Encore Wire ) stock looks very attractive sporting a Zacks Rank #1 (Strong Buy) and an overall “A” VGM Style Scores grade for the combination of Value, Growth, and Momentum.

The Industrial Products stock is part of the Wire and Cable Products Industry which is currently in the top 1% of over 250 Zacks Industries. Encore is a low-cost manufacturer of copper and aluminum electrical building wire and cable for the interior wiring in homes, apartments, manufactured housing, and commercial and industrial buildings.

Encore has been a primary beneficiary of what the company stated is a continued tightness in raw materials and the general inability of the sector to meet demand for the timely delivery of finished goods which has kept its bookings strong.

Style Scores

The recent pullback from its 52-week highs could certainly be a buying opportunity and Encore stock checks all the boxes for a buy-the-dip prospect as it relates to the Zacks Style Scores which serve as a complementary set of indicators to use alongside the Zacks Rank.

“A” Momentum Grade

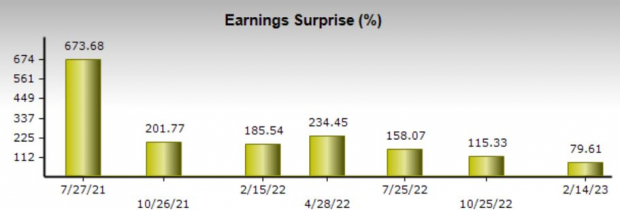

The mild pullback over the last week may be healthy regarding more sustained upside as WIRE stock has soared following its fourth-quarter report on February 14. Encore impressively surpassed Q4 bottom-line expectations by 79% on EPS of $8.28 compared to estimates of $4.61.

Image Source: Zacks Investment Research

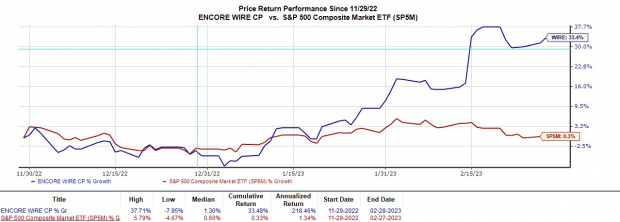

Encore stock was up +19% in February with the S&P 500 down -2% and the Wire & Cable Products Market up +10%. Even better, WIRE stock is up more than 30% in the last three months to easily top the benchmark and its Zacks Subindustry’s +19%.

Image Source: Zacks Investment Research

“A” Growth Grade

Among Encore’s stellar growth, the story here is also the earnings estimate revisions which attribute to the stock sporting a Zacks Rank #1 (Strong Buy).

Encore’s fiscal 2023 earnings estimates have gone up 28% to $19.76 per share over the last 30 days. This is a great sign as FY23 earnings are expected to drop -46% after a very exceptional year that saw EPS of $36.91 in 2022.

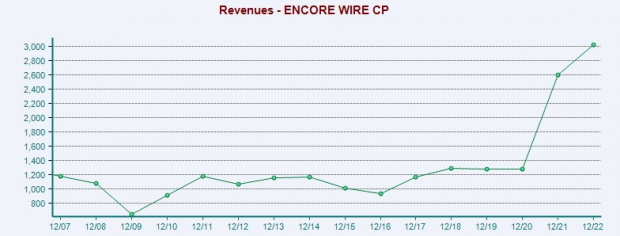

On that note, Encore’s bottom line growth has been remarkable, increasing 886% over the last five years with 2018 EPS at $3.74. On the top line, sales of $3.01 billion in 2022 represented 135% growth over the last five years with 2018 sales at $1.28 billion.

Image Source: Zacks Investment Research

“A” Value Grade

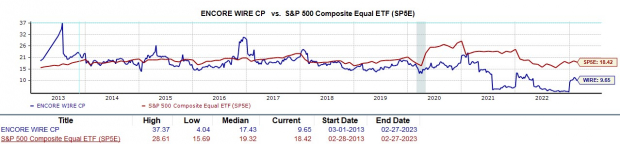

In regards to valuation fundamentals, WIRE trades at $193 per share and just 9.6X forward earnings which is on par with the industry average and well below the S&P 500’s 18.4X. Encore stock also trades 74% below its decade-long high of 37.3X and at a 45% discount to the median of 17.4X.

