The rally off the October lows has clearly favored the Dow 30 holdings, as the major blue-chip average temporarily exited correction territory yesterday. Meanwhile, tech has not fared as well, as the Nasdaq remains near its bear market lows. The S&P 500 continues to hover in a bear market, down more than 20% from its January peak.

There’s certainly no absence of potential catalysts to push equity prices one way or the other, as investors await several results from both the midterm elections as well as a slew of companies that have yet to report third-quarter earnings. And with October’s CPI release due out tomorrow morning, the end of this week is shaping up to be a market mover.

The hard penny investing environment continues, as opposed to the easy dollar, ultra-low interest rate market setting we saw for much of the last decade. Yes, the Fed has begun to drop hints of slowing the pace of future rate hikes, but markets aren’t likely to meaningfully turn the corner until that process becomes clearer. And while it remains to be seen if we are headed for an official recession, stocks tend to put in bottom before that period ends.

One of the ways we can bypass the current economic uncertainty is to identify leading industry groups. Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. Focusing on stocks within the top-performing industries provides a constant ‘tailwind’ to our investing results. Including this step in our selection process also allows us to narrow down the investment universe and select stocks with the best profit potential.

The best-performing industry groups are dynamic and constantly evolving, so investors would be wise to stay abreast of these groups. The stocks within these groups will typically be leading the market – and it is these stocks that we want to target for long trade initiations. Below is one example of a group that is outperforming in the current market environment and whose constituents are receiving positive earnings estimate revisions.

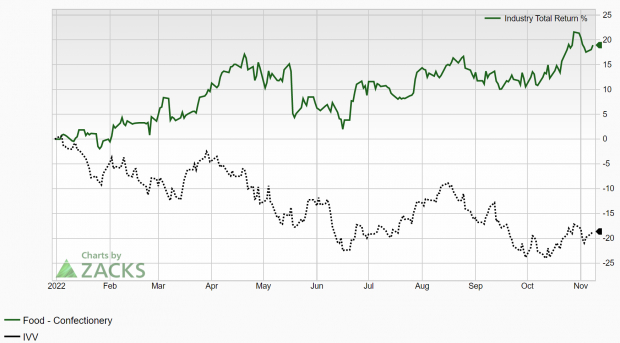

The Zacks Food-Confectionery industry, part of the Consumer Staples sector, is currently ranked in the top 8% of all industry groups. More specifically, this group is ranked #20 out of all 252 Zacks Ranked Industries. This group has steadily outperformed the market this year as we can see below:

Image Source: Zacks Investment Research

Let’s take a deeper look at a highly-rated stock within this leading industry group.

Hostess Brands, Inc.

Hostess Brands is a packaged food company that develops, manufactures, and distributes snack products primarily in the United States. TWNK provides a wide range of sweets such as donuts, pastries, cookies and wafers under various recognized brands like Twinkies, CupCakes, Donettes, HoHos, and Cloverhill.

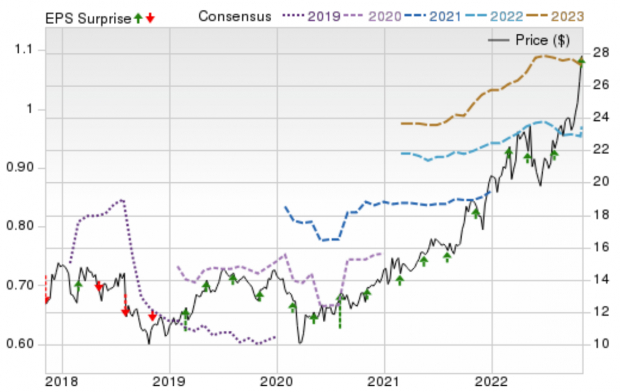

A Zacks #2 (Buy) stock, TWNK has exceeded earnings estimates in each of the past four quarters, delivering an average earnings surprise of 8.9% over that timeframe. The company most recently reported Q3 EPS last week of $0.23/share, a 9.52% surprise over consensus estimates. Sales of $346.2 million also beat estimates by 7.18%. The sustained success has aided TWNK’s stock this year, returning north of 40% while the major averages hover in a deep correction.

Image Source: Zacks Investment Research

For the full year, analysts have raised their earnings estimates by 1.04% in the past week. TWNK is projected to post 2022 EPS of $0.97/share, reflecting growth of 10.23% relative to last year. Sales are seen climbing 17.68% to $1.34 billion.

Make sure to keep an eye on TWNK as the stock continues to outperform the market.

Image: Bigstock

A Proven Strategy to Bypass the Economic Uncertainty

The rally off the October lows has clearly favored the Dow 30 holdings, as the major blue-chip average temporarily exited correction territory yesterday. Meanwhile, tech has not fared as well, as the Nasdaq remains near its bear market lows. The S&P 500 continues to hover in a bear market, down more than 20% from its January peak.

There’s certainly no absence of potential catalysts to push equity prices one way or the other, as investors await several results from both the midterm elections as well as a slew of companies that have yet to report third-quarter earnings. And with October’s CPI release due out tomorrow morning, the end of this week is shaping up to be a market mover.

The hard penny investing environment continues, as opposed to the easy dollar, ultra-low interest rate market setting we saw for much of the last decade. Yes, the Fed has begun to drop hints of slowing the pace of future rate hikes, but markets aren’t likely to meaningfully turn the corner until that process becomes clearer. And while it remains to be seen if we are headed for an official recession, stocks tend to put in bottom before that period ends.

One of the ways we can bypass the current economic uncertainty is to identify leading industry groups. Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. Focusing on stocks within the top-performing industries provides a constant ‘tailwind’ to our investing results. Including this step in our selection process also allows us to narrow down the investment universe and select stocks with the best profit potential.

The best-performing industry groups are dynamic and constantly evolving, so investors would be wise to stay abreast of these groups. The stocks within these groups will typically be leading the market – and it is these stocks that we want to target for long trade initiations. Below is one example of a group that is outperforming in the current market environment and whose constituents are receiving positive earnings estimate revisions.

The Zacks Food-Confectionery industry, part of the Consumer Staples sector, is currently ranked in the top 8% of all industry groups. More specifically, this group is ranked #20 out of all 252 Zacks Ranked Industries. This group has steadily outperformed the market this year as we can see below:

Image Source: Zacks Investment Research

Let’s take a deeper look at a highly-rated stock within this leading industry group.

Hostess Brands, Inc.

Hostess Brands is a packaged food company that develops, manufactures, and distributes snack products primarily in the United States. TWNK provides a wide range of sweets such as donuts, pastries, cookies and wafers under various recognized brands like Twinkies, CupCakes, Donettes, HoHos, and Cloverhill.

A Zacks #2 (Buy) stock, TWNK has exceeded earnings estimates in each of the past four quarters, delivering an average earnings surprise of 8.9% over that timeframe. The company most recently reported Q3 EPS last week of $0.23/share, a 9.52% surprise over consensus estimates. Sales of $346.2 million also beat estimates by 7.18%. The sustained success has aided TWNK’s stock this year, returning north of 40% while the major averages hover in a deep correction.

Image Source: Zacks Investment Research

For the full year, analysts have raised their earnings estimates by 1.04% in the past week. TWNK is projected to post 2022 EPS of $0.97/share, reflecting growth of 10.23% relative to last year. Sales are seen climbing 17.68% to $1.34 billion.

Make sure to keep an eye on TWNK as the stock continues to outperform the market.