The 2022 bear market has undoubtedly been one of the more difficult market environments to navigate over the last several decades. The volatility has frustrated both bulls and bears, as the whipsaw action has made it problematic to profit from either the long or short side.

But traders who are able to adapt their strategies to the volatility can reap substantial profits. When most stocks are falling, it’s common sense that profits will be smaller than normal and losses will be larger and more frequent. There are a few ways we can lessen any potential downside impact and adjust our strategy to the more volatile environment, including:

1) Sizing positions less than normal, resulting in less capital commitment

2) Tightening up our stop loss/selling target

3) Taking profits more quickly than normal

4) Targeting leading industries for long positions

Once the market starts to improve and we see that our recent investments are trending well, we can increase these levels back to where they were previously.

Regardless of your individual market approach to investing or trading, there is only one way to protect your portfolio from a large loss. Selling at a small loss before it snowballs into a large loss is the only way to ensure a devastating drawdown does not occur within the context of a portfolio.

The most important thing during bear markets is avoiding the big errors. We want to have a plan going in that will help guide us when the market tests our resolve. The stock market has a way of proving the majority wrong. Making investors feel unwise is the market’s way of pressuring them to act in a foolish manner. It’s essential to remain disciplined and not deviate from our strategy.

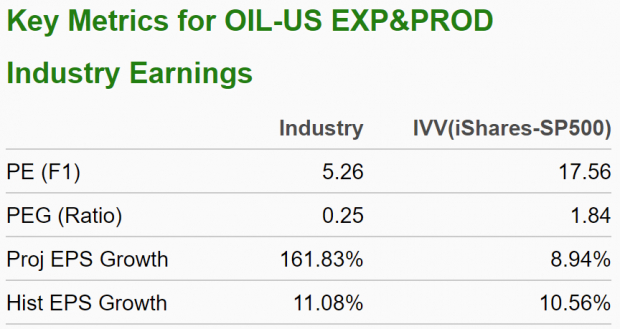

One of the ways we can improve our results during corrections is to target stocks in leading industries. The Zacks Oil and Gas – Exploration and Production – United States industry is currently ranked in the top 2% out of approximately 250 industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this industry to outperform over the next 3 to 6 months. This group has advanced nearly 50% this year versus a -17.2% loss for the S&P 500. Also note its promising characteristics:

Image Source: Zacks Investment Research

Let’s take a look at a Zacks Rank #1 (Strong Buy) stock within this leading industry.

Chesapeake Energy Corp.

Chesapeake Energy is an independent energy exploration and production company. CHK is engaged in the acquisition and development of properties primed for the production of oil and natural gas. The company has interests in approximately 8,200 gross productive wells and 661 million barrels of oil-equivalent reserves. Chesapeake Energy was founded in 1989 and is based in Oklahoma City, OK.

CHK has surpassed earnings estimates in three of the past four quarters. The company most recently reported Q1 EPS earlier this month of $3.09, a 25.61% positive surprise over the $2.46 consensus estimate. CHK has delivered a trailing four-quarter average earnings surprise of 23.46%, helping the stock surge 110.3% in the past year.

Chesapeake Energy Corporation Price, Consensus and EPS Surprise

Analysts are in agreement in terms of revisions and have raised earnings estimates across the board. The current-quarter EPS estimates have increased 10.93% in the past 60 days. The Q2 Zacks Consensus Estimate now stands at $3.45, translating to an astounding 110.37% potential growth rate relative to the same quarter last year.

Make sure to put CHK on your watchlist as the energy company continues to outperform.

Image: Bigstock

Adapting Trading Strategies to Volatile Markets

The 2022 bear market has undoubtedly been one of the more difficult market environments to navigate over the last several decades. The volatility has frustrated both bulls and bears, as the whipsaw action has made it problematic to profit from either the long or short side.

But traders who are able to adapt their strategies to the volatility can reap substantial profits. When most stocks are falling, it’s common sense that profits will be smaller than normal and losses will be larger and more frequent. There are a few ways we can lessen any potential downside impact and adjust our strategy to the more volatile environment, including:

1) Sizing positions less than normal, resulting in less capital commitment

2) Tightening up our stop loss/selling target

3) Taking profits more quickly than normal

4) Targeting leading industries for long positions

Once the market starts to improve and we see that our recent investments are trending well, we can increase these levels back to where they were previously.

Regardless of your individual market approach to investing or trading, there is only one way to protect your portfolio from a large loss. Selling at a small loss before it snowballs into a large loss is the only way to ensure a devastating drawdown does not occur within the context of a portfolio.

The most important thing during bear markets is avoiding the big errors. We want to have a plan going in that will help guide us when the market tests our resolve. The stock market has a way of proving the majority wrong. Making investors feel unwise is the market’s way of pressuring them to act in a foolish manner. It’s essential to remain disciplined and not deviate from our strategy.

One of the ways we can improve our results during corrections is to target stocks in leading industries. The Zacks Oil and Gas – Exploration and Production – United States industry is currently ranked in the top 2% out of approximately 250 industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this industry to outperform over the next 3 to 6 months. This group has advanced nearly 50% this year versus a -17.2% loss for the S&P 500. Also note its promising characteristics:

Image Source: Zacks Investment Research

Let’s take a look at a Zacks Rank #1 (Strong Buy) stock within this leading industry.

Chesapeake Energy Corp.

Chesapeake Energy is an independent energy exploration and production company. CHK is engaged in the acquisition and development of properties primed for the production of oil and natural gas. The company has interests in approximately 8,200 gross productive wells and 661 million barrels of oil-equivalent reserves. Chesapeake Energy was founded in 1989 and is based in Oklahoma City, OK.

CHK has surpassed earnings estimates in three of the past four quarters. The company most recently reported Q1 EPS earlier this month of $3.09, a 25.61% positive surprise over the $2.46 consensus estimate. CHK has delivered a trailing four-quarter average earnings surprise of 23.46%, helping the stock surge 110.3% in the past year.

Chesapeake Energy Corporation Price, Consensus and EPS Surprise

Analysts are in agreement in terms of revisions and have raised earnings estimates across the board. The current-quarter EPS estimates have increased 10.93% in the past 60 days. The Q2 Zacks Consensus Estimate now stands at $3.45, translating to an astounding 110.37% potential growth rate relative to the same quarter last year.

Make sure to put CHK on your watchlist as the energy company continues to outperform.