We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Value stocks always make sense for smart and savvy investors, but this philosophy has been downright necessary after the sluggish start to 2022. With the market spending most of January under siege from a more hawkish Fed, soaring inflation and supply chain issues; value stocks are finally getting their due as a great place to not only protect money… but also to make money.

Undervalued stocks may not stay undervalued for long, especially if they’ve got a high Zacks Rank and the market picks up. These are the stable names that can keep you in the green as we struggle to return to normal. And we’ve got a screen that will help you find them.

The Undervalued Zacks #1 Rank Stocks screen is aptly titled because that’s exactly what it looks to find. Below are three names that recently passed this screen. However, these positions can change quickly, especially is such hectic times, so make sure to also look at the full list for a broader view of the landscape.

We all know what Goodyear (GT - Free Report) does. It flies blimps over the Superbowl and other sporting events! But when not doing that, the Goodyear Tire & Rubber Company is one of the world’s largest tire companies with 55 facilities in 23 countries around the world. Its brands include the tried and true Goodyear (which has been a household name since the late 19th century), as well as Kelly, Dunlop and several others.

This economy literally runs on rubber… or at least drives on it. That’s why Rubber – Tires belongs in the Top 6% of the Zacks Industry Rank. It also helps explain why GT is up approximately 90% over the past 12 months. In its third-quarter report from early November, the company saw demand from both the consumer replacement market and from freight volume.

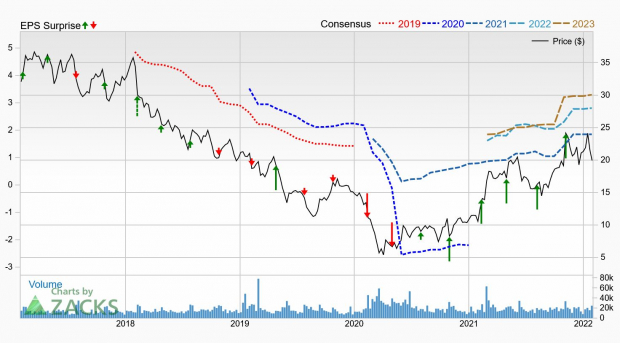

The company reported earnings per share of 72 cents in the quarter, which eclipsed the Zacks Consensus Estimate by 213% and makes six straight quarters of positive earnings surprises. Revenues of $4.9 billion improved more than 42% year over year and surpassed our expectation by nearly 7%.

The top line improvement was attributed to the Cooper Tire merger (which was completed on June 7), improvements in price/mix, increased sales from other tire-related businesses and higher volume. In regards to that merger, GT expects a benefit of $250 million in run-rate synergies by mid-2023, which is up from the initial forecast of $165 million.

The next earnings report is right around the corner on February 8. Analysts seem to be staying put with their earnings estimates in the runup, but the improvement can clearly be seen when comparing to three months ago.

The Zacks Consensus Estimate for this year is now $1.85, which has soared 29.4% in 90 days. Next year is up 21.7% in that time to $2.80, suggesting an impressive year-over-year improvement of more than 51%.

Hewlett Packard Enterprise (HPE - Free Report) is one of those companies at the right place and at the right time. The work-from-home environment that the pandemic created changed things permanently, which means people require better connectivity and need to break away from remote data centers to participate and compete in the global workforce.

That’s why demand for HPE’s edge-to-cloud portfolio is on the rise, since people want their data closer and easier to access. The company is really being rewarded for having its head in the clouds, as shares are up 36.2% over the past 12 months while its space (computer – integrated systems) is in the top 39% of the Zacks Industry Rank.

Of course, HPE was formed when Hewlett-Packard Co. was split in two about six years ago. It’s the enterprise and service business-oriented side of the breakup. It reports financial results through six segments with the largest being Compute at 44% of fiscal 2021 revenues. This unit includes general purpose server and certain workload optimized server portfolios.

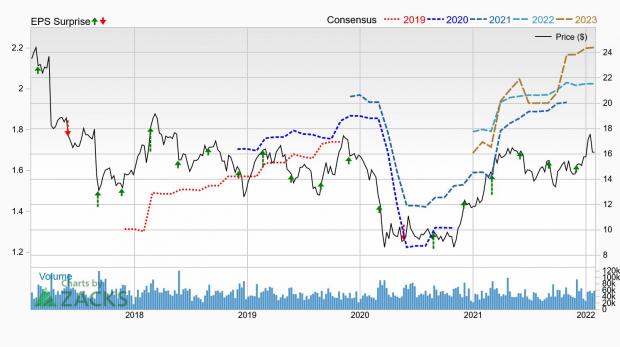

The company has beaten the Zacks Consensus Estimate for six straight quarters. Most recently, its fiscal fourth quarter earnings per share of 52 cents topped expectations by 6.1%. Net revenue of $7.4 billion improved 2% year over year. For fiscal year 2021, earnings of $1.96 and revenue of $27.8 billion increased over 27% and 3% from the previous year, respectively.

