We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

What an amazing start to November! A ‘goldilocks’ jobs report, a taper announcement and passage of a $1.2 Trillion infrastructure package. And amid all this, investors enjoyed a solid earnings season that reassured nervous investors at a time of soaring inflation and severe global supply chain issues.

Oh, and the major indices started the month with a solid week of new highs. There may never be a better time to take a look at the Zacks #1 Rank Growth Stocks screen.

In addition to a Strong Buy ranking, this strategy also looks for stocks with a minimum 20% historical growth EPS rate and a 20% or more projected growth rate. We’re looking for big growth in the past and the present that will lead to big growth in the future.

Below are three names that recently passed the test for this screen:

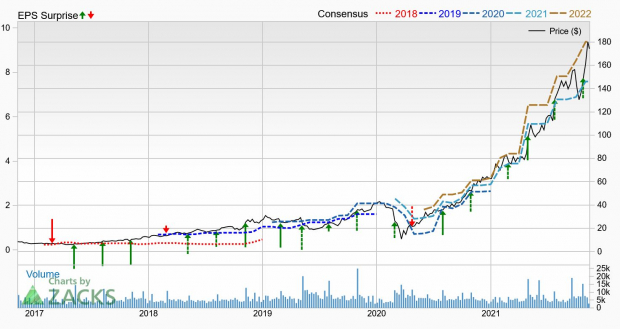

Crocs (CROX - Free Report) fell victim to the globe’s severe supply chain issues just like most other retailers, but this popular footwear brand proved to be as durable and flexible as its iconic clogs and sandals. Despite the challenges, CROX continues to beat earnings estimates and also raised its revenue growth forecast for fiscal 2021.

If you don’t own a pair of Crocs yourself, then you certainly know someone who does. Its one of the leading footwear brands in the world and is famous for its clog material dubbed Croslite. The wide variety of footwear products include sandals, wedges, flips and more that cater to people of all ages. As part of the textile – apparel space, CROX is in the top 20% of the Zacks Industry Rank. Shares are up more than 180% so far this year.

The third quarter saw earnings per share of $2.47, which beat the Zacks Consensus Estimate by 30%. In addition to being the sixth straight positive surprise, the result also marks the 14th outperformance in the past 15 quarters. (You can probably guess why it had a rare miss in April of 2020.)

Revenue of $625.9 million was a record, and also increased 73% year over year while topping the Zacks Consensus Estimate by 1.7%. Business was strong in all regions.

Its Vietnamese factory felt the pinch from severe global supply chain issues, which led to closures and disruptions in the global supply chain. However, CROX confronted the problem and made moves to weather this storm, including shifting production to other areas, improving its factory throughput, leveraging air freight and strategically allocating units. These actions appear to be successful, as evidenced by the short and long-term goals.

In fact, the company has been so agile in unprecedented circumstances that it now sees revenue growth between 62% and 65% this year, compared to an earlier forecast of 60% to 65%. Furthermore, adjusted operating margin is now expected around 28%, instead of the prior outlook of 25% and fiscal 2020’s 18.9%.

Analysts are impressed with CROX and its successful efforts to combat current challenges. The Zacks Consensus Estimate for this year is up 11.9% over the past 60 days to $7.59, while next year climbed nearly 20% in that time to $9.38. Most impressively though, analysts currently expect year-over-year improvement of 23.6%.

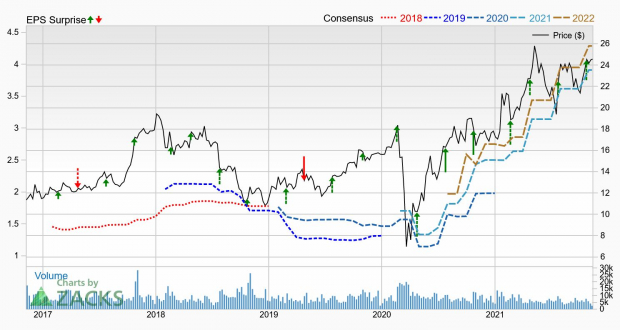

No growth screen would be complete without knocking on the door of the homebuilders. This space enjoyed an enviable combination of surging demand (due to historically-low rates and millennial interest) along with a glut in supply (due to that pandemic). The building products – home builders space is still in the top 30% of the Zacks Industry Rank.

And one of the few companies from that space with Zacks Rank #1 (Strong Buy) status is Tri Pointe Homes (TPH - Free Report) , which builds premium homes and communities in 10 states. Shares are up 45% so far in 2021 with ten straight quarters of positive earnings surprises. Strong revenue growth and margin expansion led to a solid third-quarter report late last month.

Earnings per share of $1.17 topped the Zacks Consensus Estimate by more than 31% and brought the four-quarter average surprise to nearly 32%. Home sales revenue of over $1 billion improved 25% from last year and also beat our expectations. Even with the supply chain issues, TPH managed to increase deliveries by an impressive 25%.

