Adam Resources & Energy ) currently lands a Zacks Rank #5 (Strong Sell) with its Oil and Gas-Refining and Marketing Industry also in the bottom 29% of over 250 Zacks industries. Investors may want to be cautious with Adam Resources showing signs of a downtrend in the industry.

Recent volatility in crude oil prices may be weighing on Adam Resources which is engaged in oil and gas exploration and production, crude oil marketing, petroleum products marketing, and tank truck transportation of petroleum products and liquid chemicals.

Dimming Outlook

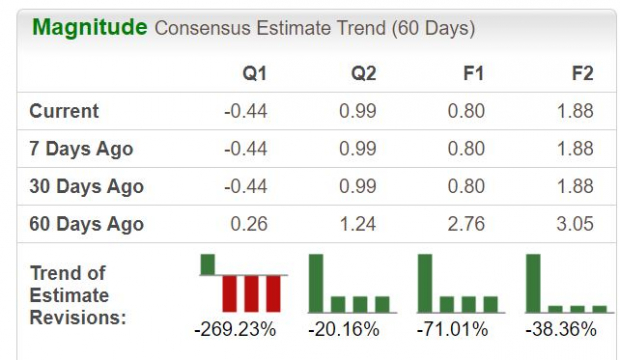

The steep decline in Adam Resources' earnings estimates over the last few months is very alarming. Fiscal 2023 earnings estimates have plunged -70% to $0.80 per share compared to EPS estimates of $2.76 a share 60 days ago.

Furthermore, FY24 EPS estimates have dropped -38% to $1.88 per share compared to estimates of $3.05 a share two months ago.

Image Source: Zacks Investment Research

High Valuation

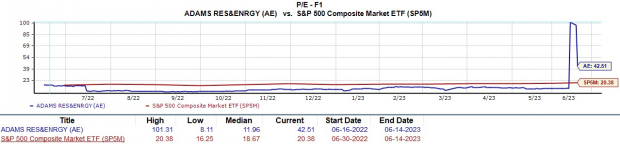

Declining earnings estimates have also dimmed Adam Resources’ valuation. At $35 a share, Adam Resources’ price-to-earnings valuation is still concerning despite dropping from a peak of 101.3X earnings over the last year.

Shares of AE currently trade at 42.5X forward earnings which is uncomfortably above the industry average of 6.7X and the S&P 500’s 20.3X.

Image Source: Zacks Investment Research

Bottom Line

It may be wise for investors to stay away from Adam Resources stock at the moment. The large decline in earnings estimate revisions signals shares of AE could move lower. This is more likely with Adam Resources P/E valuation appearing to be inflated at the moment.

Bear of the Day: Adam Resources & Energy (AE)

Adam Resources & Energy ) currently lands a Zacks Rank #5 (Strong Sell) with its Oil and Gas-Refining and Marketing Industry also in the bottom 29% of over 250 Zacks industries. Investors may want to be cautious with Adam Resources showing signs of a downtrend in the industry.

Recent volatility in crude oil prices may be weighing on Adam Resources which is engaged in oil and gas exploration and production, crude oil marketing, petroleum products marketing, and tank truck transportation of petroleum products and liquid chemicals.

Dimming Outlook

The steep decline in Adam Resources' earnings estimates over the last few months is very alarming. Fiscal 2023 earnings estimates have plunged -70% to $0.80 per share compared to EPS estimates of $2.76 a share 60 days ago.

Furthermore, FY24 EPS estimates have dropped -38% to $1.88 per share compared to estimates of $3.05 a share two months ago.

Image Source: Zacks Investment Research

High Valuation

Declining earnings estimates have also dimmed Adam Resources’ valuation. At $35 a share, Adam Resources’ price-to-earnings valuation is still concerning despite dropping from a peak of 101.3X earnings over the last year.

Shares of AE currently trade at 42.5X forward earnings which is uncomfortably above the industry average of 6.7X and the S&P 500’s 20.3X.

Image Source: Zacks Investment Research

Bottom Line

It may be wise for investors to stay away from Adam Resources stock at the moment. The large decline in earnings estimate revisions signals shares of AE could move lower. This is more likely with Adam Resources P/E valuation appearing to be inflated at the moment.