HPE said that “the demand environment has been incredibly strong and accelerated in the second half of the year, which gives us important momentum headed into next year”.

Speaking of the future, non-GAAP earnings per share for the fiscal first quarter are expected between 42 cents and 50 cents, while fiscal 2022 is seen at $1.96 to $2.10.

The Zacks Consensus Estimate for this fiscal year (ending 10/22) is at $2.03 while next fiscal year (ending 10/23) is at $2.20, suggesting year-over-year improvement of more than 8%.

The future is certainly fertile for agribusiness giant Archer Daniels Midland Company (ADM - Free Report) , which just reported its tenth straight quarter with a positive earnings surprise and ninth straight quarter with adjusted operating profit growth. In fact, the company feels so good about the future that it announced an 8% increase to its quarterly dividend.

ADM is one of the leading producers of food and beverage ingredients. It processes commodities like oilseeds, corn, wheat, cocoa and other feedstuffs to make things like natural flavor ingredients, natural colors, proteins, emulsifiers, natural health, nutrition products and dozens of other products.

The company operates through four business units with the biggest being Ag Services & Oilseeds, which accounted for more than 78% of 2021 total revenues. The other units are Carbohydrate Solutions (13%), Nutrition (7.9%) and Other (0.4%).

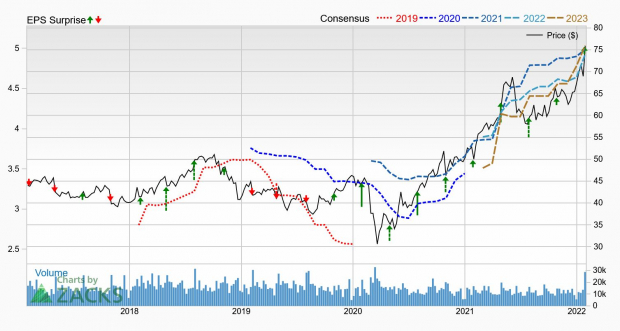

ADM managed to fight against supply chain challenges with strong demand, improved productivity and product innovations. As a result, the fourth quarter saw earnings per share of $1.50 that eclipsed the Zacks Consensus Estimate by a solid 10.3%. This makes ten consecutive quarters of beats and brings the four quarter average to nearly 22%.

Revenue of $23.09 billion improved 28.4% from last year and topped our expectation by over 13%. The Ag Services & Oilseeds unit was just slightly off a strong fourth quarter of 2020, but Carbohydrate Solutions more than doubled and Nutrition revenue grew 19%. Even the small Other business was “substantially higher”.

As the raised dividend shows, ADM is optimistic about the future given strong demand for its products. Furthermore, it is “advancing our productivity and innovation action to accelerate earnings growth”.

Analysts like the company’s moves and have raised their estimates over the past seven days. The Zacks Consensus Estimate for this year and next are $4.92 and $5.03, respectively, which have advanced 3.8% and 5.7% over the past week. Year-over-year profit growth is currently seen at 2.2% with a lot of time for improvement moving forward.

Image Source: Zacks Investment Research

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

3 Undervalued Zacks #1 Rank Stocks

Value stocks always make sense for smart and savvy investors, but this philosophy has been downright necessary after the sluggish start to 2022. With the market spending most of January under siege from a more hawkish Fed, soaring inflation and supply chain issues; value stocks are finally getting their due as a great place to not only protect money… but also to make money.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Undervalued stocks may not stay undervalued for long, especially if they’ve got a high Zacks Rank and the market picks up. These are the stable names that can keep you in the green as we struggle to return to normal. And we’ve got a screen that will help you find them.

The Undervalued Zacks #1 Rank Stocks screen is aptly titled because that’s exactly what it looks to find. Below are three names that recently passed this screen. However, these positions can change quickly, especially is such hectic times, so make sure to also look at the full list for a broader view of the landscape.

Goodyear (GT - Free Report)

We all know what Goodyear (GT - Free Report) does. It flies blimps over the Superbowl and other sporting events! But when not doing that, the Goodyear Tire & Rubber Company is one of the world’s largest tire companies with 55 facilities in 23 countries around the world. Its brands include the tried and true Goodyear (which has been a household name since the late 19th century), as well as Kelly, Dunlop and several others.