Even with the pandemic losing its grip and people getting ready to resume normal lives, the future looks pretty good for TPH. The company still enjoys a robust backlog, healthy demand outlook and a strong balance sheet. These demand drivers should continue even as we leave Covid behind, as millennials have discovered the benefits of owning a home.

As a result, deliveries for the full year are expected between 6,000 and 6300 with an average sales price of $635K to $640K.

Analysts have boosted their forecasts for this year... and for next. The Zacks Consensus Estimate for 2021 is now $3.91, which is up 8% in 30 days. The 2022 estimate is now up to $4.29, marking a rise of 8.6% since the report and suggesting year-over-year improvement of nearly 10%.

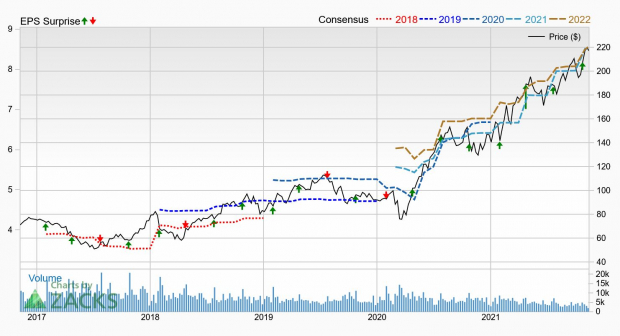

It seems fitting that Tractor Supply Company (TSCO - Free Report) would be in a growth screen like this one. Not only does the company sell products to farmers and ranchers, but the raised forecast for 2021 also shows plenty of growth in the future.

TSCO is the largest retail farm and ranch store in the country, operating more than 1900 Tractor Supply stores across 49 states (as of Sep 25, 2021). The company focuses on recreational farmers and ranchers, as well as tradespeople and small businesses. It offers a wide array of merchandise such as livestock, pet and animal products, maintenance products for agricultural and rural use, hardware and tools, lawn and garden power equipment, truck and towing products, and work apparel.

Shares are up approximately 60% so far this year after seven straight quarters of positive surprises. The company decided to raise its outlook for the full year despite “unprecedented pressures across our supply chain”. The “Life Out Here” strategy, detailed in late October 2020, appears to be bearing fruit. This plan to drive sustainable growth focuses on the five pillars of customers, digitization, execution, team members and total shareholder return.

TSCO reported third-quarter earnings per share of $1.95, which beat the Zacks Consensus Estimate by more than 18%. The four-quarter average beat is now up to 22.8%. Net sales of $3.02 billion jumped 15.8% from last year and eclipsed our expectation by over 5%. Comparable store sales grew by 13.1%, marking six straight quarters of double-digits for this metric.

The company says business has “never been stronger” and that growth continues to be “robust”. This optimism was underscored when expectations for 2021 were raised. TSCO now expects net sales of $12.6 billion, instead of $12.1 billion to $12.3 billion. Furthermore, earnings per share are now seen between $8.40 and $8.50, rather than $7.70 to $8.

Analysts responded by boosting their own expectations. The Zacks Consensus Estimate for this year is now $8.51, which is up 8% over the past 60 days. The forecast for next year is $8.55, marking a 6% gain in that time and a slight improvement over the previous year with plenty of time to rise further.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Growth Stocks with a Zacks Rank #1

What an amazing start to November! A ‘goldilocks’ jobs report, a taper announcement and passage of a $1.2 Trillion infrastructure package. And amid all this, investors enjoyed a solid earnings season that reassured nervous investors at a time of soaring inflation and severe global supply chain issues.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Oh, and the major indices started the month with a solid week of new highs. There may never be a better time to take a look at the Zacks #1 Rank Growth Stocks screen.

In addition to a Strong Buy ranking, this strategy also looks for stocks with a minimum 20% historical growth EPS rate and a 20% or more projected growth rate. We’re looking for big growth in the past and the present that will lead to big growth in the future.

Below are three names that recently passed the test for this screen:

Crocs (CROX - Free Report)

Crocs (CROX - Free Report) fell victim to the globe’s severe supply chain issues just like most other retailers, but this popular footwear brand proved to be as durable and flexible as its iconic clogs and sandals. Despite the challenges, CROX continues to beat earnings estimates and also raised its revenue growth forecast for fiscal 2021.

If you don’t own a pair of Crocs yourself, then you certainly know someone who does. Its one of the leading footwear brands in the world and is famous for its clog material dubbed Croslite. The wide variety of footwear products include sandals, wedges, flips and more that cater to people of all ages. As part of the textile – apparel space, CROX is in the top 20% of the Zacks Industry Rank. Shares are up more than 180% so far this year.

