We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

US stock indexes have staged yet another bullish breakout. The economy is steady, employment is robust, inflation continues to fall, and stocks are making record highs – if you aren’t bullish now, I don’t know what else to tell you.

Image Source: TradingView

Stock Market Generals Grow Profits, Show Powerful Momentum

Life can be very easy in this market, as some of the largest and most prevalent companies in the world are still trading at appealing levels.

The ‘Magnificent 7’ continues to grow earnings at an incredible pace, while the stocks also shows encouraging momentum. Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +25.5% from the same period last year on +13.1% higher revenues, while the stock prices on several of them push YTD highs.

My favorite names from the Mag 7 currently are Amazon ((AMZN - Free Report) ), Apple ((AAPL - Free Report) ), and Alphabet ((GOOGL - Free Report) ). Also, Nvidia ((NVDA - Free Report) ), gets an honorable mention because it too is still a fantastic stock with a top Zacks Rank.

In the chart below we can see that each of these stocks is showing significant relative strength against the broad market. Apple, although it trails the market YTD, shows the most significant short-term momentum, up 30% in just the last three months.

Image Source: Zacks Investment Research

Rising Earnings Trend Lifts Share Price

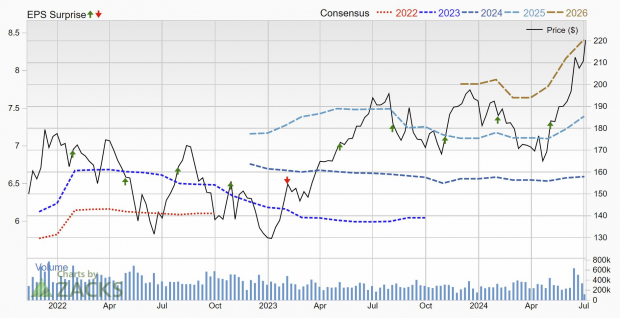

Apple, a consistently successful company with a strong stock performance, is one whose earnings trends I closely monitor. However, over the past two years, earnings revisions have been flat, and while it remains a decent performer, it hasn't delivered any exceptional growth.

Notably, Apple’s earnings revision trend has begun to turn higher for the first time in a while. This is extremely encouraging action, and Apple now enjoys a Zacks Rank #2 (Buy) rating.

Amazon too has seen its earnings revision trend turn higher, giving it a Zacks Rank #2 (Buy) rating as well.

Apple, Amazon, and Alphabet all have massive tailwinds coming from the AI boom. We learned about Apple’s new AI software integrations, as well as Alphabets new AI agents over the last couple of months, but there are numerous other ways the technology is being used behind the scenes as well.

At Amazon, its web services business is going to be a huge beneficiary as technology companies ramp up computing power. But AI will also be used at its fulfillment operations, as the massive scale benefits from optimizations. Amazon is also quietly one of the biggest users of new robotics tech, as its operations continue to be automated.

Based on these developments it’s no surprise we are beginning to see analysts raise earnings estimates.

Image Source: Zacks Investment Research

Reasonable Valuations, Especially Alphabet

Although Alphabet currently has a Zacks Rank #3 (Hold) rating, reflecting a flat earnings revision trend, it still has a lot going for it. It is currently the relatively cheapest stock in the group.

Today, it has a one year forward earnings multiple of 24.4x, which is just above the market average, and below its 10-year median of 26.1x. GOOGL is also expected to grow its EPS 17.5% annually over the next 3-5 years, plans to buy back some $70 billion in shares this year, and is now paying a tidy 0.43% dividend.

Amazon too is trading at a deep historical discount. At 43x forward earnings it is well below its 10-year median of 98.2x, and EPS is forecast to grow 29.6% annually over the next 3-5 years.

At 33.4x, Apple is the only one trading above its historical median valuation, but for a company of its quality it is no surprise its earns a premium valuation.

Image Source: Zacks Investment Research

Bottom Line

This bull market continues to charge, fueled by a robust economy, falling inflation, and stellar earnings growth from industry leaders. The "Magnificent 7" stands out with their impressive earnings and momentum, offering attractive entry points for investors seeking exposure to top performers.

