This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

I. A Brief U.S. Import Backdrop to 2025 Trade Wars

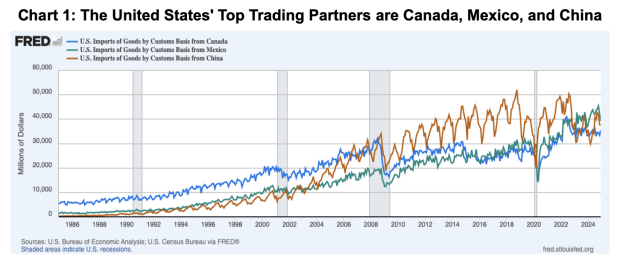

Taken together, Canada, China, and Mexico accounted for $2.2 trillion worth of U.S. overseas trade in 2024, according to U.S. Federal Census data. In March 2025, the U.S. economy is $30.337 trillion. That makes up a 7.25% proportion, scale-wise.

- About $840 billion of that came from trade with Mexico, $762 billion from Canadian imports and exports, and $582 billion from China

- U.S. trade with Mexico, Canada, and China in 2024 accounted for around 40% of America’s total commerce in goods around the world

Image Source: St Louis Federal Reserve

Unlike traditional trade policy, the announced import tariffs are designed to deliver a financial sting right away, trade experts told CNBC.

Consumers will bear the brunt of the tariffs in higher prices.

The Tax Policy Center estimates that Trump’s Mexico and Canada tariffs alone will cost the average household an additional $930 a year by 2026. In 2023, the median household income in the U.S. was $80,610. That’s a household ‘tax’ rate of 1.15%.

A comment I pulled from the Financial Times helps made sense, of this picture:

“Some executives said their businesses would survive even if Trump eventually imposed higher tariffs on Mexico. Labor costs in Texas are several times higher than those in Mexico, which Mexicans believe gives their country an enduring competitive advantage.”

“The average manufacturing wage in Nuevo León state, where Monterrey is the capital, is around $33 per day, according to state government data; in Texas it is about $292 a day, according to the Federal Reserve Bank of St Louis.”

In short, the gap between a Mexico or China manufacturer’s daily wage is 8.8 times higher. Protectionist trade policy would need an 880% tariff rate, to bring that to parity.

II. The International Emergency Economic Powers Act (IEEPA)

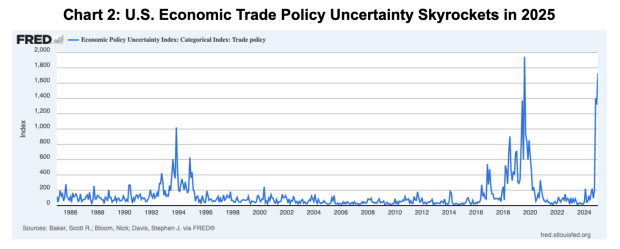

The U.S. Economic Trade Policy Uncertainty Index (shown below) is typically calculated by analyzing the frequency of news articles mentioning terms like "trade," "tariffs," and "uncertainty" within a specific time frame.

This index gives a higher value when there is more discussion about potential policy changes in trade.

And lately, at 1,728 — from a typical index level of 100 — it is exploding.

Image Source: St Louis Federal Reserve

Next are three news excerpts, on why this is happening:

(A) CNBC: Part of the reason Trump could impose the tariffs so quickly is because the White House is invoking a sweeping national security law to justify the new levies.

Until now, the International Emergency Economic Powers Act, IEEPA, had been used mainly to impose emergency sanctions on foreign dictators or suspected terrorist groups.

But the Trump administration argues that the illicit global fentanyl trade and immigrants at the Mexican border both qualify as “unusual and extraordinary” foreign threats to American national security, justifying Trump’s use of emergency powers under IEEPA.

Trump is using the law in a broader way than any president has before, Trade Partnership Worldwide’s Anthony said.

By pushing the boundaries of presidential authority, Trump is inviting legal challenges, Anthony said.

(B) AP: What is the International Emergency Economic Powers Act?

This is the 1977 law that helped enable Trump to declare an economic emergency in the executive orders and implement his tariffs.

There are more than three dozen active emergencies, including measures taken to respond to the 1979 Iran hostage crisis, human rights violations in Venezuela, nuclear weapon development in North Korea and multiple actions taken by China and Russia.

The law enables a president to freeze and block transactions in response to “unusual and extraordinary” threats outside the United States.

(C) Politico: The International Emergency Economic Powers Act, passed in 1977, grants the president broad authority over economic transactions, and a wide range of abilities to deal with “any unusual and extraordinary threat,” stemming in whole or in part from foreign sources.

Presidents, including Trump’s predecessor Joe Biden, have used the law to impose economic sanctions on other countries, including on Russia after it launched its 2022 war on Ukraine.

But the closest a president has come to citing a national emergency to impose tariffs was when President Richard Nixon used a different law — the Trading with the Enemy Act of 1917 — to levy a temporary universal tariff on all imports in 1971.

Trump justified his new tariffs Saturday by pointing to “the major threat of illegal aliens and deadly drugs killing our Citizens, including fentanyl,” which he claims Mexico, Canada and China are not doing enough to keep from coming into the United States.

But Bill Reinsch, a former Commerce Department official now at the Center for Strategic and International Studies, said Trump’s use of IEEPA to justify his trade actions “doesn’t really pass the red-face test,” setting the stage for a company or trade association whose members have been harmed by the action to sue.