The third quarter saw earnings per share of $2.47, which beat the Zacks Consensus Estimate by 30%. In addition to being the sixth straight positive surprise, the result also marks the 14th outperformance in the past 15 quarters. (You can probably guess why it had a rare miss in April of 2020.)

Revenue of $625.9 million was a record, and also increased 73% year over year while topping the Zacks Consensus Estimate by 1.7%. Business was strong in all regions.

Its Vietnamese factory felt the pinch from severe global supply chain issues, which led to closures and disruptions in the global supply chain. However, CROX confronted the problem and made moves to weather this storm, including shifting production to other areas, improving its factory throughput, leveraging air freight and strategically allocating units. These actions appear to be successful, as evidenced by the short and long-term goals.

In fact, the company has been so agile in unprecedented circumstances that it now sees revenue growth between 62% and 65% this year, compared to an earlier forecast of 60% to 65%. Furthermore, adjusted operating margin is now expected around 28%, instead of the prior outlook of 25% and fiscal 2020’s 18.9%.

Analysts are impressed with CROX and its successful efforts to combat current challenges. The Zacks Consensus Estimate for this year is up 11.9% over the past 60 days to $7.59, while next year climbed nearly 20% in that time to $9.38. Most impressively though, analysts currently expect year-over-year improvement of 23.6%.

Tri Pointe Homes (TPH - Free Report)

No growth screen would be complete without knocking on the door of the homebuilders. This space enjoyed an enviable combination of surging demand (due to historically-low rates and millennial interest) along with a glut in supply (due to that pandemic). The building products – home builders space is still in the top 30% of the Zacks Industry Rank.

And one of the few companies from that space with Zacks Rank #1 (Strong Buy) status is Tri Pointe Homes (TPH - Free Report) , which builds premium homes and communities in 10 states. Shares are up 45% so far in 2021 with ten straight quarters of positive earnings surprises. Strong revenue growth and margin expansion led to a solid third-quarter report late last month.

Earnings per share of $1.17 topped the Zacks Consensus Estimate by more than 31% and brought the four-quarter average surprise to nearly 32%. Home sales revenue of over $1 billion improved 25% from last year and also beat our expectations. Even with the supply chain issues, TPH managed to increase deliveries by an impressive 25%.

Even with the pandemic losing its grip and people getting ready to resume normal lives, the future looks pretty good for TPH. The company still enjoys a robust backlog, healthy demand outlook and a strong balance sheet. These demand drivers should continue even as we leave Covid behind, as millennials have discovered the benefits of owning a home.

As a result, deliveries for the full year are expected between 6,000 and 6300 with an average sales price of $635K to $640K.

Analysts have boosted their forecasts for this year... and for next. The Zacks Consensus Estimate for 2021 is now $3.91, which is up 8% in 30 days. The 2022 estimate is now up to $4.29, marking a rise of 8.6% since the report and suggesting year-over-year improvement of nearly 10%.

Tractor Supply Company (TSCO - Free Report)

It seems fitting that Tractor Supply Company (TSCO - Free Report) would be in a growth screen like this one. Not only does the company sell products to farmers and ranchers, but the raised forecast for 2021 also shows plenty of growth in the future.

TSCO is the largest retail farm and ranch store in the country, operating more than 1900 Tractor Supply stores across 49 states (as of Sep 25, 2021). The company focuses on recreational farmers and ranchers, as well as tradespeople and small businesses. It offers a wide array of merchandise such as livestock, pet and animal products, maintenance products for agricultural and rural use, hardware and tools, lawn and garden power equipment, truck and towing products, and work apparel.

Shares are up approximately 60% so far this year after seven straight quarters of positive surprises. The company decided to raise its outlook for the full year despite “unprecedented pressures across our supply chain”. The “Life Out Here” strategy, detailed in late October 2020, appears to be bearing fruit. This plan to drive sustainable growth focuses on the five pillars of customers, digitization, execution, team members and total shareholder return.

TSCO reported third-quarter earnings per share of $1.95, which beat the Zacks Consensus Estimate by more than 18%. The four-quarter average beat is now up to 22.8%. Net sales of $3.02 billion jumped 15.8% from last year and eclipsed our expectation by over 5%. Comparable store sales grew by 13.1%, marking six straight quarters of double-digits for this metric.

The company says business has “never been stronger” and that growth continues to be “robust”. This optimism was underscored when expectations for 2021 were raised. TSCO now expects net sales of $12.6 billion, instead of $12.1 billion to $12.3 billion. Furthermore, earnings per share are now seen between $8.40 and $8.50, rather than $7.70 to $8.

Analysts responded by boosting their own expectations. The Zacks Consensus Estimate for this year is now $8.51, which is up 8% over the past 60 days. The forecast for next year is $8.55, marking a 6% gain in that time and a slight improvement over the previous year with plenty of time to rise further.