Analysts are cutting full year estimates on The Gap as it heads into its fourth quarter earnings report. Should investors be worried? This Zacks Rank #5 (Strong Sell) is still expected to grow earnings by 31% in fiscal 2023.

The Gap is a global retailer that operates the Gap, Old Navy, Banana Republic and Athleta brands both in brick and mortar stores and online.

Estimates Being Cut Ahead of Q4 Results

The Gap is expected to report fourth quarter 2021 results on Mar 3, 2022. But analysts are already cutting their estimates leading into the report.

In the last week, 2 estimates have been cut for the quarter, which has pushed down the Zacks Consensus Estimate to a loss of $0.13 from a loss of $0.12.

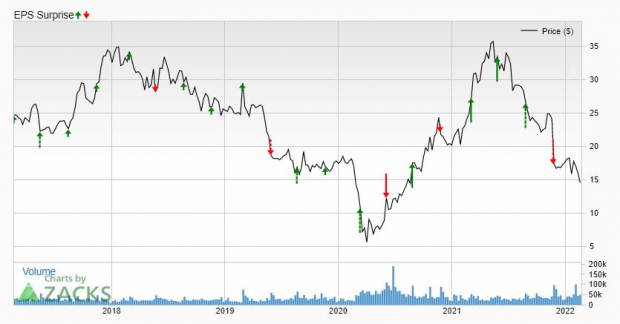

The Gap has beat 3 out of the last 4 quarters but it missed big last quarter, missing by 45%.

Image Source: Zacks Investment Research

Full Year Estimates Cut Too

The Gap has fallen to a Zacks Strong Sell because the full year estimates for both fiscal 2021 and fiscal 2022 have also been cut in the last week. The Zacks Rank is determined by revisions to analyst earnings estimates.

3 estimates have been lowered for fiscal 2021 in the prior 7 days, pushing the Zacks Consensus down to $1.33 from $1.35 in that time.

2 estimates were also cut for fiscal 2022. The 2022 Zacks Consensus has fallen to $1.75 from $2.05 in the last 60 days.

However, that's still year-over-year earnings growth of 31%.

Are Shares a Deal?

Shares have plunged 43% over the last 3 months even though the holiday season was a success for the retail industry with strong consumer spending.

Image Source: Zacks Investment Research

The Gap now trades with a forward P/E of just 8.1.

It also has a PEG ratio of 0.7. A PEG ratio under 1.0 usually indicates a company has both value and growth.

The Gap also pays a dividend, currently yielding a juicy 3.4%.

Investors seem especially nervous about apparel retailers who have been dealing with supply chain issues the last 6 months due to COVID disruptions.

But will earnings really rise 31% in 2022 as analysts are forecasting?

Investors interested in The Gap should tune into the earnings report on Mar 3 to find out.

Image: Bigstock

Bear of the Day: The Gap (GPS)

Analysts are cutting full year estimates on The Gap as it heads into its fourth quarter earnings report. Should investors be worried? This Zacks Rank #5 (Strong Sell) is still expected to grow earnings by 31% in fiscal 2023.

The Gap is a global retailer that operates the Gap, Old Navy, Banana Republic and Athleta brands both in brick and mortar stores and online.

Estimates Being Cut Ahead of Q4 Results

The Gap is expected to report fourth quarter 2021 results on Mar 3, 2022. But analysts are already cutting their estimates leading into the report.

In the last week, 2 estimates have been cut for the quarter, which has pushed down the Zacks Consensus Estimate to a loss of $0.13 from a loss of $0.12.

The Gap has beat 3 out of the last 4 quarters but it missed big last quarter, missing by 45%.

Image Source: Zacks Investment Research

Full Year Estimates Cut Too

The Gap has fallen to a Zacks Strong Sell because the full year estimates for both fiscal 2021 and fiscal 2022 have also been cut in the last week. The Zacks Rank is determined by revisions to analyst earnings estimates.

3 estimates have been lowered for fiscal 2021 in the prior 7 days, pushing the Zacks Consensus down to $1.33 from $1.35 in that time.

2 estimates were also cut for fiscal 2022. The 2022 Zacks Consensus has fallen to $1.75 from $2.05 in the last 60 days.

However, that's still year-over-year earnings growth of 31%.

Are Shares a Deal?

Shares have plunged 43% over the last 3 months even though the holiday season was a success for the retail industry with strong consumer spending.

Image Source: Zacks Investment Research

The Gap now trades with a forward P/E of just 8.1.

It also has a PEG ratio of 0.7. A PEG ratio under 1.0 usually indicates a company has both value and growth.

The Gap also pays a dividend, currently yielding a juicy 3.4%.

Investors seem especially nervous about apparel retailers who have been dealing with supply chain issues the last 6 months due to COVID disruptions.

But will earnings really rise 31% in 2022 as analysts are forecasting?

Investors interested in The Gap should tune into the earnings report on Mar 3 to find out.