Gap Inc. stock skyrocketed off its covid lows on the back of larger market exuberance and its own sales comeback. But GPS, like many early highflyers during that run, simply went way too far, too fast.

The retailer also ran into supply chain constraints that have continued to drag down the company that owns Gap, Old Navy, and more.

Struggling in a Modern Retail World

Gap is an icon in the apparel world that initially rose to power on the back of denim. Today, the firm’s portfolio of retail brands includes its namesake, Old Navy, Banana Republic, and Athleta, which competes against the likes of Lululemon in the athleisure realm.

The company has struggled to maintain consistent sales growth in the fickle fashion world. Plus, GPS now faces more competition than ever for customers from countless small e-commerce retailers that have found success through social media and direct marketing. Gap’s revenue has dipped on a YoY basis in four out of the last seven years, including a 1.2% drop in 2019 and a 16% fall during the covid-hit 2020.

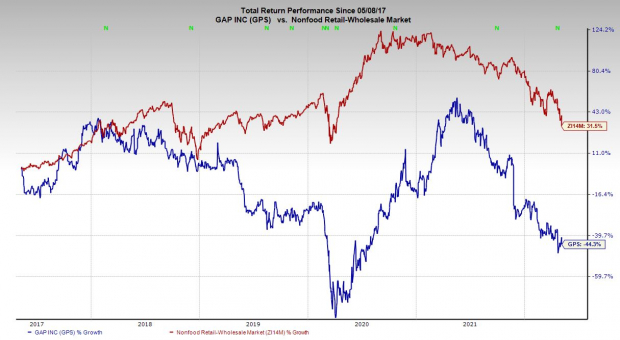

Image Source: Zacks Investment Research

Gap did bounce back in a huge way in 2021, posting 21% revenue growth to climb above its pre-pandemic totals. Unfortunately, the firm is being hit hard by inventory setbacks as global supply chains remain clogged.

GPS shares tumbled again in April after the company lowered its Q1 guidance and announced the departure of Old Navy’s chief executive. The company cited “macro-economic dynamics as well as the execution challenges at the Old Navy brand” as the reason for the subdued outlook.

Gap’s first quarter FY22 financial results are due out on May 26. Zacks estimates call for its first quarter revenue to slide 14% YoY and for it to swing from adjusted earnings of +$0.48 a share in the prior-year period to a -$0.09 a share loss. Prior to the updated guidance on April 21, Gap’s Q1 consensus stood at +$0.05 a share.

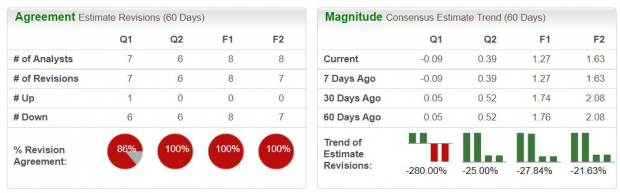

Image Source: Zacks Investment Research

Bottom Line

The nearby chart showcases how far not only its first quarter estimate has fallen, but also its FY22 and FY23 outlooks—down 28% and 22%, respectively. The downward earnings revisions trends help Gap stock land a Zacks Rank #5 (Strong Sell) right now. Plus, the Retail - Apparel and Shoes space is in the bottom 33% of over 250 Zacks industries.

Gap stock has plummeted over 60% in the past year, alongside its industry’s 35% downturn. And it might be best to stay away from GPS shares, even at these prices, at least until after its upcoming earnings results.

Bear of the Day: Gap Inc. (GPS)

Gap Inc. stock skyrocketed off its covid lows on the back of larger market exuberance and its own sales comeback. But GPS, like many early highflyers during that run, simply went way too far, too fast.

The retailer also ran into supply chain constraints that have continued to drag down the company that owns Gap, Old Navy, and more.

Struggling in a Modern Retail World

Gap is an icon in the apparel world that initially rose to power on the back of denim. Today, the firm’s portfolio of retail brands includes its namesake, Old Navy, Banana Republic, and Athleta, which competes against the likes of Lululemon in the athleisure realm.

The company has struggled to maintain consistent sales growth in the fickle fashion world. Plus, GPS now faces more competition than ever for customers from countless small e-commerce retailers that have found success through social media and direct marketing. Gap’s revenue has dipped on a YoY basis in four out of the last seven years, including a 1.2% drop in 2019 and a 16% fall during the covid-hit 2020.

Image Source: Zacks Investment Research

Gap did bounce back in a huge way in 2021, posting 21% revenue growth to climb above its pre-pandemic totals. Unfortunately, the firm is being hit hard by inventory setbacks as global supply chains remain clogged.

GPS shares tumbled again in April after the company lowered its Q1 guidance and announced the departure of Old Navy’s chief executive. The company cited “macro-economic dynamics as well as the execution challenges at the Old Navy brand” as the reason for the subdued outlook.

Gap’s first quarter FY22 financial results are due out on May 26. Zacks estimates call for its first quarter revenue to slide 14% YoY and for it to swing from adjusted earnings of +$0.48 a share in the prior-year period to a -$0.09 a share loss. Prior to the updated guidance on April 21, Gap’s Q1 consensus stood at +$0.05 a share.

Image Source: Zacks Investment Research

Bottom Line

The nearby chart showcases how far not only its first quarter estimate has fallen, but also its FY22 and FY23 outlooks—down 28% and 22%, respectively. The downward earnings revisions trends help Gap stock land a Zacks Rank #5 (Strong Sell) right now. Plus, the Retail - Apparel and Shoes space is in the bottom 33% of over 250 Zacks industries.

Gap stock has plummeted over 60% in the past year, alongside its industry’s 35% downturn. And it might be best to stay away from GPS shares, even at these prices, at least until after its upcoming earnings results.