The Zacks Aerospace Sector has mightily struggled over the last five years, down nearly 30% and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

A stock undergoing some turbulence in the sector, Spirit AeroSystems , has landed itself into an unfavorable Zacks Rank #5 (Strong Sell), telling us its near-term earnings outlook is under pressure.

Image Source: Zacks Investment Research

Spirit AeroSystems Holdings, Inc. is one of the most prominent independent non-OEM aircraft parts designers and manufacturers of commercial aerostructures worldwide.

Further, the company’s core product catalog includes fuselages, pylons, nacelles, and wing components.

In fact, SPR resides in the Zacks Aerospace – Defense Industry, which is currently ranked in the bottom 16% of all Zacks Industries.

Due to its unfavorable industry ranking, we expect it to underperform the market over the next three to six months.

Let’s take a deeper look at the company.

Share Performance

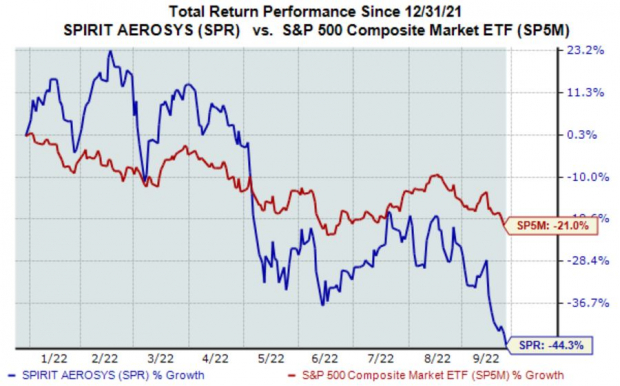

Year-to-date, it’s been a challenging road for SPR shares, down more than 40% and widely underperforming the S&P 500.

Image Source: Zacks Investment Research

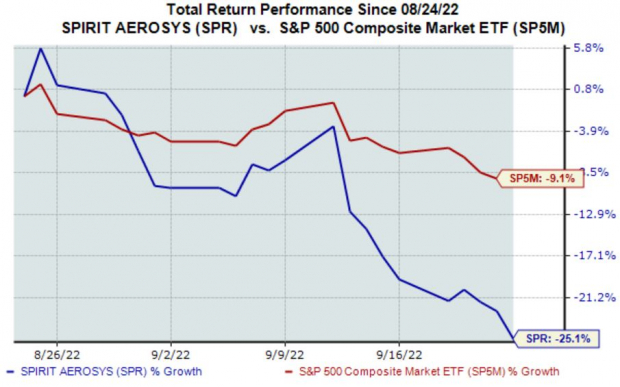

And over the last month, shares are down 25%.

Image Source: Zacks Investment Research

The unfavorable price action SPR shares have undergone tells us sellers have had the upper hand all year long.

Quarterly Performance

Spirit AeroSystems has struggled to exceed quarterly estimates, falling short of the Zacks Consensus EPS Estimate in six of its previous ten quarters. Just in its latest print, SPR registered a triple-digit 425% bottom-line miss.

However, top-line results have been notably strong, with SPR exceeding revenue estimates in seven of its last ten prints.

Bottom Line

Unfavorable price action and negative estimate revisions from analysts paint a grim picture for the company in the short term.

Spirit AeroSystems is a Zacks Rank #5 (Strong Sell), telling us it has a weak near-term earnings outlook.

Instead, investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – these stocks have a much stronger earnings outlook.

Bear of the Day: Spirit AeroSystems (SPR)

The Zacks Aerospace Sector has mightily struggled over the last five years, down nearly 30% and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

A stock undergoing some turbulence in the sector, Spirit AeroSystems , has landed itself into an unfavorable Zacks Rank #5 (Strong Sell), telling us its near-term earnings outlook is under pressure.

Image Source: Zacks Investment Research

Spirit AeroSystems Holdings, Inc. is one of the most prominent independent non-OEM aircraft parts designers and manufacturers of commercial aerostructures worldwide.

Further, the company’s core product catalog includes fuselages, pylons, nacelles, and wing components.

In fact, SPR resides in the Zacks Aerospace – Defense Industry, which is currently ranked in the bottom 16% of all Zacks Industries.

Due to its unfavorable industry ranking, we expect it to underperform the market over the next three to six months.

Let’s take a deeper look at the company.

Share Performance

Year-to-date, it’s been a challenging road for SPR shares, down more than 40% and widely underperforming the S&P 500.

Image Source: Zacks Investment Research

And over the last month, shares are down 25%.

Image Source: Zacks Investment Research

The unfavorable price action SPR shares have undergone tells us sellers have had the upper hand all year long.

Quarterly Performance

Spirit AeroSystems has struggled to exceed quarterly estimates, falling short of the Zacks Consensus EPS Estimate in six of its previous ten quarters. Just in its latest print, SPR registered a triple-digit 425% bottom-line miss.

However, top-line results have been notably strong, with SPR exceeding revenue estimates in seven of its last ten prints.

Bottom Line

Unfavorable price action and negative estimate revisions from analysts paint a grim picture for the company in the short term.

Spirit AeroSystems is a Zacks Rank #5 (Strong Sell), telling us it has a weak near-term earnings outlook.

Instead, investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – these stocks have a much stronger earnings outlook.