This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

I. Introducing Uncertainty

The outlook over the next 12 months looks hazy to many. This is a key concern.

I want to address their worries in this month’s special Zacks Econ section: The multi-faceted role uncertainty plays seems to me worthy of investigation, now.

Four types of worry can be seen, building up with the uncertainty on:

- Economic policy changes, here and abroad

- U.S. macro variables (GDP growth rates and personal consumption)

- Financial market conditions (interest rates clearly), and with

- Any episodes of equity market volatility

For example, we are entering a critical U.S. Presidential election season.

Another major concern comes from the future direction of Fed Funds policy. Will we see more Chair Powell and FOMC hikes, or rate cuts, or a lengthy pause?

In an influential piece published in 2015 in the mainstream American Economic Review (AER), titled Measuring Uncertainty, the three authors wrote down these leading lines—

“How important is time-varying economic uncertainty and what role does it play in macroeconomic fluctuations?”

“A large and growing body of literature has concerned itself with this question.”

“At a general level, uncertainty is typically defined as the conditional volatility of a disturbance that is unforecastable from the perspective of economic agents.”

“In partial equilibrium settings, increases in uncertainty can depress hiring, investment, or consumption

- “If agents are subject to fixed costs or partial irreversibilities (a ‘real options’ effect),

- “If agents are risk averse (a ‘precautionary savings’ effect)," or

- “If financial constraints tighten in response to higher uncertainty (a ‘financial frictions’ effect).”

II. Economic Policy Uncertainty

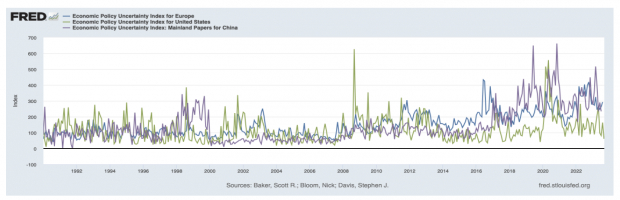

The FRED chart (below) arrays economic policy uncertainty indices for Europe, the USA and in the Mainland Papers for China.

Image Source: St Louis Federal Reserve

In brief, U.S. economic policy uncertainty (green) peaked in the early COVID period. Then, it declined sharply, getting back to where it was, prior to that momentous event. It’s below 100 now.

Not so for both Europe (blue) and China (purple)!

These two indices were elevated back in 2016 to 2018. China’s economic policy uncertainty surged the most both before, during, and after COVID.

Now, both Europe and China economic policy uncertainty are tracking around an index level of 300, while the U.S. is down at around a 100-base level.

Worry on the economic policy direction, in those 2 key global regions is a major factor. That can imply more savings/less investment, tighter financial conditions, and ultimately slower growth.

Indeed, that is what we are seeing. Germany and the Netherlands are in shallow downturns. Mainland China has gotten numerous cuts in its growth outlook, of late.

Image: Bigstock

What Role Does Uncertainty Play?

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

I. Introducing Uncertainty

The outlook over the next 12 months looks hazy to many. This is a key concern.

I want to address their worries in this month’s special Zacks Econ section: The multi-faceted role uncertainty plays seems to me worthy of investigation, now.

Four types of worry can be seen, building up with the uncertainty on:

For example, we are entering a critical U.S. Presidential election season.

Another major concern comes from the future direction of Fed Funds policy. Will we see more Chair Powell and FOMC hikes, or rate cuts, or a lengthy pause?

In an influential piece published in 2015 in the mainstream American Economic Review (AER), titled Measuring Uncertainty, the three authors wrote down these leading lines—

“How important is time-varying economic uncertainty and what role does it play in macroeconomic fluctuations?”

“A large and growing body of literature has concerned itself with this question.”

“At a general level, uncertainty is typically defined as the conditional volatility of a disturbance that is unforecastable from the perspective of economic agents.”

“In partial equilibrium settings, increases in uncertainty can depress hiring, investment, or consumption

II. Economic Policy Uncertainty

The FRED chart (below) arrays economic policy uncertainty indices for Europe, the USA and in the Mainland Papers for China.

Image Source: St Louis Federal Reserve

In brief, U.S. economic policy uncertainty (green) peaked in the early COVID period. Then, it declined sharply, getting back to where it was, prior to that momentous event. It’s below 100 now.

Not so for both Europe (blue) and China (purple)!

These two indices were elevated back in 2016 to 2018. China’s economic policy uncertainty surged the most both before, during, and after COVID.

Now, both Europe and China economic policy uncertainty are tracking around an index level of 300, while the U.S. is down at around a 100-base level.

Worry on the economic policy direction, in those 2 key global regions is a major factor. That can imply more savings/less investment, tighter financial conditions, and ultimately slower growth.

Indeed, that is what we are seeing. Germany and the Netherlands are in shallow downturns. Mainland China has gotten numerous cuts in its growth outlook, of late.