It's back. Pioneer Natural Resources has regained the Zacks #1 (Strong Buy) rank, the top Zacks Rank, as earnings estimates are starting to be revised higher for 2023 and 2024 after they were cut as oil prices declined over the last year.

Pioneer Natural Resources is an independent oil and natural gas exploration and production company with acreage in the Permian Basin. It's one of the largest E&Ps in the industry, with a market cap of $52 billion.

Oil Back to $90

Energy earnings exploded higher last year after the Ukraine War spiked prices of both oil and natural gas to multi-year highs. Pioneer Natural Resources is unhedged, which means it does not have hedging contracts on the commodities.

Earnings soared to $30.57 in 2022 but oil and natural gas prices had been on a steady decline for the last year, which meant that earnings would be much lower.

However, WTI crude has rallied back to $90 a barrel in the third quarter of this year.

Earnings Estimates Inching Up

Average realized price for oil was $72.90 in the second quarter of this year. Analysts are betting it is higher for the third quarter.

1 estimate has been raised for the third quarter and the full year just this week.

For the full year, the Zacks Consensus is moving higher, rising to $20.62 from $18.80 just 60 days ago. This is still an earnings decline of 32.5%, but it is moving in the right direction, which is up.

Analysts are getting bullish on 2024 as well. 1 estimate is higher for 2024 in the last week as well. The 2024 Zacks Consensus Estimate has jumped to $24.23 from $21.22 just 2 months ago. This is earnings growth of 17.5% for next year.

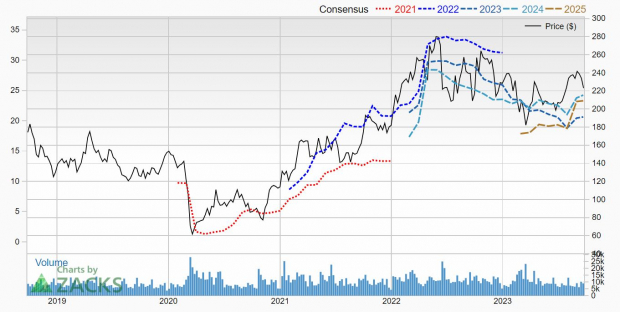

Here's what it looks like on the chart, with the earnings estimates just starting to inch higher.

Image Source: Zacks Investment Research

Pioneer is Cheap

Shares of Pioneer have been in a narrow trading range for the last year. They have really under performed the S&P 500 though.

Image Source: Zacks Investment Research

But the shares are cheap, with a forward P/E of just 10.8.

It also has one of the best balance sheets in the industry. As of June 30, 2023, it had net debt of $5.2 billion. It also had $1.9 billion of liquidity, comprised of $91 million of cash on hand and $1.8 billion available under a $2.0 billion unsecured credit facility.

In the second quarter, Pioneer generated $742 million in free cash flow. It paid out 75% of it to shareholders in the form of a base plus variable dividend, which was $1.84 per share, as well as a $124 million share repurchase.

The dividend yielded 3.3% at the time of the release of the earnings results on Aug 1, 2023.

If you are looking for a large independent E&P which is shareholder friendly with energy prices on the rise, Pioneer Natural Resources should be on your short list.

[In full disclosure, Tracey owns shares of PXD in Zacks Value Investor portfolio and her own personal portfolio.]

Image: Bigstock

Bull of the Day: Pioneer Natural Resources (PXD)

It's back. Pioneer Natural Resources has regained the Zacks #1 (Strong Buy) rank, the top Zacks Rank, as earnings estimates are starting to be revised higher for 2023 and 2024 after they were cut as oil prices declined over the last year.

Pioneer Natural Resources is an independent oil and natural gas exploration and production company with acreage in the Permian Basin. It's one of the largest E&Ps in the industry, with a market cap of $52 billion.

Oil Back to $90

Energy earnings exploded higher last year after the Ukraine War spiked prices of both oil and natural gas to multi-year highs. Pioneer Natural Resources is unhedged, which means it does not have hedging contracts on the commodities.

Earnings soared to $30.57 in 2022 but oil and natural gas prices had been on a steady decline for the last year, which meant that earnings would be much lower.

However, WTI crude has rallied back to $90 a barrel in the third quarter of this year.

Earnings Estimates Inching Up

Average realized price for oil was $72.90 in the second quarter of this year. Analysts are betting it is higher for the third quarter.

1 estimate has been raised for the third quarter and the full year just this week.

For the full year, the Zacks Consensus is moving higher, rising to $20.62 from $18.80 just 60 days ago. This is still an earnings decline of 32.5%, but it is moving in the right direction, which is up.

Analysts are getting bullish on 2024 as well. 1 estimate is higher for 2024 in the last week as well. The 2024 Zacks Consensus Estimate has jumped to $24.23 from $21.22 just 2 months ago. This is earnings growth of 17.5% for next year.

Here's what it looks like on the chart, with the earnings estimates just starting to inch higher.

Image Source: Zacks Investment Research

Pioneer is Cheap

Shares of Pioneer have been in a narrow trading range for the last year. They have really under performed the S&P 500 though.

Image Source: Zacks Investment Research

But the shares are cheap, with a forward P/E of just 10.8.

It also has one of the best balance sheets in the industry. As of June 30, 2023, it had net debt of $5.2 billion. It also had $1.9 billion of liquidity, comprised of $91 million of cash on hand and $1.8 billion available under a $2.0 billion unsecured credit facility.

In the second quarter, Pioneer generated $742 million in free cash flow. It paid out 75% of it to shareholders in the form of a base plus variable dividend, which was $1.84 per share, as well as a $124 million share repurchase.

The dividend yielded 3.3% at the time of the release of the earnings results on Aug 1, 2023.

If you are looking for a large independent E&P which is shareholder friendly with energy prices on the rise, Pioneer Natural Resources should be on your short list.

[In full disclosure, Tracey owns shares of PXD in Zacks Value Investor portfolio and her own personal portfolio.]