Sotherly Hotels Inc. is seeing a return of travelers to its hotels in 2022. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by the triple digits in 2022.

Sotherly Hotels Inc. is a lodging REIT focused on upscale to upper-upscale full-service hotels in the Southern United States. It's portfolio currently consists of 10 hotel properties, comprising 2,786 rooms, as well as interests in 2 condominium hotels and their associated rental programs.

The hotels operate under the Hilton Worldwide and Hyatt Hotels brands, as well as independent hotels.

Another Beat in the Second Quarter

On Aug 11, Sotherly Hotels reported second quarter results and beat the Zacks Consensus by 571%. Earnings were $0.33 versus the Zacks Consensus of a loss of $0.07.

It was the third consecutive earnings beat in a row.

The all-important RevPAR metric, or room revenue per available room, actually exceeded the second quarter of 2019, which was pre-pandemic.

RevPAR increase to $128.63 for the second quarter from $94.93 in the same period in 2021. This was also 0.5% above second quarter 2019 RevPAR of $128.05. This was drive by higher average daily rates ("ADR") this year versus last year.

As anyone who has stayed in a hotel this year knows, rates have jumped. Sotherly's ADR for Q2 rose to $189.24 from $161.00 last year.

Occupancy also rose to 68% from 59% in 2021 as travel picked up steam this year. Compared to 2019, ADR also rose by 12.7%, but that was due to the higher daily rate as occupancy lagged 2019 by 8.3% which was at 76%.

Total revenue jumped to $47.2 million from $34.4 million a year ago. This was just under the revenue in Q2 of 2019, which was $51.5 million.

"We expect this momentum to continue, as same-store composite ADR during the month of July outperformed the same period in 2019 by 11.7%, leading to a 1.4% gain in RevPAR," said Dave Folsom, CEO.

"The quarter also saw the full repayment and extinguishment of the company’s outstanding loan with Kemmons Wilson, which was issued in June 2020 to provide liquidity as the Company experienced some of the strongest impacts of the pandemic," he added.

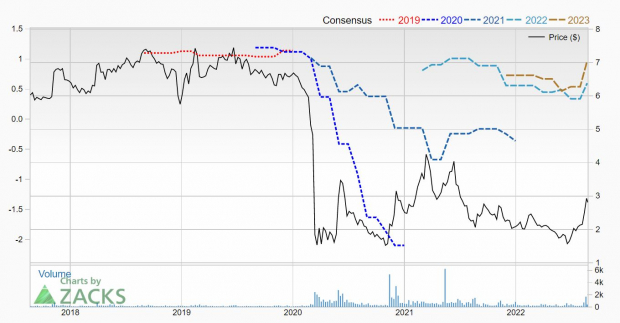

Full Year Earnings Estimates Move Higher

Sotherly is still not providing full year guidance due to COVID-19 but it said its expects Composite RevPAR to be 6.5% ahead of Q3 2019 RevPAR and well ahead of last year.

Analysts liked what they heard as one earnings estimate has been revised higher for both 2022 and 2023 in the last 30 days.

The 2022 Zacks Consensus Estimate has jumped up to $0.60 from $0.34 in the last month. That's earnings growth of 300% as Sotherly lost $0.30 a share last year.

The 2023 Zacks Consensus Estimate also rose in the last 30 days, to $0.97 from $0.54. That's another 62% earnings growth.

Image Source: Zacks Investment Research

Shares are Dirt Cheap

Sotherly is a small cap company with a stock that is trading under $5. Shares have jumped 30.8% year-to-date on the return of travel, easily outperforming the S&P 500.

Image Source: Zacks Investment Research

But with rising earnings, it's also dirt cheap. Sotherly has a forward P/E of just 4.7.

REITs normally pay a dividend, but Sotherly suspended the dividend when the pandemic hit. It has not yet reinstituted it.

But for investors looking for a value stock in the hotel industry, REITs like Sotherly, which are back on track as the pandemic eases, should be on your shortlist.

Image: Bigstock

Bull of the Day: Sotherly Hotels (SOHO)

Sotherly Hotels Inc. is seeing a return of travelers to its hotels in 2022. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by the triple digits in 2022.

Sotherly Hotels Inc. is a lodging REIT focused on upscale to upper-upscale full-service hotels in the Southern United States. It's portfolio currently consists of 10 hotel properties, comprising 2,786 rooms, as well as interests in 2 condominium hotels and their associated rental programs.

The hotels operate under the Hilton Worldwide and Hyatt Hotels brands, as well as independent hotels.

Another Beat in the Second Quarter

On Aug 11, Sotherly Hotels reported second quarter results and beat the Zacks Consensus by 571%. Earnings were $0.33 versus the Zacks Consensus of a loss of $0.07.

It was the third consecutive earnings beat in a row.

The all-important RevPAR metric, or room revenue per available room, actually exceeded the second quarter of 2019, which was pre-pandemic.

RevPAR increase to $128.63 for the second quarter from $94.93 in the same period in 2021. This was also 0.5% above second quarter 2019 RevPAR of $128.05. This was drive by higher average daily rates ("ADR") this year versus last year.

As anyone who has stayed in a hotel this year knows, rates have jumped. Sotherly's ADR for Q2 rose to $189.24 from $161.00 last year.

Occupancy also rose to 68% from 59% in 2021 as travel picked up steam this year. Compared to 2019, ADR also rose by 12.7%, but that was due to the higher daily rate as occupancy lagged 2019 by 8.3% which was at 76%.

Total revenue jumped to $47.2 million from $34.4 million a year ago. This was just under the revenue in Q2 of 2019, which was $51.5 million.

"We expect this momentum to continue, as same-store composite ADR during the month of July outperformed the same period in 2019 by 11.7%, leading to a 1.4% gain in RevPAR," said Dave Folsom, CEO.

"The quarter also saw the full repayment and extinguishment of the company’s outstanding loan with Kemmons Wilson, which was issued in June 2020 to provide liquidity as the Company experienced some of the strongest impacts of the pandemic," he added.

Full Year Earnings Estimates Move Higher

Sotherly is still not providing full year guidance due to COVID-19 but it said its expects Composite RevPAR to be 6.5% ahead of Q3 2019 RevPAR and well ahead of last year.

Analysts liked what they heard as one earnings estimate has been revised higher for both 2022 and 2023 in the last 30 days.

The 2022 Zacks Consensus Estimate has jumped up to $0.60 from $0.34 in the last month. That's earnings growth of 300% as Sotherly lost $0.30 a share last year.

The 2023 Zacks Consensus Estimate also rose in the last 30 days, to $0.97 from $0.54. That's another 62% earnings growth.

Image Source: Zacks Investment Research

Shares are Dirt Cheap

Sotherly is a small cap company with a stock that is trading under $5. Shares have jumped 30.8% year-to-date on the return of travel, easily outperforming the S&P 500.

Image Source: Zacks Investment Research

But with rising earnings, it's also dirt cheap. Sotherly has a forward P/E of just 4.7.

REITs normally pay a dividend, but Sotherly suspended the dividend when the pandemic hit. It has not yet reinstituted it.

But for investors looking for a value stock in the hotel industry, REITs like Sotherly, which are back on track as the pandemic eases, should be on your shortlist.