Flagstar Bancorp rode the housing boom wave during the pandemic as it has one of the largest mortgage businesses in the country. But this Zacks Rank #5 (Strong Sell) is expected to see its earnings fall by 53% in 2022 as the mortgage market dries up.

Flagstar is a community bank headquartered in Troy, Michigan which provides commercial, small business and consumer banking services through 158 branches in Michigan, Indiana, California, Wisconsin and Ohio. In addition, it also provides home loans in all 50 states through a network of brokers and correspondents as well as from 84 retail locations in 28 states.

It handles payments and record keeping for $272 billion of loans representing over 1.2 million borrowers.

Flagstar and New York Community Bancorp to Merge

On Apr 26, 2021, New York Community Bancorp and Flagstar announced they would merge and create a regional powerhouse.

It was an all-stock deal.

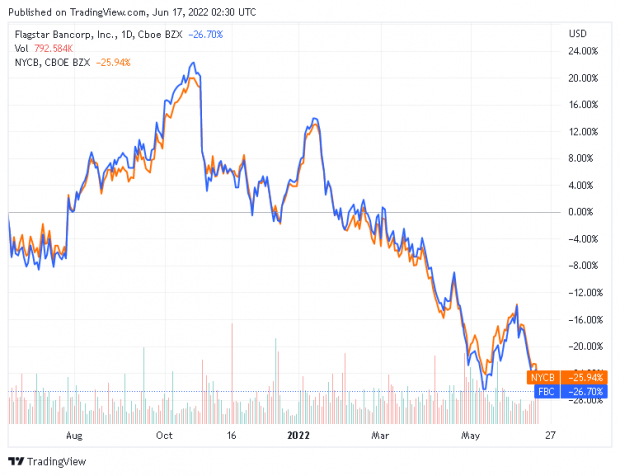

But that was well over a year ago and the merger hasn't happened yet. Meanwhile both stocks are down double digits this year.

Flagstar has fallen 30% year-to-date and New York Community Bancorp has slid 28.7%. New York Community Bancorp is also at 52-week lows.

Both banks are Zacks #5 (Strong Sells).

Will this deal still close? Both banks are expected to report second quarter earnings at the end of July, 2022.

Two Misses in a Row

On Apr 27, Flagstar reported its 2022 first quarter results and missed the Zacks Consensus Estimate by $0.32. Earnings were $1.02 versus the Consensus of $1.34.

It was the second miss in a row.

Mortgage revenue declined more than expected due to the unprecedented increase in mortgage rates, but its net interest margin and MSR returns improved significantly.

The net interest margin for the first quarter was 3.12%, the highest adjusted net interest margin Flagstar had ever reported.

Earnings Expected to Plunge

Given the continued slowing in the mortgage market, it's not surprising that the analysts are bearish.

2 estimates have been cut in the last 60 days which has pushed the Zacks Consensus Estimate down to $4.89 from $5.55.

That is an earnings decline of 53.9% as Flagstar made $10.60 last year.

Cheap But Uncertainty

Both Flagstar and New York Community Bancorp are cheap. Flagstar trades with a forward P/E of 7.2. It also pays a dividend, currently yielding 0.7%.

New York Community Bancorp trades with a forward P/E of just 6.9. It, too, pays a dividend which is currently yielding 7.5%.

The stocks have moved in tandem over the last year as investors await the merger.

Image Source: Zacks Investment Research

But for investors looking for a bank right now, it may make sense to look elsewhere instead of at either of these two Zacks #5 (Strong Sell) stocks while there is so much uncertainty.

Image: Bigstock

Bear of the Day: Flagstar Bancorp (FBC)

Flagstar Bancorp rode the housing boom wave during the pandemic as it has one of the largest mortgage businesses in the country. But this Zacks Rank #5 (Strong Sell) is expected to see its earnings fall by 53% in 2022 as the mortgage market dries up.

Flagstar is a community bank headquartered in Troy, Michigan which provides commercial, small business and consumer banking services through 158 branches in Michigan, Indiana, California, Wisconsin and Ohio. In addition, it also provides home loans in all 50 states through a network of brokers and correspondents as well as from 84 retail locations in 28 states.

It handles payments and record keeping for $272 billion of loans representing over 1.2 million borrowers.

Flagstar and New York Community Bancorp to Merge

On Apr 26, 2021, New York Community Bancorp and Flagstar announced they would merge and create a regional powerhouse.

It was an all-stock deal.

But that was well over a year ago and the merger hasn't happened yet. Meanwhile both stocks are down double digits this year.

Flagstar has fallen 30% year-to-date and New York Community Bancorp has slid 28.7%. New York Community Bancorp is also at 52-week lows.

Both banks are Zacks #5 (Strong Sells).

Will this deal still close? Both banks are expected to report second quarter earnings at the end of July, 2022.

Two Misses in a Row

On Apr 27, Flagstar reported its 2022 first quarter results and missed the Zacks Consensus Estimate by $0.32. Earnings were $1.02 versus the Consensus of $1.34.

It was the second miss in a row.

Mortgage revenue declined more than expected due to the unprecedented increase in mortgage rates, but its net interest margin and MSR returns improved significantly.

The net interest margin for the first quarter was 3.12%, the highest adjusted net interest margin Flagstar had ever reported.

Earnings Expected to Plunge

Given the continued slowing in the mortgage market, it's not surprising that the analysts are bearish.

2 estimates have been cut in the last 60 days which has pushed the Zacks Consensus Estimate down to $4.89 from $5.55.

That is an earnings decline of 53.9% as Flagstar made $10.60 last year.

Cheap But Uncertainty

Both Flagstar and New York Community Bancorp are cheap. Flagstar trades with a forward P/E of 7.2. It also pays a dividend, currently yielding 0.7%.

New York Community Bancorp trades with a forward P/E of just 6.9. It, too, pays a dividend which is currently yielding 7.5%.

The stocks have moved in tandem over the last year as investors await the merger.

Image Source: Zacks Investment Research

But for investors looking for a bank right now, it may make sense to look elsewhere instead of at either of these two Zacks #5 (Strong Sell) stocks while there is so much uncertainty.