This economy literally runs on rubber… or at least drives on it. That’s why Rubber – Tires belongs in the Top 6% of the Zacks Industry Rank. It also helps explain why GT is up approximately 90% over the past 12 months. In its third-quarter report from early November, the company saw demand from both the consumer replacement market and from freight volume.

The company reported earnings per share of 72 cents in the quarter, which eclipsed the Zacks Consensus Estimate by 213% and makes six straight quarters of positive earnings surprises. Revenues of $4.9 billion improved more than 42% year over year and surpassed our expectation by nearly 7%.

The top line improvement was attributed to the Cooper Tire merger (which was completed on June 7), improvements in price/mix, increased sales from other tire-related businesses and higher volume. In regards to that merger, GT expects a benefit of $250 million in run-rate synergies by mid-2023, which is up from the initial forecast of $165 million.

The next earnings report is right around the corner on February 8. Analysts seem to be staying put with their earnings estimates in the runup, but the improvement can clearly be seen when comparing to three months ago.

The Zacks Consensus Estimate for this year is now $1.85, which has soared 29.4% in 90 days. Next year is up 21.7% in that time to $2.80, suggesting an impressive year-over-year improvement of more than 51%.

Hewlett Packard Enterprise (HPE - Free Report)

Hewlett Packard Enterprise (HPE - Free Report) is one of those companies at the right place and at the right time. The work-from-home environment that the pandemic created changed things permanently, which means people require better connectivity and need to break away from remote data centers to participate and compete in the global workforce.

That’s why demand for HPE’s edge-to-cloud portfolio is on the rise, since people want their data closer and easier to access. The company is really being rewarded for having its head in the clouds, as shares are up 36.2% over the past 12 months while its space (computer – integrated systems) is in the top 39% of the Zacks Industry Rank.

Of course, HPE was formed when Hewlett-Packard Co. was split in two about six years ago. It’s the enterprise and service business-oriented side of the breakup. It reports financial results through six segments with the largest being Compute at 44% of fiscal 2021 revenues. This unit includes general purpose server and certain workload optimized server portfolios.

The company has beaten the Zacks Consensus Estimate for six straight quarters. Most recently, its fiscal fourth quarter earnings per share of 52 cents topped expectations by 6.1%. Net revenue of $7.4 billion improved 2% year over year. For fiscal year 2021, earnings of $1.96 and revenue of $27.8 billion increased over 27% and 3% from the previous year, respectively.

HPE said that “the demand environment has been incredibly strong and accelerated in the second half of the year, which gives us important momentum headed into next year”.

Speaking of the future, non-GAAP earnings per share for the fiscal first quarter are expected between 42 cents and 50 cents, while fiscal 2022 is seen at $1.96 to $2.10.

The Zacks Consensus Estimate for this fiscal year (ending 10/22) is at $2.03 while next fiscal year (ending 10/23) is at $2.20, suggesting year-over-year improvement of more than 8%.

Archer Daniels Midland Company (ADM - Free Report)

The future is certainly fertile for agribusiness giant Archer Daniels Midland Company (ADM - Free Report) , which just reported its tenth straight quarter with a positive earnings surprise and ninth straight quarter with adjusted operating profit growth. In fact, the company feels so good about the future that it announced an 8% increase to its quarterly dividend.

ADM is one of the leading producers of food and beverage ingredients. It processes commodities like oilseeds, corn, wheat, cocoa and other feedstuffs to make things like natural flavor ingredients, natural colors, proteins, emulsifiers, natural health, nutrition products and dozens of other products.

The company operates through four business units with the biggest being Ag Services & Oilseeds, which accounted for more than 78% of 2021 total revenues. The other units are Carbohydrate Solutions (13%), Nutrition (7.9%) and Other (0.4%).

ADM managed to fight against supply chain challenges with strong demand, improved productivity and product innovations. As a result, the fourth quarter saw earnings per share of $1.50 that eclipsed the Zacks Consensus Estimate by a solid 10.3%. This makes ten consecutive quarters of beats and brings the four quarter average to nearly 22%.

Revenue of $23.09 billion improved 28.4% from last year and topped our expectation by over 13%. The Ag Services & Oilseeds unit was just slightly off a strong fourth quarter of 2020, but Carbohydrate Solutions more than doubled and Nutrition revenue grew 19%. Even the small Other business was “substantially higher”.

As the raised dividend shows, ADM is optimistic about the future given strong demand for its products. Furthermore, it is “advancing our productivity and innovation action to accelerate earnings growth”.

Analysts like the company’s moves and have raised their estimates over the past seven days. The Zacks Consensus Estimate for this year and next are $4.92 and $5.03, respectively, which have advanced 3.8% and 5.7% over the past week. Year-over-year profit growth is currently seen at 2.2% with a lot of time for improvement moving forward.