“The question will be, can you find a judge who will write an injunction to stay the tariffs from going into effect,” Reinsch said. “And my prediction is that will be hard, because you’re asking a federal judge to essentially say, ‘I know more than the President does about what an emergency is.’ And I think judges are going to be reluctant to do that.”

That won’t stop a lawsuit from proceeding, most likely all the way to the Supreme Court, Reinsch said, but it could be years before there is a conclusion to the legal battle.

“The courts have historically upheld the president’s power to take emergency actions, especially when they are related to national security. But one important question is whether they will uphold the use of tariffs. In the past, [IEEPA] has only been used to impose sanctions,” said Tim Brightbill, a trade attorney at the law firm Wiley Rein in Washington, DC.

Image: Bigstock

Making Sense of Trade Wars

This is an excerpt from our most recent Economic Outlook report. To access the full PDF, please click here.

I. A Brief U.S. Import Backdrop to 2025 Trade Wars

Taken together, Canada, China, and Mexico accounted for $2.2 trillion worth of U.S. overseas trade in 2024, according to U.S. Federal Census data. In March 2025, the U.S. economy is $30.337 trillion. That makes up a 7.25% proportion, scale-wise.

Image Source: St Louis Federal Reserve

Unlike traditional trade policy, the announced import tariffs are designed to deliver a financial sting right away, trade experts told CNBC.

Consumers will bear the brunt of the tariffs in higher prices.

The Tax Policy Center estimates that Trump’s Mexico and Canada tariffs alone will cost the average household an additional $930 a year by 2026. In 2023, the median household income in the U.S. was $80,610. That’s a household ‘tax’ rate of 1.15%.

A comment I pulled from the Financial Times helps made sense, of this picture:

“Some executives said their businesses would survive even if Trump eventually imposed higher tariffs on Mexico. Labor costs in Texas are several times higher than those in Mexico, which Mexicans believe gives their country an enduring competitive advantage.”

“The average manufacturing wage in Nuevo León state, where Monterrey is the capital, is around $33 per day, according to state government data; in Texas it is about $292 a day, according to the Federal Reserve Bank of St Louis.”

In short, the gap between a Mexico or China manufacturer’s daily wage is 8.8 times higher. Protectionist trade policy would need an 880% tariff rate, to bring that to parity.

II. The International Emergency Economic Powers Act (IEEPA)

The U.S. Economic Trade Policy Uncertainty Index (shown below) is typically calculated by analyzing the frequency of news articles mentioning terms like "trade," "tariffs," and "uncertainty" within a specific time frame.

This index gives a higher value when there is more discussion about potential policy changes in trade.

And lately, at 1,728 — from a typical index level of 100 — it is exploding.

Image Source: St Louis Federal Reserve

Next are three news excerpts, on why this is happening:

(A) CNBC: Part of the reason Trump could impose the tariffs so quickly is because the White House is invoking a sweeping national security law to justify the new levies.

Until now, the International Emergency Economic Powers Act, IEEPA, had been used mainly to impose emergency sanctions on foreign dictators or suspected terrorist groups.

But the Trump administration argues that the illicit global fentanyl trade and immigrants at the Mexican border both qualify as “unusual and extraordinary” foreign threats to American national security, justifying Trump’s use of emergency powers under IEEPA.

Trump is using the law in a broader way than any president has before, Trade Partnership Worldwide’s Anthony said.

By pushing the boundaries of presidential authority, Trump is inviting legal challenges, Anthony said.

(B) AP: What is the International Emergency Economic Powers Act?

This is the 1977 law that helped enable Trump to declare an economic emergency in the executive orders and implement his tariffs.

There are more than three dozen active emergencies, including measures taken to respond to the 1979 Iran hostage crisis, human rights violations in Venezuela, nuclear weapon development in North Korea and multiple actions taken by China and Russia.

The law enables a president to freeze and block transactions in response to “unusual and extraordinary” threats outside the United States.

(C) Politico: The International Emergency Economic Powers Act, passed in 1977, grants the president broad authority over economic transactions, and a wide range of abilities to deal with “any unusual and extraordinary threat,” stemming in whole or in part from foreign sources.

Presidents, including Trump’s predecessor Joe Biden, have used the law to impose economic sanctions on other countries, including on Russia after it launched its 2022 war on Ukraine.

But the closest a president has come to citing a national emergency to impose tariffs was when President Richard Nixon used a different law — the Trading with the Enemy Act of 1917 — to levy a temporary universal tariff on all imports in 1971.

Trump justified his new tariffs Saturday by pointing to “the major threat of illegal aliens and deadly drugs killing our Citizens, including fentanyl,” which he claims Mexico, Canada and China are not doing enough to keep from coming into the United States.

But Bill Reinsch, a former Commerce Department official now at the Center for Strategic and International Studies, said Trump’s use of IEEPA to justify his trade actions “doesn’t really pass the red-face test,” setting the stage for a company or trade association whose members have been harmed by the action to sue.

“The question will be, can you find a judge who will write an injunction to stay the tariffs from going into effect,” Reinsch said. “And my prediction is that will be hard, because you’re asking a federal judge to essentially say, ‘I know more than the President does about what an emergency is.’ And I think judges are going to be reluctant to do that.”

That won’t stop a lawsuit from proceeding, most likely all the way to the Supreme Court, Reinsch said, but it could be years before there is a conclusion to the legal battle.

“The courts have historically upheld the president’s power to take emergency actions, especially when they are related to national security. But one important question is whether they will uphold the use of tariffs. In the past, [IEEPA] has only been used to impose sanctions,” said Tim Brightbill, a trade attorney at the law firm Wiley Rein in Washington, DC.