Today’s Bull of the Day is Sanderson Farms . The company resides in the consumer staples sector, a realm where companies generate consistent and reliable revenues due to their products’ persistent demand – in the face of good and bad times.

Headquartered in Mississippi, Sanderson Farms is a Fortune 1000 company engaged in the production, processing, marketing, and distribution of fresh and frozen chicken and other prepared food items. The company maximizes stockholder value via being a highly successful producer and marketer of high-quality food products while providing superior service to the food industry.

Additionally, Sanderson Farms has strategic locations throughout the southeast, processing over 16 million chickens weekly.

Year-to-date, SAFM shares have provided investors with a stellar 12.5% return, easily outpacing the S&P 500 and undoubtedly becoming a bright spot in an otherwise dim market.

Image Source: Zacks Investment Research

Previous Earnings

Sanderson Farms posted robust quarterly results in its latest release, beating EPS and revenue estimates extensively. Quarterly sales of $1.54 billion was more than enough to beat the Zacks Consensus Estimate, penciling in a 7.6% beat on the top-line.

In addition, the company reported quarterly EPS of $14.39, beating Zacks Consensus Estimate of $6.81 per share by a massive triple-digit 111%.

Valuation & Growth Forecasts

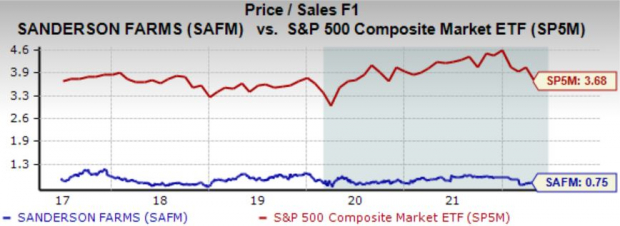

SAFM boasts an enticingly low 0.7X forward price-to-sales ratio, well below 2017 highs of 1.2X and nicely underneath its five-year median of 0.8X. Additionally, the current value represents a steep 79% discount relative to the S&P 500’s forward price-to-sales ratio of 3.7X.

Image Source: Zacks Investment Research

SAFM has a Style Score of an A for Value, making it look that much more enticing.

For the upcoming quarter, the Zacks Consensus EPS Estimate resides at $12.42, reflecting a massive 68% growth in the bottom-line from the year-ago quarter. Looking ahead, for FY22, the $48.02 per share estimate displays a notable triple-digit 140% increase in earnings year-over-year.

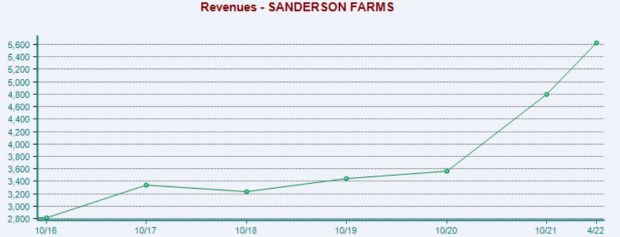

Revenue estimates display top-line strength as well. SAFM is forecasted to rake in $1.7 billion in revenue for the upcoming quarter, a considerable 26% increase in revenue compared to the year-ago quarter. Additionally, the FY22 revenue estimate of $6.3 billion represents a substantial 30% expansion in the top-line year-over-year.

Image Source: Zacks Investment Research

Dividends

For investors looking for an income stream, SAFM has that covered with its 0.84% annual dividend yield with a payout ratio sitting very sustainably at 5% of earnings. The company has increased its dividend twice over the last five years and has a five-year annualized dividend growth rate of a notable 11.8%.

Bottom Line

One of the best ways investors can find expected winners within the market is by utilizing the Zacks Rank – one of the most potent market tools out there. A portfolio consisting of Zacks Rank #1 (Strong Buy) stocks has beaten the market in 26 of the last 31 years with an average annual return of 25%.

Additionally, the top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Sanderson Farms would be an excellent bet for investors looking to add a solid stock to their portfolios, as displayed by its Zack Rank #1 (Strong Buy).

Image: Bigstock

Bull of the Day: Sanderson Farms, Inc. (SAFM)

Today’s Bull of the Day is Sanderson Farms . The company resides in the consumer staples sector, a realm where companies generate consistent and reliable revenues due to their products’ persistent demand – in the face of good and bad times.

Headquartered in Mississippi, Sanderson Farms is a Fortune 1000 company engaged in the production, processing, marketing, and distribution of fresh and frozen chicken and other prepared food items. The company maximizes stockholder value via being a highly successful producer and marketer of high-quality food products while providing superior service to the food industry.

Additionally, Sanderson Farms has strategic locations throughout the southeast, processing over 16 million chickens weekly.

Year-to-date, SAFM shares have provided investors with a stellar 12.5% return, easily outpacing the S&P 500 and undoubtedly becoming a bright spot in an otherwise dim market.

Image Source: Zacks Investment Research

Previous Earnings

Sanderson Farms posted robust quarterly results in its latest release, beating EPS and revenue estimates extensively. Quarterly sales of $1.54 billion was more than enough to beat the Zacks Consensus Estimate, penciling in a 7.6% beat on the top-line.

In addition, the company reported quarterly EPS of $14.39, beating Zacks Consensus Estimate of $6.81 per share by a massive triple-digit 111%.

Valuation & Growth Forecasts

SAFM boasts an enticingly low 0.7X forward price-to-sales ratio, well below 2017 highs of 1.2X and nicely underneath its five-year median of 0.8X. Additionally, the current value represents a steep 79% discount relative to the S&P 500’s forward price-to-sales ratio of 3.7X.

Image Source: Zacks Investment Research

SAFM has a Style Score of an A for Value, making it look that much more enticing.

For the upcoming quarter, the Zacks Consensus EPS Estimate resides at $12.42, reflecting a massive 68% growth in the bottom-line from the year-ago quarter. Looking ahead, for FY22, the $48.02 per share estimate displays a notable triple-digit 140% increase in earnings year-over-year.

Revenue estimates display top-line strength as well. SAFM is forecasted to rake in $1.7 billion in revenue for the upcoming quarter, a considerable 26% increase in revenue compared to the year-ago quarter. Additionally, the FY22 revenue estimate of $6.3 billion represents a substantial 30% expansion in the top-line year-over-year.

Image Source: Zacks Investment Research

Dividends

For investors looking for an income stream, SAFM has that covered with its 0.84% annual dividend yield with a payout ratio sitting very sustainably at 5% of earnings. The company has increased its dividend twice over the last five years and has a five-year annualized dividend growth rate of a notable 11.8%.

Bottom Line

One of the best ways investors can find expected winners within the market is by utilizing the Zacks Rank – one of the most potent market tools out there. A portfolio consisting of Zacks Rank #1 (Strong Buy) stocks has beaten the market in 26 of the last 31 years with an average annual return of 25%.

Additionally, the top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Sanderson Farms would be an excellent bet for investors looking to add a solid stock to their portfolios, as displayed by its Zack Rank #1 (Strong Buy).