOS - Free Report) , a leading producer and marketer of concentrated phosphate and potash crop nutrients. Shares are up over 60% so far this year, and the company expects the second half of 2021 to be one of its best periods in over a decade.

In the second quarter, MOS reported earnings per share of $1.17, which beat the Zacks Consensus Estimate by more than 15%. It was the fifth straight quarter with a positive surprise. The average beat over the past four quarters is just under 43%, but that’s skewed a bit by a triple digit surprise in the fourth quarter.

Net sales of $2.8 billion actually fell a little short of our expectations, but still jumped 37% year over year as stronger pricing offset the lower volumes. Net sales in Phosphates rose 54%, while sales in Potash advanced 19%. Volumes in both segments declined.

Looking forward, MOS sees a $90-$100 per ton improvement in average realized price in the Phosphates segment sequentially in the third quarter, while the Potash segment should have a $25-$35 per ton improvement.

The Zacks Consensus Estimate for this year is up to $4.86, which has surged 47.7% over the past two months. Expectations for next year are at $4.68, which suggests a year-over-year decline. However, analysts have raised their expectations by approximately 43% in 60 days, so there’s a lot of room for improvement before December 2022 rolls around.

Best Buy (BBY - Free Report)

It’s scary to think where this country would’ve been in this pandemic without technology. It allowed millions of people to work from home and students to learn from home during an unprecedented shutdown. We were able to stay in close contact with loved ones in quarantine. And technology provided gaming and streaming options to keep the family occupied so you can have just a few sweet moments of solitude before resuming your government-mandated house arrest with those lovely people.

Throughout all these circumstances, Best Buy (BBY - Free Report) was there with the consumer electronics necessary to keep things going when Covid locked things up. The dependence on technology led to 14 straight quarters of positive surprises for the company, including a more than 56% beat in its recently reported fiscal second quarter.

BBY is part of the Retail – Consumer Electronics space, which means it’s in the top 13% of the Zacks Industry Rank. The company has been focused on developing its omni-channel capabilities, improving the supply chain and cost-containment efforts. It’s really been paying off!

Earnings per share reached $2.98 in its fiscal second quarter, which trounced the Zacks Consensus Estimate by more than $1.

Enterprise revenues jumped nearly 20% to $11.85 billion, compared to our expectation of $11.6 billion. Enterprise comp sales increased by the same percentage. Key drivers in the quarter were computing, mobile phones, home theater, appliances and services.

Best of all though, BBY expects continued customer demand and solid momentum. In fact, it now sees enterprise comparable sales increasing between 9% and 11% for fiscal 2022, compared to the previous outlook of 3% to 6%.

The Zacks Consensus Estimate for this fiscal year (ending January 2022) is up to $9.95, which has advanced 16.9% in just two months. The expectation for next year (ending January 2023) is only at $9.54, which is up 9.3% in two months but down year over year. However, there’s plenty of time for that to improve as consumers are unlikely to throw their computers, TVs and gaming systems away in the future.