AvidXchange Holdings, Inc. is an accounts payable software and payment solutions firm. AvidXchange crushed our Q3 earnings estimates in early November and boosted its outlook.

AVDX stock has surged since its release to take it above key moving averages. AvidXchange is also gaining more attention from Wall Street.

On top of that, AvidXchange trades for around $11 per share and roughly 60% below its post-IPO highs in late 2021 right as the market peaked.

Simple & Essential

AvidXchange’s core business is focused on accounts payable automation software and payment solutions for mid-market businesses and their suppliers. AVDX aims to help boost efficiency, visibility, and control across the entire accounts payable process, while also attempting to reduce costs and risks.

AvidXchange’s customers can integrate its offerings within their current accounting systems and enterprise resource planning solutions from Intuit’s QuickBooks to Microsoft Dynamics and beyond. AVDX's specific offerings include AI-powered invoice automation software, purchase order software, purchase-to-pay automation, and much more.

Image Source: Zacks Investment Research

AvidXchange’s accounts payable software is hardly flashy, but successfully operating in the background has helped it amass nearly 9,000 customers across real estate, construction, financial services, healthcare, technology, and beyond.

Recent Growth & Outlook

AvidXchange posted a solid beat-and-raise third quarter on November 8. The firm reported adjusted earnings of +$0.03 a share to blow away the Zacks estimate of a -$0.05 per share loss on the back of 20% revenue growth.

AVDX has crushed our bottom-line estimates for four periods running. AVDX’s boosted earnings outlook helps it land a Zacks Rank #1 (Strong Buy) right now.

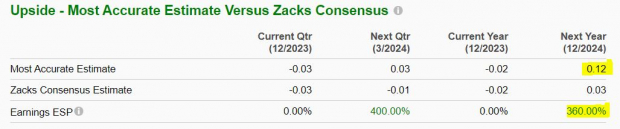

Image Source: Zacks Investment Research

AvidXchange is currently projected to trim its adjusted full year loss from -$0.24 a share to -$0.02 and then surge to +$0.03 in 2024.

Better still, AVDX’s most accurate/most recent estimate for FY24 came in at +$0.12 per share, 360% higher than its already hugely improved consensus. The company’s newly-boosted adjusted EPS estimates extended its streak of improving earnings outlooks that began in early 2022.

AvidXchange said when it reported its third quarter results that it is positioned to achieve its “medium and long-term Rule of 40 and 40-plus targets.” The Rule of 40, which is a metric many successful software firms aim to sustain, is when a firm achieves a combined growth rate and profit margin of 40% or higher.

Zacks estimates call for AvidXchange to post 19% revenue growth in both 2023 and 2024 to climb from $316 million last year to $444.6 million in fiscal 2024. The firm’s projected expansion comes on top of 27% revenue growth in FY22 (its first full year public).

Price Performance & Technical Levels

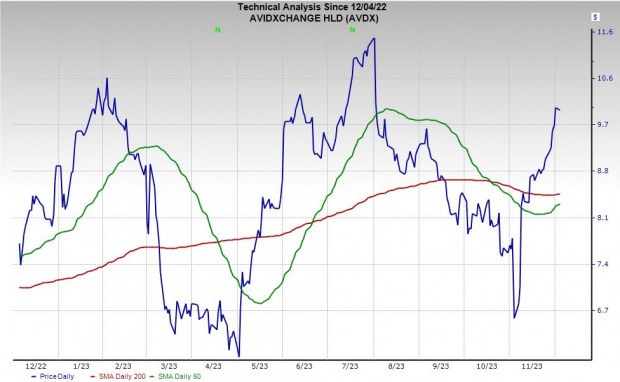

AvidXchange stock is up 10% in 2023 vs. the Zacks Tech sector’s 45%. AVDX’s YTD performance includes some large swings. AVDX stock has surged 40% since early November. The recent rebound sent AVDX shares back above their 50-day and 200-day moving averages.

Image Source: Zacks Investment Research

AVDX went public in the fourth quarter of 2021 right before the market peaked. AvidXchange is currently trading roughly 60% below its highs of over $25 per share at $11. AVDX also trades about 12% below its average Zacks price target.

The company’s valuation levels in terms of earnings multiples are a bit out of whack considering that it is not projected to swing to positive adjusted earnings until next year. AvidXchange trades 72% below its highs at 5.1X forward 12-month sales vs. Tech’s 4X.

