We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Markets Appear Vulnerable: Hideout in these 3 Top Ranked Defensive Stocks

The stock market has moved aggressively higher since the start of the year with the S&P 500 gaining 4.6% YTD and the Nasdaq 100 5.2%. While there is nothing inherently wrong with the market showing such strength, there are a few concerning developments brewing that may lead to at least a minor correction in the coming weeks.

Because of these developments, I am turning my focus to some more defensive stocks which I will share here.

Channel Breakdown

In the chart below we can see that the Nasdaq 100 has been trading almost perfectly up and to the right for the last three and a half months. But volatility has begun to pick up, and the index has now broken down below the lower bound of this upward trending channel.

These channel breakdowns can often be an early signal for more volatility, and so long as the market is below this level, I remain cautious. There is a similar setup in the S&P 500 as well.

Image Source: TradingView

Rates and Inflation

Part of what powered the stock market rally over the last three months was the growing expectation that the Fed would be cutting interest rates early in 2024. But it seems we may be kicking the can down the road.

At the last CPI data release, we learned that inflation was hotter than expected, indicating that there may be some risk of cutting rates too early. Additionally, the employment data has also consistently shown that the labor market is extremely strong.

Because it appears that the economy is still in expansion, even with high interest rates, there is very little pressure on the central bank to rush and lower interest rates, and in fact there may be a risk of causing the economy to overheat if they do it too soon.

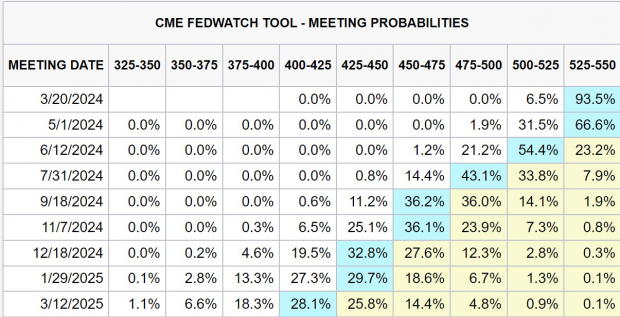

Just a month ago, futures markets were pricing in the first rate cut at the March meeting, and a second rate cut at the May meeting, but both of those are now off the table. This is already a big reversal in interest rate expectations and the ‘higher for longer’ narrative could be a catalyst for a further market selloff.

Image Source: CME Group

Seasonality

Last year we learned just how influential the seasonal trends of the market can be, as equities followed them almost perfectly all year. If you respect the market’s seasonality, you should be concerned about the next month.

As can be seen in the chart below, the S&P 500 has just entered what is often the most volatile period of the year. Now through mid-March has the potential to bring some considerable selling.

Image Source: Equity Clock

Leading Stocks Reverting

A lot of the upside action in markets has been taking place in the high velocity, high growth technology and Artificial Intelligence adjacent stocks. Namely Super Micro Computer(SMCI - Free Report) and Nvidia(NVDA - Free Report) have made truly stunning moves in just the last six weeks, with SMCI rallying as much as 280%, only to fall more than -30% in just the last week.

But there are other cracks forming in these leading sectors. Cloud and cyber security stocks have also been major contributors to the rally, and just this morning, one of the leading names got hit hard. Palo Alto Networks (PANW - Free Report) , got hammered -30% this morning after cutting guidance.

The mean reversion occurring in these high momentum stocks has me looking for low-risk, secure, non-cyclical stocks to rotate into.

Image Source: TradingView

Top Ranked Stocks for Defense

Now all these factors together don’t necessarily mean there is a stock market crash around the corner. The economy is strong, the Fed will be cutting rates later this year, and we are likely in a longer-term bull market that started last year.

However, even bull markets can have pullbacks of 5-10%, and for investors looking to get tactically defensive, now is a good time to initiate that plan.

One of the first places I like to look for defensive stocks is the healthcare sector. Medical stocks have non-cyclical characteristics, and regularly outperform the market during periods of elevated volatility. Even better if I can find ones that have a top Zacks Rank and are showing relative strength against the market.

The two healthcare stocks that I am looking at are HCA Healthcare (HCA - Free Report) and DaVita (DVA - Free Report) . Both stocks have Zacks Rank #1 (Strong Buy) ratings and are industry leading names.

HCA Healthcare is the largest non-governmental operator of acute care hospitals in the US and enjoys a steady earnings revisions trend, and reasonable growth estimates in the coming years. Furthermore, the price action in the stock has been forming a convincing bullish pattern.

If HCA stock can breakout above the $310 level, it should send it to new highs.

Image Source: TradingView

DaVita, the country’s leading provider of dialysis care has a very similar setup to HCA Healthcare. In addition to a steady earnings revision trend, and strong EPS growth estimates, the DaVita has a reasonable valuation of 13.7x forward earnings.

It also has a clean technical trade setup like HCA. After gapping up following earnings, DaVita stock has been building out a bull flag. A move above the $123.50 level would signal a breakout, and likely draw in buyers.

Image Source: TradingView

And finally, the last defensive stock pick is General Motors (GM - Free Report) . In addition to a Zacks Rank #1 (Strong Buy) rating, demonstrated by upward trending earnings revisions, the stock has a rock-bottom valuation. General Motors has a one year forward earnings multiple of just 4.3x. And with EPS growth estimates of 9% annually over the next 3-5 years, that gives GM a PEG Ratio of just 0.48x, indicating deep value based on the metric.

Like the others, General Motors stock also boasts a clean technical trading setup. Just today, GM stock broke out from a bull flag, and looks primed for a big move higher. What makes this strength even more impressive is that the stock is strong while the broad market is selling off today.