Moreover, the growing adoption of AI across these companies, particularly in areas like automation and cloud computing, positions them for long-term dominance in the evolving technological landscape. With valuations remaining reasonable and fundamental strength unwavering, this market rally appears poised to extend its winning streak.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Market Break Out: 3 Leading Stocks to Buy Now

US stock indexes have staged yet another bullish breakout. The economy is steady, employment is robust, inflation continues to fall, and stocks are making record highs – if you aren’t bullish now, I don’t know what else to tell you.

Image Source: TradingView

Stock Market Generals Grow Profits, Show Powerful Momentum

Life can be very easy in this market, as some of the largest and most prevalent companies in the world are still trading at appealing levels.

The ‘Magnificent 7’ continues to grow earnings at an incredible pace, while the stocks also shows encouraging momentum. Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +25.5% from the same period last year on +13.1% higher revenues, while the stock prices on several of them push YTD highs.

My favorite names from the Mag 7 currently are Amazon ((AMZN - Free Report) ), Apple ((AAPL - Free Report) ), and Alphabet ((GOOGL - Free Report) ). Also, Nvidia ((NVDA - Free Report) ), gets an honorable mention because it too is still a fantastic stock with a top Zacks Rank.

In the chart below we can see that each of these stocks is showing significant relative strength against the broad market. Apple, although it trails the market YTD, shows the most significant short-term momentum, up 30% in just the last three months.

Image Source: Zacks Investment Research

Rising Earnings Trend Lifts Share Price

Apple, a consistently successful company with a strong stock performance, is one whose earnings trends I closely monitor. However, over the past two years, earnings revisions have been flat, and while it remains a decent performer, it hasn't delivered any exceptional growth.

Notably, Apple’s earnings revision trend has begun to turn higher for the first time in a while. This is extremely encouraging action, and Apple now enjoys a Zacks Rank #2 (Buy) rating.

Amazon too has seen its earnings revision trend turn higher, giving it a Zacks Rank #2 (Buy) rating as well.

Apple, Amazon, and Alphabet all have massive tailwinds coming from the AI boom. We learned about Apple’s new AI software integrations, as well as Alphabets new AI agents over the last couple of months, but there are numerous other ways the technology is being used behind the scenes as well.

At Amazon, its web services business is going to be a huge beneficiary as technology companies ramp up computing power. But AI will also be used at its fulfillment operations, as the massive scale benefits from optimizations. Amazon is also quietly one of the biggest users of new robotics tech, as its operations continue to be automated.

Based on these developments it’s no surprise we are beginning to see analysts raise earnings estimates.

Image Source: Zacks Investment Research

Reasonable Valuations, Especially Alphabet

Although Alphabet currently has a Zacks Rank #3 (Hold) rating, reflecting a flat earnings revision trend, it still has a lot going for it. It is currently the relatively cheapest stock in the group.

Today, it has a one year forward earnings multiple of 24.4x, which is just above the market average, and below its 10-year median of 26.1x. GOOGL is also expected to grow its EPS 17.5% annually over the next 3-5 years, plans to buy back some $70 billion in shares this year, and is now paying a tidy 0.43% dividend.

Amazon too is trading at a deep historical discount. At 43x forward earnings it is well below its 10-year median of 98.2x, and EPS is forecast to grow 29.6% annually over the next 3-5 years.

At 33.4x, Apple is the only one trading above its historical median valuation, but for a company of its quality it is no surprise its earns a premium valuation.

Image Source: Zacks Investment Research

Bottom Line

This bull market continues to charge, fueled by a robust economy, falling inflation, and stellar earnings growth from industry leaders. The "Magnificent 7" stands out with their impressive earnings and momentum, offering attractive entry points for investors seeking exposure to top performers.

Moreover, the growing adoption of AI across these companies, particularly in areas like automation and cloud computing, positions them for long-term dominance in the evolving technological landscape. With valuations remaining reasonable and fundamental strength unwavering, this market rally appears poised to extend its winning streak.