This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Are you ready to be shocked?

The following is based on current projections by the Institute for Health Metrics and Evaluation (IHME)

This research institute works in the area of global health statistics and impact evaluation. The main group is based at the University of Washington-Seattle.

- On Jan. 27th, 2022, projections peak for COVID infections at 2,847,000 a day.

- At the prior Dec. 27th, 2021 peak, the IHME shows us 505,000 infections a day.

- Around two weeks later, on Feb. 14th, 2022 a peak 52,728 U.S. COVID hospital beds could be needed.

- On that looming Feb. 14th day, 13,727 of needed hospital beds could be ICU beds.

- At a prior Jan. 24th 2021 peak? 49,230 beds and 11,237 ICU beds were needed.

The IHME projects the USA accumulates 970,243 COVID deaths by April 1st, 2022.

IHME United States COVID-19 Projections

In light of this crisis, what can we learn from U.S. macroeconomic and labor statistics, on the performance of the U.S. health care system, during such a mammoth COVID caseload and hospitalization crisis?

Read on carefully.

Status Report on U.S. Health Care Macro Accounting

To start with, the broad medical care price system has handled the COVID surge well.

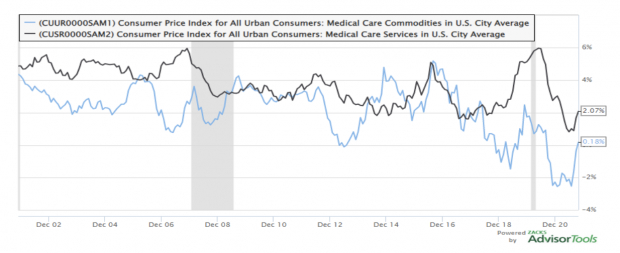

As the U.S. BLS chart (below) shows, the medical services 12-month % consumer price change topped out at +6.0% y/y just after the March 2020 shutdown period.

The medical services CPI is at +2.0% y/y now.

The 12-month % consumer price change in medical care commodities stayed just under a +2.0% y/y rate during the March 2020 shutdown period.

Medical commodity prices then receded into -2.0% y/y territory, when U.S. hospitals called off other care, to save space for COVID patients at the Jan-Feb 2021 peak.

The medical commodity price CPI is no longer moving, and is at +0.0% y/y now.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The BLS medical care index is one of eight major groups in the U.S. Consumer Price Index (CPI). It is divided into two main components: medical care services and medical care commodities, each containing several item categories.

Medical care services, the larger component in terms of weight in the CPI, is organized into three categories: professional services, hospital and related services, and health insurance.

Medical care commodities, the other major component, includes medicinal drugs and medical equipment and supplies.

A. What are medical care services?

Health services serve patients, families, communities and populations. They cover emergency, preventative, rehabilitative, long-term, hospital, diagnostic, primary, palliative and home care. These services are centered around making health care accessible, high quality and patient-centered.

B. What are health and social care services?

The Health and Social Care sector consists of any organization which provides healthcare support to people, for example hospitals, dentists and specialist support like physiotherapy, and social care support, for example, nursing homes, foster caring and nurseries. Medical services mean medical, surgical, dental, x-ray, ambulance, hospital, professional nursing and funeral services.

C. What are the two types of healthcare services?

There are two types of healthcare facilities: private healthcare services and public healthcare services.

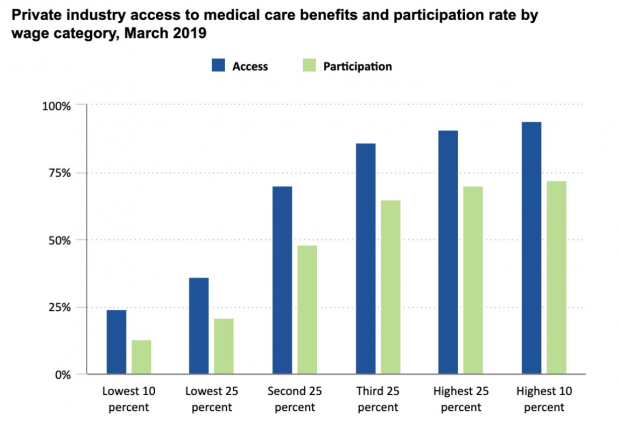

Entering the COVID crisis, as the chart below shows, the U.S. had very unequal access to medical care benefits. The lower wage categories oftentimes did not get private industry medical care benefits, and had to rely on public health care services.

Image Source: U.S. Bureau of Labor Statistics

Image Source: U.S. Bureau of Labor Statistics

Image: Bigstock

Can U.S. Healthcare Handle Another Peak COVID Surge?

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

Are you ready to be shocked?

The following is based on current projections by the Institute for Health Metrics and Evaluation (IHME)

This research institute works in the area of global health statistics and impact evaluation. The main group is based at the University of Washington-Seattle.

The IHME projects the USA accumulates 970,243 COVID deaths by April 1st, 2022.

IHME United States COVID-19 Projections

In light of this crisis, what can we learn from U.S. macroeconomic and labor statistics, on the performance of the U.S. health care system, during such a mammoth COVID caseload and hospitalization crisis?

Read on carefully.

Status Report on U.S. Health Care Macro Accounting

To start with, the broad medical care price system has handled the COVID surge well.

As the U.S. BLS chart (below) shows, the medical services 12-month % consumer price change topped out at +6.0% y/y just after the March 2020 shutdown period.

The medical services CPI is at +2.0% y/y now.

The 12-month % consumer price change in medical care commodities stayed just under a +2.0% y/y rate during the March 2020 shutdown period.

Medical commodity prices then receded into -2.0% y/y territory, when U.S. hospitals called off other care, to save space for COVID patients at the Jan-Feb 2021 peak.

The medical commodity price CPI is no longer moving, and is at +0.0% y/y now.

The BLS medical care index is one of eight major groups in the U.S. Consumer Price Index (CPI). It is divided into two main components: medical care services and medical care commodities, each containing several item categories.

Medical care services, the larger component in terms of weight in the CPI, is organized into three categories: professional services, hospital and related services, and health insurance.

Medical care commodities, the other major component, includes medicinal drugs and medical equipment and supplies.

A. What are medical care services?

Health services serve patients, families, communities and populations. They cover emergency, preventative, rehabilitative, long-term, hospital, diagnostic, primary, palliative and home care. These services are centered around making health care accessible, high quality and patient-centered.

B. What are health and social care services?

The Health and Social Care sector consists of any organization which provides healthcare support to people, for example hospitals, dentists and specialist support like physiotherapy, and social care support, for example, nursing homes, foster caring and nurseries. Medical services mean medical, surgical, dental, x-ray, ambulance, hospital, professional nursing and funeral services.

C. What are the two types of healthcare services?

There are two types of healthcare facilities: private healthcare services and public healthcare services.

Entering the COVID crisis, as the chart below shows, the U.S. had very unequal access to medical care benefits. The lower wage categories oftentimes did not get private industry medical care benefits, and had to rely on public health care services.