Image Source: Zacks Investment Research

Balance Sheet & Cash

Piggybacking off of Encore’s valuation, its management team boasted that its impressive balance sheet has no long-term debt and its revolving credit line is untapped. Encore had $730.6 million in cash at the end of 2022 compared to $439 million at year-end 2021.

To the delight of investors, Encore announced it will increase its share repurchase plan from 1 million to 2 million shares to enhance value and capital return for shareholders. Notably, Encore’s low Price/Cash Flow ratio is very attractive for investors at 5.15 compared to the industry average of 7.20 and the S&P 500’s 15.68.

Image Source: Zacks Investment Research

Takeaway

Now may be a great time to buy Encore stock as its historical performance further supports the company’s current momentum, valuation, and growth. Shares of WIRE are now up +489% over the last decade to largely outperform the S&P 500’s +160% with Encore’s strong management, low debt, and cash on hand during economic uncertainty in the broader economy very reassuring.

Bull of the Day: Encore Wire (WIRE)

Encore Wire ) stock looks very attractive sporting a Zacks Rank #1 (Strong Buy) and an overall “A” VGM Style Scores grade for the combination of Value, Growth, and Momentum.

The Industrial Products stock is part of the Wire and Cable Products Industry which is currently in the top 1% of over 250 Zacks Industries. Encore is a low-cost manufacturer of copper and aluminum electrical building wire and cable for the interior wiring in homes, apartments, manufactured housing, and commercial and industrial buildings.

Encore has been a primary beneficiary of what the company stated is a continued tightness in raw materials and the general inability of the sector to meet demand for the timely delivery of finished goods which has kept its bookings strong.

Style Scores

The recent pullback from its 52-week highs could certainly be a buying opportunity and Encore stock checks all the boxes for a buy-the-dip prospect as it relates to the Zacks Style Scores which serve as a complementary set of indicators to use alongside the Zacks Rank.

“A” Momentum Grade

The mild pullback over the last week may be healthy regarding more sustained upside as WIRE stock has soared following its fourth-quarter report on February 14. Encore impressively surpassed Q4 bottom-line expectations by 79% on EPS of $8.28 compared to estimates of $4.61.

Image Source: Zacks Investment Research

Encore stock was up +19% in February with the S&P 500 down -2% and the Wire & Cable Products Market up +10%. Even better, WIRE stock is up more than 30% in the last three months to easily top the benchmark and its Zacks Subindustry’s +19%.

Image Source: Zacks Investment Research

“A” Growth Grade

Among Encore’s stellar growth, the story here is also the earnings estimate revisions which attribute to the stock sporting a Zacks Rank #1 (Strong Buy).

Encore’s fiscal 2023 earnings estimates have gone up 28% to $19.76 per share over the last 30 days. This is a great sign as FY23 earnings are expected to drop -46% after a very exceptional year that saw EPS of $36.91 in 2022.

On that note, Encore’s bottom line growth has been remarkable, increasing 886% over the last five years with 2018 EPS at $3.74. On the top line, sales of $3.01 billion in 2022 represented 135% growth over the last five years with 2018 sales at $1.28 billion.

Image Source: Zacks Investment Research

“A” Value Grade

In regards to valuation fundamentals, WIRE trades at $193 per share and just 9.6X forward earnings which is on par with the industry average and well below the S&P 500’s 18.4X. Encore stock also trades 74% below its decade-long high of 37.3X and at a 45% discount to the median of 17.4X.

Image Source: Zacks Investment Research

Balance Sheet & Cash

Piggybacking off of Encore’s valuation, its management team boasted that its impressive balance sheet has no long-term debt and its revolving credit line is untapped. Encore had $730.6 million in cash at the end of 2022 compared to $439 million at year-end 2021.

To the delight of investors, Encore announced it will increase its share repurchase plan from 1 million to 2 million shares to enhance value and capital return for shareholders. Notably, Encore’s low Price/Cash Flow ratio is very attractive for investors at 5.15 compared to the industry average of 7.20 and the S&P 500’s 15.68.

Image Source: Zacks Investment Research

Takeaway

Now may be a great time to buy Encore stock as its historical performance further supports the company’s current momentum, valuation, and growth. Shares of WIRE are now up +489% over the last decade to largely outperform the S&P 500’s +160% with Encore’s strong management, low debt, and cash on hand during economic uncertainty in the broader economy very reassuring.