We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Hidden Gem: This Underfollowed Top Ranked Stock is Integral to the AI Boom

Although it may seem like Artificial Intelligence stocks are all that’s being talked about these days, the hype is indeed real. AI technology will probably be as significant to the stock market and economy as the internet has been, and the market has been telling us this in bold font.

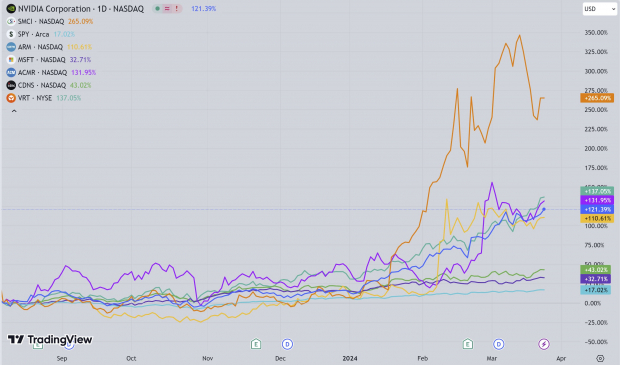

Just look at this popular basket of AI-adjacent stocks and see how significant the market outperformance has been in the last seven months. Even the lowest performing stock has nearly doubled the returns of the broad market over that time.

I will say some of these stocks have had their valuations pumped up significantly, possibly limiting the near-term upside. Thus, I have been looking for some off-the-beaten-path AI opportunities.

By utilizing the Zacks Rank, I have identified one such stock that I think may offer huge opportunity over the next few months and years. It is a small cap stock that plays a particularly niche role in the semiconductor industry and is anticipating exceptional growth in the coming years.

Read ahead and learn about ACM Research (ACMR - Free Report) .

Image Source: TradingView

ACM Research

ACM Research is a leading provider of single-wafer wet cleaning equipment, offering innovative solutions for semiconductor manufacturing processes. Founded in 1998, the company specializes in developing, manufacturing, and selling advanced cleaning equipment designed to meet the stringent requirements of the semiconductor industry.

ACM's technology enables precise and efficient cleaning of individual silicon wafers, essential for ensuring high-quality semiconductor production.

ACM Research also plays a crucial role in the AI industry through its cutting-edge wet cleaning equipment. As AI hardware demands increasingly sophisticated semiconductor components, the need for precise and reliable wafer cleaning solutions becomes paramount. ACM's technology ensures the cleanliness and integrity of semiconductor wafers, contributing to the manufacturing of AI chips with optimal performance and efficiency.

By providing essential equipment for semiconductor fabrication, ACM Research indirectly supports the development and advancement of AI technologies, enabling the deployment of powerful AI systems across various applications and industries.

However, because this is a little-known company, its influence on the industry is easily overlooked, and thus creates a fantastic opportunity for discerning investors.

Not only does ACMR have this under-the-radar status, but it also enjoys a Zacks Rank #1 (Strong Buy) rating, impressive growth forecasts, a reasonable valuation, and a compelling technical trading setup.

Sales and Earnings

Earnings estimates have rocketed higher over the last month as analysts realize the tailwind AI will provide ACMR’s business. ACM Research also sits in the Top 1% of the Zacks Industry Rank (1 out of 252) and is the only name in the Semiconductor Equipment – Material Services industry.

Image Source: Zacks Investment Research

Sales at ACM Research have been rising at an exponential pace over the last five years going from just under $100 million annually to more than $550 million in the trailing 12 months. That pace of growth is expected to continue as well with current forecasts expecting 25% YoY growth this year and 26% next year.

Image Source: Zacks Investment Research

Valuation

At this point in time, ACM Research is trading near its five-year low in terms of earnings multiples. Today, it is valued at 18.5x TTM earnings, which is well below the industry average and its five-year median.

Because ACMR has flown under the radar since the start of the AI boom, its valuation hasn’t been jacked up nearly as much as the other AI adjacent stocks. Thus, investors buying now are getting in a below industry valuation, with multi-year tailwinds at their backs.

