Foot Locker , a retailer of athletic shoes and apparel with nearly 2,600 stores worldwide is fighting to find its place in the dynamic retail landscape as sales decline and earnings are revised lower, giving it a Zacks Rank #5 (Strong Sell) rating. These developments, among others, make Foot Locker stock one that investors should avoid until management can shift the focus of the company.

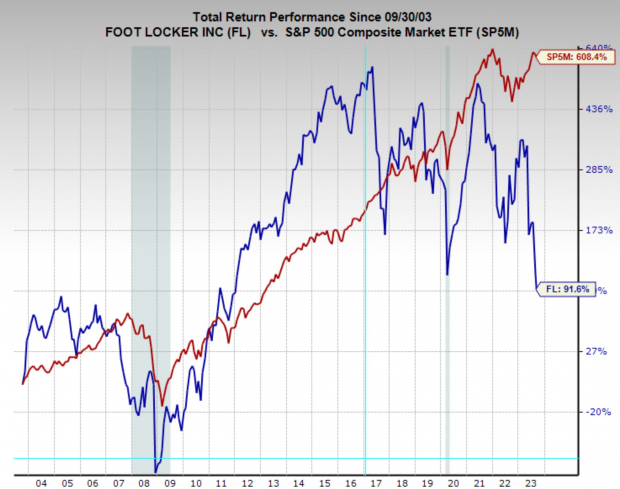

Demonstrating just how challenging the retail industry is, FL stock has returned just 3.3% annually over the last 20 years, substantially underperforming the broad market, which returned 10% annually. However, that poor performance is still better than the industry average of just 2.8% annual return over the same period.

Image Source: Zacks Investment Research

Earnings Downgrades

Foot Locker’s bleak outlook is highlighted by its anemic sales growth. Q2 sales of $1.8 billion missed analyst estimates and showed a -9.9% YoY decline. Next quarter and FY23 sales are also expected to see YoY declines of -9%.

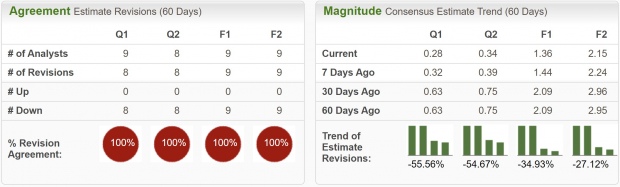

Analysts have unanimously revised Foot Locker’s earnings estimates lower over the last two months. Current quarterly earnings expectations have been lowered by -56% and are projected to fall -78% YoY to $0.28 per share. FY23 earnings estimates have been downgraded by -35% and are forecast to decline -73% YoY to $1.36 per share.

Accenting just how badly FL is struggling was the large drop in margins in the recent quarterly report. Gross margins fell 460 basis points YoY due to higher promotional activity and markdowns.

Image Source: Zacks Investment Research

Valuation

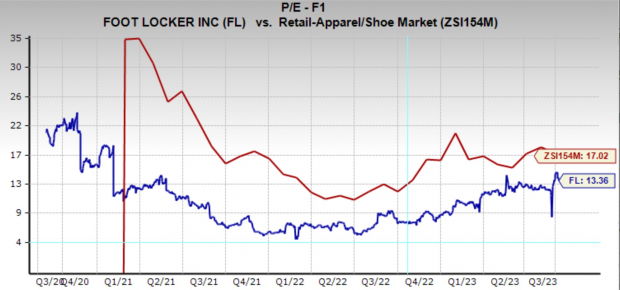

Even with these bearish developments, Foot Locker still trades above its historical valuation. Today, FL is trading at a one year forward earnings multiple of 13.4x, which is below the industry average, and above its 10-year median of 12x.

Image Source: Zacks Investment Research

Bottom Line

There is a bright spot for the company though, as its digital business has been performing well. Foot Locker has been investing in its digital presence to bolster its omni-channel capabilities allowing customers the option to “Shop My Store,” buy online and pickup in person, a membership program, and the option to make purchases using Apple Pay and Google Pay.

However, while e-commerce developments are promising, there is still a way to go before FL is worth investing in. Investors can start to consider the stock again once it begins to see its earnings estimates trend higher again.

Bear of the Day: Foot Locker (FL)

Foot Locker , a retailer of athletic shoes and apparel with nearly 2,600 stores worldwide is fighting to find its place in the dynamic retail landscape as sales decline and earnings are revised lower, giving it a Zacks Rank #5 (Strong Sell) rating. These developments, among others, make Foot Locker stock one that investors should avoid until management can shift the focus of the company.

Demonstrating just how challenging the retail industry is, FL stock has returned just 3.3% annually over the last 20 years, substantially underperforming the broad market, which returned 10% annually. However, that poor performance is still better than the industry average of just 2.8% annual return over the same period.

Image Source: Zacks Investment Research

Earnings Downgrades

Foot Locker’s bleak outlook is highlighted by its anemic sales growth. Q2 sales of $1.8 billion missed analyst estimates and showed a -9.9% YoY decline. Next quarter and FY23 sales are also expected to see YoY declines of -9%.

Analysts have unanimously revised Foot Locker’s earnings estimates lower over the last two months. Current quarterly earnings expectations have been lowered by -56% and are projected to fall -78% YoY to $0.28 per share. FY23 earnings estimates have been downgraded by -35% and are forecast to decline -73% YoY to $1.36 per share.

Accenting just how badly FL is struggling was the large drop in margins in the recent quarterly report. Gross margins fell 460 basis points YoY due to higher promotional activity and markdowns.

Image Source: Zacks Investment Research

Valuation

Even with these bearish developments, Foot Locker still trades above its historical valuation. Today, FL is trading at a one year forward earnings multiple of 13.4x, which is below the industry average, and above its 10-year median of 12x.

Image Source: Zacks Investment Research

Bottom Line

There is a bright spot for the company though, as its digital business has been performing well. Foot Locker has been investing in its digital presence to bolster its omni-channel capabilities allowing customers the option to “Shop My Store,” buy online and pickup in person, a membership program, and the option to make purchases using Apple Pay and Google Pay.

However, while e-commerce developments are promising, there is still a way to go before FL is worth investing in. Investors can start to consider the stock again once it begins to see its earnings estimates trend higher again.