Image Source: TradingView

Bottom Line

As is clear from the above write-up, there are at least a few developments in this market that are concerning. From interest rates to technical breakdowns, and we haven’t even mentioned the geopolitical tensions and approaching US presidential election, which only add to the uncertainty.

We also have to wait and see earnings from Nvidia today after the close, which is probably the most important earnings event of the season.

Nonetheless, even with all these bearish catalysts building there is always a bull market somewhere, you just have to dig.

Best of luck trading!

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Markets Appear Vulnerable: Hideout in these 3 Top Ranked Defensive Stocks

The stock market has moved aggressively higher since the start of the year with the S&P 500 gaining 4.6% YTD and the Nasdaq 100 5.2%. While there is nothing inherently wrong with the market showing such strength, there are a few concerning developments brewing that may lead to at least a minor correction in the coming weeks.

Because of these developments, I am turning my focus to some more defensive stocks which I will share here.

Channel Breakdown

In the chart below we can see that the Nasdaq 100 has been trading almost perfectly up and to the right for the last three and a half months. But volatility has begun to pick up, and the index has now broken down below the lower bound of this upward trending channel.

These channel breakdowns can often be an early signal for more volatility, and so long as the market is below this level, I remain cautious. There is a similar setup in the S&P 500 as well.

Image Source: TradingView

Rates and Inflation

Part of what powered the stock market rally over the last three months was the growing expectation that the Fed would be cutting interest rates early in 2024. But it seems we may be kicking the can down the road.

At the last CPI data release, we learned that inflation was hotter than expected, indicating that there may be some risk of cutting rates too early. Additionally, the employment data has also consistently shown that the labor market is extremely strong.

Because it appears that the economy is still in expansion, even with high interest rates, there is very little pressure on the central bank to rush and lower interest rates, and in fact there may be a risk of causing the economy to overheat if they do it too soon.

Just a month ago, futures markets were pricing in the first rate cut at the March meeting, and a second rate cut at the May meeting, but both of those are now off the table. This is already a big reversal in interest rate expectations and the ‘higher for longer’ narrative could be a catalyst for a further market selloff.

Image Source: CME Group

Seasonality

Last year we learned just how influential the seasonal trends of the market can be, as equities followed them almost perfectly all year. If you respect the market’s seasonality, you should be concerned about the next month.

As can be seen in the chart below, the S&P 500 has just entered what is often the most volatile period of the year. Now through mid-March has the potential to bring some considerable selling.

Image Source: Equity Clock

Leading Stocks Reverting

A lot of the upside action in markets has been taking place in the high velocity, high growth technology and Artificial Intelligence adjacent stocks. Namely Super Micro Computer (SMCI - Free Report) and Nvidia (NVDA - Free Report) have made truly stunning moves in just the last six weeks, with SMCI rallying as much as 280%, only to fall more than -30% in just the last week.

But there are other cracks forming in these leading sectors. Cloud and cyber security stocks have also been major contributors to the rally, and just this morning, one of the leading names got hit hard. Palo Alto Networks (PANW - Free Report) , got hammered -30% this morning after cutting guidance.

The mean reversion occurring in these high momentum stocks has me looking for low-risk, secure, non-cyclical stocks to rotate into.

Image Source: TradingView

Top Ranked Stocks for Defense

Now all these factors together don’t necessarily mean there is a stock market crash around the corner. The economy is strong, the Fed will be cutting rates later this year, and we are likely in a longer-term bull market that started last year.

However, even bull markets can have pullbacks of 5-10%, and for investors looking to get tactically defensive, now is a good time to initiate that plan.

One of the first places I like to look for defensive stocks is the healthcare sector. Medical stocks have non-cyclical characteristics, and regularly outperform the market during periods of elevated volatility. Even better if I can find ones that have a top Zacks Rank and are showing relative strength against the market.

The two healthcare stocks that I am looking at are HCA Healthcare (HCA - Free Report) and DaVita (DVA - Free Report) . Both stocks have Zacks Rank #1 (Strong Buy) ratings and are industry leading names.

HCA Healthcare is the largest non-governmental operator of acute care hospitals in the US and enjoys a steady earnings revisions trend, and reasonable growth estimates in the coming years. Furthermore, the price action in the stock has been forming a convincing bullish pattern.

If HCA stock can breakout above the $310 level, it should send it to new highs.

Image Source: TradingView

DaVita, the country’s leading provider of dialysis care has a very similar setup to HCA Healthcare. In addition to a steady earnings revision trend, and strong EPS growth estimates, the DaVita has a reasonable valuation of 13.7x forward earnings.

It also has a clean technical trade setup like HCA. After gapping up following earnings, DaVita stock has been building out a bull flag. A move above the $123.50 level would signal a breakout, and likely draw in buyers.

Image Source: TradingView

And finally, the last defensive stock pick is General Motors (GM - Free Report) . In addition to a Zacks Rank #1 (Strong Buy) rating, demonstrated by upward trending earnings revisions, the stock has a rock-bottom valuation. General Motors has a one year forward earnings multiple of just 4.3x. And with EPS growth estimates of 9% annually over the next 3-5 years, that gives GM a PEG Ratio of just 0.48x, indicating deep value based on the metric.

Like the others, General Motors stock also boasts a clean technical trading setup. Just today, GM stock broke out from a bull flag, and looks primed for a big move higher. What makes this strength even more impressive is that the stock is strong while the broad market is selling off today.

Image Source: TradingView

Bottom Line

As is clear from the above write-up, there are at least a few developments in this market that are concerning. From interest rates to technical breakdowns, and we haven’t even mentioned the geopolitical tensions and approaching US presidential election, which only add to the uncertainty.

We also have to wait and see earnings from Nvidia today after the close, which is probably the most important earnings event of the season.

Nonetheless, even with all these bearish catalysts building there is always a bull market somewhere, you just have to dig.

Best of luck trading!