Bottom Line

The stock is gaining more attention from Wall Street. Zacks currently has 12 brokerage recommendations for AvidXchange vs. 10 two months ago, and eight of those 12 brokerage recommendations are “Strong Buys.” Additional brokerage coverage could help AvidXchange stock in both the near term and the long run.

AvidXchange’s balance sheet is solid, and the firm continues to gain steam in an essential and critical area of business software, while also landing more key partnerships.

Bull of the Day: AvidXchange Holdings, Inc. (AVDX)

AvidXchange Holdings, Inc. is an accounts payable software and payment solutions firm. AvidXchange crushed our Q3 earnings estimates in early November and boosted its outlook.

AVDX stock has surged since its release to take it above key moving averages. AvidXchange is also gaining more attention from Wall Street.

On top of that, AvidXchange trades for around $11 per share and roughly 60% below its post-IPO highs in late 2021 right as the market peaked.

Simple & Essential

AvidXchange’s core business is focused on accounts payable automation software and payment solutions for mid-market businesses and their suppliers. AVDX aims to help boost efficiency, visibility, and control across the entire accounts payable process, while also attempting to reduce costs and risks.

AvidXchange’s customers can integrate its offerings within their current accounting systems and enterprise resource planning solutions from Intuit’s QuickBooks to Microsoft Dynamics and beyond. AVDX's specific offerings include AI-powered invoice automation software, purchase order software, purchase-to-pay automation, and much more.

Image Source: Zacks Investment Research

AvidXchange’s accounts payable software is hardly flashy, but successfully operating in the background has helped it amass nearly 9,000 customers across real estate, construction, financial services, healthcare, technology, and beyond.

Recent Growth & Outlook

AvidXchange posted a solid beat-and-raise third quarter on November 8. The firm reported adjusted earnings of +$0.03 a share to blow away the Zacks estimate of a -$0.05 per share loss on the back of 20% revenue growth.

AVDX has crushed our bottom-line estimates for four periods running. AVDX’s boosted earnings outlook helps it land a Zacks Rank #1 (Strong Buy) right now.

Image Source: Zacks Investment Research

AvidXchange is currently projected to trim its adjusted full year loss from -$0.24 a share to -$0.02 and then surge to +$0.03 in 2024.

Better still, AVDX’s most accurate/most recent estimate for FY24 came in at +$0.12 per share, 360% higher than its already hugely improved consensus. The company’s newly-boosted adjusted EPS estimates extended its streak of improving earnings outlooks that began in early 2022.

AvidXchange said when it reported its third quarter results that it is positioned to achieve its “medium and long-term Rule of 40 and 40-plus targets.” The Rule of 40, which is a metric many successful software firms aim to sustain, is when a firm achieves a combined growth rate and profit margin of 40% or higher.

Zacks estimates call for AvidXchange to post 19% revenue growth in both 2023 and 2024 to climb from $316 million last year to $444.6 million in fiscal 2024. The firm’s projected expansion comes on top of 27% revenue growth in FY22 (its first full year public).

Price Performance & Technical Levels

AvidXchange stock is up 10% in 2023 vs. the Zacks Tech sector’s 45%. AVDX’s YTD performance includes some large swings. AVDX stock has surged 40% since early November. The recent rebound sent AVDX shares back above their 50-day and 200-day moving averages.

Image Source: Zacks Investment Research

AVDX went public in the fourth quarter of 2021 right before the market peaked. AvidXchange is currently trading roughly 60% below its highs of over $25 per share at $11. AVDX also trades about 12% below its average Zacks price target.

The company’s valuation levels in terms of earnings multiples are a bit out of whack considering that it is not projected to swing to positive adjusted earnings until next year. AvidXchange trades 72% below its highs at 5.1X forward 12-month sales vs. Tech’s 4X.

Bottom Line

The stock is gaining more attention from Wall Street. Zacks currently has 12 brokerage recommendations for AvidXchange vs. 10 two months ago, and eight of those 12 brokerage recommendations are “Strong Buys.” Additional brokerage coverage could help AvidXchange stock in both the near term and the long run.

AvidXchange’s balance sheet is solid, and the firm continues to gain steam in an essential and critical area of business software, while also landing more key partnerships.