Image Source: Zacks Investment Research

Technical Setup

Finally, ACM Research stock just broke out from a powerful technical trading setup. After building out a descending bull flag for the last few weeks, price blasted through resistance, and look ready to push to new YTD highs.

Image Source: TradingView

Bottom Line

For investors looking to add exposure to the Artificial Intelligence theme, while also focusing on a quality, small cap company, ACM Research may very well be your next portfolio addition. Furthermore, it offers the advantage of being little followed and also critical to the industry so you know the business has staying power.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Hidden Gem: This Underfollowed Top Ranked Stock is Integral to the AI Boom

Although it may seem like Artificial Intelligence stocks are all that’s being talked about these days, the hype is indeed real. AI technology will probably be as significant to the stock market and economy as the internet has been, and the market has been telling us this in bold font.

Just look at this popular basket of AI-adjacent stocks and see how significant the market outperformance has been in the last seven months. Even the lowest performing stock has nearly doubled the returns of the broad market over that time.

I will say some of these stocks have had their valuations pumped up significantly, possibly limiting the near-term upside. Thus, I have been looking for some off-the-beaten-path AI opportunities.

By utilizing the Zacks Rank, I have identified one such stock that I think may offer huge opportunity over the next few months and years. It is a small cap stock that plays a particularly niche role in the semiconductor industry and is anticipating exceptional growth in the coming years.

Read ahead and learn about ACM Research (ACMR - Free Report) .

Image Source: TradingView

ACM Research

ACM Research is a leading provider of single-wafer wet cleaning equipment, offering innovative solutions for semiconductor manufacturing processes. Founded in 1998, the company specializes in developing, manufacturing, and selling advanced cleaning equipment designed to meet the stringent requirements of the semiconductor industry.

ACM's technology enables precise and efficient cleaning of individual silicon wafers, essential for ensuring high-quality semiconductor production.

ACM Research also plays a crucial role in the AI industry through its cutting-edge wet cleaning equipment. As AI hardware demands increasingly sophisticated semiconductor components, the need for precise and reliable wafer cleaning solutions becomes paramount. ACM's technology ensures the cleanliness and integrity of semiconductor wafers, contributing to the manufacturing of AI chips with optimal performance and efficiency.

By providing essential equipment for semiconductor fabrication, ACM Research indirectly supports the development and advancement of AI technologies, enabling the deployment of powerful AI systems across various applications and industries.

However, because this is a little-known company, its influence on the industry is easily overlooked, and thus creates a fantastic opportunity for discerning investors.

Not only does ACMR have this under-the-radar status, but it also enjoys a Zacks Rank #1 (Strong Buy) rating, impressive growth forecasts, a reasonable valuation, and a compelling technical trading setup.

Sales and Earnings

Earnings estimates have rocketed higher over the last month as analysts realize the tailwind AI will provide ACMR’s business. ACM Research also sits in the Top 1% of the Zacks Industry Rank (1 out of 252) and is the only name in the Semiconductor Equipment – Material Services industry.

Image Source: Zacks Investment Research

Sales at ACM Research have been rising at an exponential pace over the last five years going from just under $100 million annually to more than $550 million in the trailing 12 months. That pace of growth is expected to continue as well with current forecasts expecting 25% YoY growth this year and 26% next year.

Image Source: Zacks Investment Research

Valuation

At this point in time, ACM Research is trading near its five-year low in terms of earnings multiples. Today, it is valued at 18.5x TTM earnings, which is well below the industry average and its five-year median.

Because ACMR has flown under the radar since the start of the AI boom, its valuation hasn’t been jacked up nearly as much as the other AI adjacent stocks. Thus, investors buying now are getting in a below industry valuation, with multi-year tailwinds at their backs.

Image Source: Zacks Investment Research

Technical Setup

Finally, ACM Research stock just broke out from a powerful technical trading setup. After building out a descending bull flag for the last few weeks, price blasted through resistance, and look ready to push to new YTD highs.

Image Source: TradingView

Bottom Line

For investors looking to add exposure to the Artificial Intelligence theme, while also focusing on a quality, small cap company, ACM Research may very well be your next portfolio addition. Furthermore, it offers the advantage of being little followed and also critical to the industry so you know the business has staying power.